Partially paying the shipping amount to the shipping company and keeping a part of the amount.

In the normal case, the shipping amount is determined and the full amount is sent to the shipping company, and it does not fall under your revenues, as it is considered an expense for your company and should be paid to the shipping company.

However, sometimes you need to redistribute the shipping expense amount received from the client. In this case, part of it is considered an expense paid to the shipping company, and the other part is considered as sales revenue. How do you carry out the correct accounting treatment for this distribution?

This is what we explain in this guide.

Adding a new shipping company and determining the total shipping amount

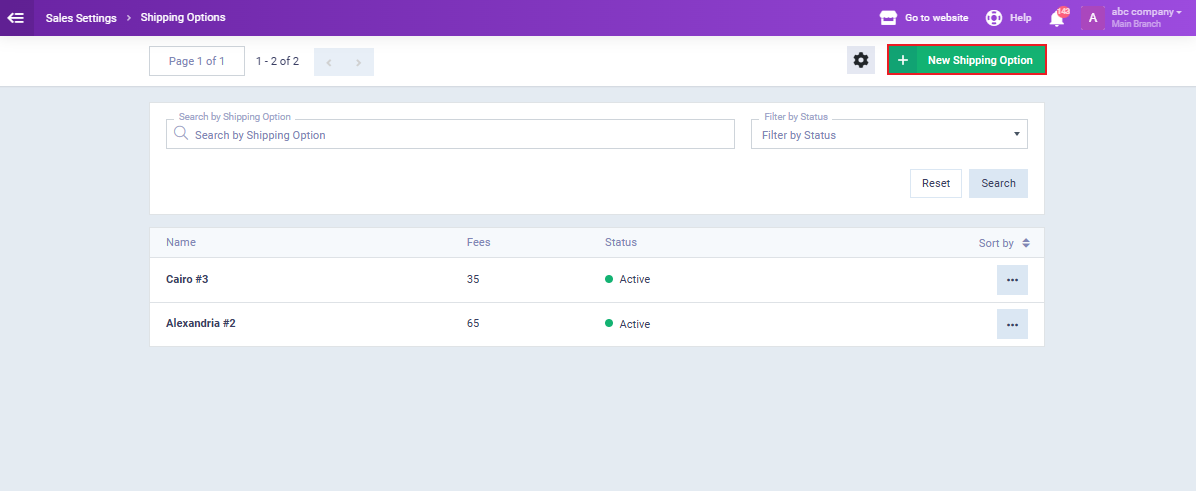

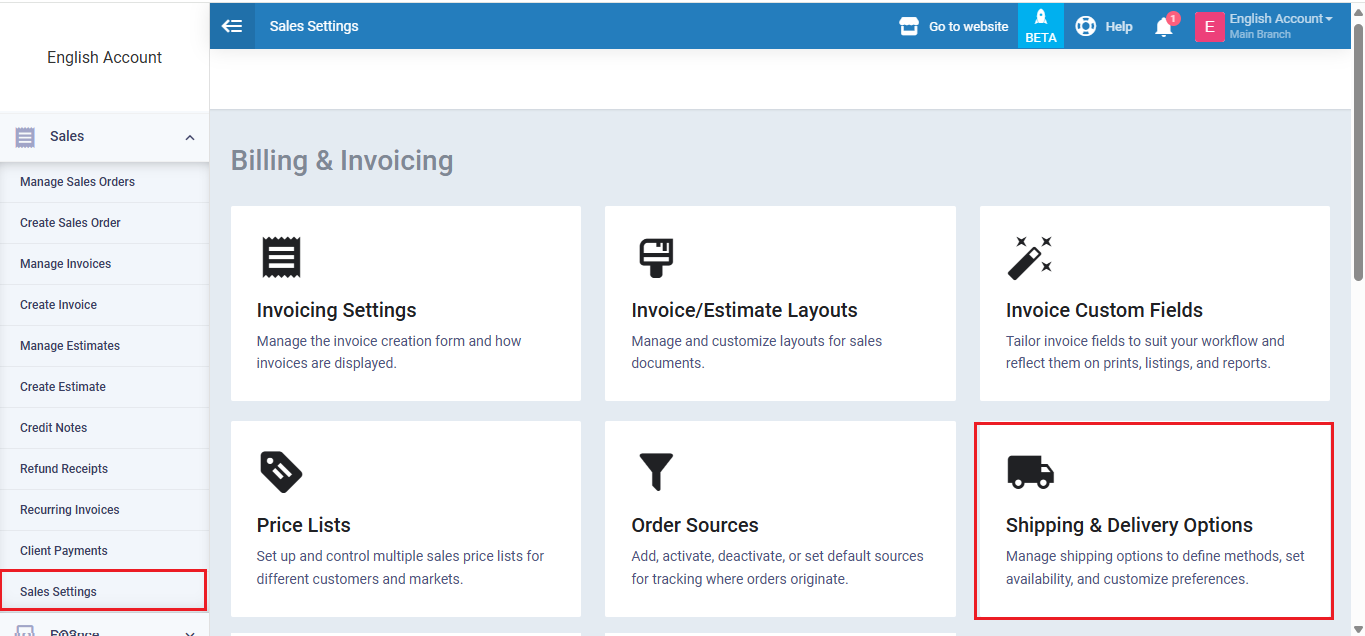

To add a new shipping company, click “Sales Settings” under “Sales” in the main menu, then click “Shipping and Delivery Options.”

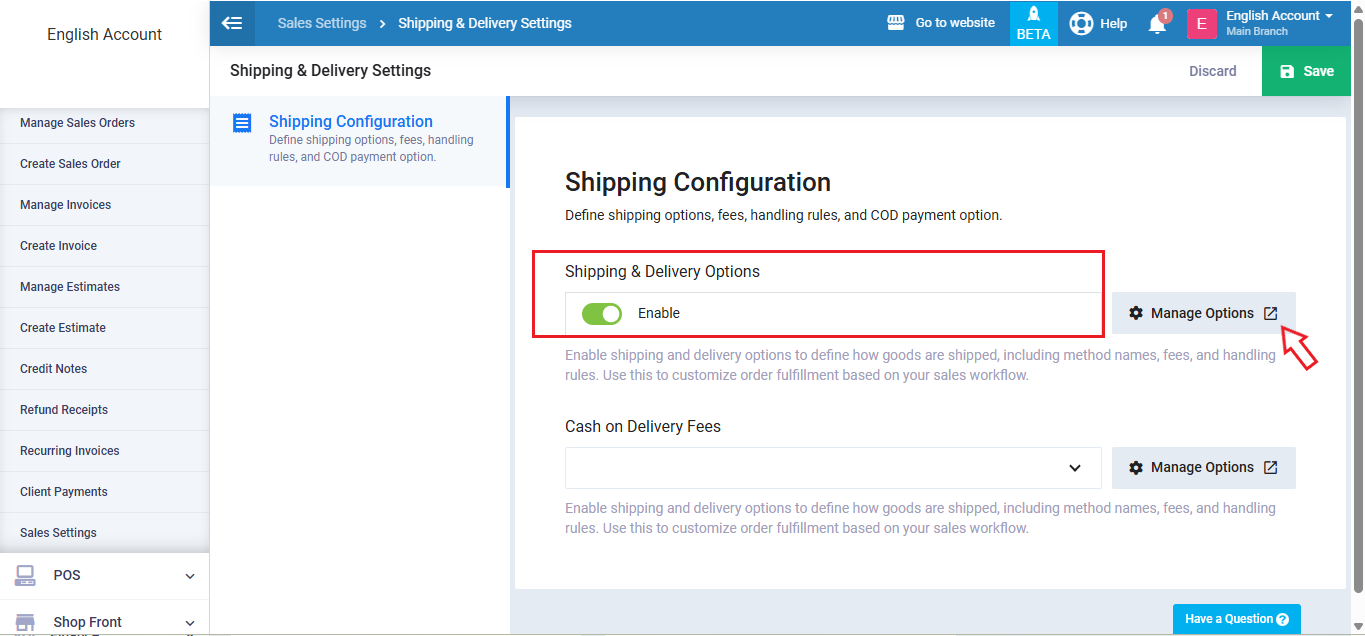

Enable the “Shipping and Delivery Options” option, then click the “Manage Options” button.

