Defining Shipping Options on the Invoice

The shipping options refer to a classification you can use to list shipping provinces and define the price for each province to list different shipping companies and their pricing, or even to include various shipping methods such as land, sea, and air shipping, among other shipping options used in your system.

This makes adding shipping information to the invoice more manageable. Basic shipping data is pre-registered in the system, eliminating the need for the invoice issuer to manually input the shipping expenses related to each province, for example, with each invoice. It is automatically applied when selecting the province. This also helps in organizing invoices and shipments based on the shipping classification included in the invoices or shipping waybills and allows for controlling the application of taxes on shipping expenses.

Conventional Shipping Details in Invoices

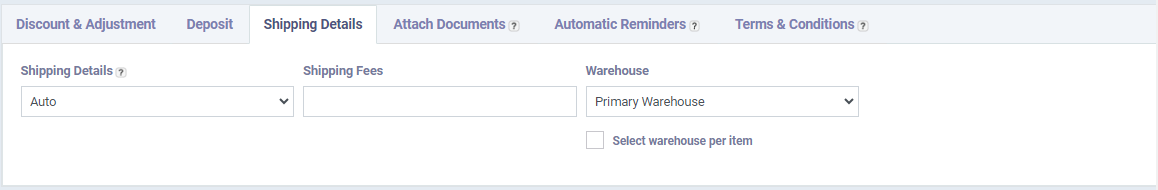

When creating a new invoice, you will find the basic shipping details. Before adding shipping options, you’ll see the basic information as follows:

- Shipping Details: This controls how the client’s shipping address appears on the invoice.

- Shipping Fees: These are manually specified.

- Warehouse: This allows you to control which warehouse the products are being shipped from, whether all products are from one warehouse or more.

