Managing the Credit Limit and Credit Period Limit of Clients

The client is often indebted due to services and products received, but what is the maximum debt limit that they cannot exceed? And what is the maximum grace period within which they can settle their debts? This is what you can control through the credit limit set for the maximum amount the client can borrow, and the credit term set for the maximum period during which the client can pay off their debts.

Enabling the Credit Limit and Credit Period Limit

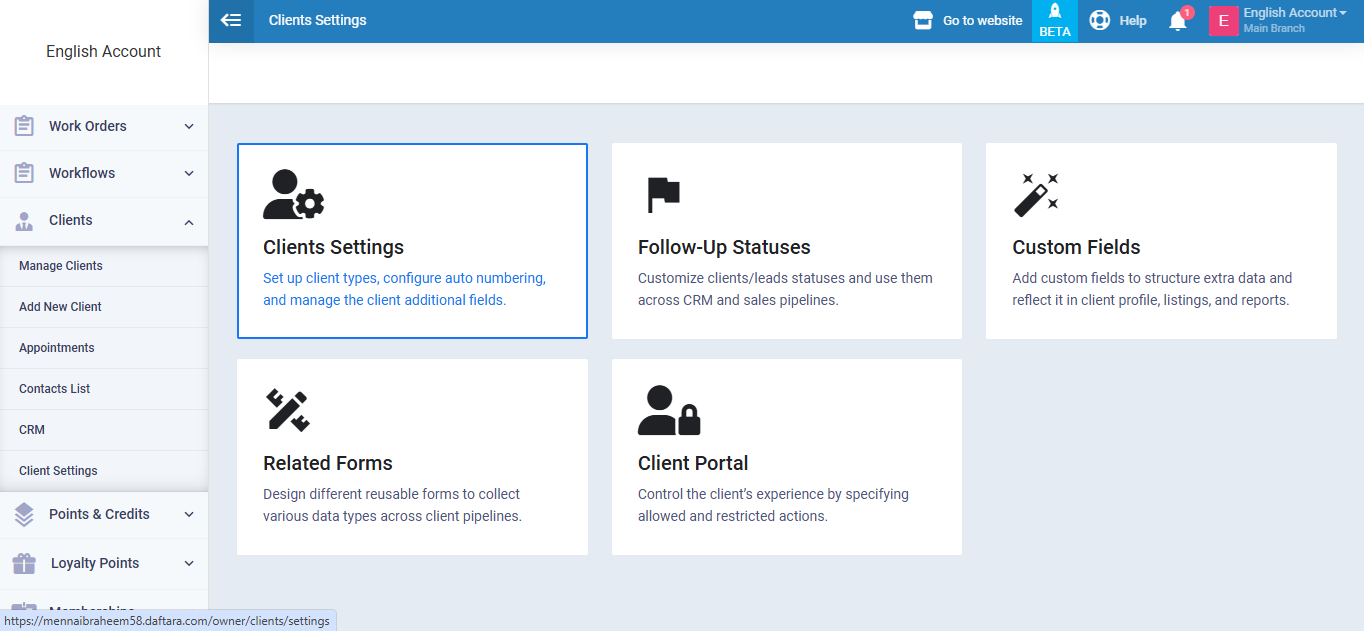

Click on “Client Settings” under “Clients” in the main menu, and click on the “Clients Settings” card.

