Display Invoice Profit

This feature provides a clear and concise view of your financial performance, enabling you to easily assess individual products’ profitability. To view the invoice profit you need to follow the steps below.

Activating the Display Invoice Profit Option

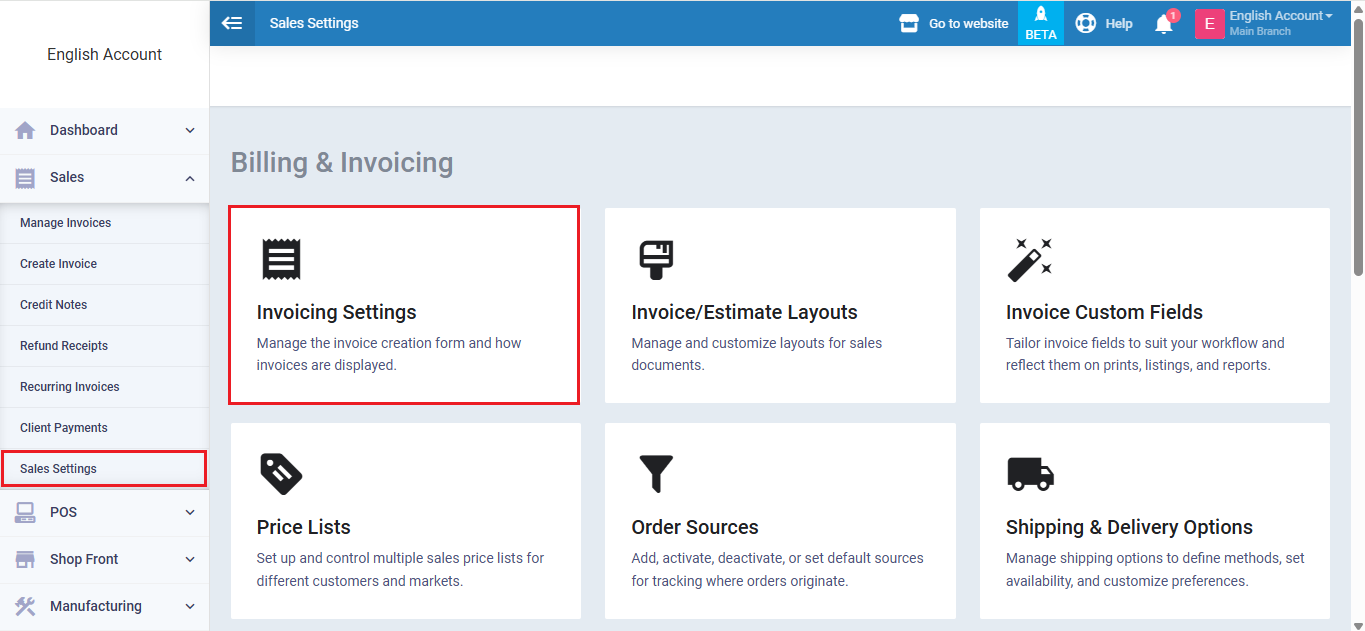

First, you need to enable the “Show Invoice Profit Tab” option from the “Sales Settings” under “Sales” in the main menu, then select the “Invoicing Settings” tab.

