Distributing Import Expenses to the Final Cost of the Product

Distributing import expenses is crucial, especially if your business relies on importing goods from abroad. The cost of imported products increases due to additional expenses related to importation beyond the actual product cost. To avoid bearing these costs individually, it is essential to distribute these expenses to the final cost of the product.

For example, if you operate in the automotive industry, own a showroom in Riyadh, and recently closed a deal with Mercedes to purchase 20 cars of C180, 20 cars of C200, and 20 cars of C300, you will incur additional expenses apart from the deal cost, such as:

- Shipping cars from the Mercedes factory in Germany to the seaport.

- Renting space on the departing port dock.

- Sea freight and insurance expenses.

- Renting space on the arrival port dock.

- Customs and storage.

- Transporting cars from the port to your warehouses.

The process of distributing expenses in Daftra involves three steps:

- Enable requisition for purchase invoices.

- Create purchase invoice.

- Distribute import expenses.

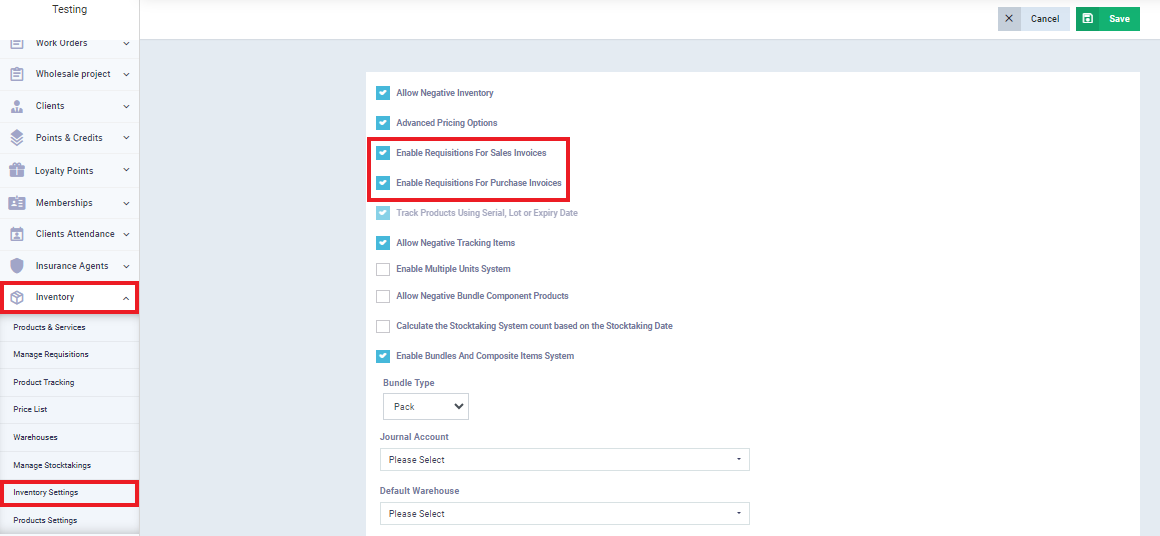

Step 1: Enable Requisition for Purchase Invoices

The first step to distribute expenses to the final product cost is to enable requisitions for purchases.

