Different Client Balances and Client Statement

Identifying the client statement of account or the financial amounts due for payment is vital for your business, and accuracy should be observed in it. Therefore, here are the details in the following steps.

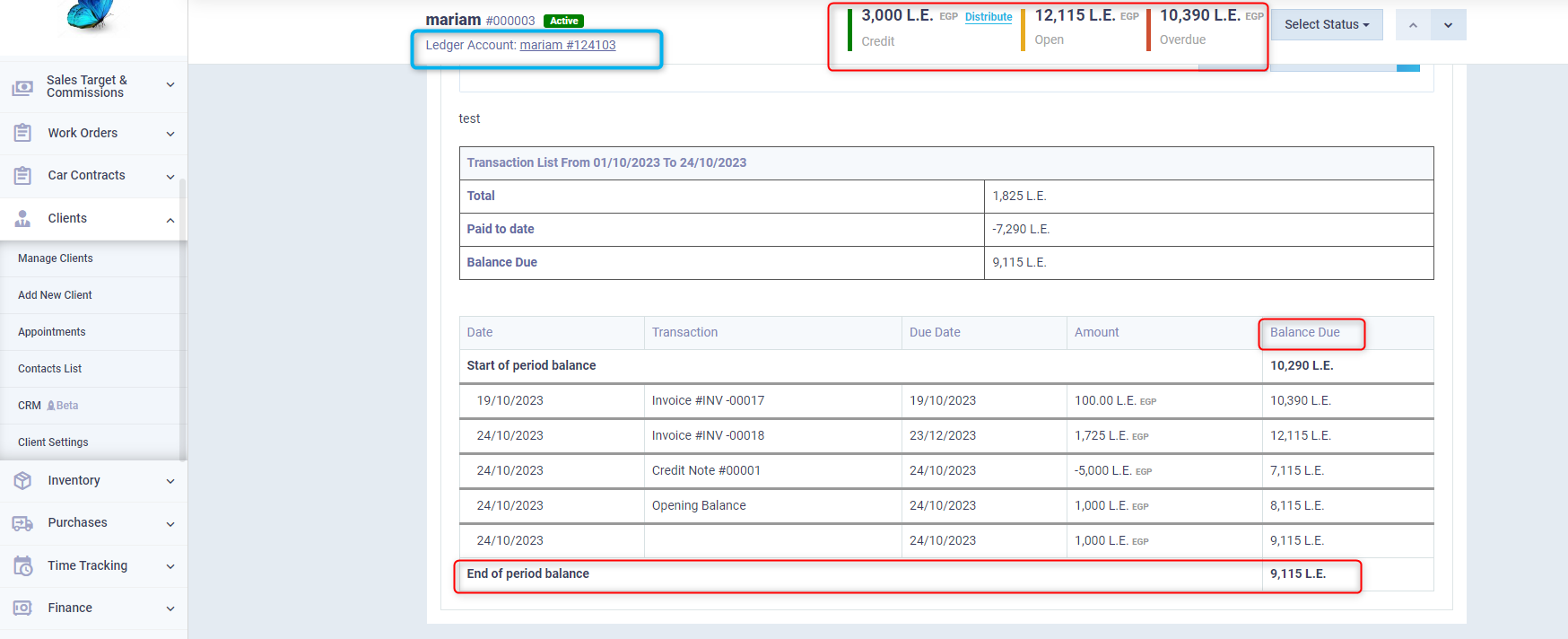

What is the difference between a Client's Open Balance and Overdue Balance?

The date of issuing an invoice may differ from the payment due date, and this is also applicable to all financial transactions with clients. Therefore, in the client’s file, you will see the total amount they owe you, as well as the amount required to be paid, i.e., the overdue amount.