Click on “New Shipping Option“.

Click on “New Shipping Option“.

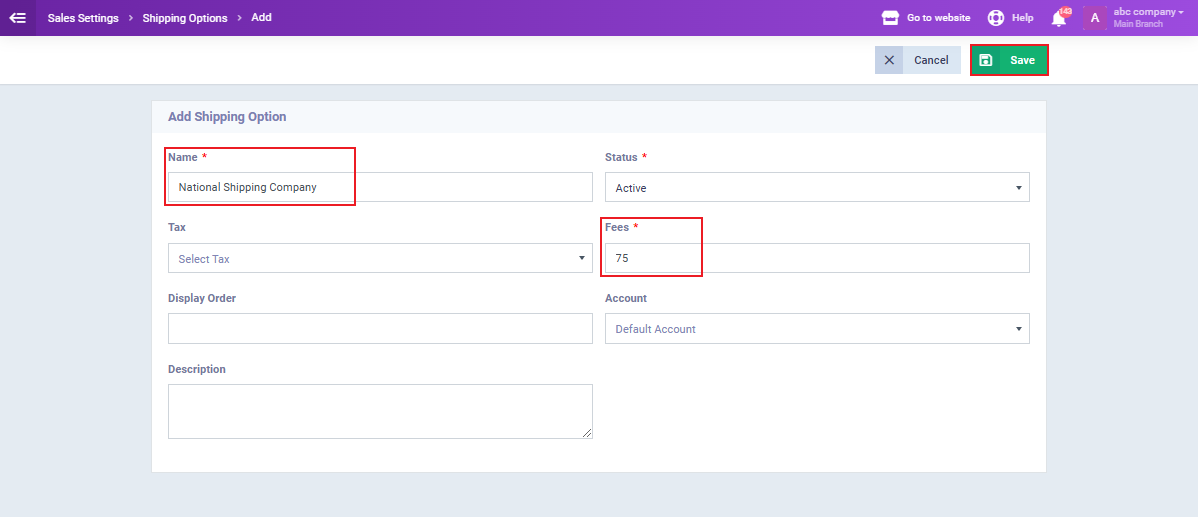

Enter the shipping company’s name in the ‘Name‘ field and the total shipping charges to be collected from the client in the ‘Fees‘ field, then click the ‘Save‘ button.

Creating an invoice for the full shipping amount and its impact on the chart of accounts

Normally, the total shipping expenses collected from the client invoice are sent to the shipping company, as shown in the following example:

