Assigning Purchase Tax & Sales Tax to Products

To ensure accurate tax reporting and compliance, it’s important to assign the correct purchase and sales tax rates to each product. This tutorial guides you through the steps to apply sales and purchase tax to products.

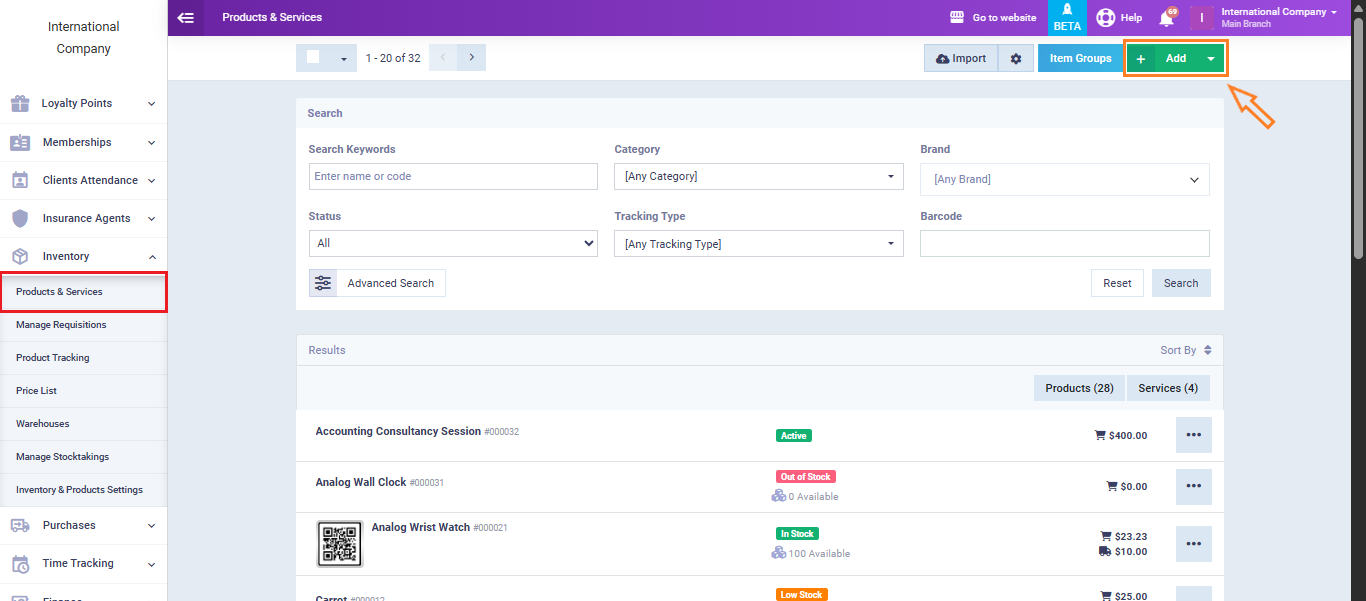

Click on “Product & Services” from the dropdown menu of “Inventory“. Click on the button “Add” to add a new product.

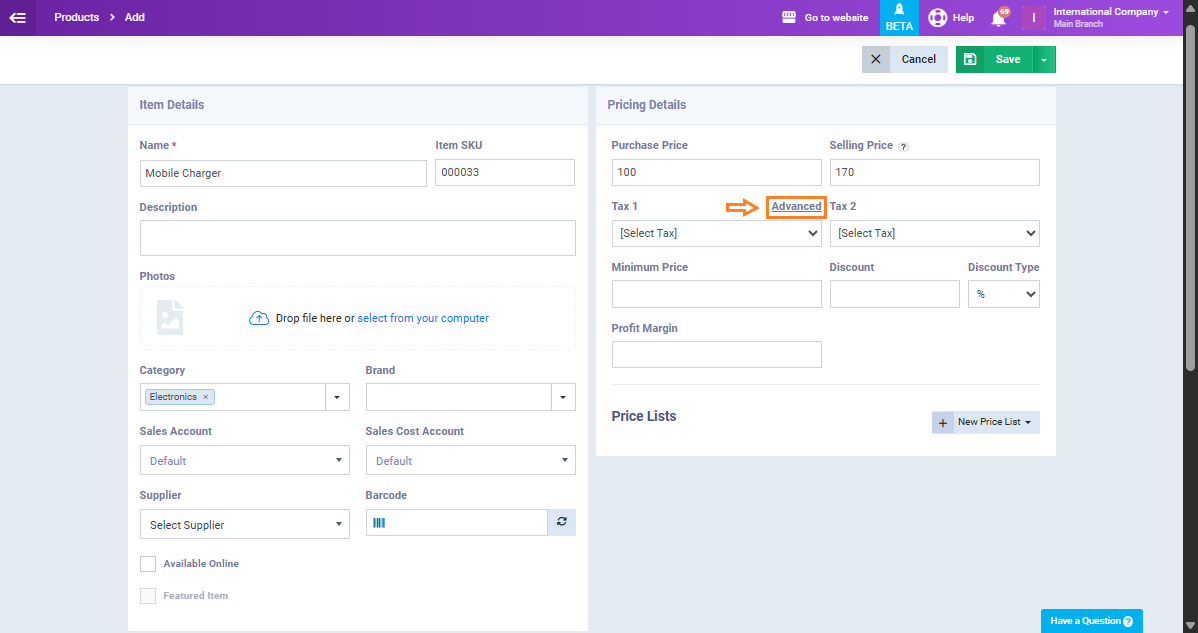

Fill in the product details, then beside the taxes fields click on “Advanced“.