Adding and Setting Shipping Options in Invoices

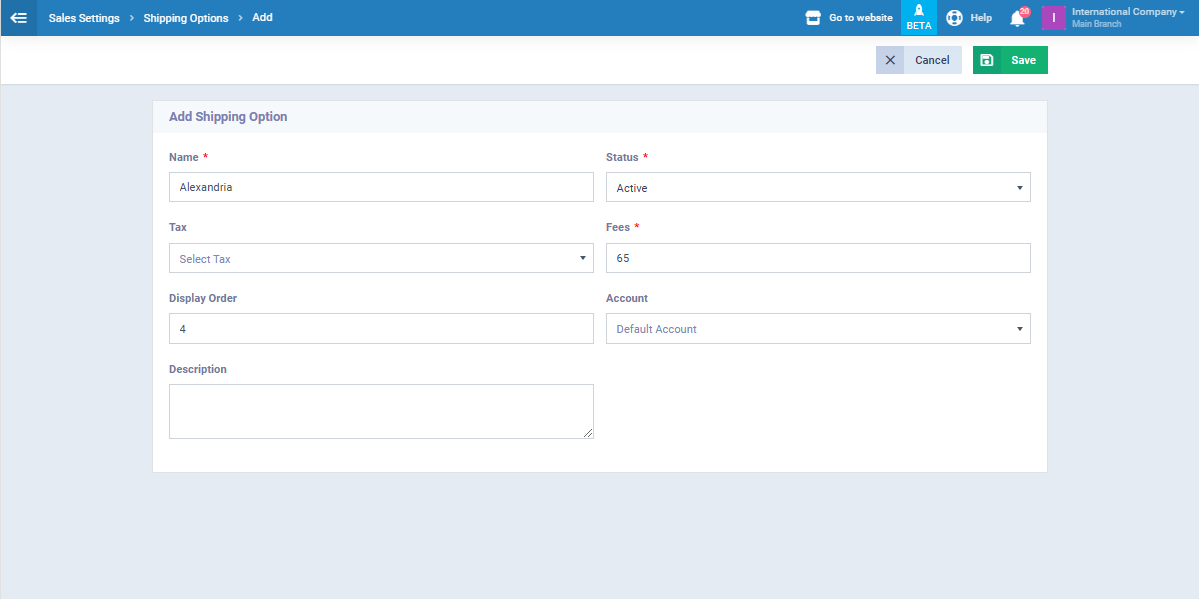

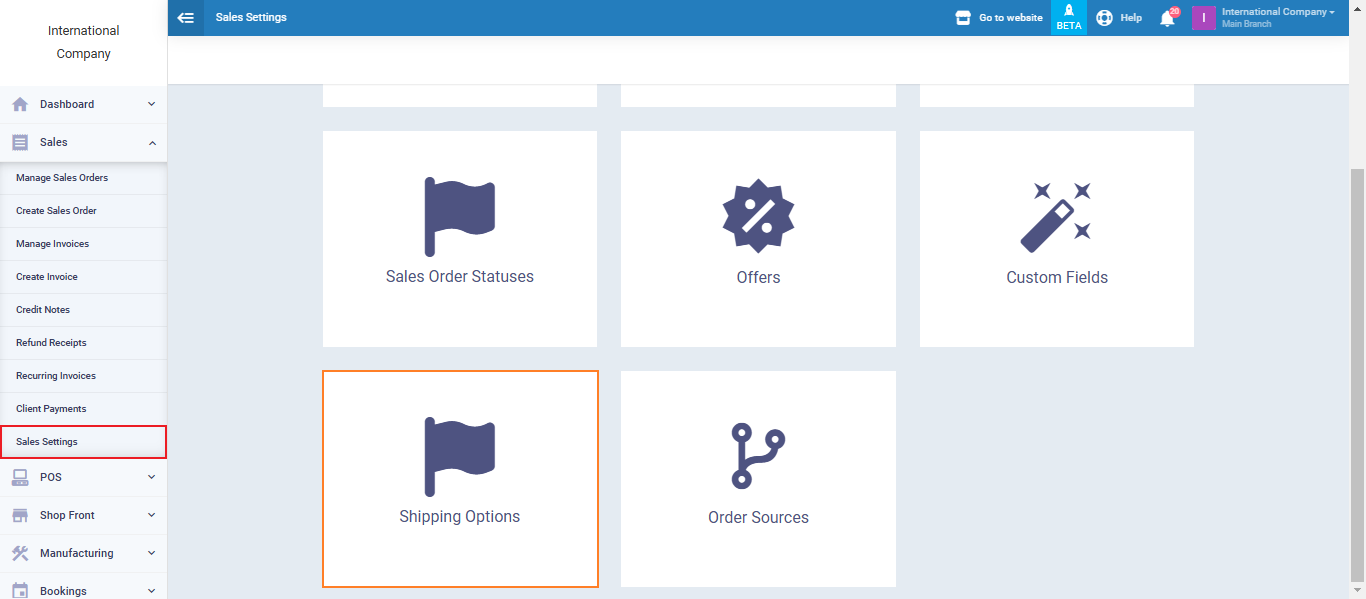

From the “Sales Settings” dropdown in the main menu, click on “Shipping Options.”

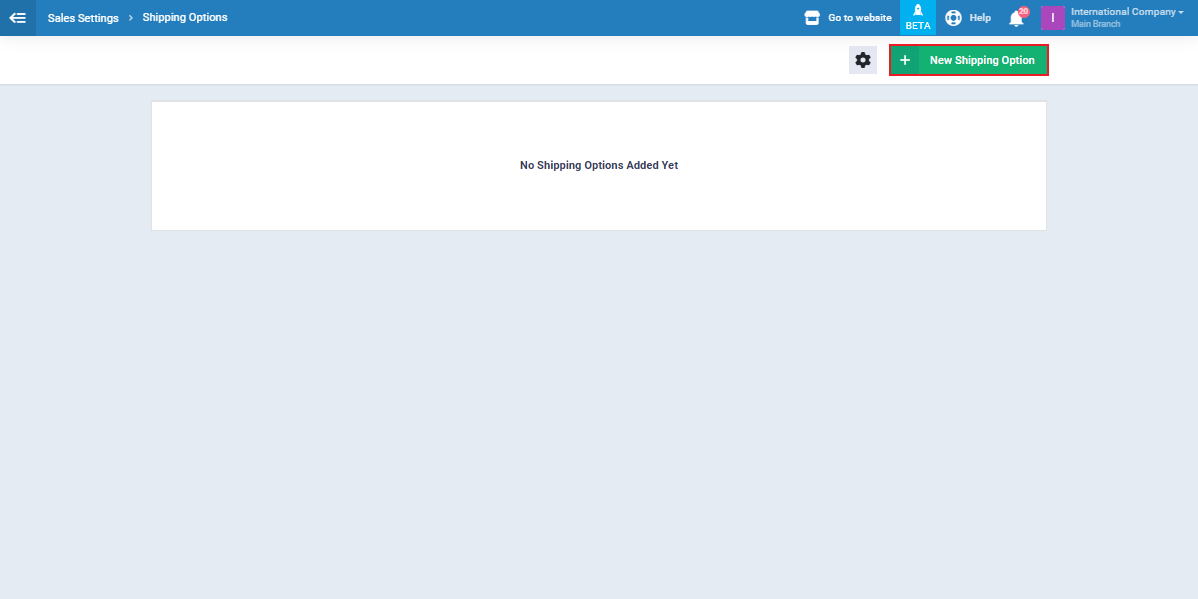

Click “Add Shipping Option” to begin adding a new shipping option.

Select the type of shipping option you want to choose for your invoices. For example, if you are using provinces as your shipping options, define each province as an independent shipping option and specify the following details:

- Shipping Option Name (e.g., the name of the province).

- Shipping Option Status (active or inactive).

- If taxes are on the shipping option fees, choose the tax type (e.g., Value Added Tax).

- Specify the Shipping Option Fee/Expense.

Please note that these fees are automatically added to the invoice after selecting the shipping option.

Arrange the display order, which refers to the priority of how this option appears among other options listed in the invoice’s shipping options dropdown menu.

-

Click on the “Save” button.

