Integrating with the Electronic Invoice (Phase 2) and sending the invoices to ZATCA

As is known, Daftra software supports the Saudi electronic invoice and is also approved by the Zakat and Income Authority in compliance with the requirements of the Zakat and Income Authority. It assists Daftra software users in linking their accounts with the Zakat and Income Authority and ensuring compliance with the Authority’s requirements. Daftra software provides integration capabilities with the Authority for both phases, the first and the second, which have been launched so far.

The linking process is currently carried out in two phases:

- Phase 1: In the first phase, taxpayers are required to issue and save electronic invoices through an electronic invoicing system that is compatible with the requirements of the Zakat, Tax, and Customs Authority. Phase 1 began on December 4, 2021 for all individuals subject to the electronic invoicing regulations and any other party issuing tax invoices on behalf of VAT-registered suppliers.

- Phase 2: Phase 2 is known as the integrated linking phase, where the taxpayer’s electronic invoicing system (Daftra) must be linked with the Zakat, Tax, and Customs Authority system (Fatoora). Electronic invoices must be issued in the required format. The implementation of Phase 2 is done gradually.

To determine if you are subject to Phase 2 of the electronic invoice based on your revenue, you can refer to this link provided by the Zakat and Income Authority: “Electronic Invoice Roll-out Phases”.

Enabling the Electronic Invoice App

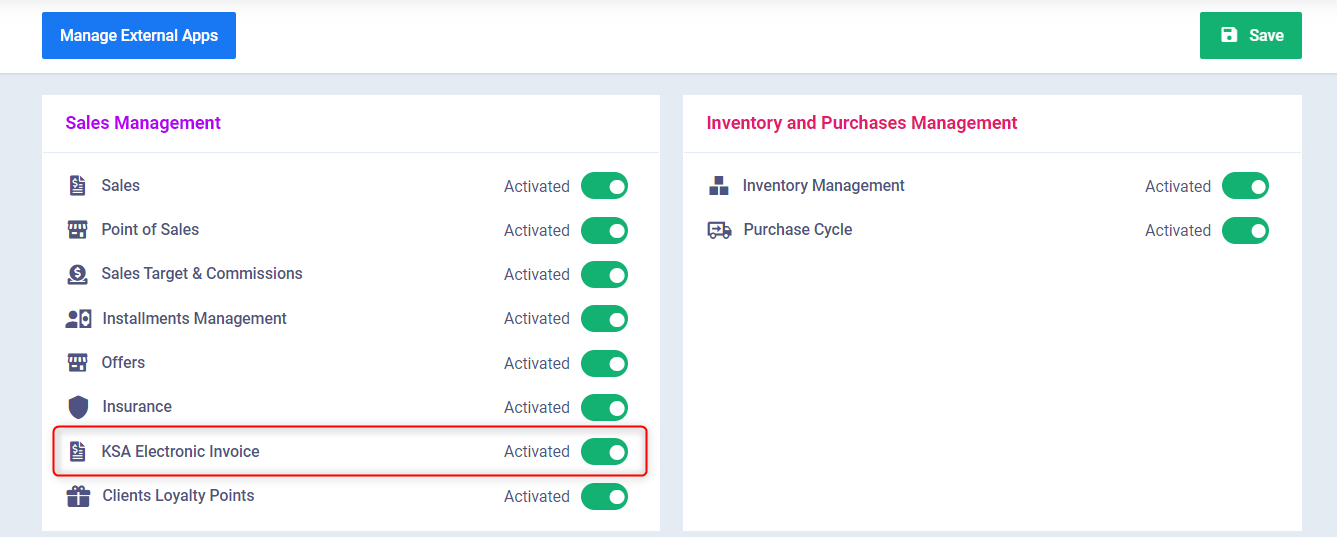

To enable direct integration with the Zakat and Income Authority, you must first ensure that the “KSA Electronic Invoice” App is activated through the Apps Manager.

- From the main menu, click on “Settings”.

- Click on “Apps Manager”.

- Activate the “KSA Electronic Invoice” App located in the Sales Management section.

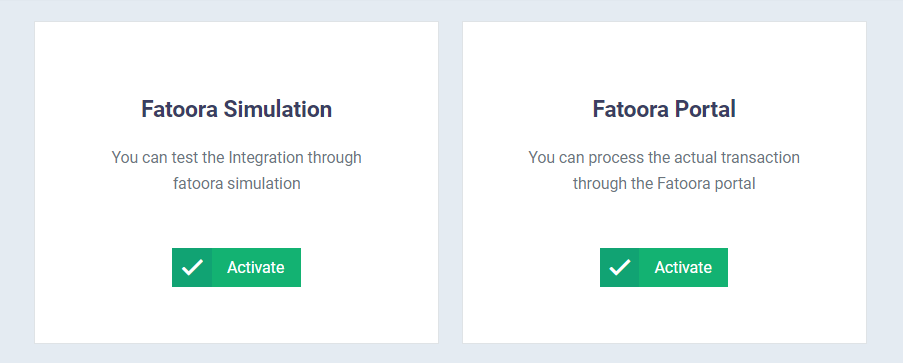

The Way of Testing Integration and Actual Integration with (Fatoora) Platform

To ensure proper integration, the Daftra software provides a trial integration option with the Zakat and Income Authority to verify the successful completion of the integration process.