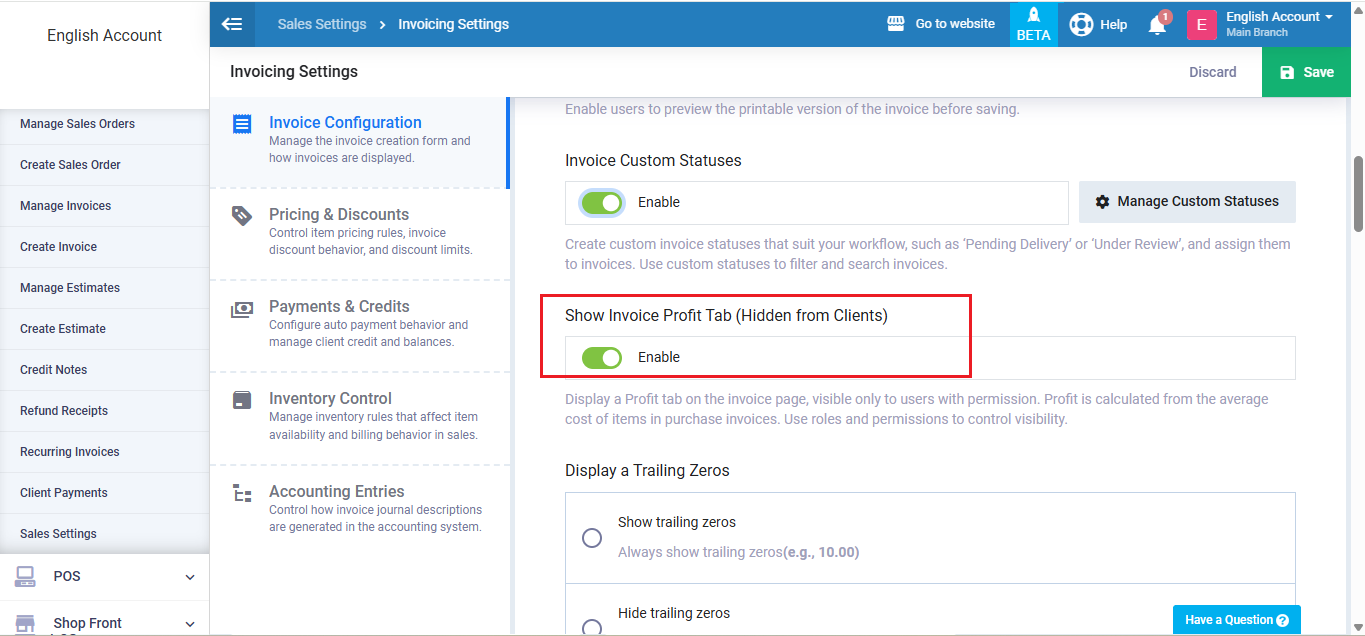

Activate “Show Invoice Profit Tab” option.

Activate “Show Invoice Profit Tab” option.

then click “Save“.

Adding Manual Inbound

The following examples illustrate how the invoice profit is calculated and affected by the item’s purchase price. Whenever a product’s purchase price increases, its selling price increases too, affecting the profit of the invoice.