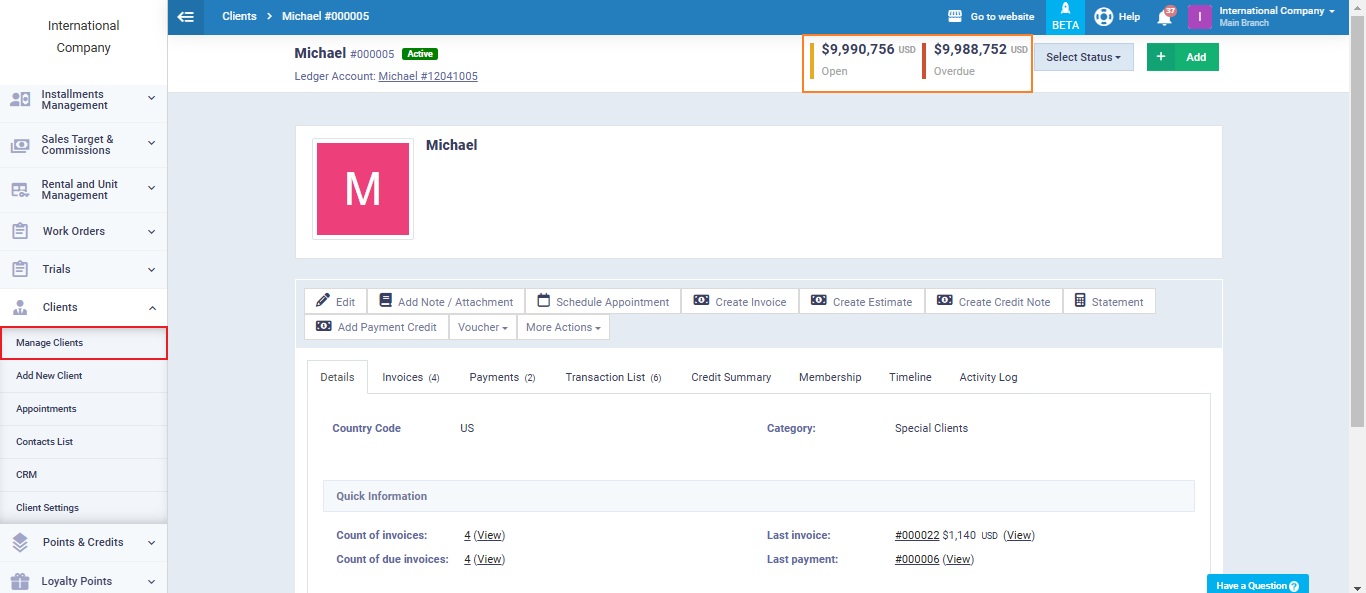

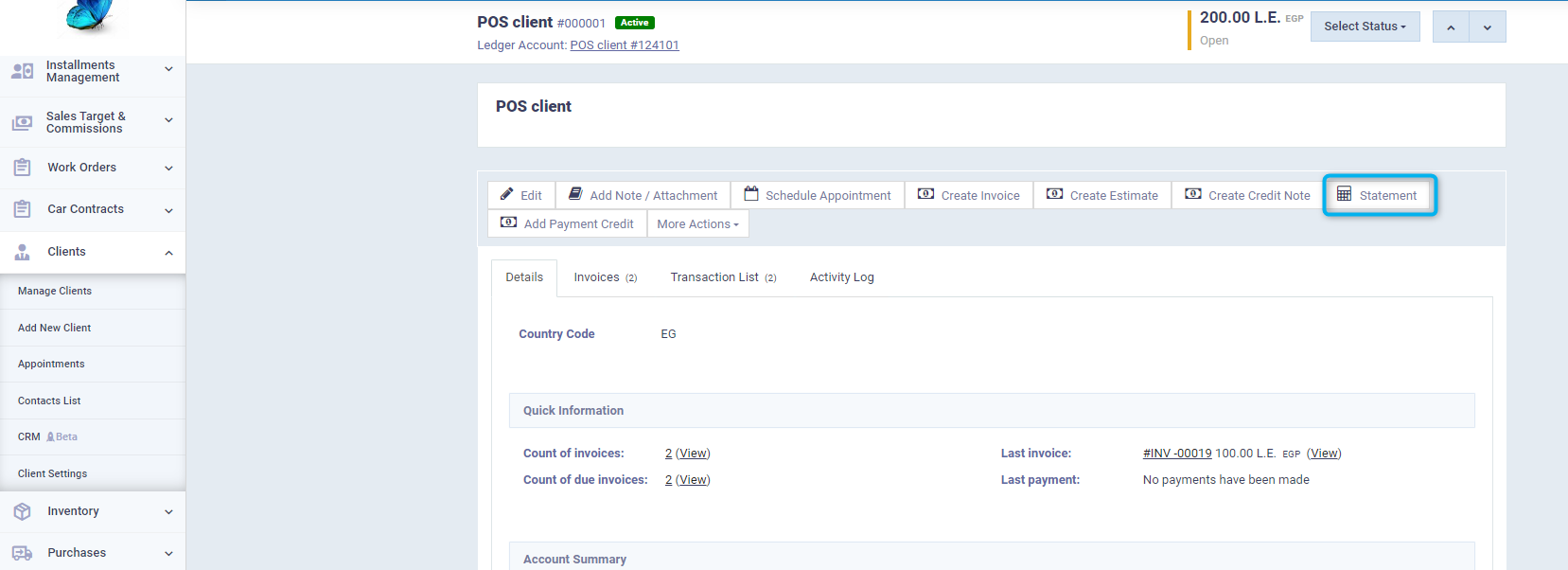

To review these details, as well as the account statement, click on “Manage Clients” found under “Clients” in the main menu, and then click on the client’s file for which you want to review the related financial amounts.