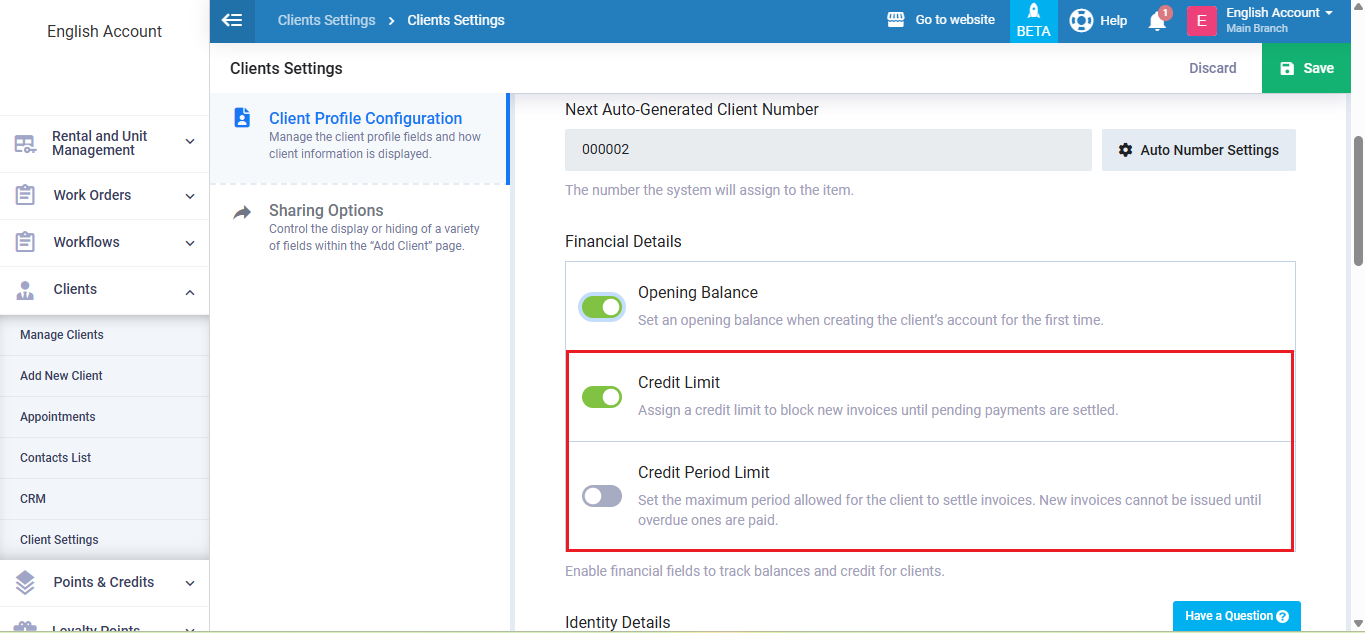

Activate the fields “Credit Period Limit” and “Credit Limit” then click on the “Save” button.

