Sales and Returns Accounting Entries

A sales process involves various accounting transactions. Each transaction is crucial for accurately recording your business’s financial activities.

Accounting entries resulting from a sales transaction can vary based on two cases:

-

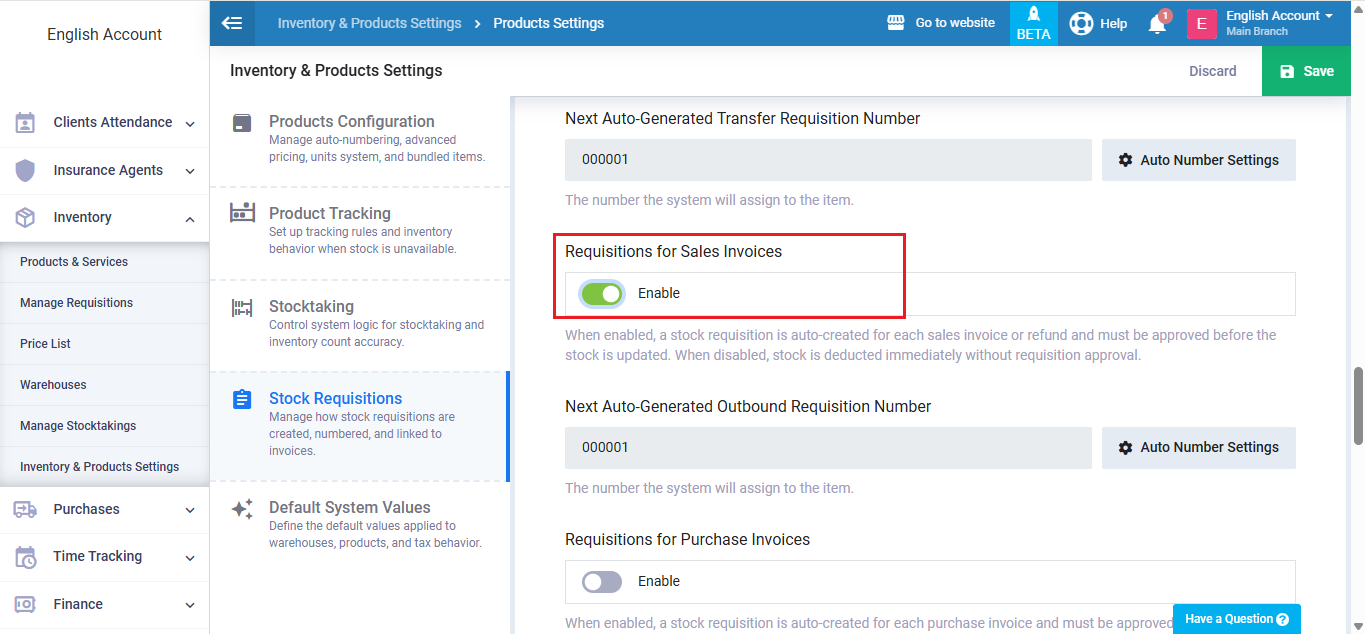

- Enable Requisitions for Sales Invoices: In this case, the system automatically generates the sales entry, while the warehouse entry necessitates manual confirmation of the requisition.

- Disable Requisitions for Sales Invoices: The system automatically generates sales and warehouse entries without any manual intervention.

In this article, we will detail the accounting entries that result from creating a sales invoice in the system, based on each case.