- Fatoora Simulation: Through this option, you can make a trial integration to test the accuracy of the integration process.

- It is recommended to use the trial integration option first to test data accuracy, information validity, and the correctness of the integration. Once confirmed, you can proceed with actual integration.

- Fatoora Portal: With this option, direct and effective integration with the Zakat and Income Authority is established.

- It is preferable to choose this option after completing the trial integration to ensure the accuracy of the integration before starting the direct integration.

Steps of Integrating your Daftra Account with the ZATCA Authority

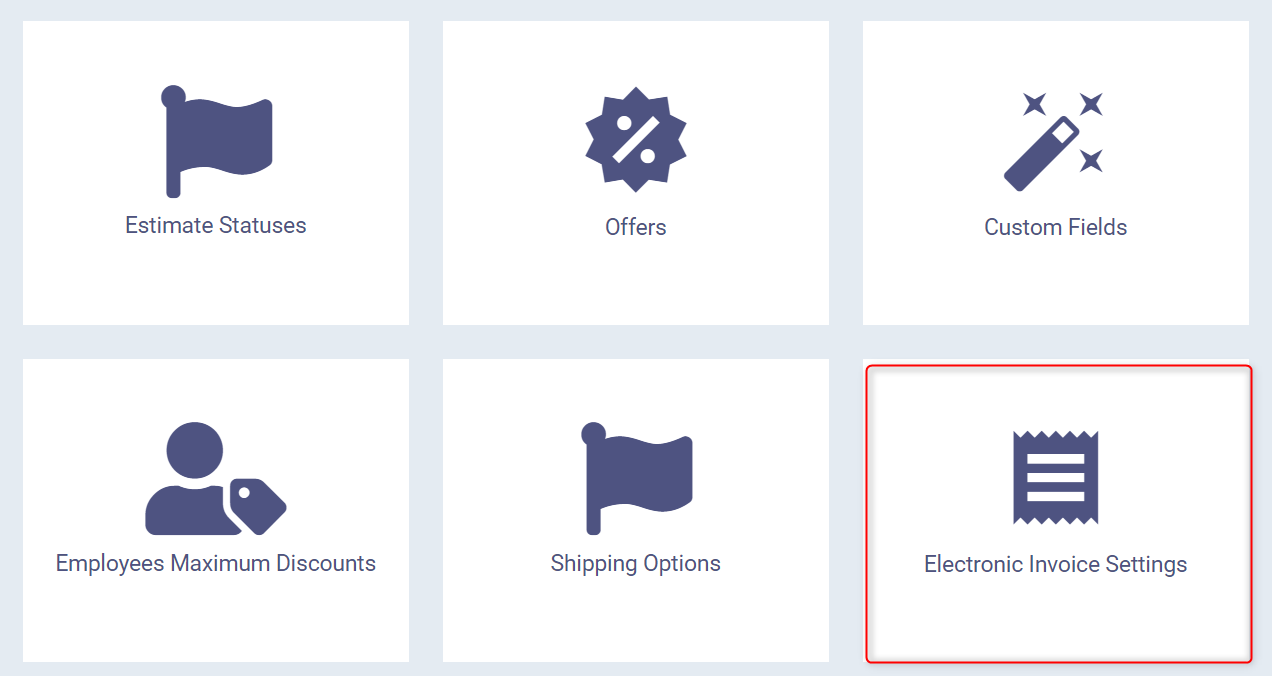

- From the main menu, click on “Sales”.

- Click on “Sales Settings”.

- Click on the “Electronic Invoice Settings” card.

- You will see two cards: “Fatoora Simulation” and “Fatoora Portal”.

- You can first try the integration process using the “Fatoora Simulation” card, and then complete the integration process by selecting the “Fatoora Portal” card.