Setting the Credit Period Limit and Credit Limit of a Client

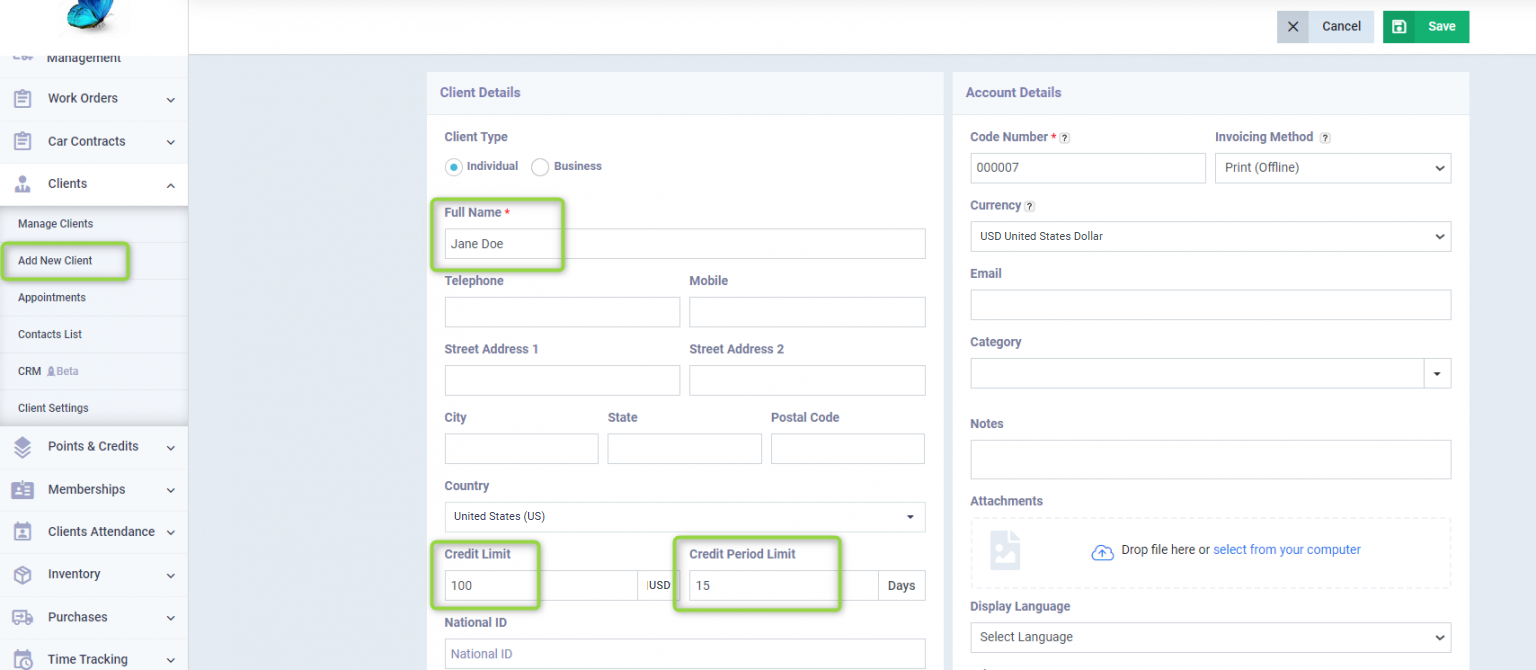

The credit limit and credit period limit can only be set when adding a new client, by clicking on “Add New Client” under “Clients” in the main menu.

Enter the maximum allowable loan amount for this client in the “Credit Limit” field and the maximum period allowed for him to pay the invoices in the “Credit Period Limit” field.