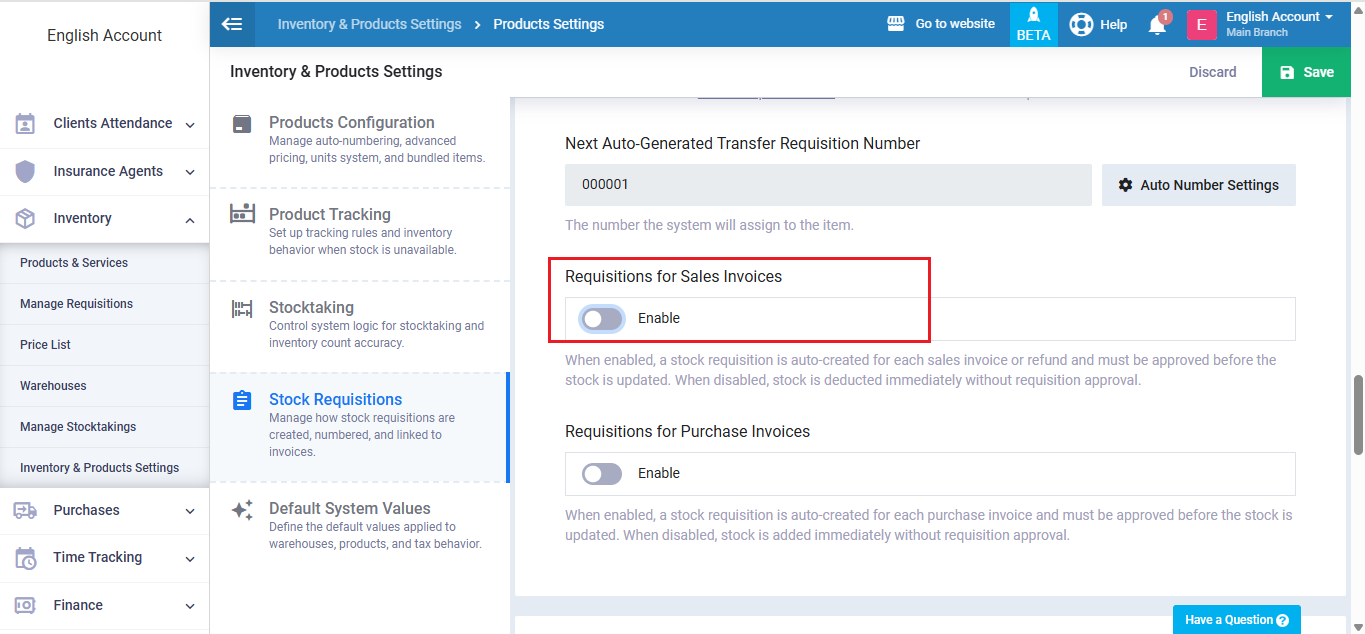

Enable Requisitions For Sales Invoices

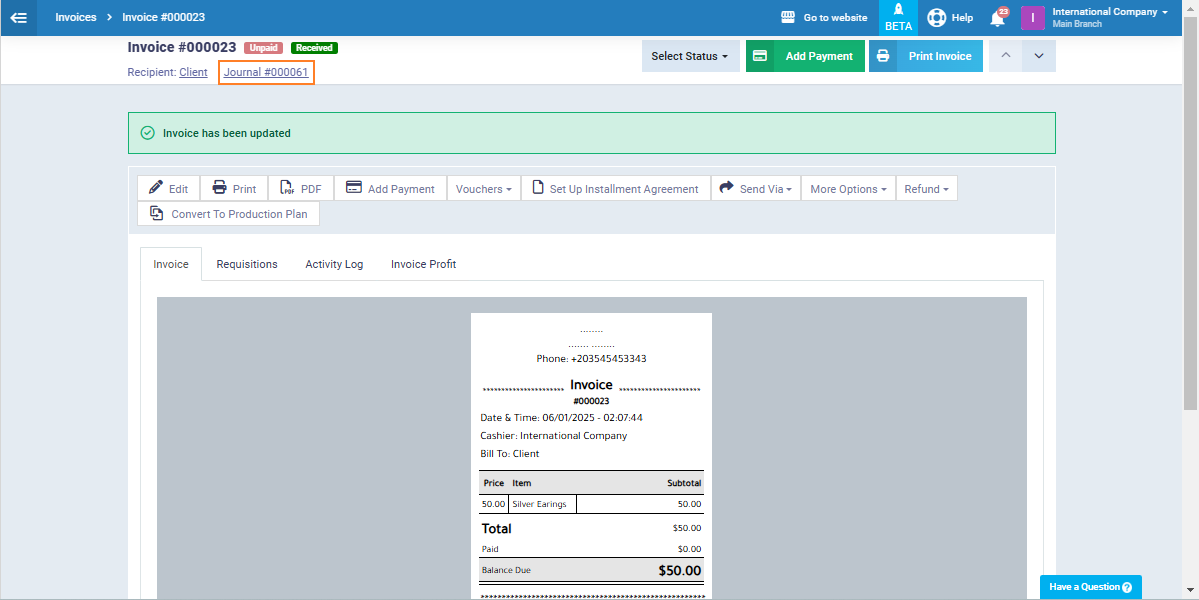

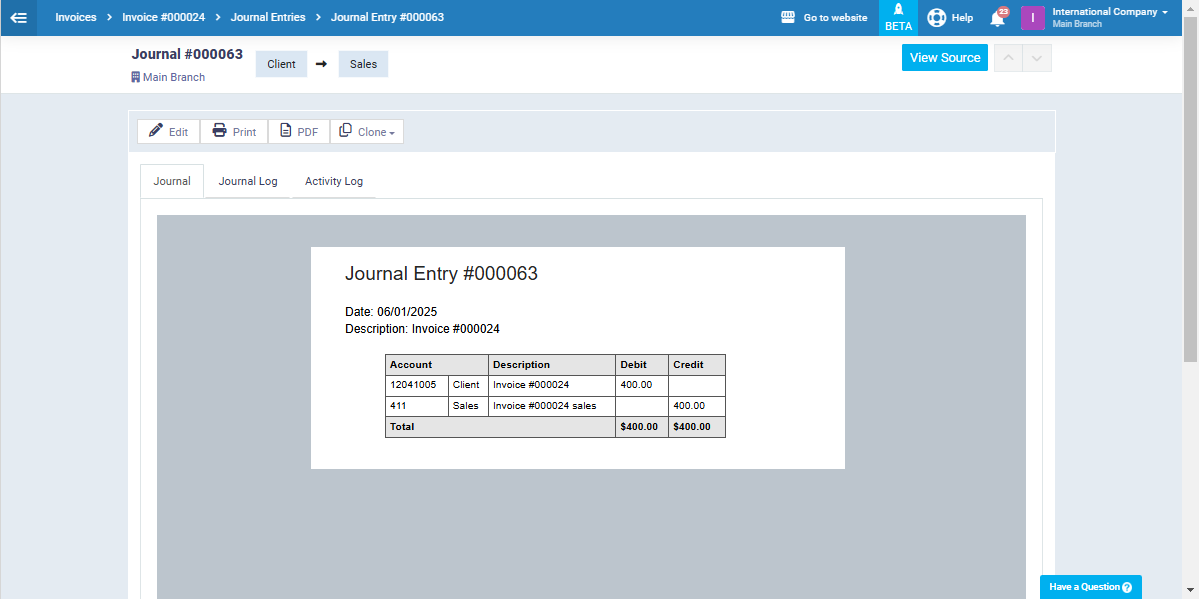

Click on the entry number located beneath the invoice number and status.

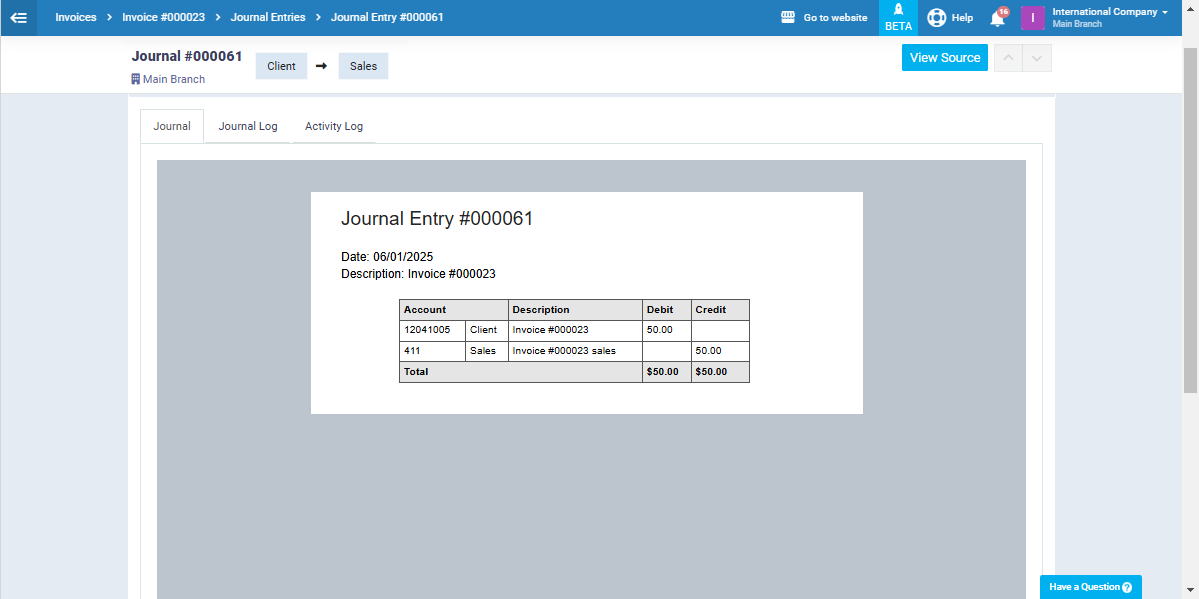

The resulting journal entry will reflect a debit to the client’s account and a corresponding credit to the sales and taxes accounts as displayed in the image below.

The system also automatically generates an outbound requisition, which requires manual confirmation.