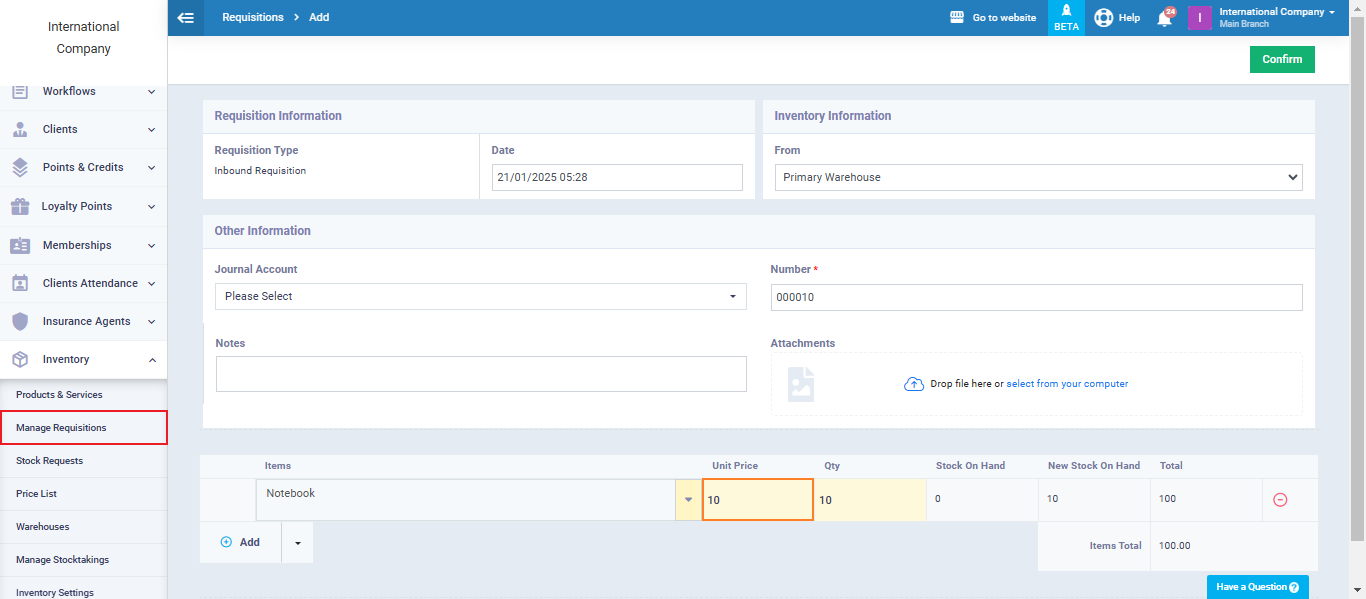

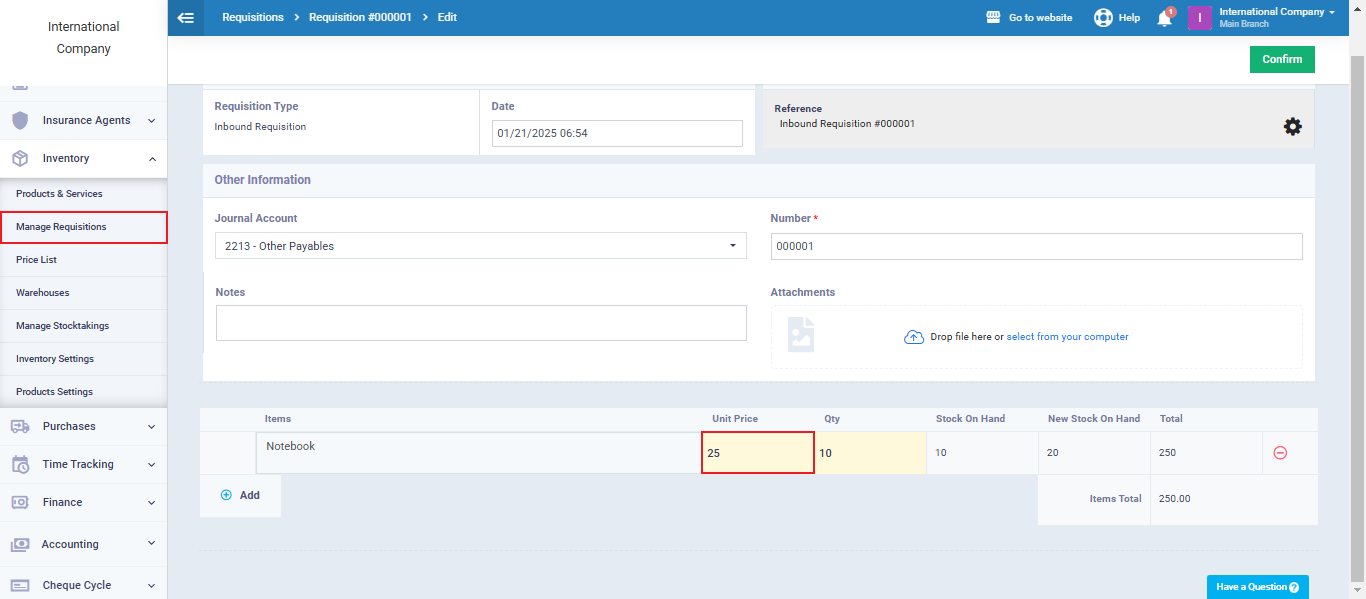

First, you need to add stock for a specific product. In the first example, we will create a new manual inbound for an existing product, “Notebook.” If you don’t have any products in your account, you’ll need to add the product first.