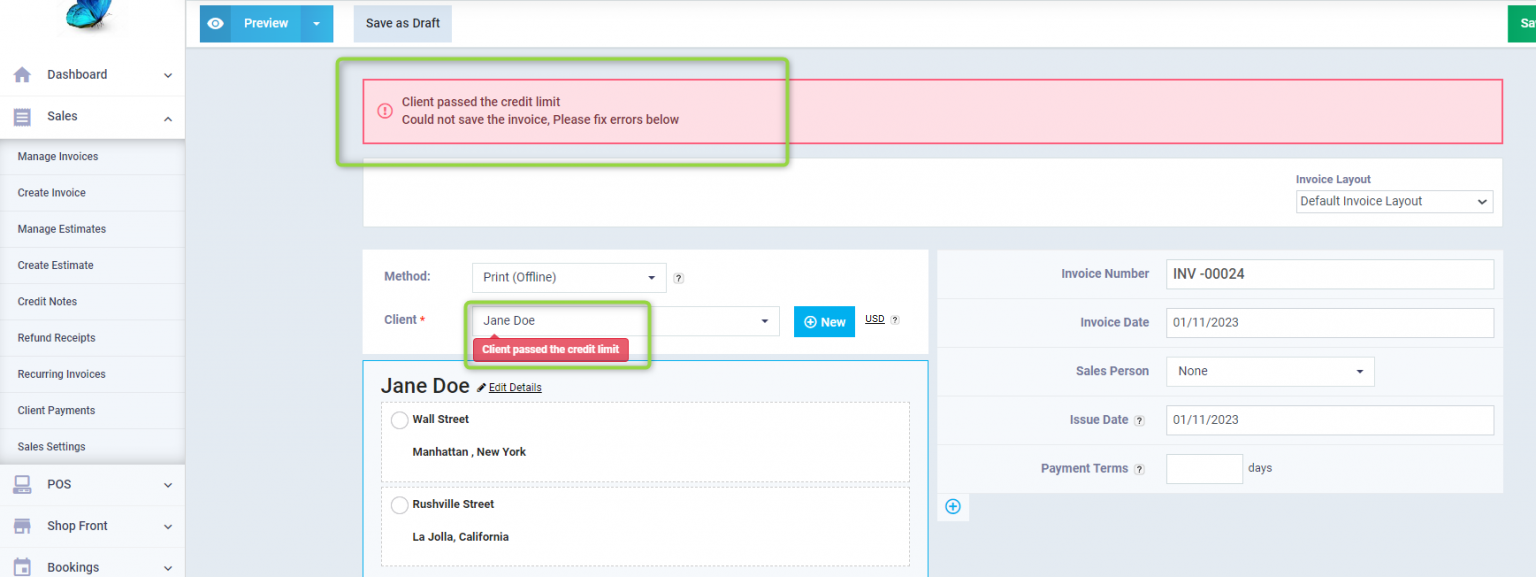

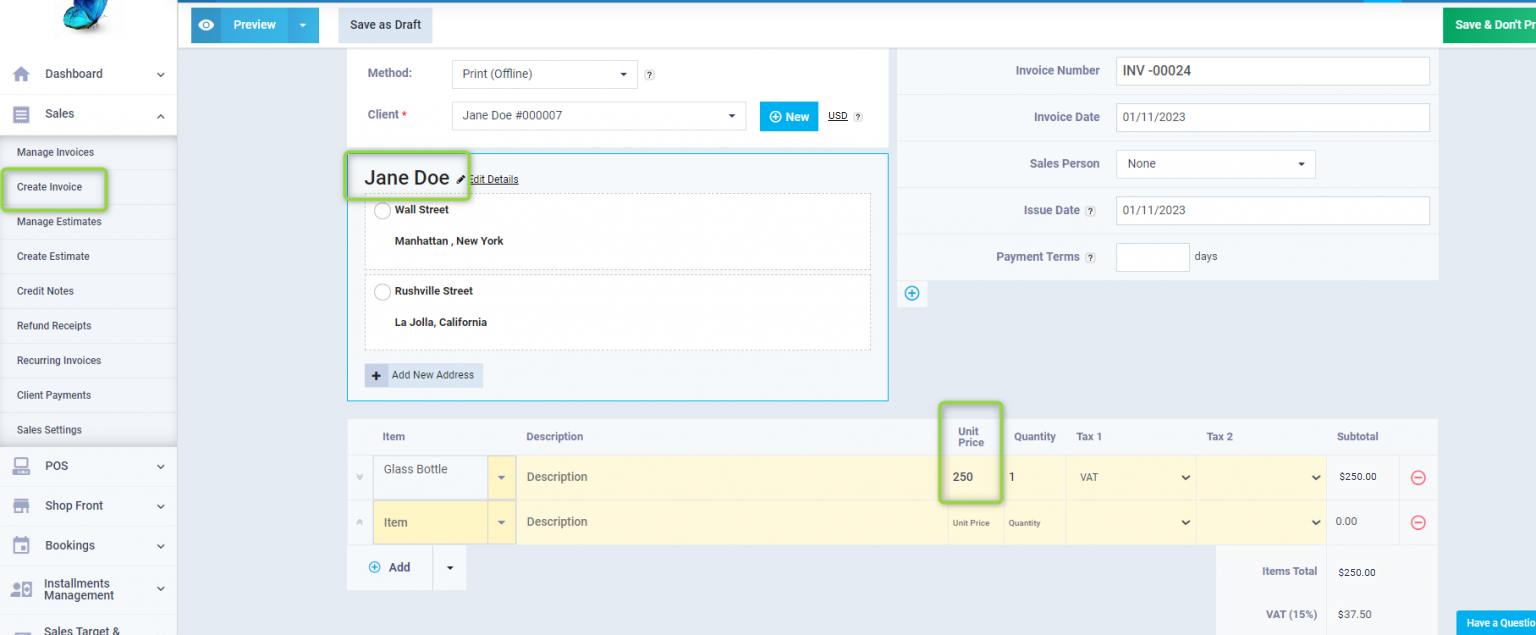

The credit limit and credit period limit are automatically applied to all of the client’s debts after setting them in the client’s profile. For example, go to “Create Invoice” under “Sales” in the main menu, and enter items for the client that exceed his previous unpaid debts plus the defined credit limit, and click the “Save” button.

The system will refuse to create the invoice, and a failure message will appear: “Client passed the credit limit”.