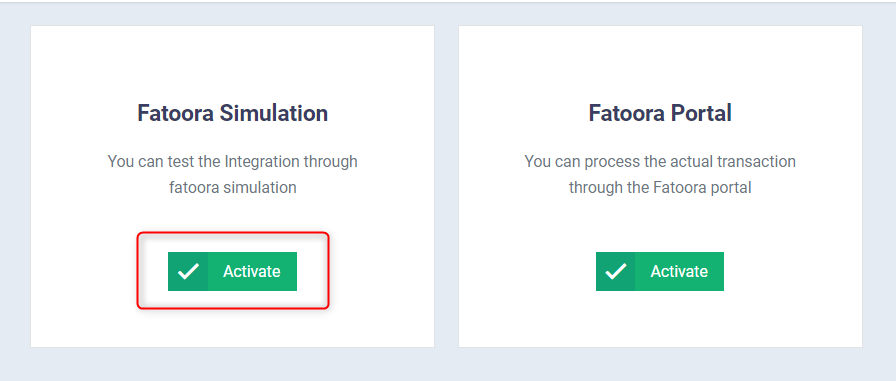

- Click on “Activate” in front of the “Fatoora Simulation” card.

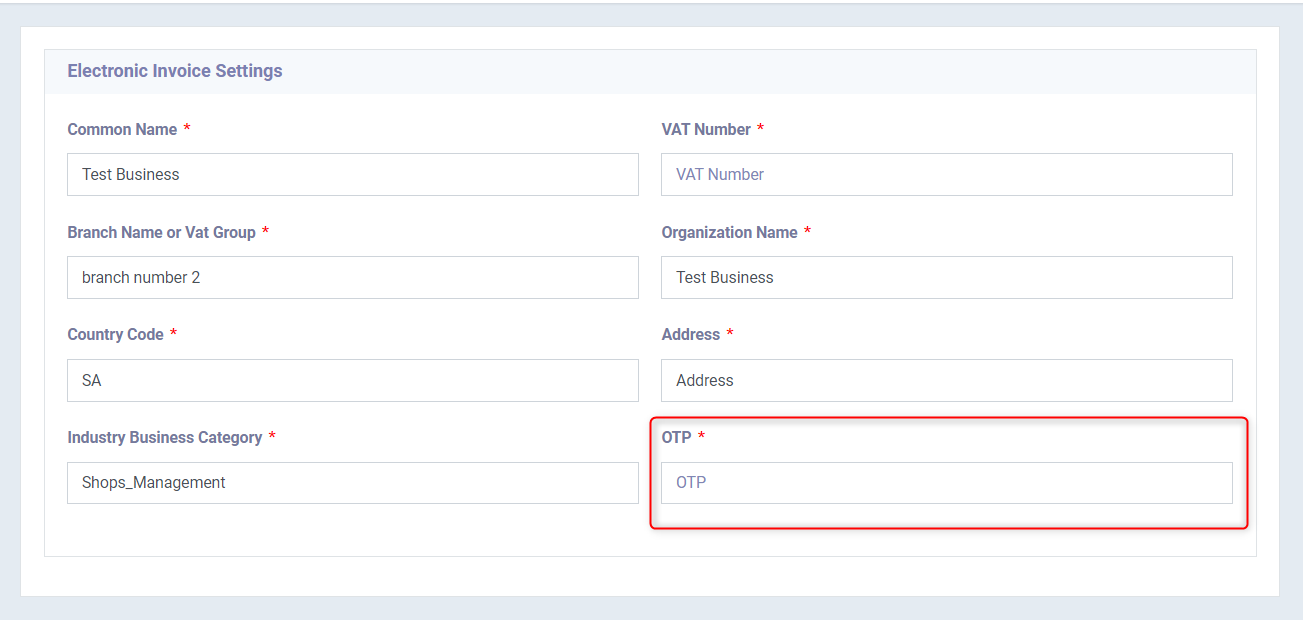

- All the data will be automatically filled if it has been added in the account settings, with one field that needs to be filled manually.

- One-Time Password (OTP): Enter the OTP code obtained from the Zakat and Income Authority.

- Note: Make sure to enter the OTP code for device registration obtained from the authority’s website, not the login OTP code.

- One-Time Password (OTP): Enter the OTP code obtained from the Zakat and Income Authority.

Example:

Click on “Electronic Invoice Settings”.

Click on “Activate” for the trial integration (Fatoora Simulation).

Make sure all your account data appears. If it doesn’t, make sure to add it. Then, enter the OTP code obtained from the Zakat and Income Authority in the “(OTP)” field.

How to Obtain the OTP Code

To complete the second phase of integration the electronic invoice between Daftra software and the Zakat and Income Authority, and if you are subject to it, you need to obtain the OTP code, which is used to complete the integration process between the two platforms. You can obtain the OTP code by following these steps:

- Register an account on the Zakat and Income Authority website.

- Choose the type of code required, whether it is “Simulation” or “Master”, based on the stage applicable to your account at the Zakat and Income Authority.

- Access the portal of the Zakat and Income Authority and then select the number of devices for which you need to obtain the OTP code.

- The OTP code will be generated and valid for only one minute.

