Managing Clients’ Opening Balance and Controlling it

Opening balances for clients are included when adding a new client, or on an existing client file you already have. These balances are useful to know whether the client has a debt that requires payment or has a credit with financial dues at the company. This, of course, is in addition to clarifying the value of the monetary amount, whether it is credit or debit.

Enabling the Addition of Clients Opening Balance

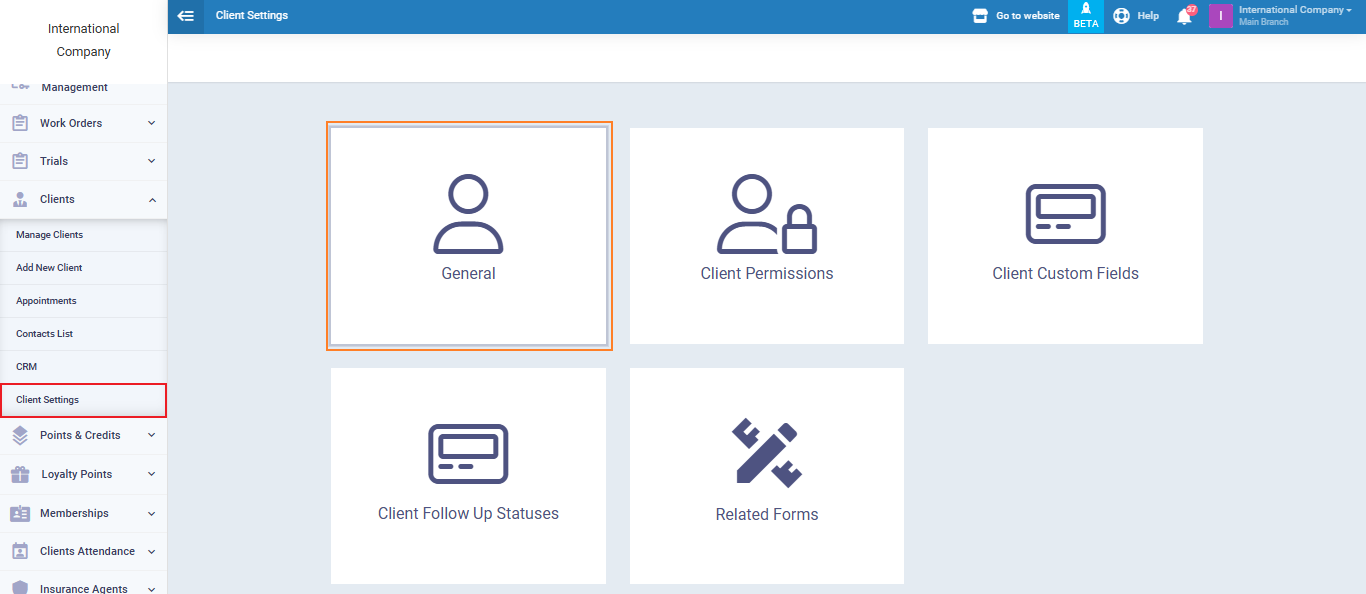

Click on “Client Settings” in the dropdown under “Clients” in the main menu and click on the “General” tab.