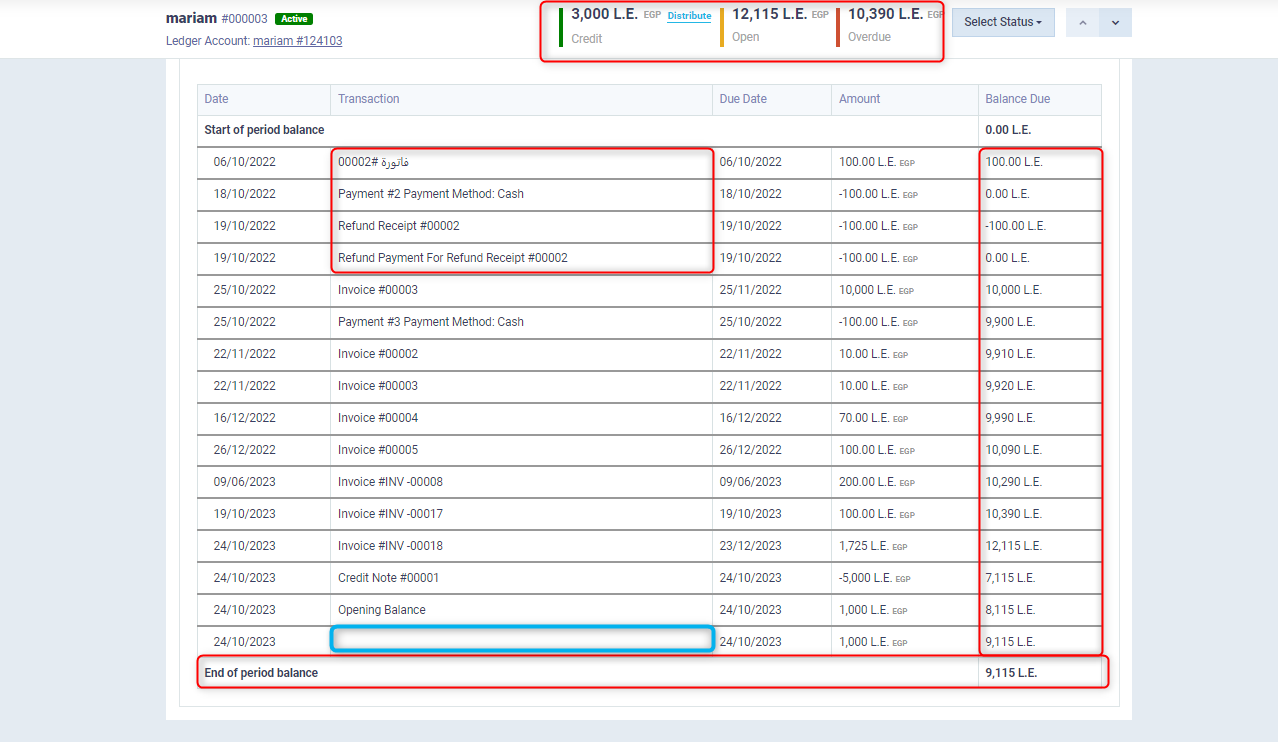

You will see the total amount owed by the client in the “Open” balance.

Meanwhile, the amount due for payment and its due date will be displayed under the “Overdue” balance.

Displaying the Client Account Statement

You can view the account statement in two ways:

- Account Statement Button

On the same screen of the open balance and the amount due (the client’s file), click on the account statement button.