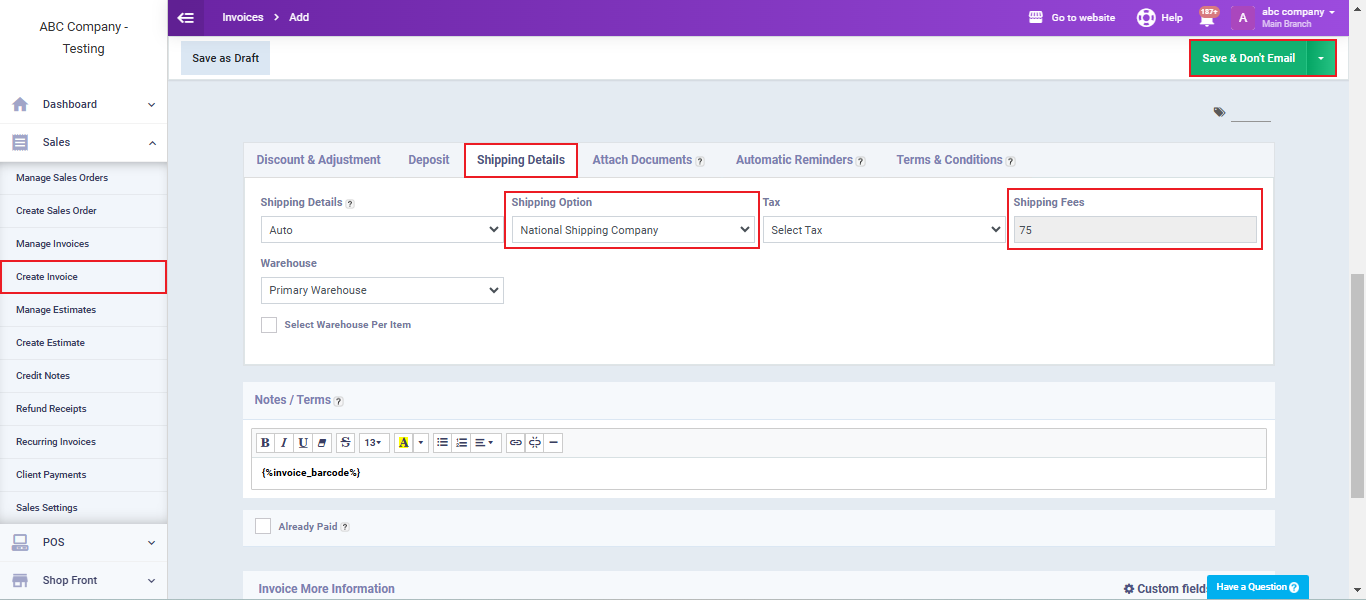

Click on ‘Create Invoice‘ under ‘Sales‘ in the main menu, then go to the ‘Shipping Details‘ section and select the desired shipping company from the dropdown list in the ‘Shipping Options‘ field. The predetermined shipping expenses will automatically appear. Complete the invoice details and click the ‘Save‘ button.