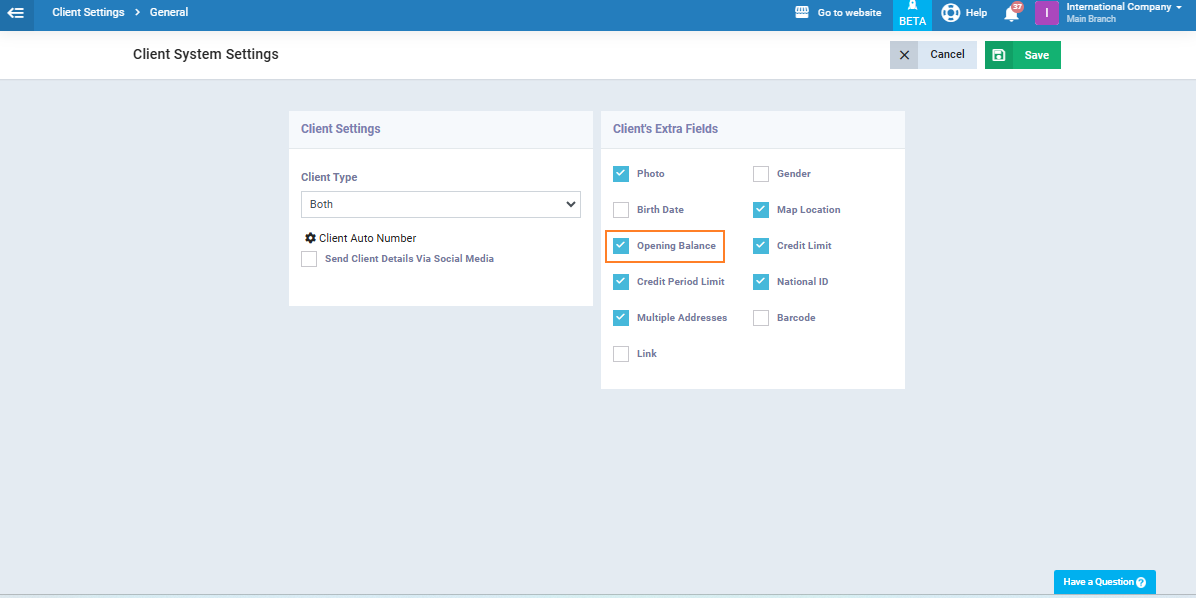

Enable the “Opening Balance” ✅ field and click on the “Save” button.