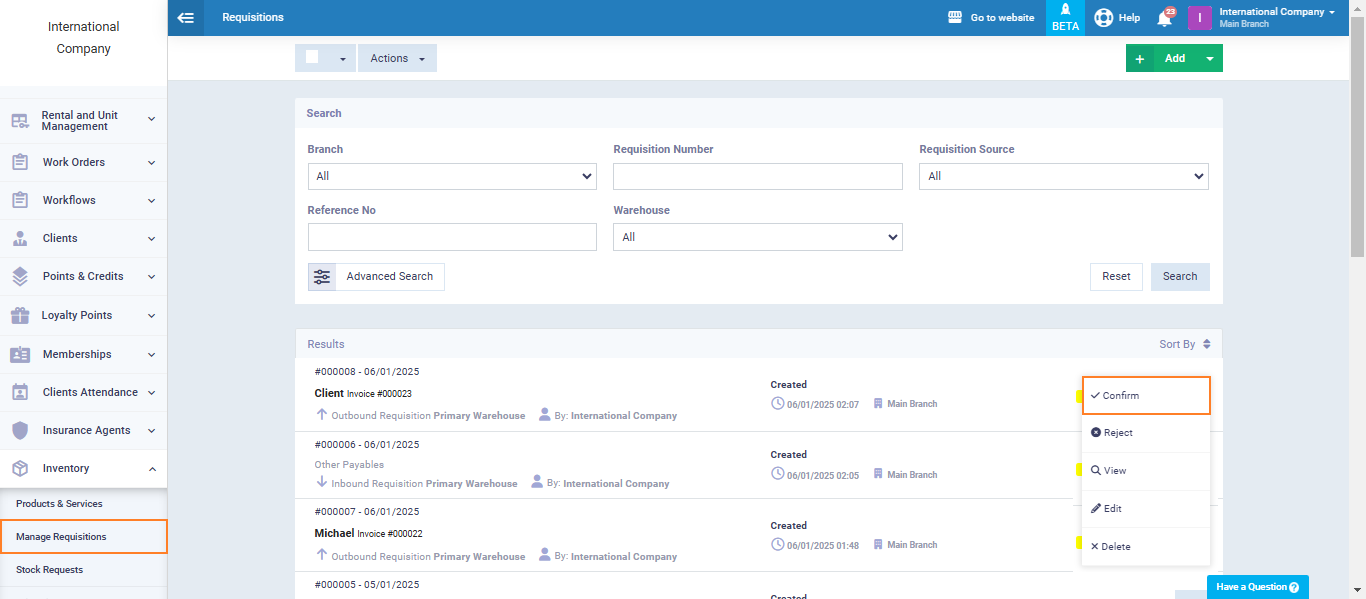

From the “Inventory” dropdown click on “Manage Requisitions“.

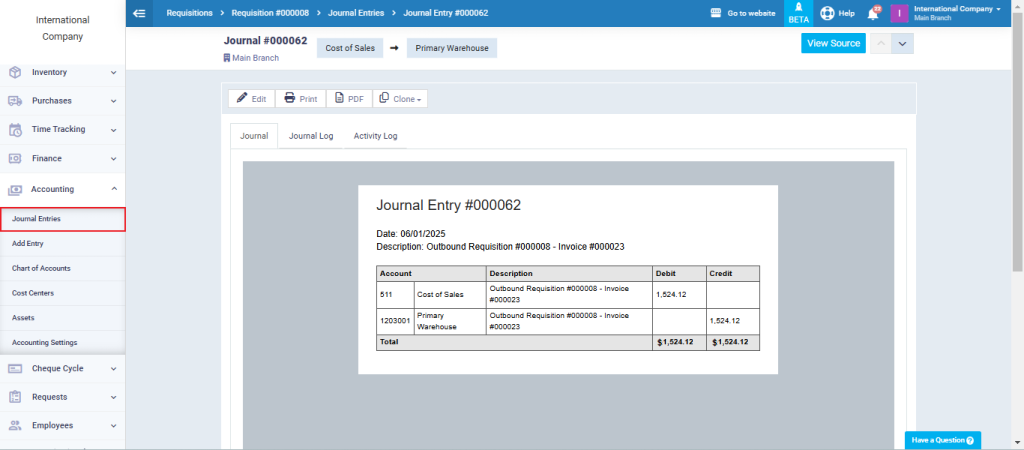

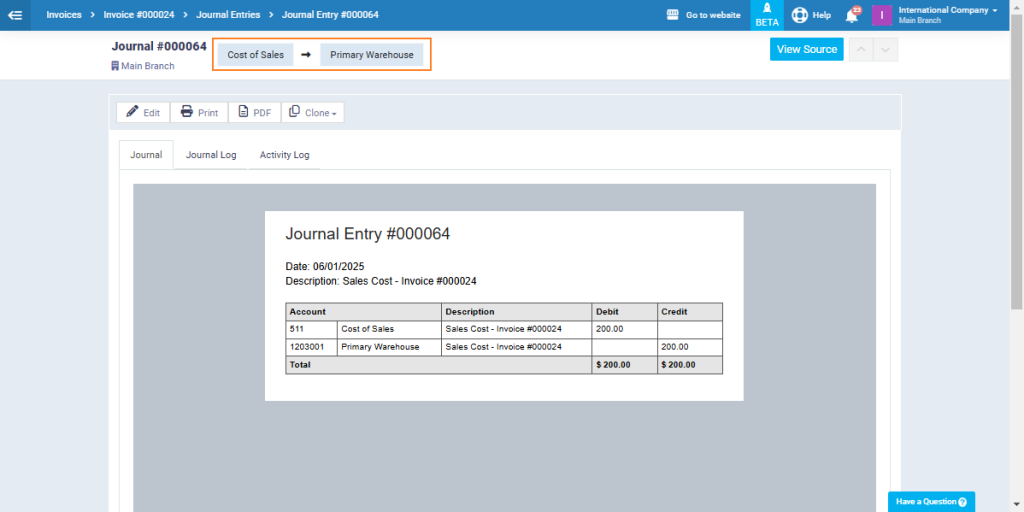

Once the requisition is confirmed, the system will automatically create an entry that debits the Cost of Sales account and credits the Warehouse account. This ensures accurate financial records by reflecting the cost and inventory reduction of the transaction.