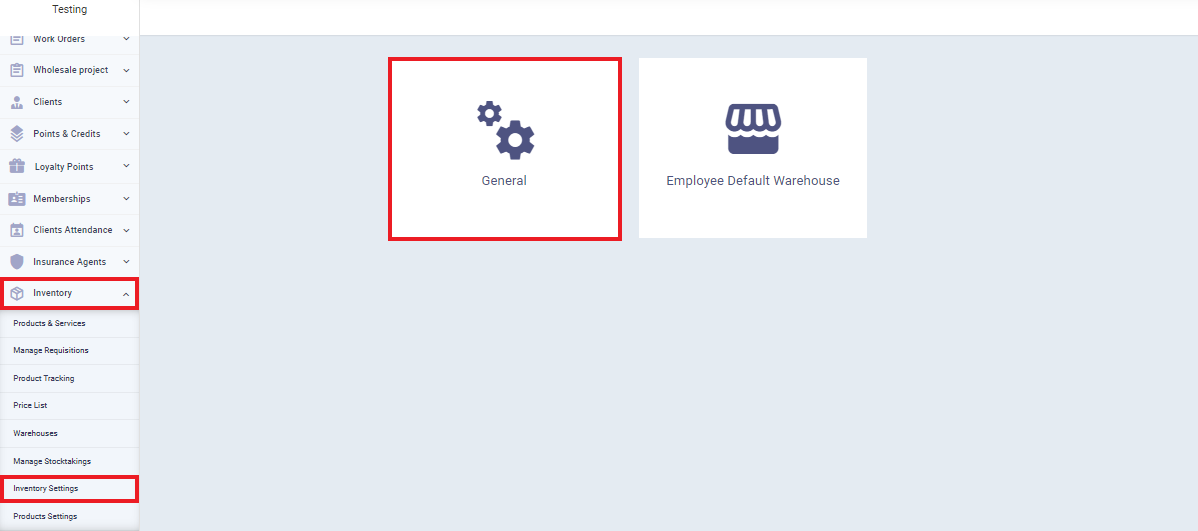

Go to “Inventory” from the main menu, then choose “Inventory Settings,” and click on the “General” tab. This step is crucial to allow the addition of expenses to the requisition before confirming its delivery.

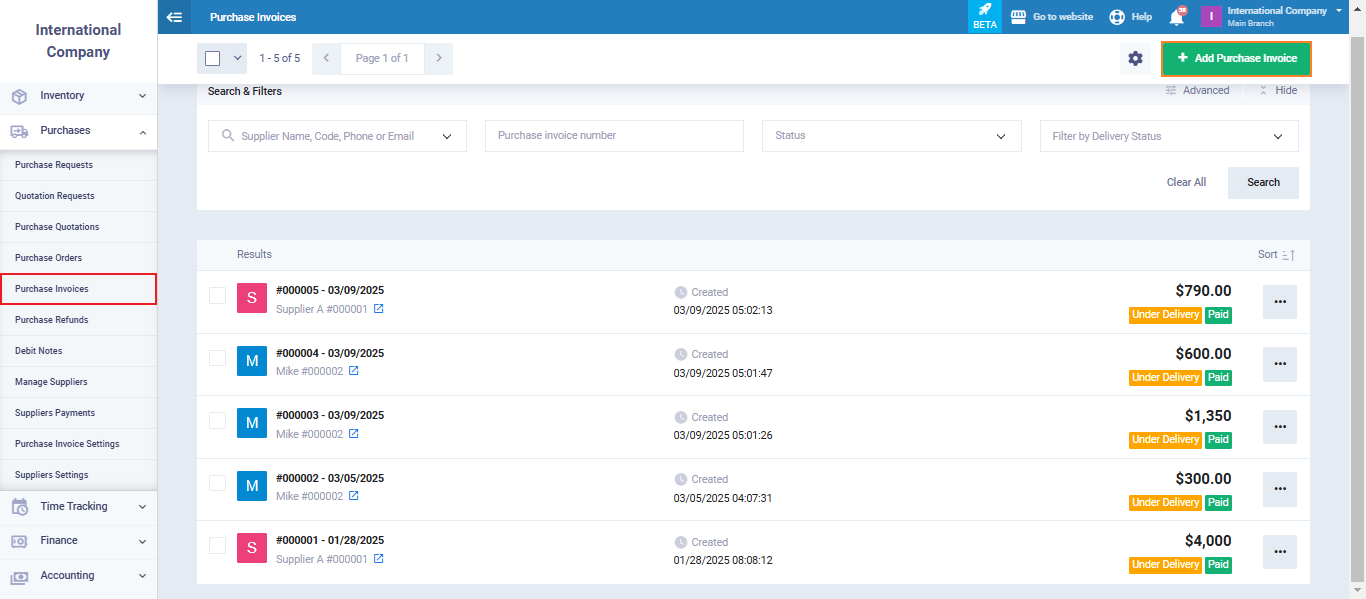

Step 2: Create a Purchase Invoice

Now we are creating a purchase invoice for the imported goods that we will distribute the import expenses on its final cost.