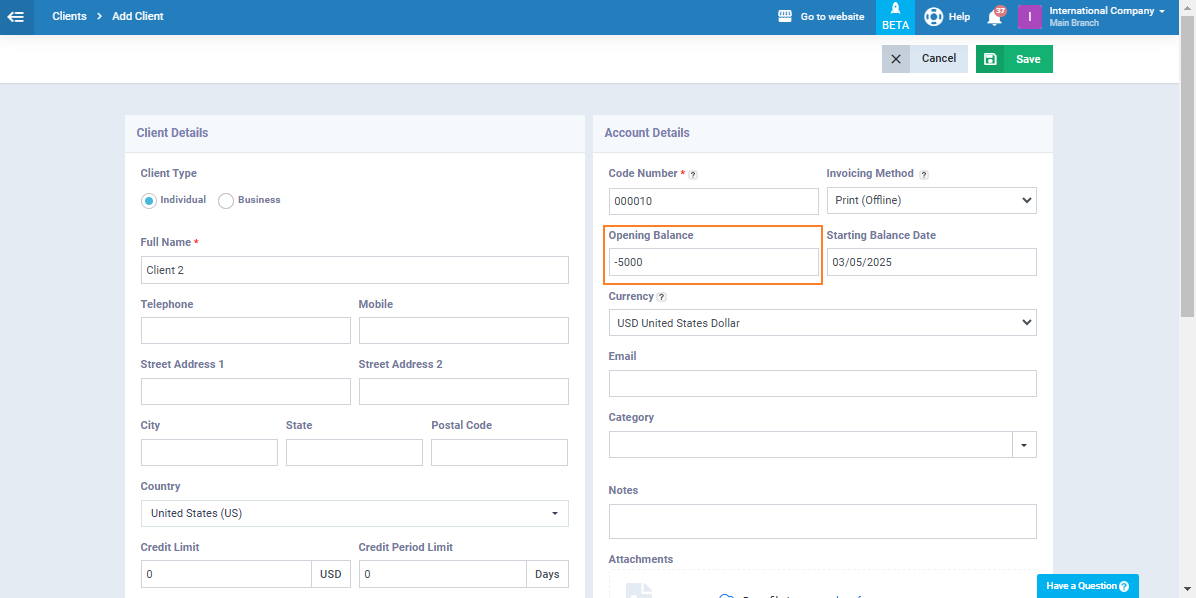

Adding the Opening Balance to a New Client

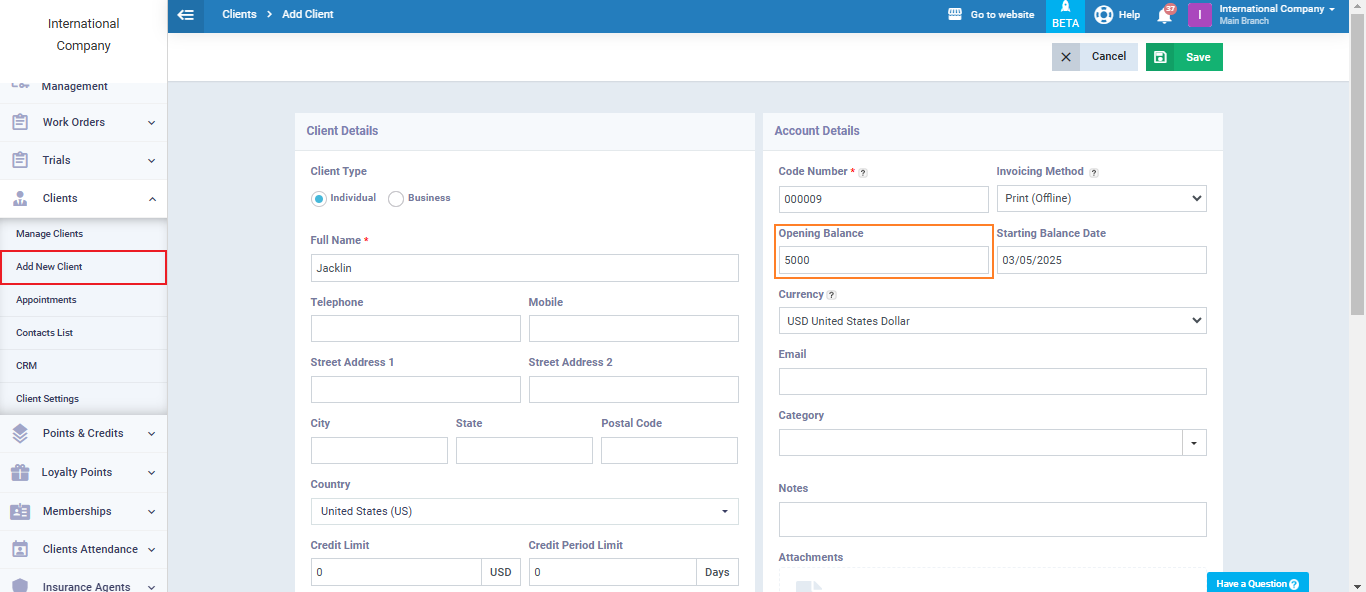

Click on “Add New Client” from the dropdown under “Clients” in the main menu.

Enter the opening balance for the client with a positive value if the client has a debt, meaning they owe you money.