Disable Requisitions For Sales Invoices

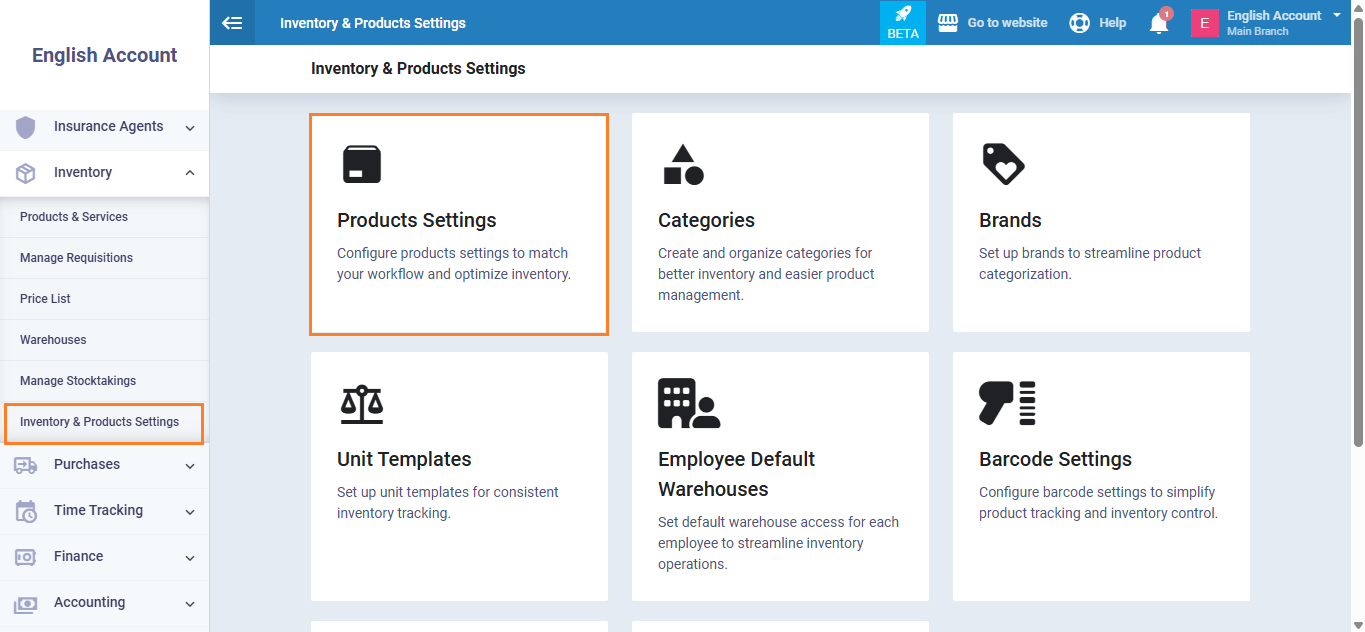

Click on “Inventory Settings“, disable “Requisition for Sales Invoices“.

