E-invoicing – Jordan

E-invoicing – Jordan

If the company has updated its tax number, the user can modify the tax number within the system without affecting previous invoices. The system will retain the old tax number on all invoices issued before the change. Follow the steps below:

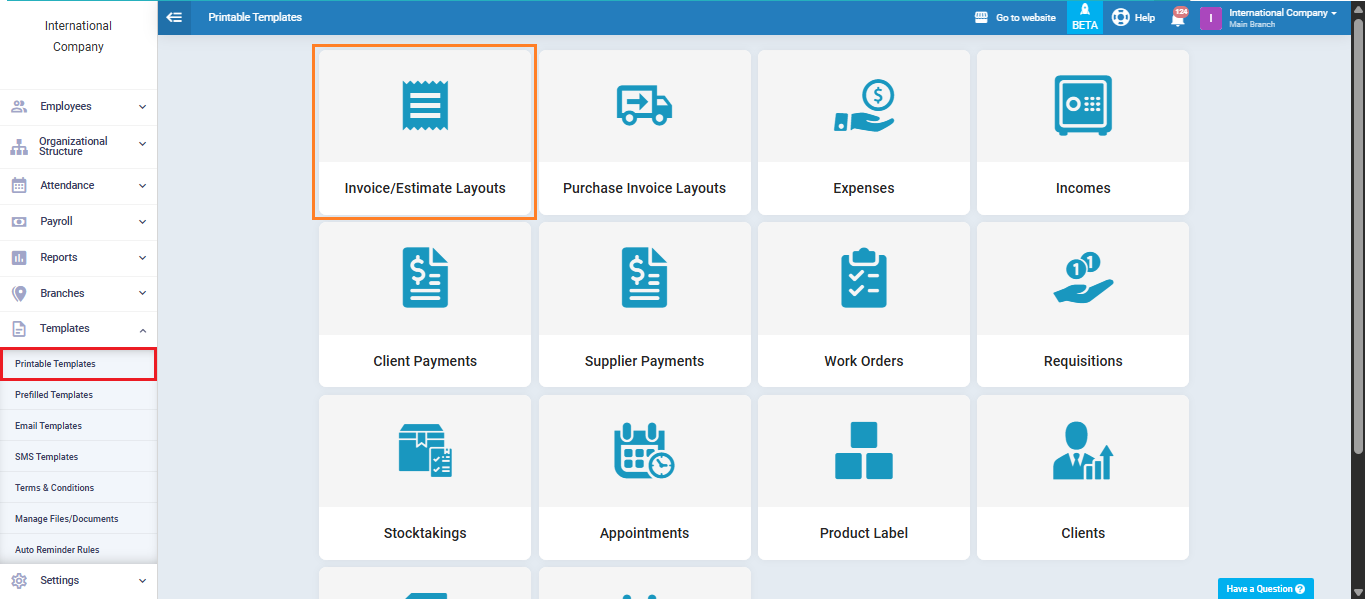

From the main menu, click “Templates”, then click “Printable Templates.”

Select “Invoice/Estimates Layouts.”

