Calculating Expenses Related to the Payment Method and the Taxes on it

There is no business activity without financial transactions that require different payment methods such as bank accounts, credit cards, or electronic wallets. These payment methods involve certain expenses related to the financial service provided to you. In most cases, the expenses associated with payment methods are subject to Value Added Tax (VAT).

To avoid the burden of adjusting the accounting aspects every time your business uses a different payment method available on your account, here is a detailed explanation of how to set up your account to calculate the tax applied to expenses related to the payment method, in addition to managing the expenses of the payment methods.

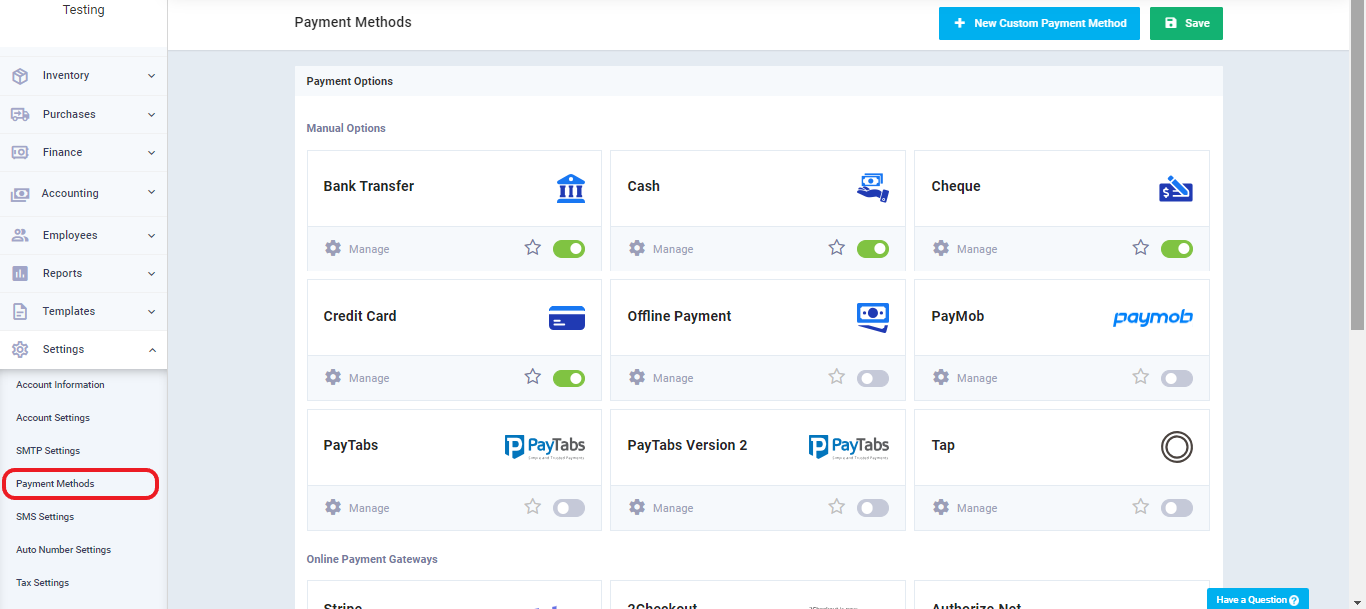

Available payment methods on the system and the expenses associated with them

There are several payment methods available on the system, such as cash payments, bank transfers, credit cards, online payment gateways, and electronic wallets. Additionally, you have the option to add any payment gateway you prefer. You can access these options by navigating to the ‘Settings’ on the main menu and clicking on ‘Payment Methods.’ There, you will find a list of available payment methods. Activate the payment method you desire and click the button on the payment method you wish to review. Let’s now understand how to configure the expenses and taxes associated with them.