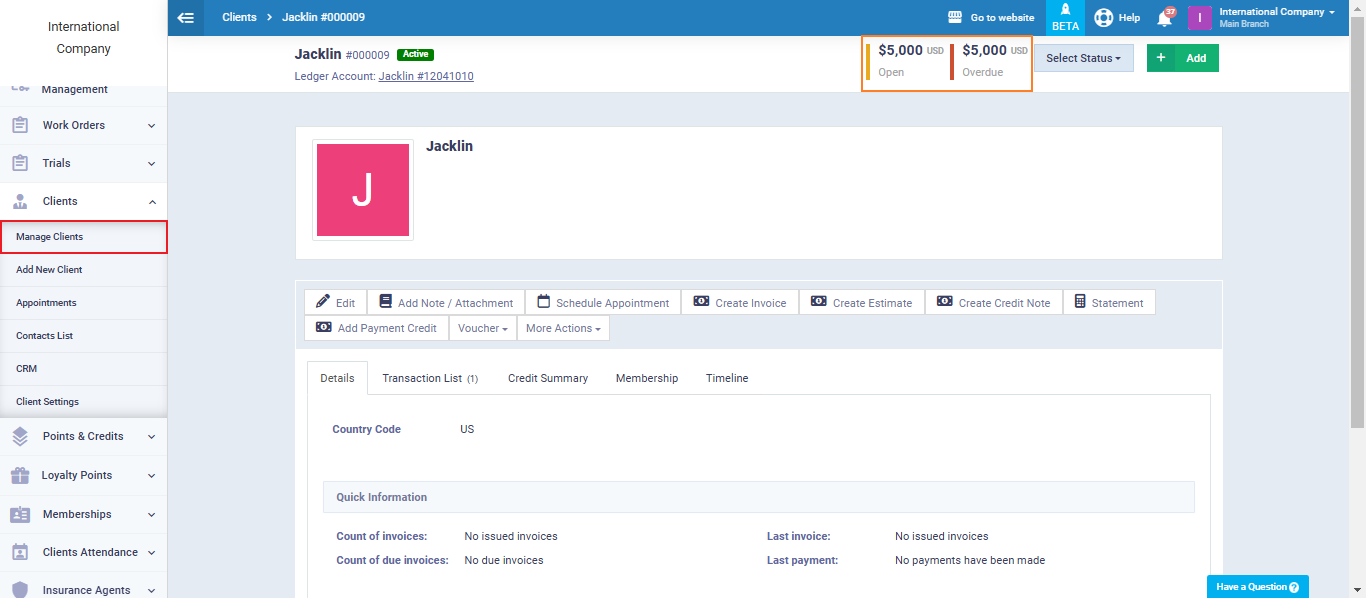

This will display the client’s balance in their profile under “Overdue”.

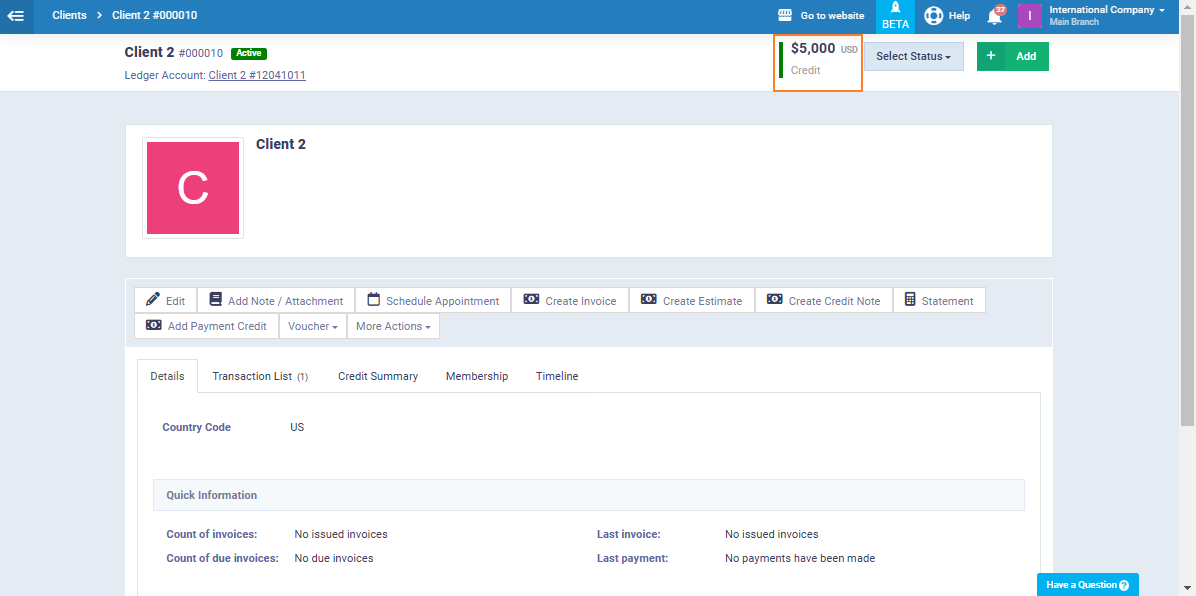

If the balance is a credit and the client has money with you, follow the same step but add the opening balance with a negative value (-).

This will display their credit balance in their profile.