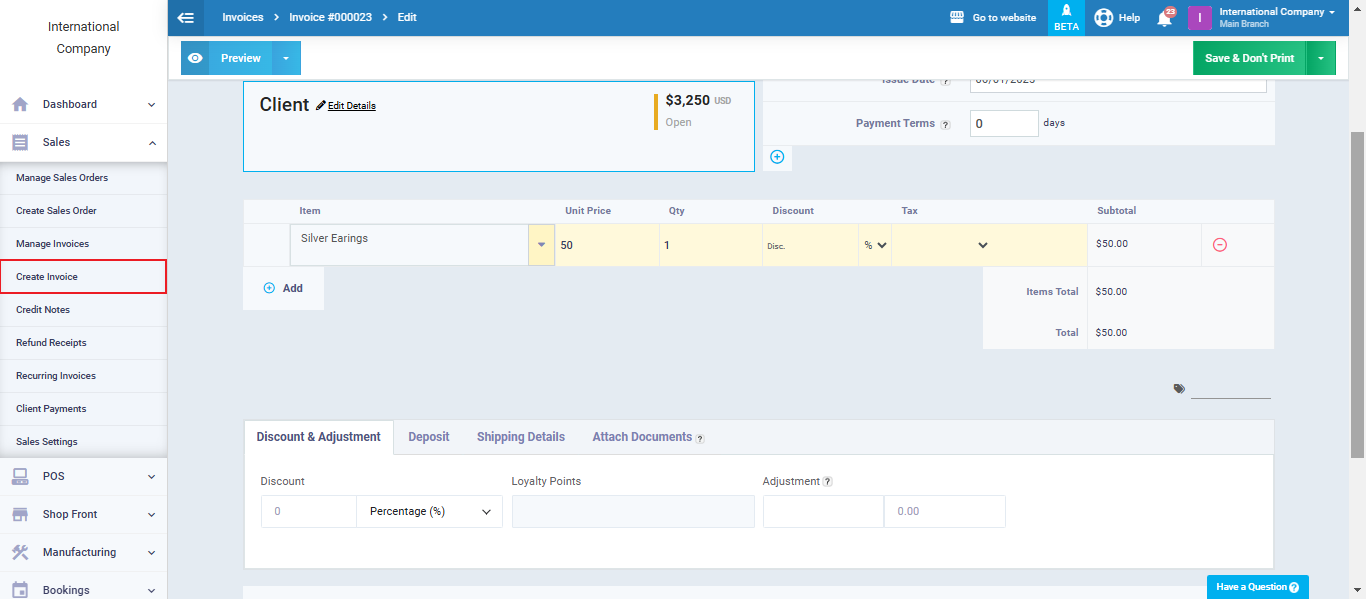

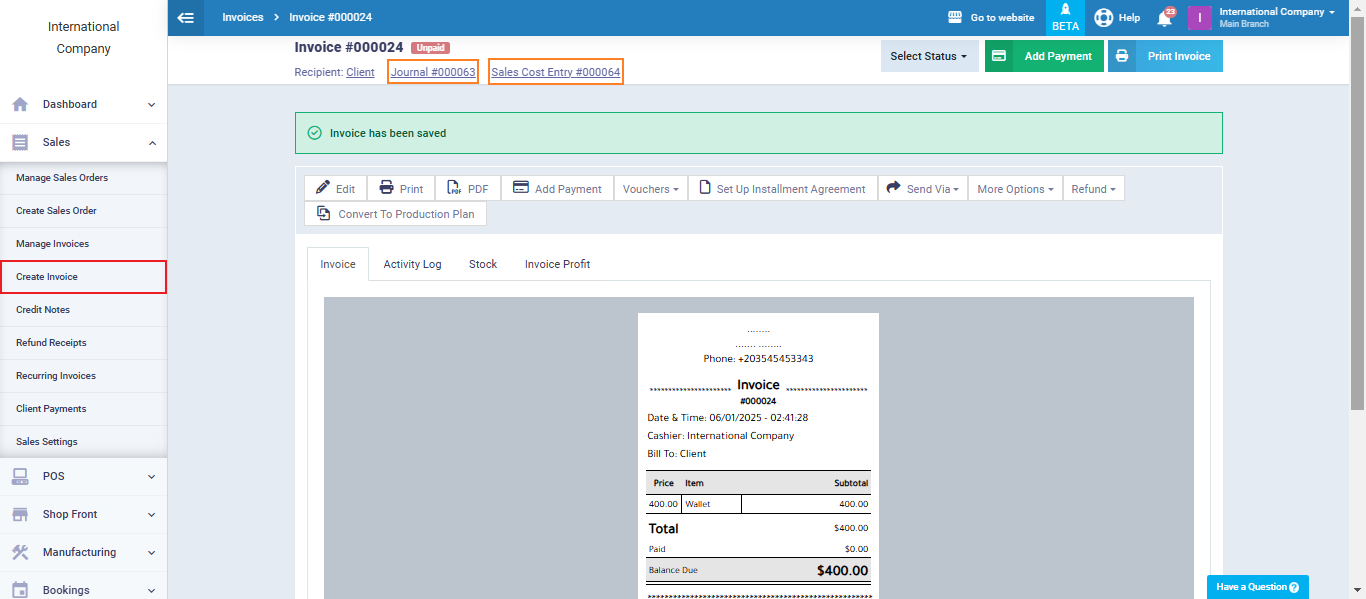

Then, from the “Sales” dropdown menu choose “Create Invoice“. Fill in the invoice info then click on the “Save” button.

In this case, the sales invoice automatically produces 2 different entries which are:

Upon issuing a sales invoice, a sales entry will typically involve debiting the Client account and crediting the Sales account.

Additionally, any applicable sales taxes will be credited to the Taxes account.

As the “Requisitions For Sales Invoices” is not enabled, the system will automatically produce an entry from the “Cost of Sales” account to the “Primary Warehouse” account without any manual intervention.