After saving all the shipping options you want, go to “Create an Invoice” in the sales dropdown menu on the main menu. You will find a new menu under the shipping option field that you can choose from and complete the rest of the information as usual.

Tax on Shipping Options

The type of tax you have chosen to apply to shipping options can be either included or excluded from the shipping price, depending on what you decided earlier for this tax type in the system.

Separating taxes from the shipping price in accounting settings helps maintain organized records. It separates taxes as amounts that need to be paid to governmental authorities and does not consider them as part of your profits. This is applicable whether you are a shipping company or if you partially profit from shipping prices, even if you are not a shipping company.

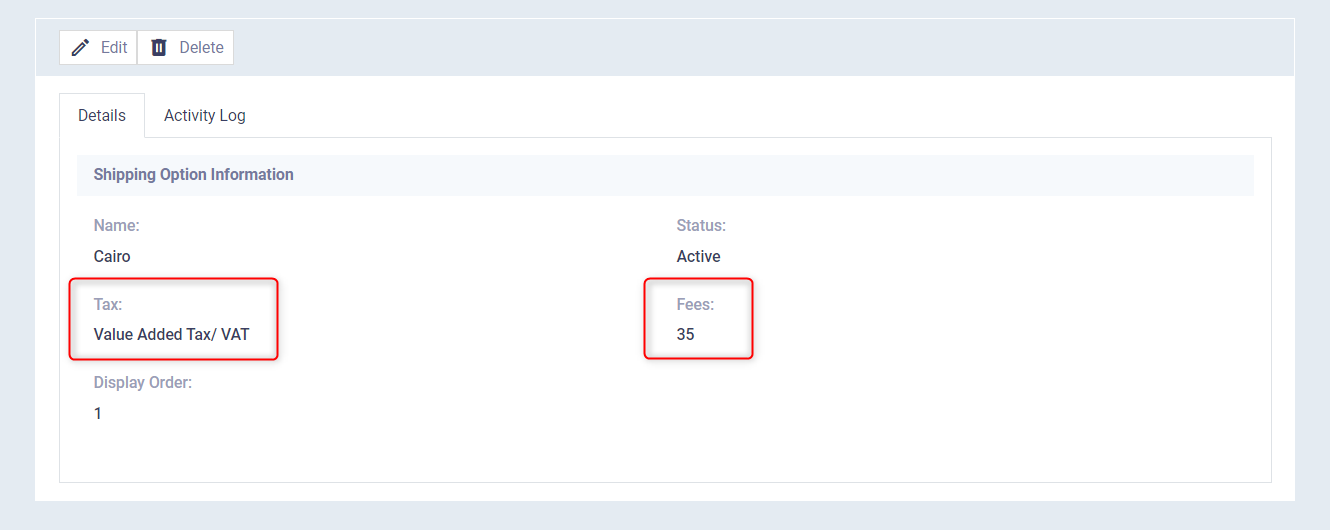

Here, for the shipping option “Cairo Governorate,” Value Added Tax (VAT) is applied, and the shipping fee is 35.

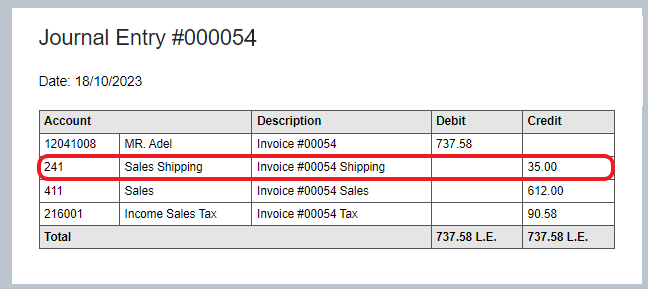

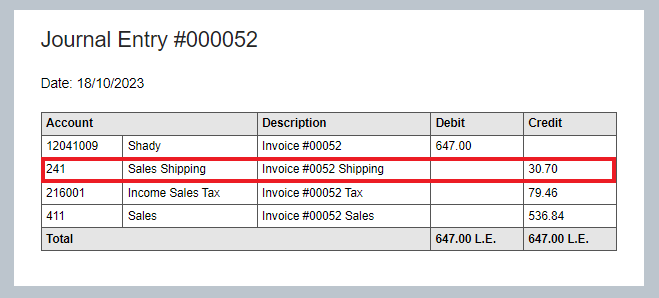

When issuing an invoice that includes the “Cairo Governorate” shipping option, the shipping expenses are recorded in the accounting entries as the full value of 35 if your Value Added Tax (VAT) is not included in the product or service price but is included in the shipping price. This means that the 35 Egyptian pounds are attributed to the shipping expenses alone, and the tax is calculated as a percentage of this amount as follows:

Or the tax amount can be deducted from the shipping expenses if the shipping tax is included in the shipping price. In this case, the 35 specified as the shipping price is divided into the shipping expenses amount and the tax amount on shipping expenses, which follows the tax rate in your country. Here, for example, it was calculated at a rate of 14% according to Egyptian Value Added Tax laws.