Workstation Guide

The manufacturing process may take place in one or multiple steps, with each workstation representing one of these steps.

Each workstation follows the time unit assigned to it, with costs calculated in minutes or hours, or other units. The cost increases as the time spent at the workstation increases.

Costs directly related to the workstation are added within it, such as the wages of the workers at this station, the assets used in the manufacturing process, and any other expenses related to it.

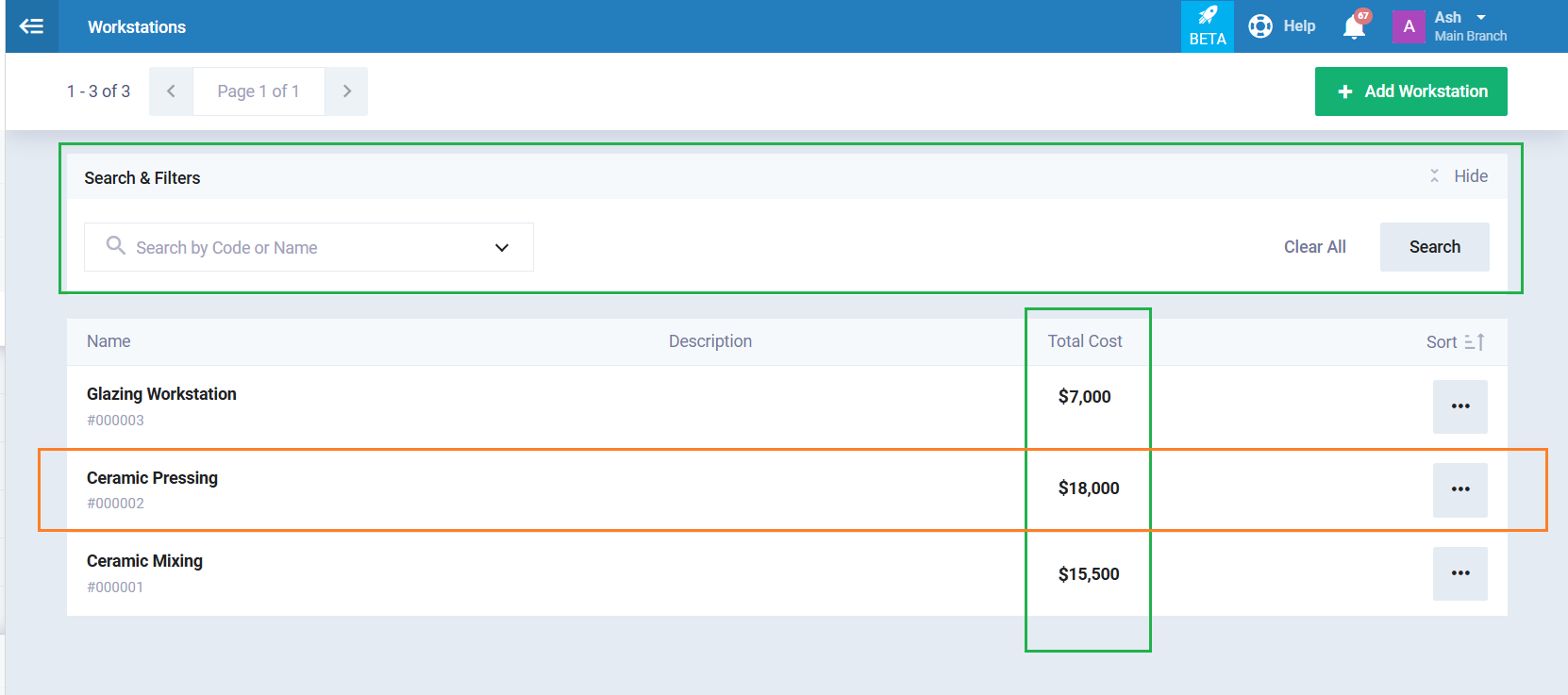

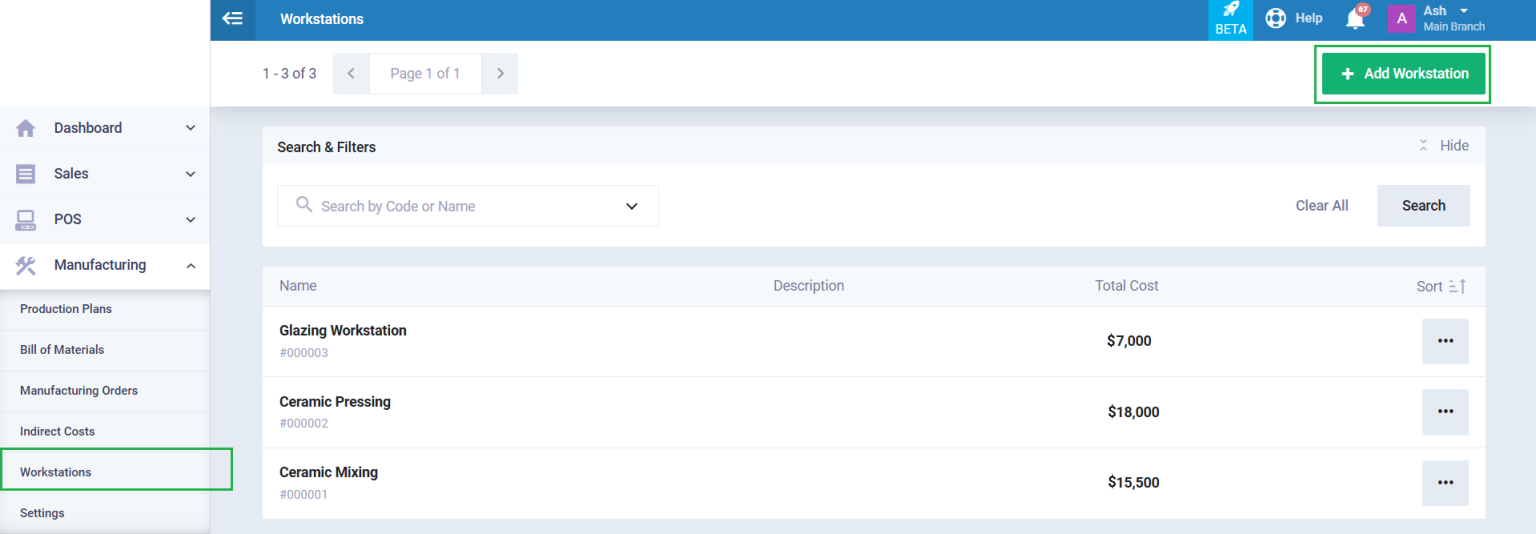

Workstations and Available Actions

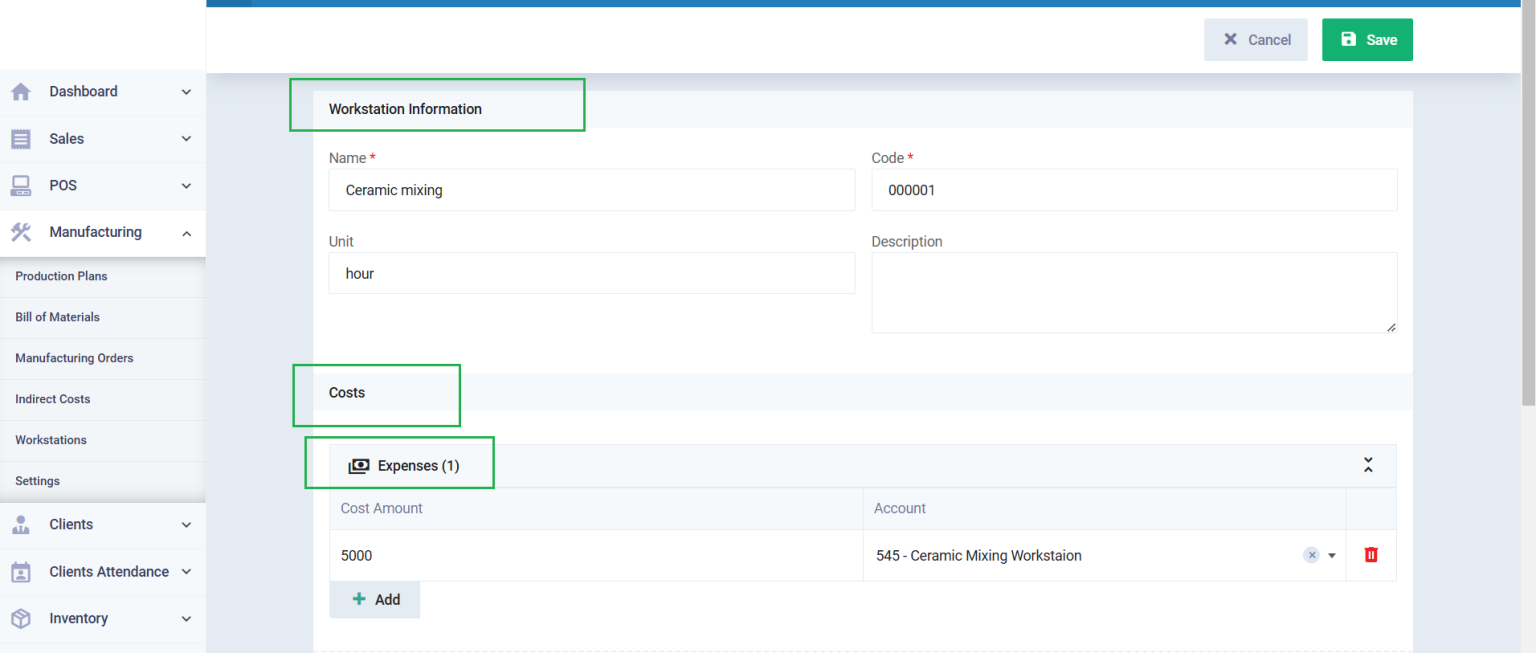

Enter the Workstation information as follows:

- Workstation information:

- Name: Add a name for the workstation.