From the main menu click on “Manage Requisitions” under “Inventory”, then click on “+Add“, and choose “Manual Inbound“.

Fill in the requisition data then click on “Confirm“

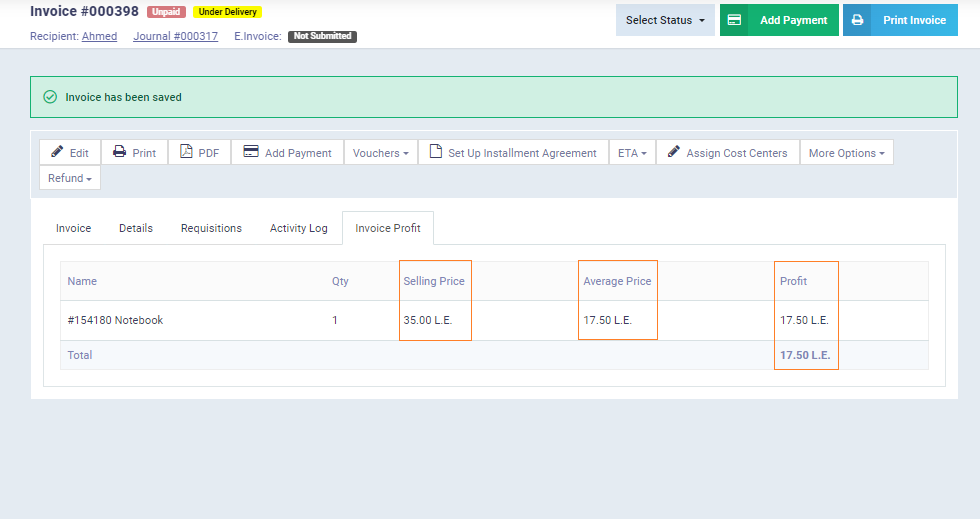

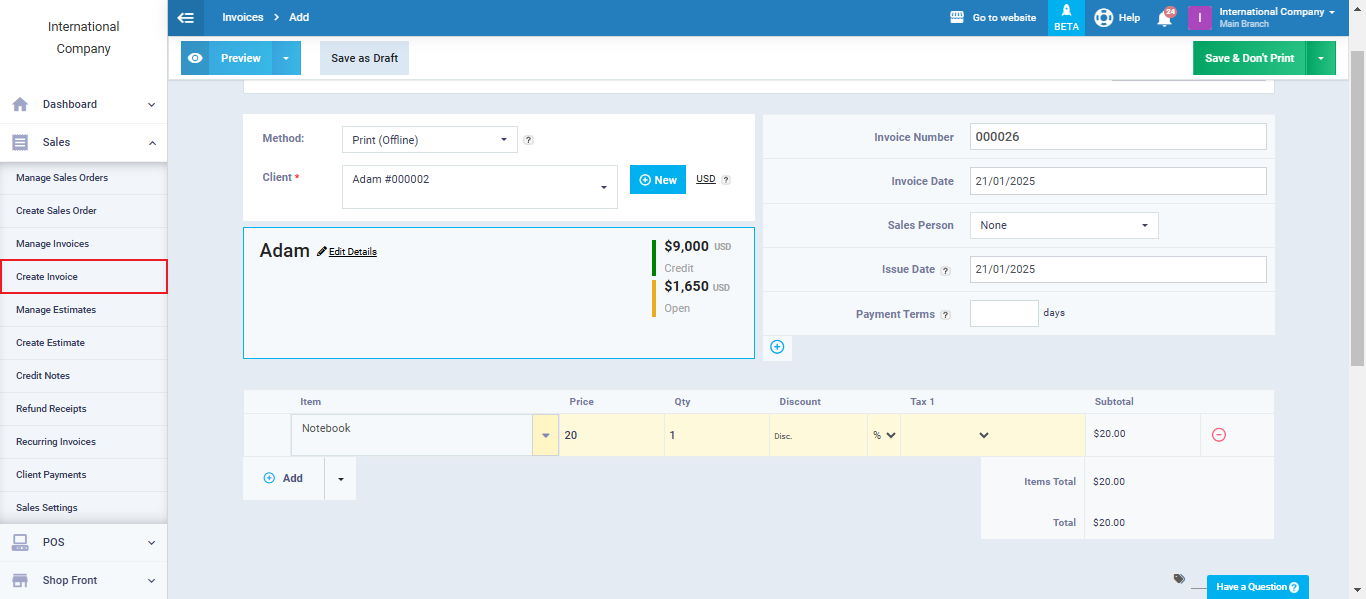

Now, go to the “Create Invoice” screen, and in the item field choose “Notebook” and fill in the rest of the invoice data.

then click on “Save“.

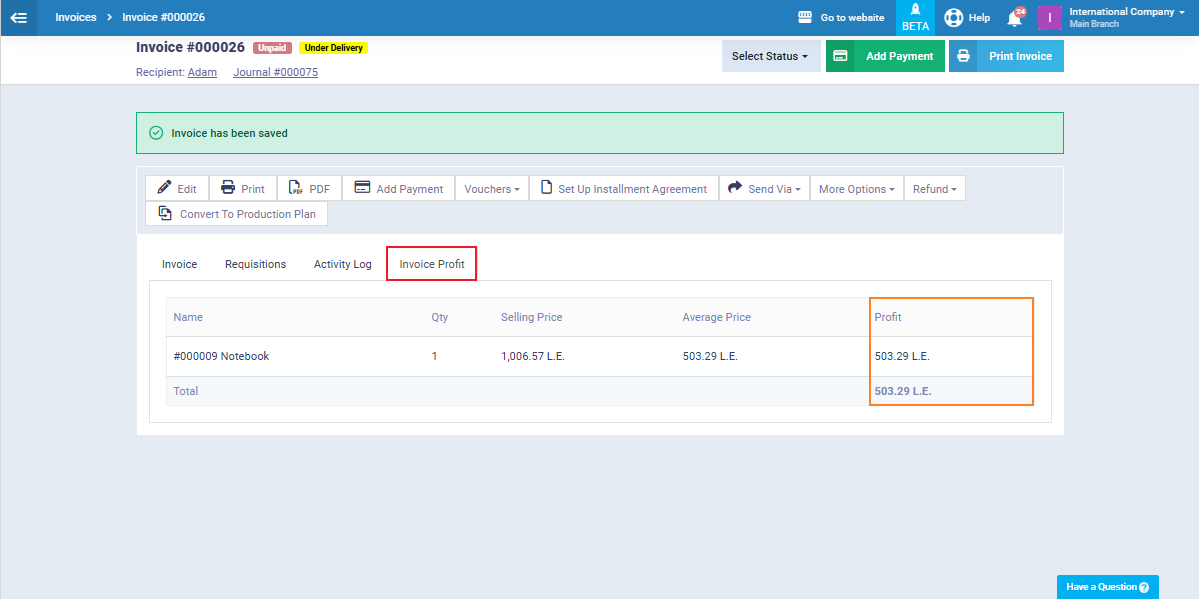

The invoice profit depends on the difference between a product’s average cost price and its selling price.

The system automatically calculates the average cost price based on all recorded purchase prices over time, while the selling price is initially set from the inventory system’s product details but can be fully customized to fit pricing strategies, discounts, and market conditions.

If we added another manual inbound for the same product “Notebook” but with a different purchase price of “25” instead of “10” in the first example

then created an invoice with a different selling price of “35” instead of “20”

we’ll find that the average price and profit have increased, proving that the invoice’s profit is calculated and affected by each product’s purchase and selling price.