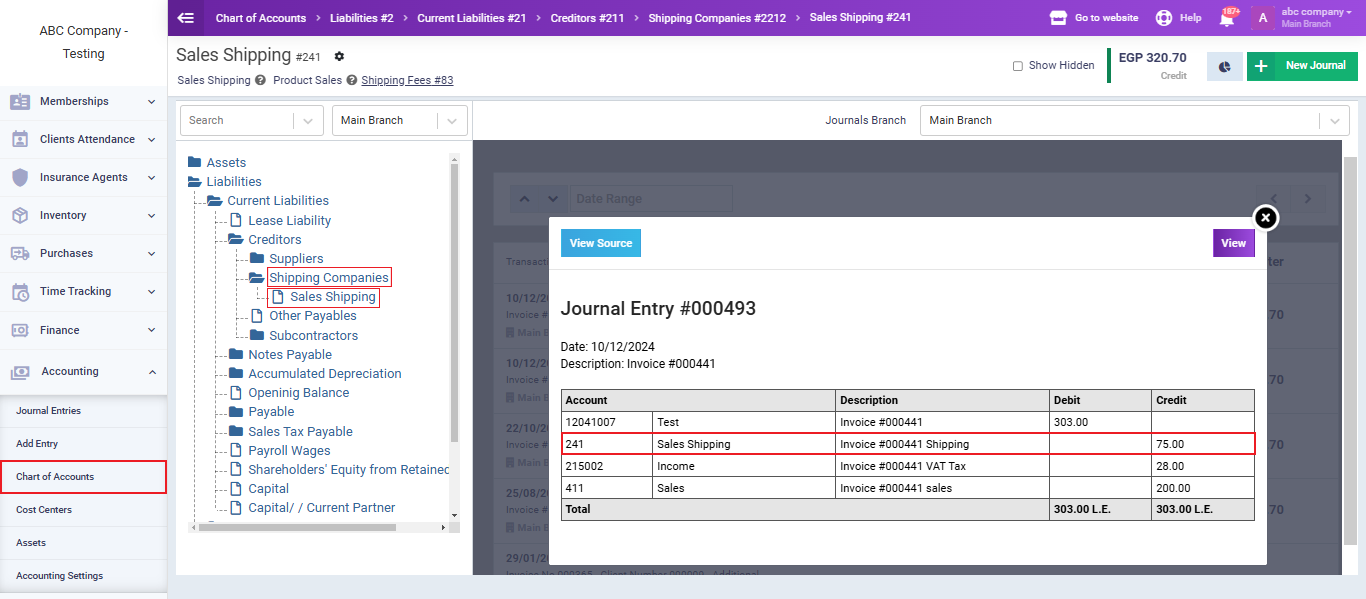

You will find the entry in the chart of accounts, and the entire shipping amount has been directed to the Sales Shipping Account.

Adding an entry to route part of the shipping expenses to you instead of paying them to the shipping company

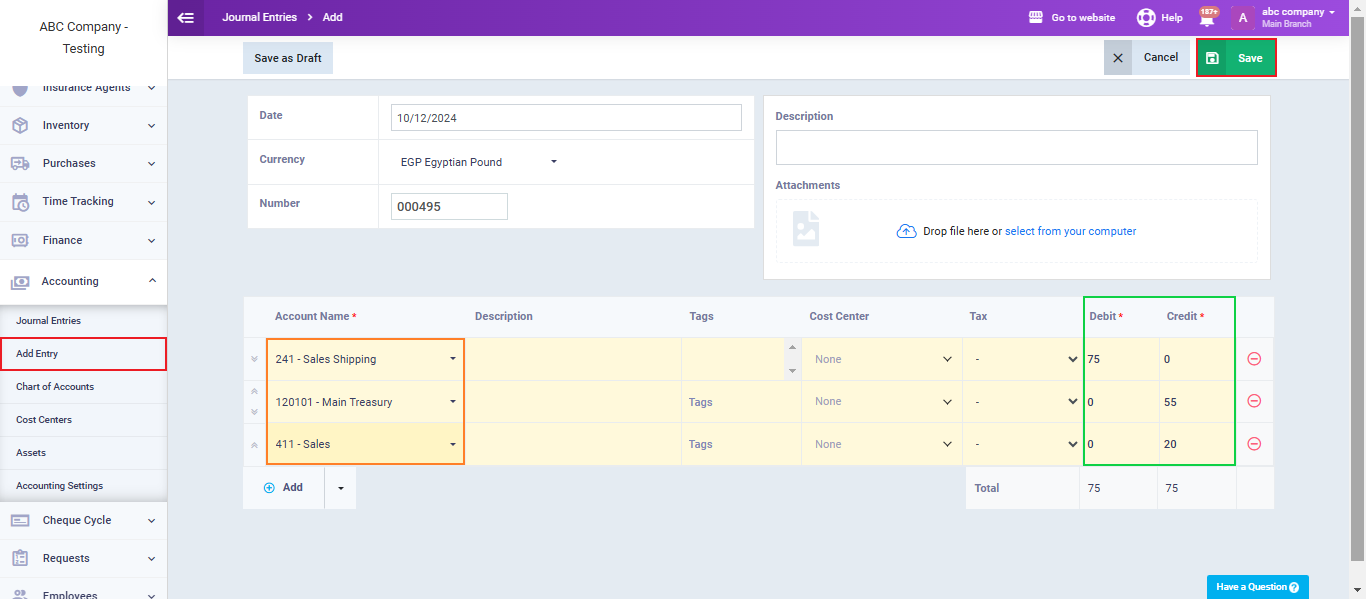

Click on ‘Add Entry‘ under ‘Accounting‘ in the main menu, then enter the entry as follows:

Debit Sales Shipping Account (75)

Credit Treasury Account (55)

Credit Sales Account (20)

This means redirecting the shipping amount from the Sales Shipping Account, with 20 EGP from the total shipping amount going into your Sales Account as part of your revenue.

The remaining 55 EGP is directed to your main treasury account.

Then click the ‘Save‘ button.