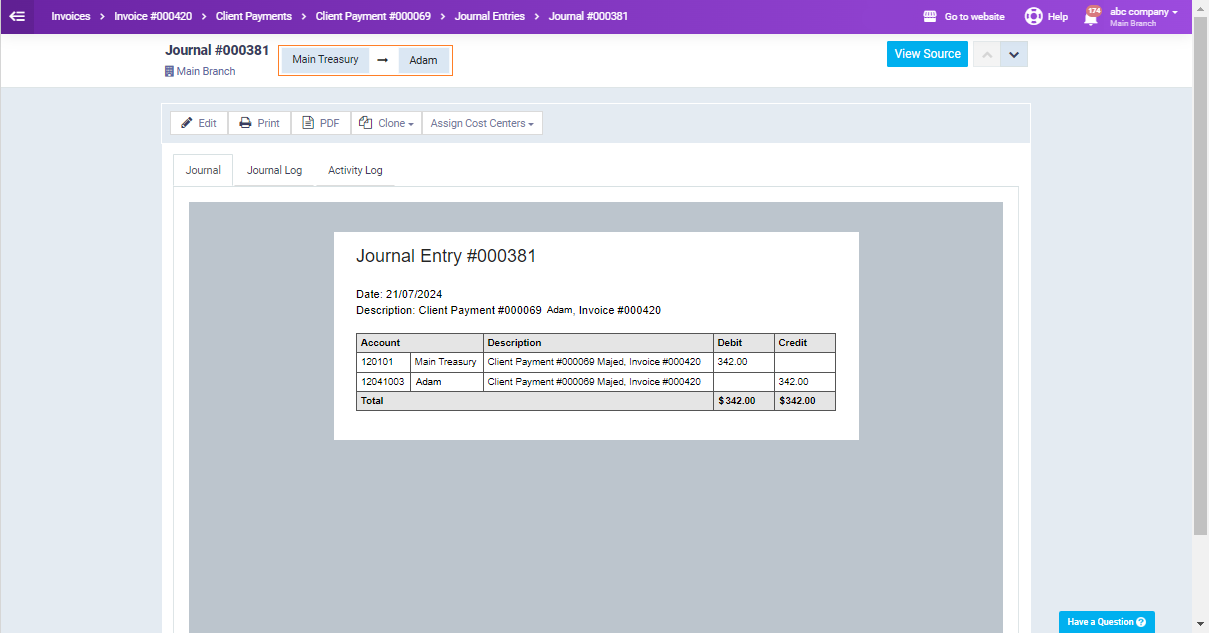

Client Payment Entry

This entry is automatically generated from the treasury/bank account to the client’s account when a payment is added to the sales invoice, regardless of whether the “Enable Requisitions For Sales Invoice” feature is activated.