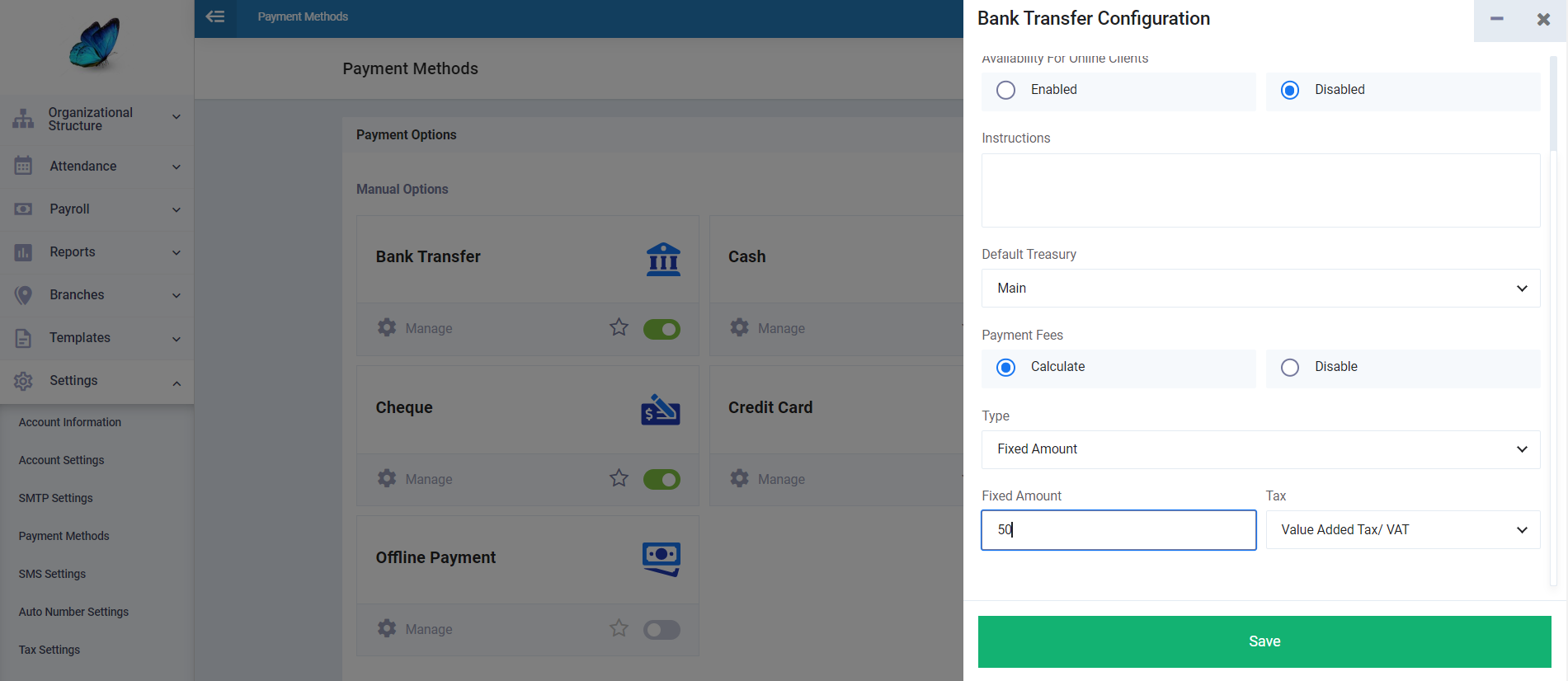

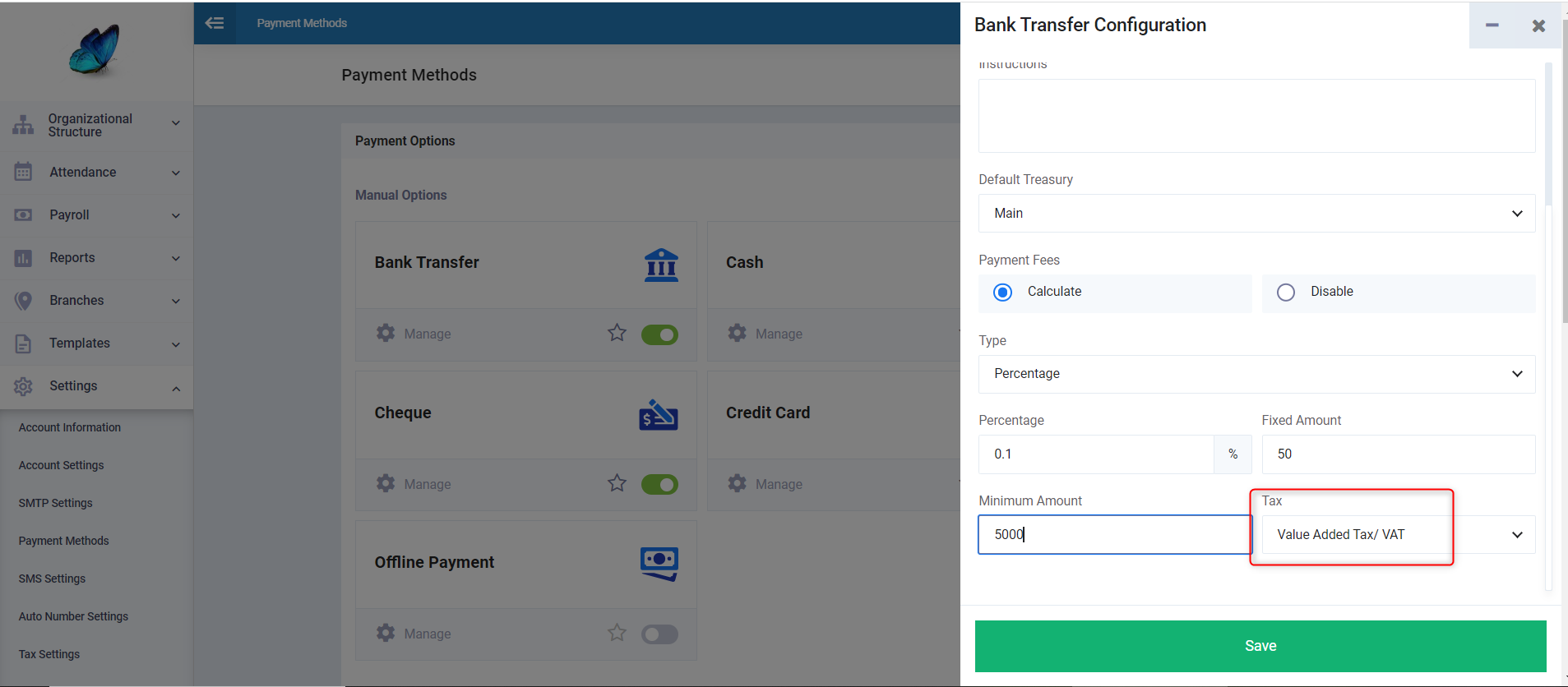

For example, if you activate bank transfers as a payment method and review the payment method’s details, you will find the option to enable the calculation of expenses associated with this payment method. You can do this by clicking on the calculate button under ‘Payment Fees.’ Here, you can choose whether the expenses calculated for the payment method are:

- A fixed amount based on the transfer amount, regardless of its value. For instance, you can set the payment expenses for bank transfers at 50 Saudi Riyals, which would apply whether the transfer amount is 1,000 Riyals or 1,000,000 Riyals. You simply need to specify the amount.