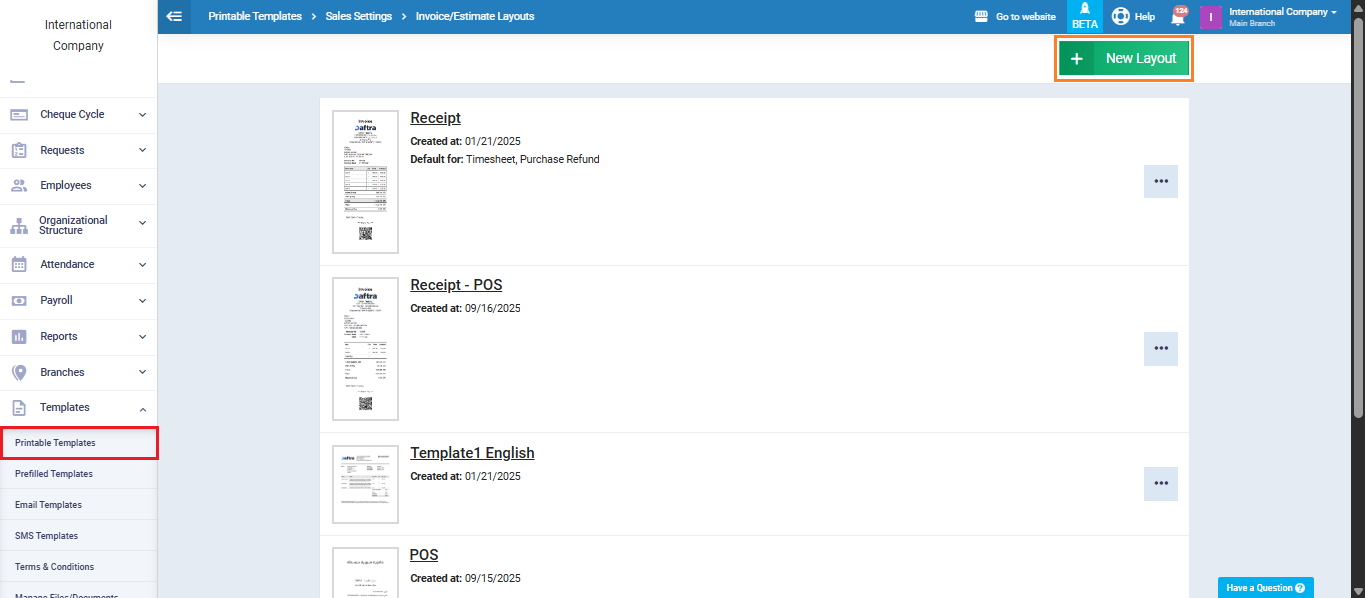

Select from the list the template used for invoices:

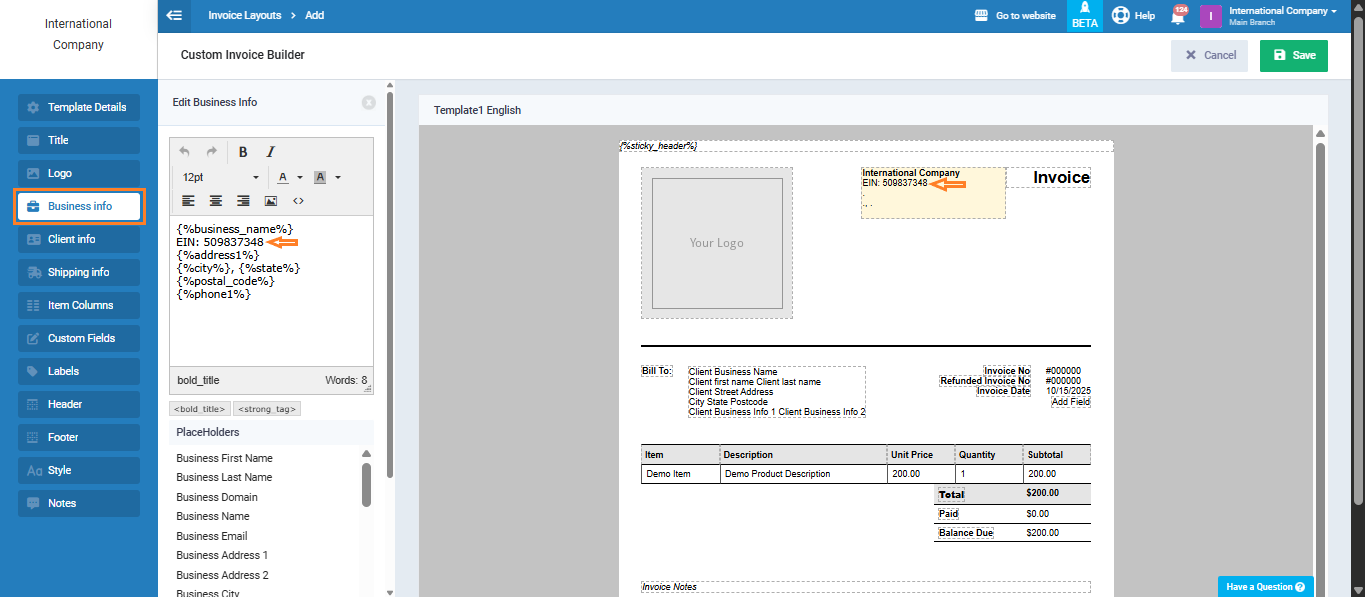

In the tax number field, manually enter the old tax number as shown in the following image.