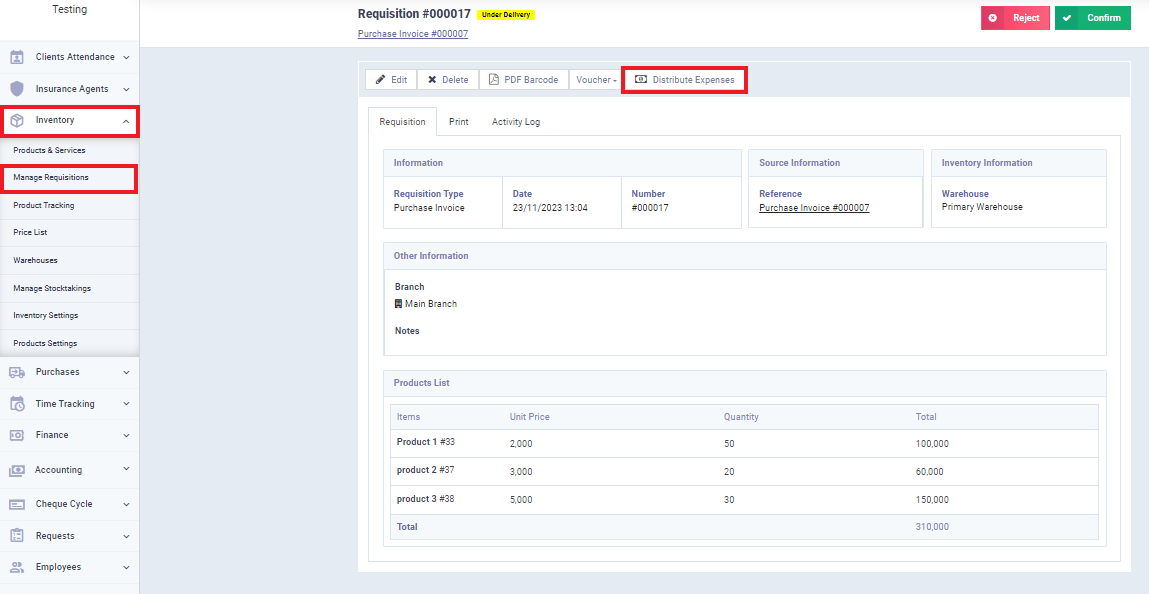

Step 3: Distribute import expenses

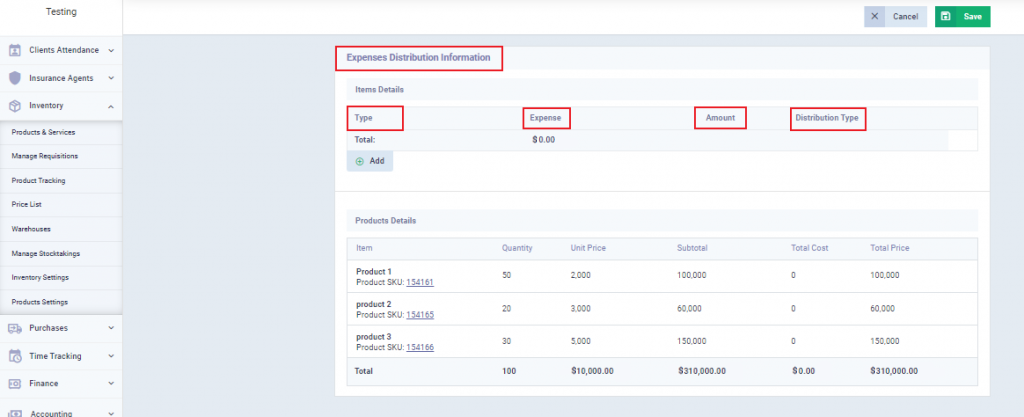

To distribute expenses, you must first select the requisition on which the expenses will be distributed. Go to “Inventory” from the main menu, then click on “Manage Requisitions“, then select the requisitions, and then click on the “Distribute Expenses” button.