- Code: Automatically generated number by the system for each workstation.

- Unit: Enter the unit of measurement for calculating the workstation’s costs. (Such as “Minutes“)

- Costs:

- Enter the value of each expense you add and select the account to link this expense to from the chart of accounts.

You can modify the chart of accounts and add a specific account for this expense, such as an electricity expenses account. For more information on how to add a new account to the chart of accounts, refer to this guide.

- Enter the value of each expense you add and select the account to link this expense to from the chart of accounts.

- Costs:

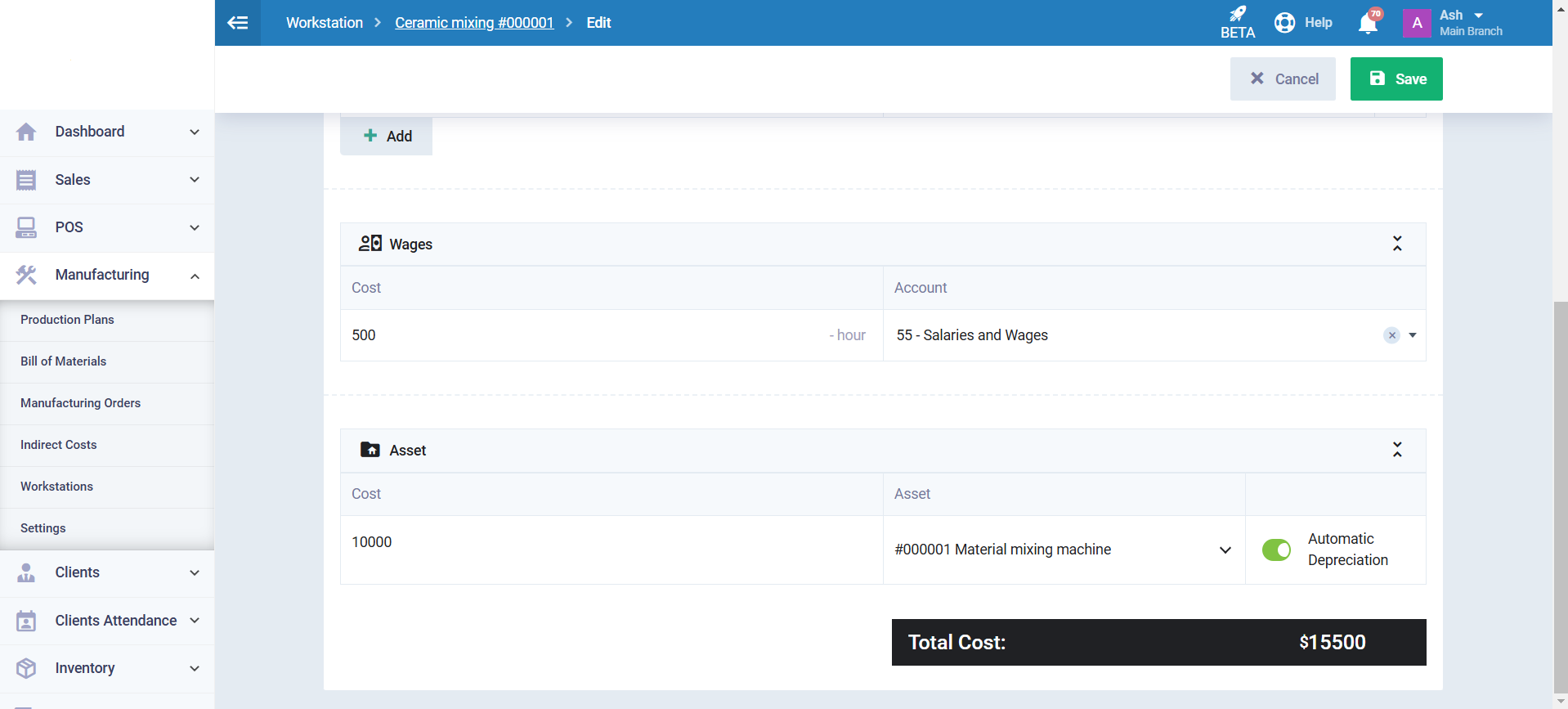

- Wages: Enter the value of each wage related to the workstation and select the account to link this wage to from the chart of accounts.