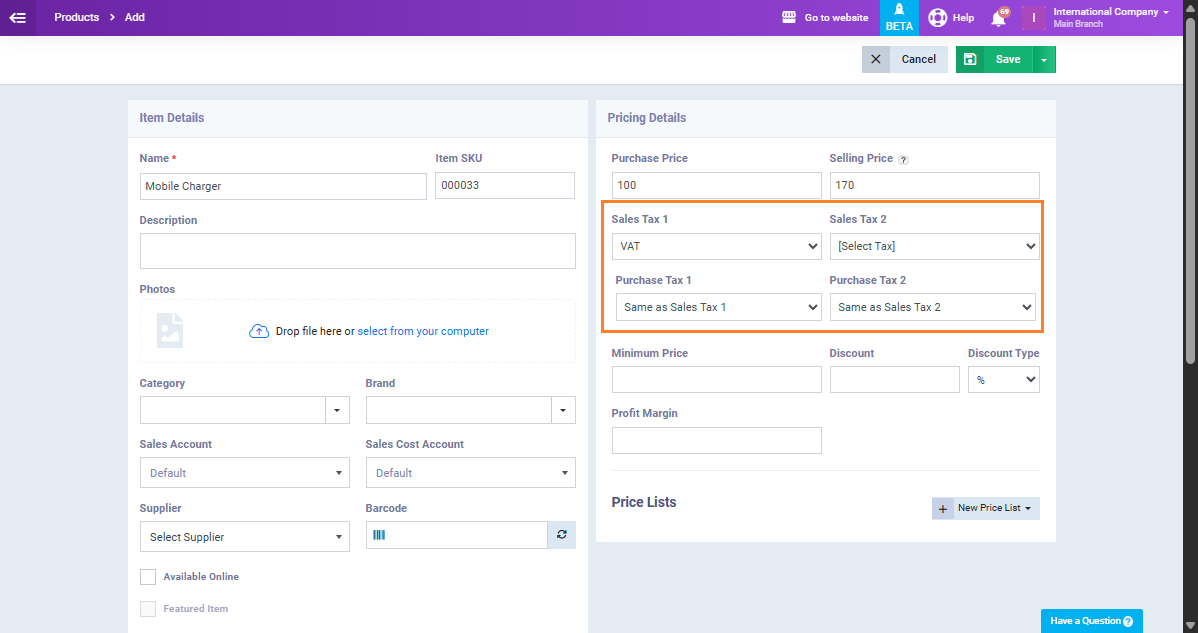

After clicking on “Advanced,” four tax fields will appear, allowing you to assign both sales and purchase taxes as follows:

- Sales Tax 1: The primary tax applied to a product when it’s sold to customers.

- Sales Tax 2: An optional secondary sales tax. Useful if your region requires multiple taxes.

- Purchase Tax 1: This is the main tax applied when purchasing the product from suppliers. It can match Sales Tax 1 or be selected independently based on purchase tax requirements.

- Purchase Tax 2: A secondary purchase tax field. Used when multiple purchase-related taxes are applicable. Can also be set to match Sales Tax 2 or defined separately.

In this example, we’ll assign VAT as both the sales and purchase tax for the product, then click the “Save” button to apply the changes.