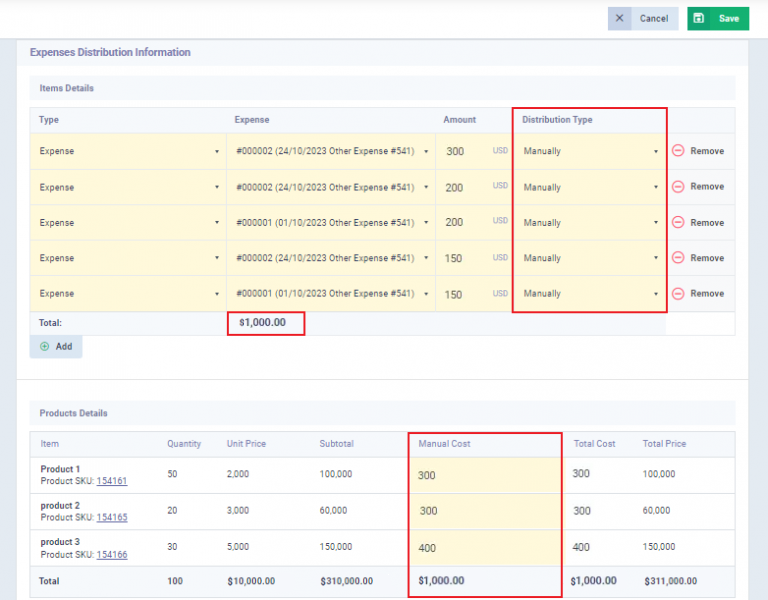

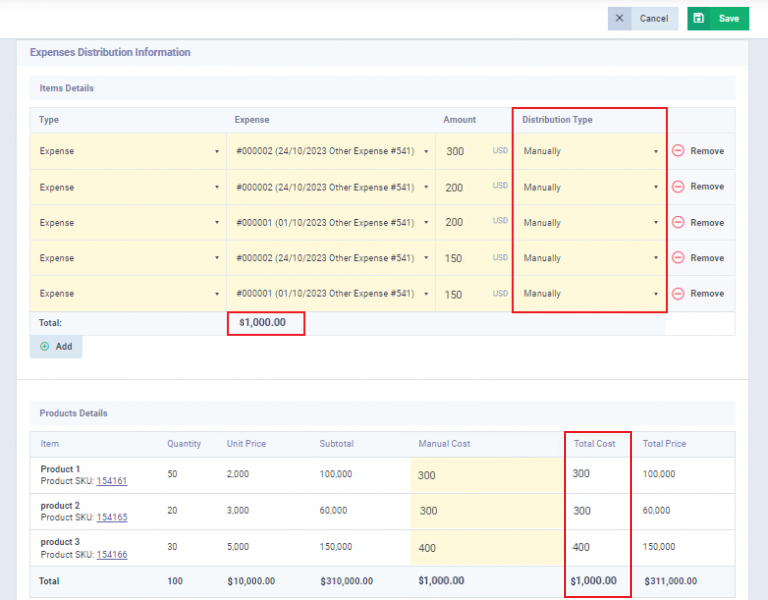

First: Determine whether the distributed expense is an expense or a journal entry.

If choosing “Expense“: You can select an existing expense if you have added an expense before, or add a new expense.

If choosing “Entry“: You can select an existing entry if you have added an entry before, or add a new daily entry.

Amount: Specify the cost of this expense.

Manual

Amount

Quantity