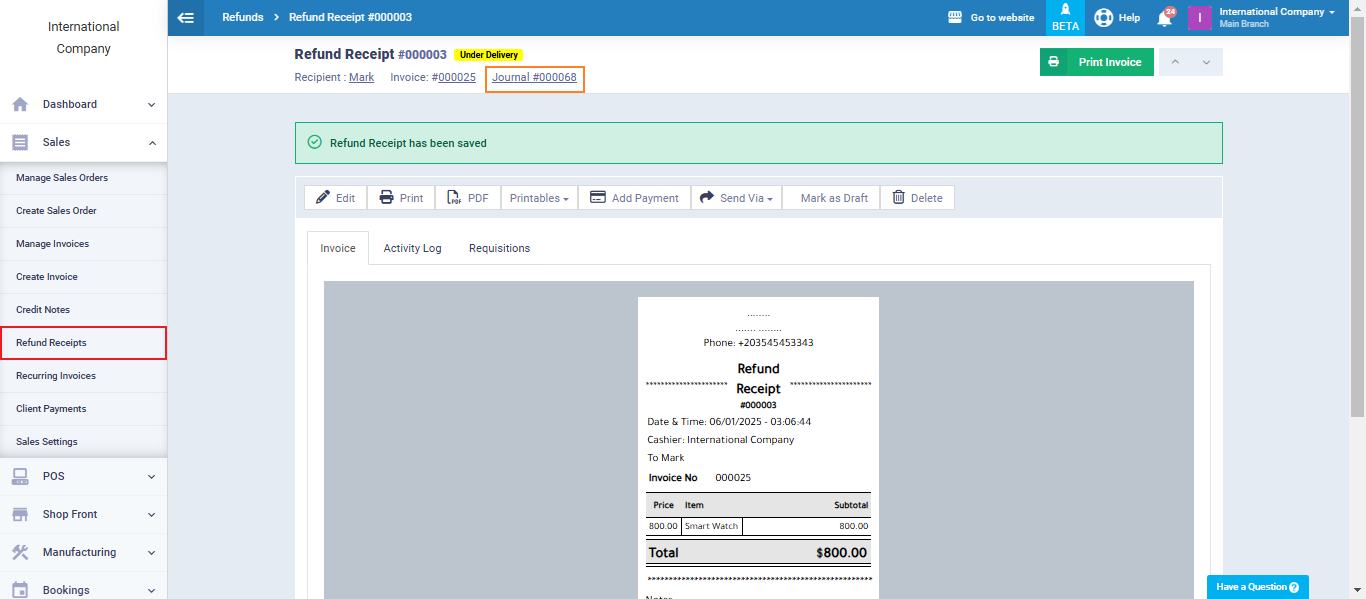

Refund Receipt Entries

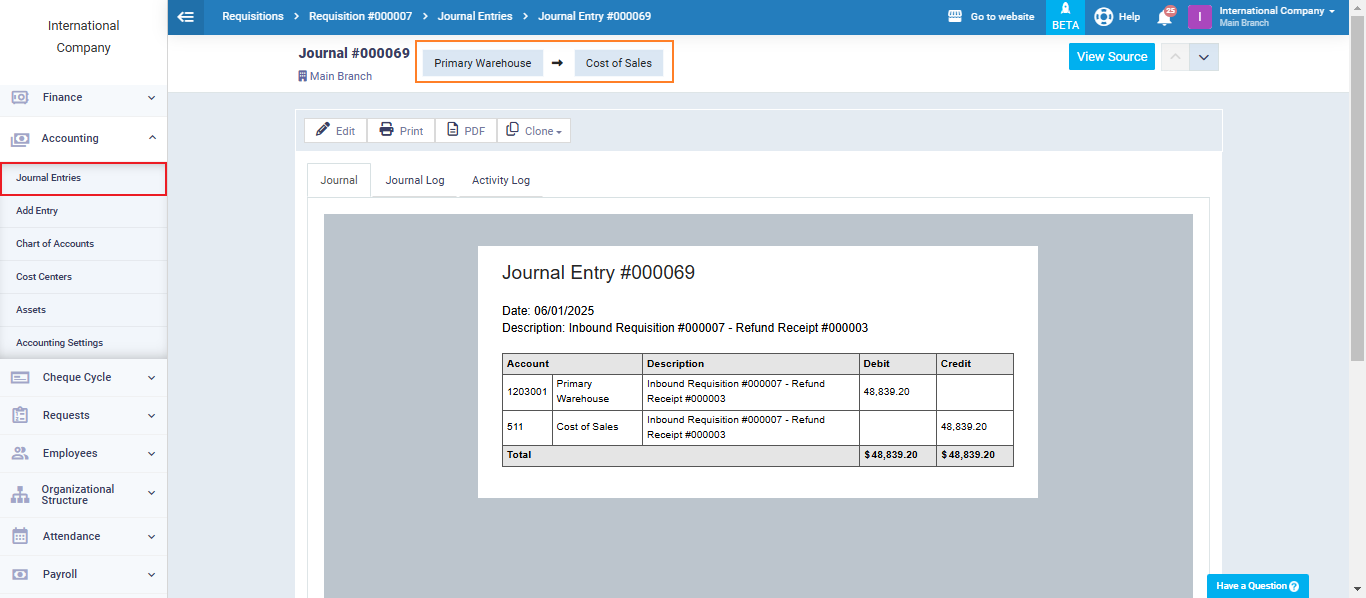

After creating a refund receipt an entry will be automatically produced, click on the Journal under the Refund receipt number as shown in the image below.

The refund receipt automatically generates an inbound requisition. This requisition must be confirmed to create the refund entry.

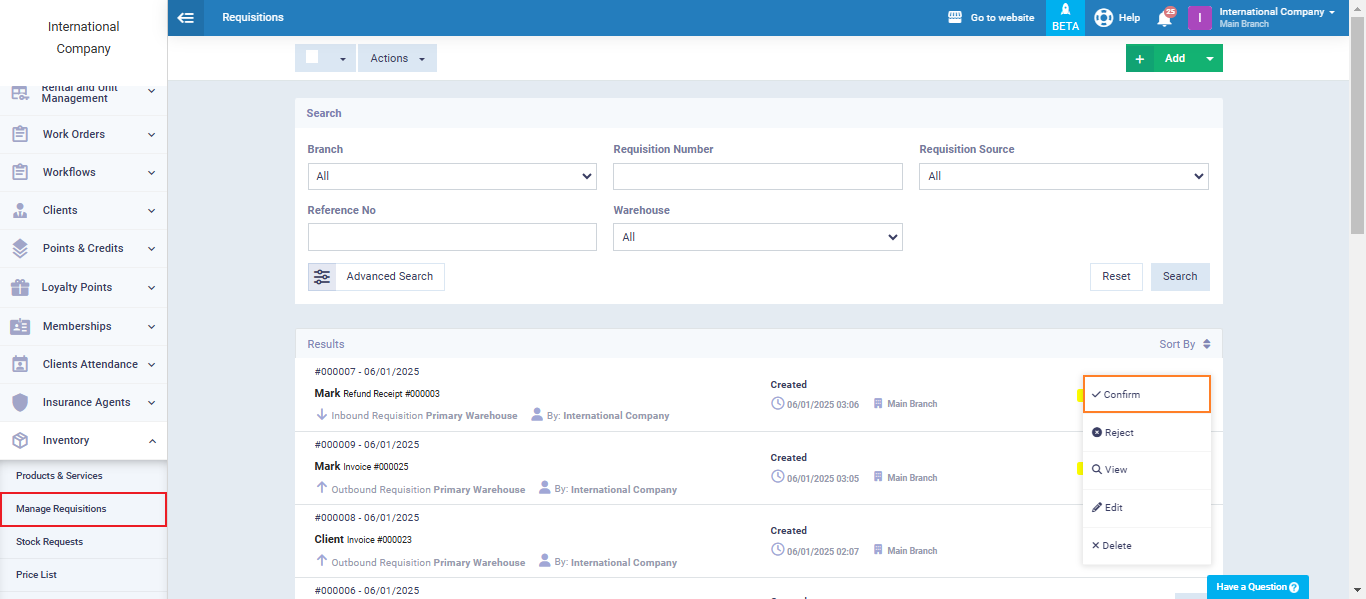

Click on “Manage Requisitions” and click on the “…” beside the desired requisition then click on “Confirm“.

Direct to the “Journal Entries” and you’ll find the entry of the refund receipt inbound requisition automatically generated