- Enter the OTP code in the electronic invoice settings in the Daftra software.

Sending the Invoices to the ZATCA Authority

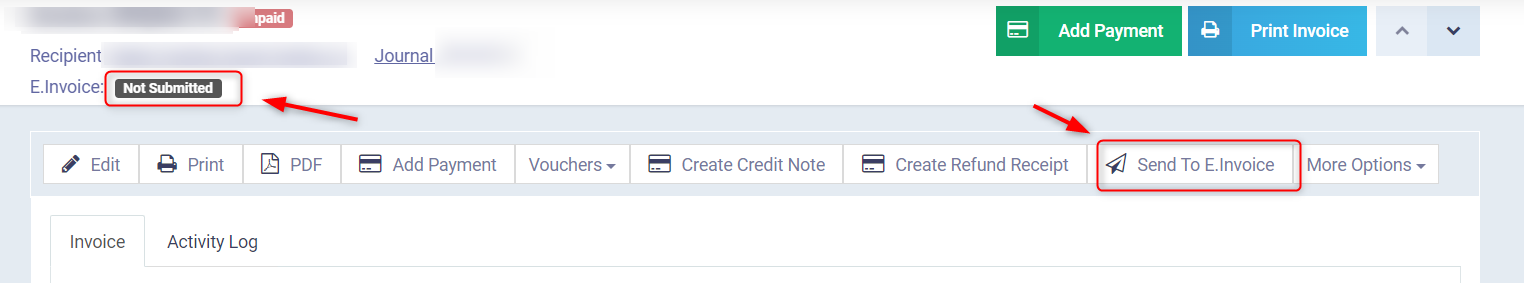

After ensuring the successful direct integration with the Zakat and Income Authority, you can save the invoice and send it to the authority while ensuring the validity of sending the invoice.

- First, when creating the invoice, the “Electronic Invoice Status” will appear as Not Submitted, indicating that the invoice has not been sent to the Zakat and Income Authority.

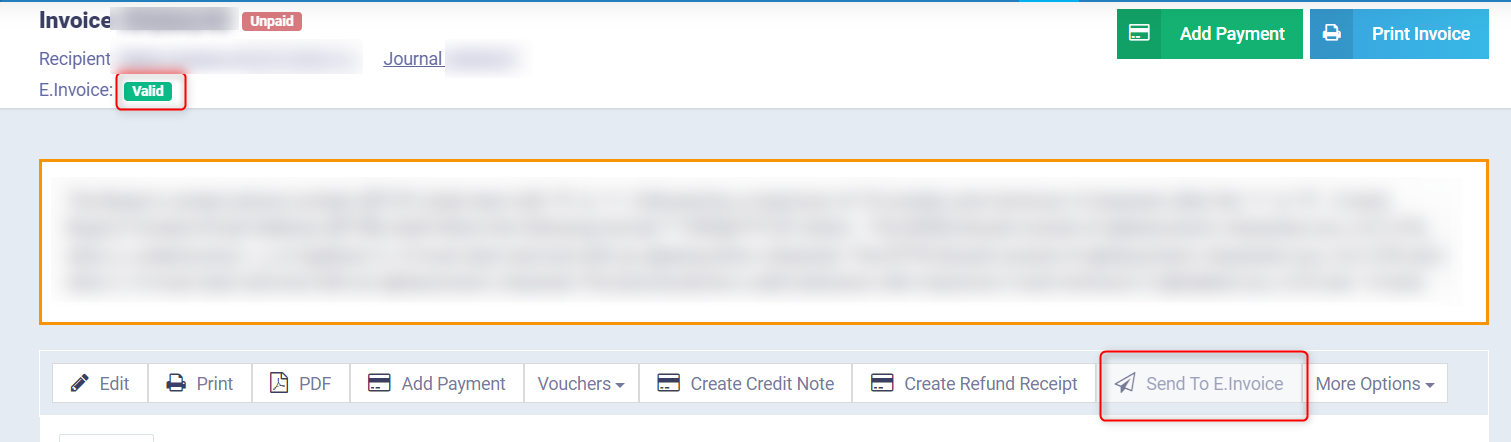

- After clicking on “Send to ZATCA”, the status of the electronic invoice will change to Valid if it is sent and received correctly from the authority’s portal.

- After clicking on “Send to E.Invoice”, the status of the electronic invoice will change to Invalid if it is sent but not received correctly from the authority’s portal.

- To send the invoice to the Zakat and Income Authority, click on the “Send to E.Invoice” button.

- After clicking on “Send to E.Invoice”, the status will appear as Valid as shown in the attached image, and the “Send to E.Invoice” button will be disabled.

- If the invoice is rejected by the Zakat and Income Authority for any reason, the invoice status will appear as Invalid.