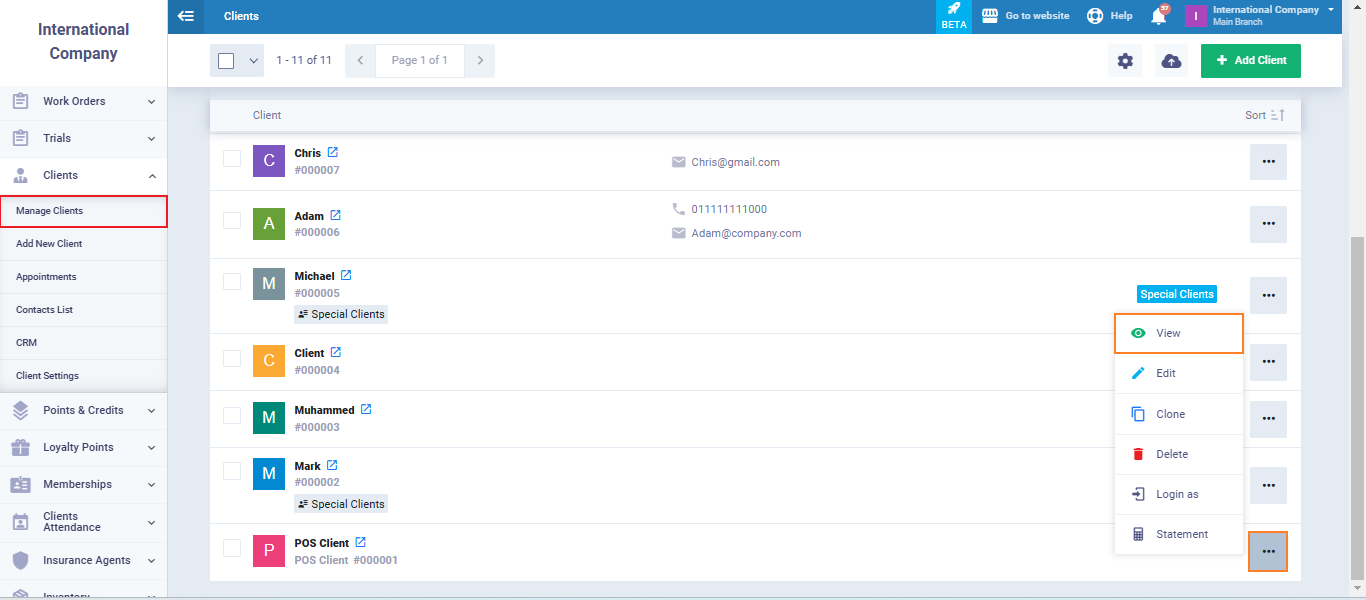

Adding and Modifying the Opening Balance of an Old Client

You can add an opening balance for an existing client who does not have one, or modify their previous opening balance.

Click on “Manage Clients” from the dropdown under “Clients” in the main menu, then click on the three dots next to the name of the client you want to add an opening balance for, and click on “View” from the dropdown menu to browse the client’s file.