- You can modify the chart of accounts and add a specific account for this wage, such as an account for electrical engineers’ wages.

- Assets: Select the asset to be included in the workstation from the assets you have added in the system and enter the cost. You can select the asset by searching for it from the assets already added in the system. And use the “Automatic Depreciation” button if you want the asset’s depreciation to be calculated automatically.

- Wages: Enter the value of each wage related to the workstation and select the account to link this wage to from the chart of accounts.

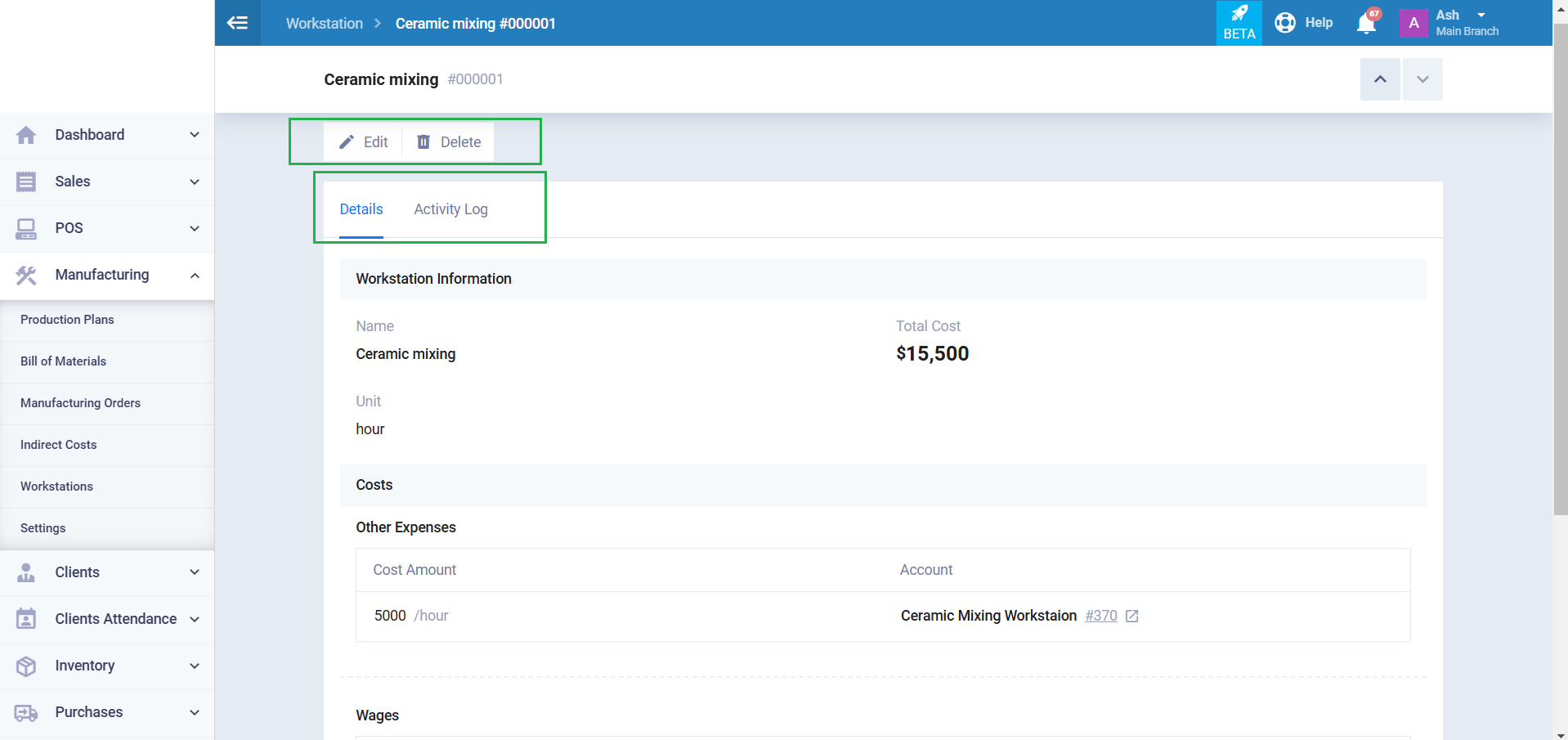

Total Cost: The total cost for all direct costs you entered for the workstation will be automatically calculated.

Click on “Save.”.

After saving the workstation, you will find all the “details” related to the workstation, as well as the “activity log”. You can also easily “edit” or “delete” the workstation if needed.