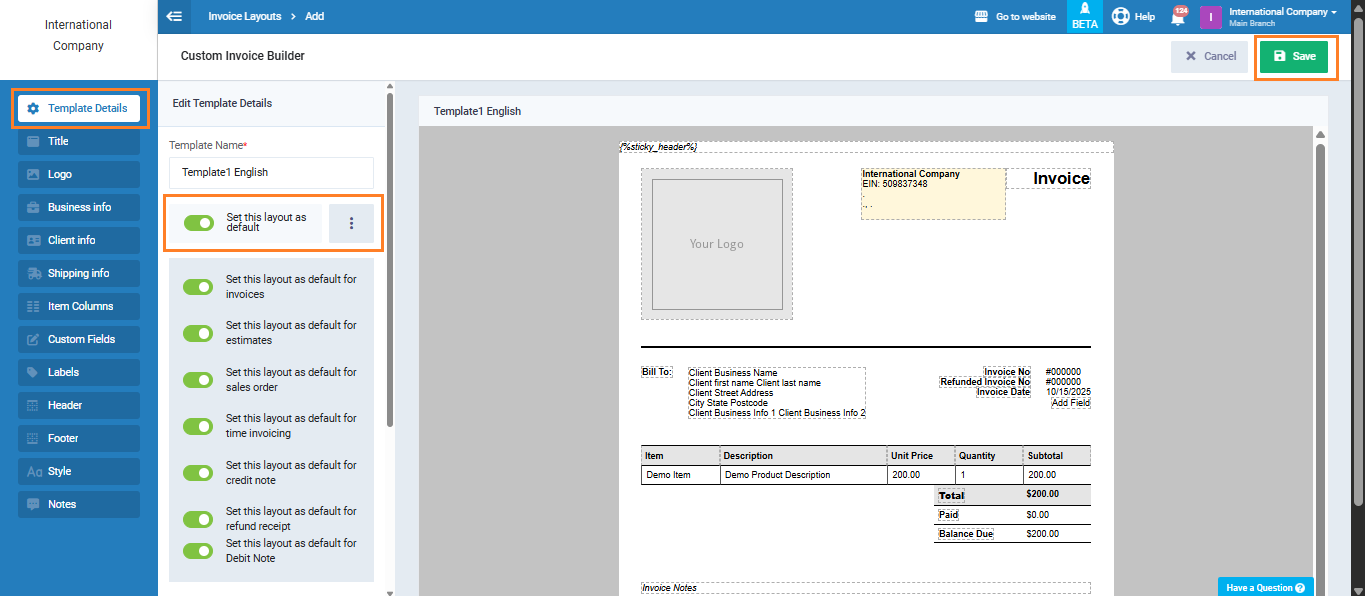

Then, from the template data, deactivate the option “Set this layout as default” and click “Save.”

After saving the template, go to “Account Settings” from the dropdown menu under “Settings” in the main menu.

Enter the new tax number in the designated field.

Next, go back to “Printable Templates“, then “Invoice/Estimates Layout,” and click “New Layout.”

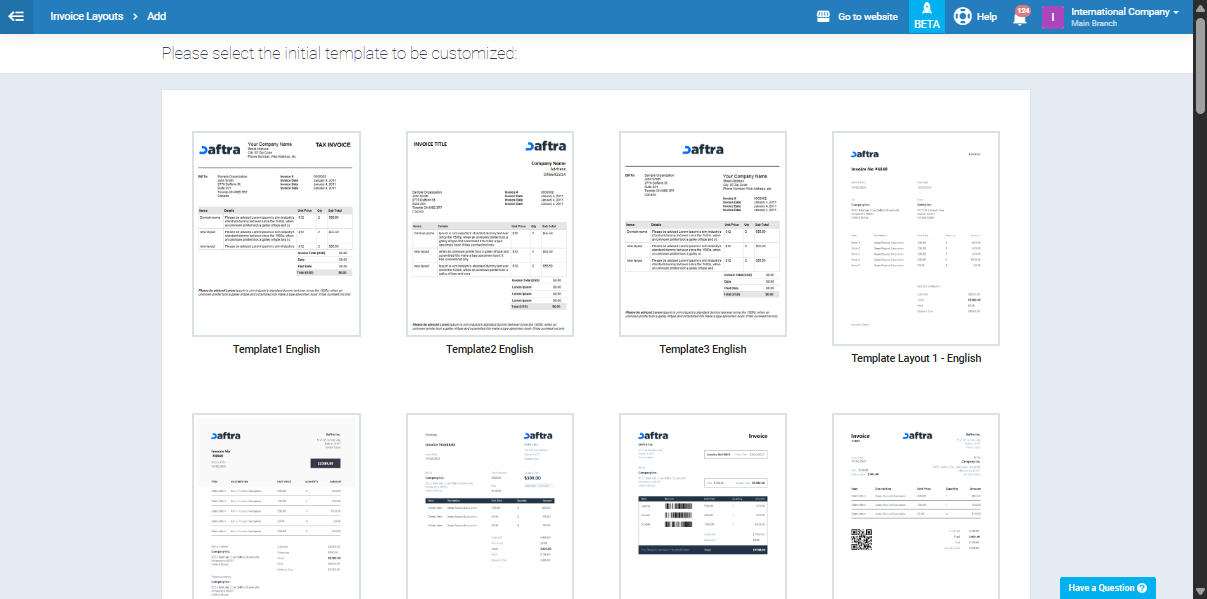

Select the desired template from the print templates list.

Click “Business Information” and you will find that the system has automatically added the new tax number in the designated field, as shown below.

Then, from the template data, make sure to activate “Set this layout as default” and click “Save.”

Now, when you go to “Manage Invoices,” you will notice that all previously issued invoices still contain the old tax number, while the new tax number will be automatically applied to any invoices created afterward.