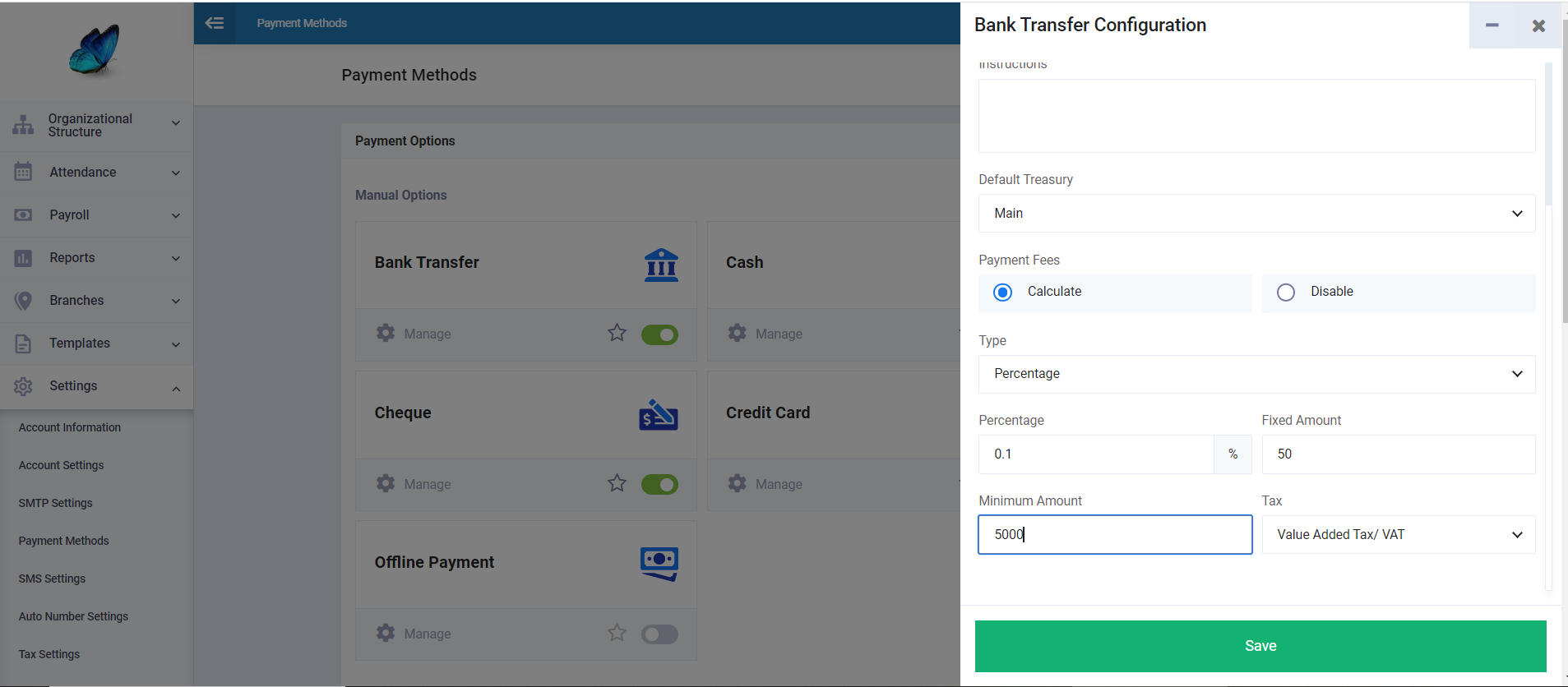

You can also set the payment expenses as a combination of a fixed amount plus a percentage deduction from the transfer amount.

You can also set the payment expenses as a combination of a fixed amount plus a percentage deduction from the transfer amount.

- For instance, you can specify the payment expenses as 50 Saudi Riyals plus a 0.1% deduction from the total amount.

- Note: When calculating payment expenses as a percentage of the amount, you can define a minimum amount to apply the percentage. For smaller amounts, you can either ignore the percentage expenses as per your defined minimum or stick with the fixed amount you specify alongside the percentage.

The taxes imposed on payment methods

You can choose ‘No Tax’ if there are no payment-specific taxes applied. However, if there is a tax imposed on the payment method expenses, you can select ‘VAT‘ from the dropdown under ‘Tax’ and then click ‘Save’ to apply the tax at the applicable VAT rate in the country associated with your account.

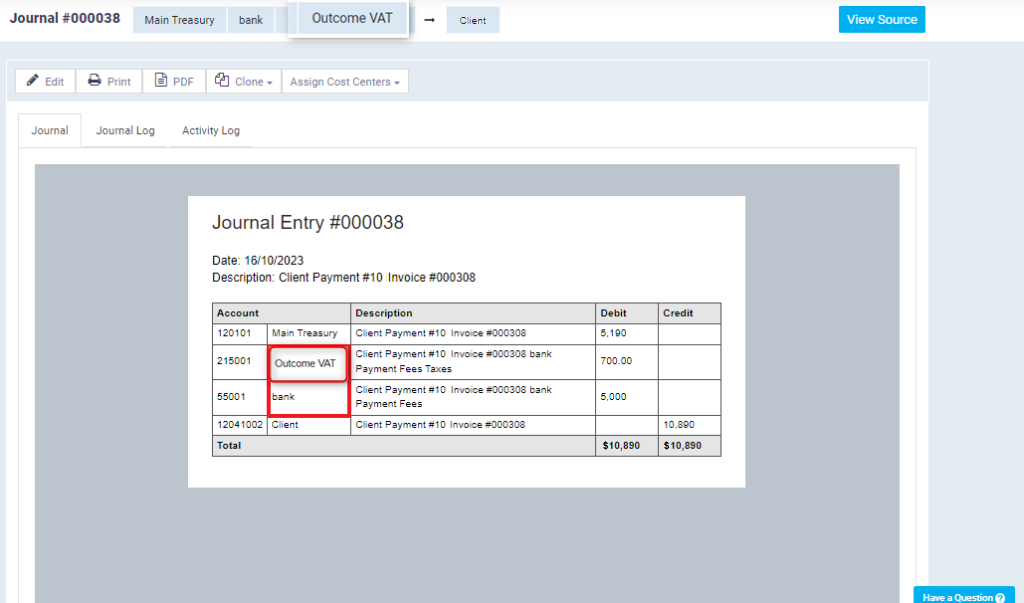

When paying any invoice and selecting the payment method that has Value Added Tax applied to its expenses, you will find that an automatic journal entry is created by the system, which includes both the expenses related to the payment method and the Value Added Tax on these expenses.

Note: The 15% VAT rate activated as Value Added Tax is calculated only on the expenses, not on the total paid amount.