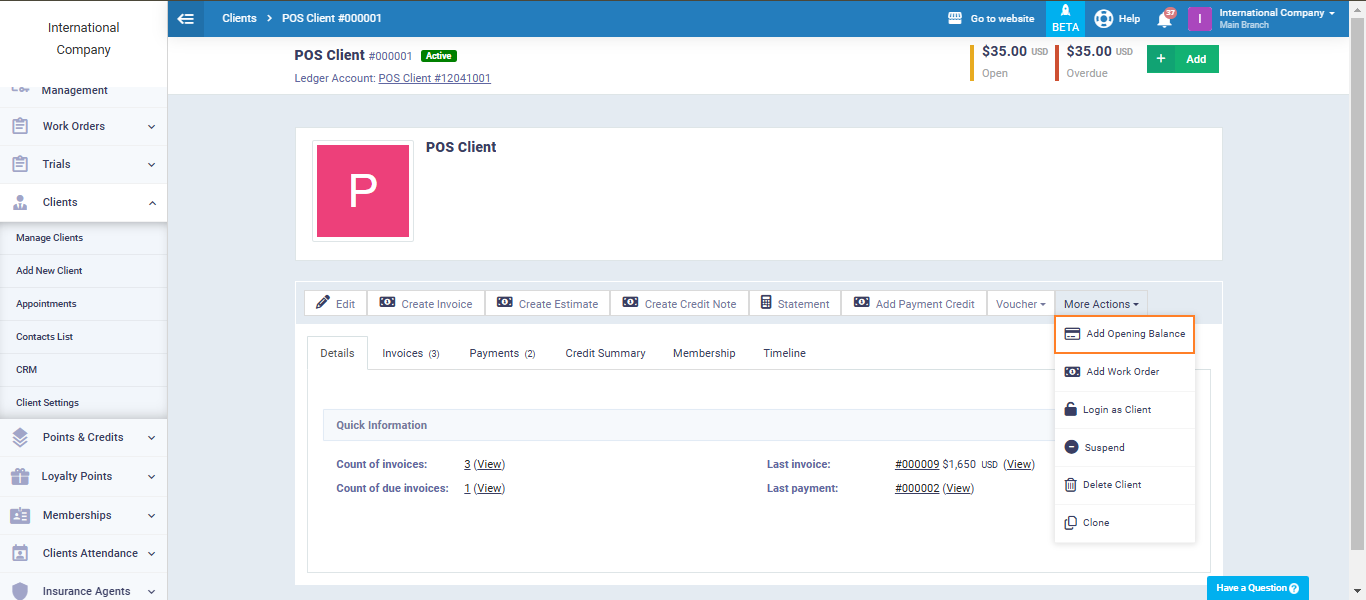

Click on the “More Actions” button and then choose from the dropdown menu “Add Opening Balance” or “Edit Opening Balance”.

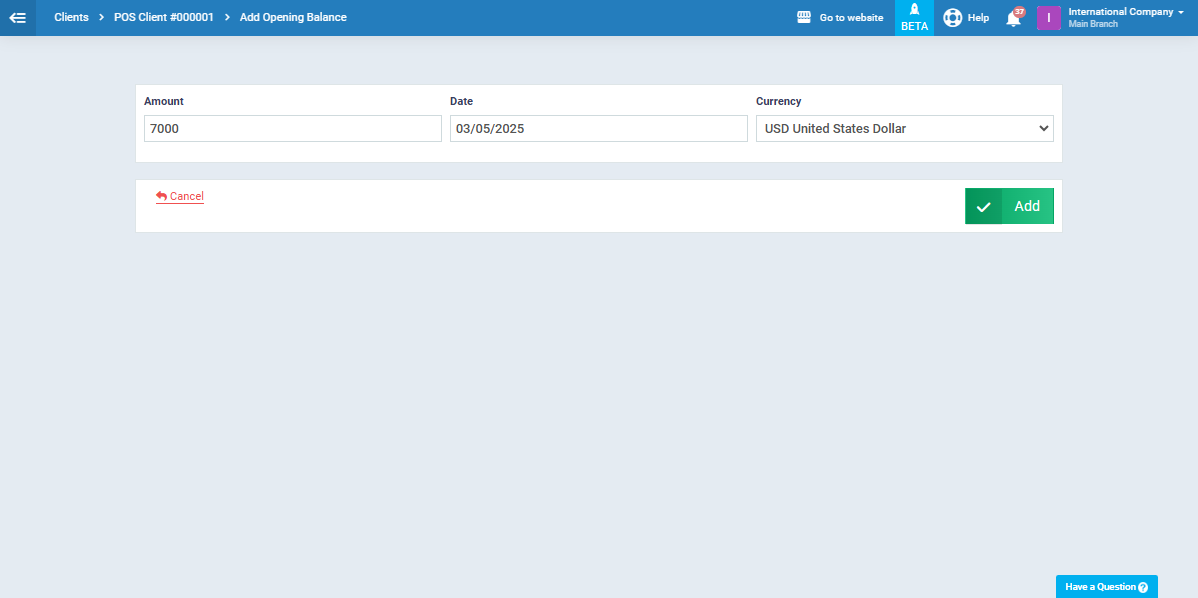

Enter the amount of the opening balance as positive for a debtor balance or negative for a creditor balance, the date, and the currency, then click on the “Add” button.

After adding the opening balance, you can print or save the account statement including this balance, or click on “Email to Client” if you want to share the account statement with them.