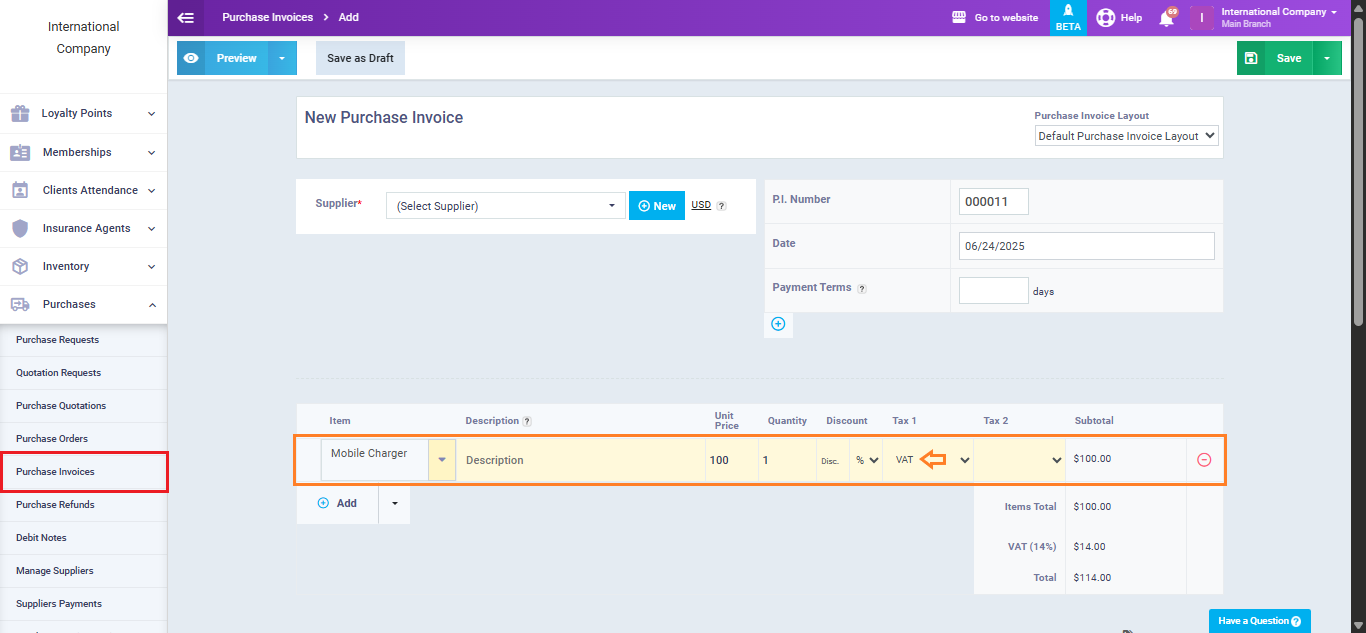

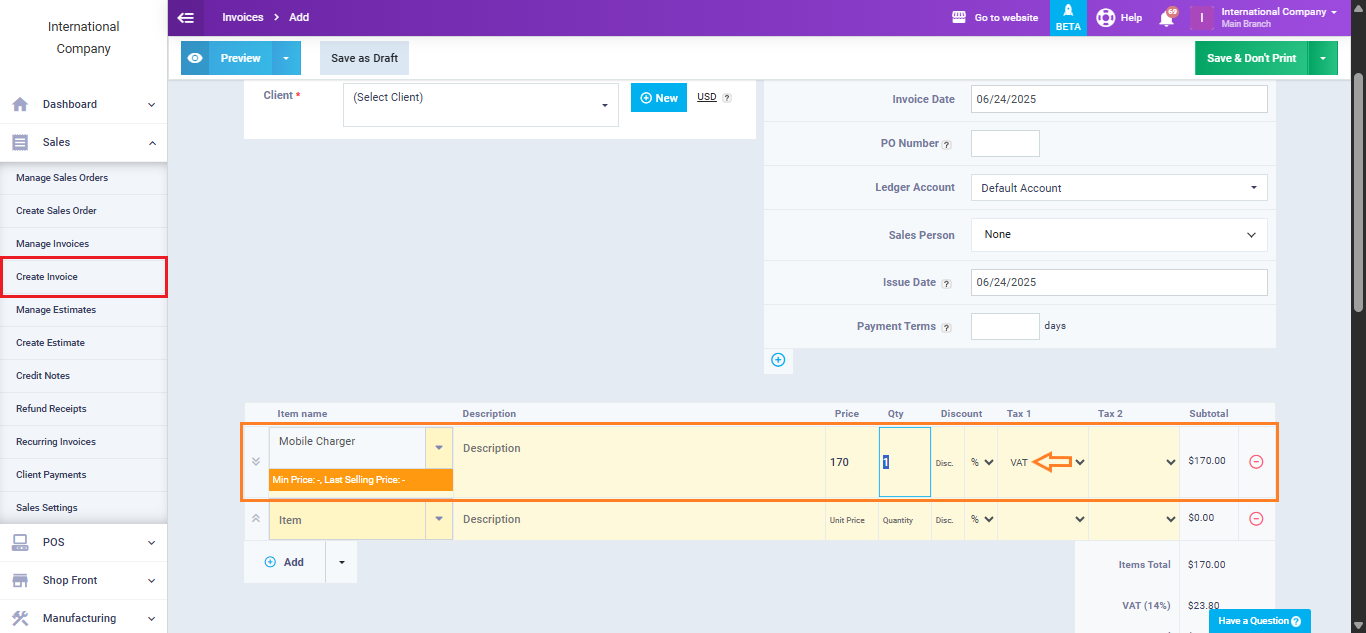

Now, when creating a sales or purchase invoice for the product “Mobile Charger” the system will include the tax automatically in the invoice as shown below.

From the “Sales” dropdown menu, click on “Create Invoice.” In the item field, add the product “Mobile Charger.” You’ll see that the “VAT” is automatically applied in the “Tax1” field, as it was previously assigned to the product.

Now, navigate to “Purchase Invoices” from the “Purchases” dropdown menu and create a new purchase invoice. When you add the same product in the item field, you’ll notice that “VAT” is automatically applied in the “Tax1” field as well.