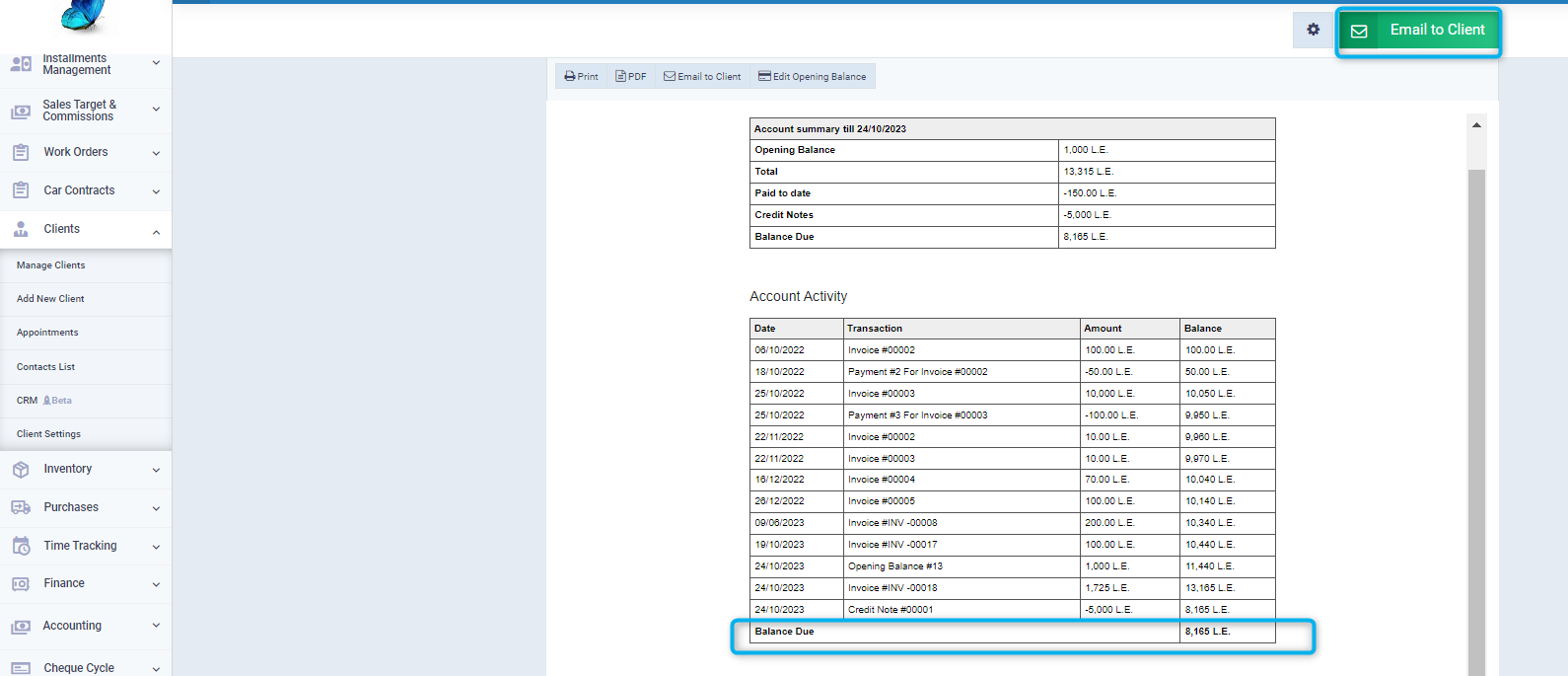

You will see a summary of the account, transactions, and the amount that the client needs to pay. Some actions such as printing or downloading the account statement as a PDF will appear. If the client’s email is included in their profile information, a “Email to Client” button will appear.

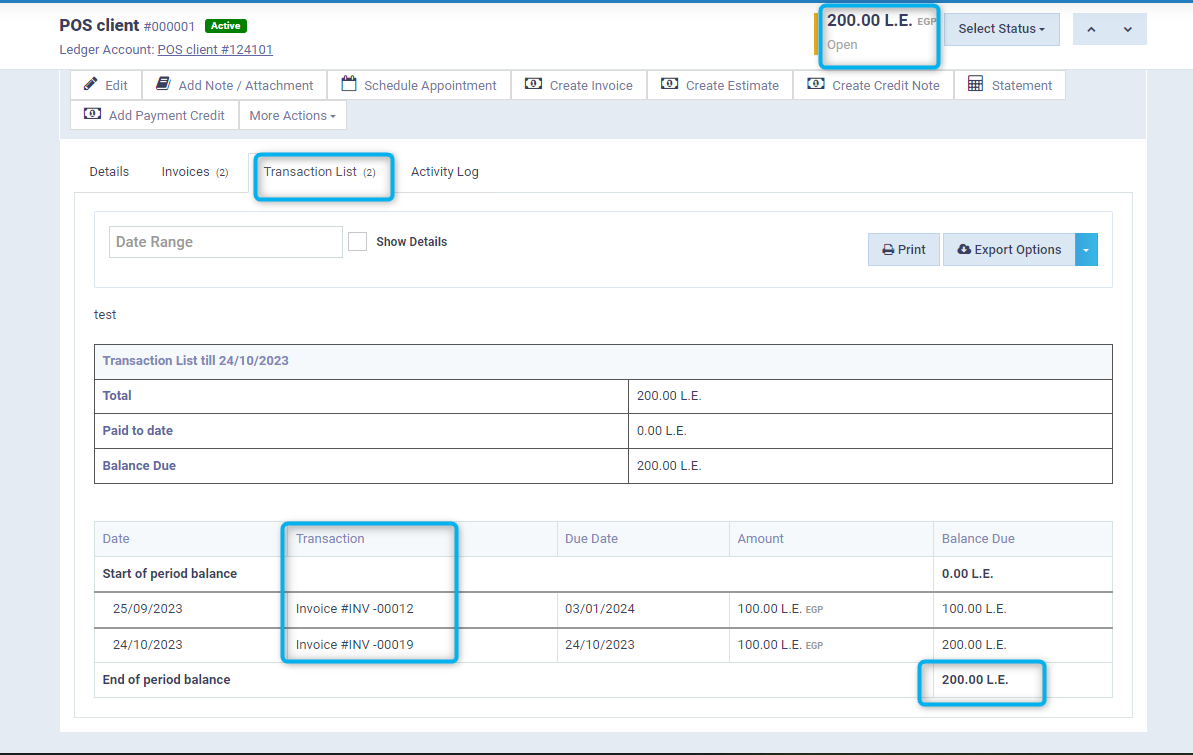

- Transaction List

From the client’s file, click on the “Transaction List” tab to view the following details:

Start of period balance: If the client has an opening balance, it will appear in this field.

- Date: This refers to the date of the transaction, such as the invoice creation date or the payment transaction date.

- Transaction: This shows the type of transaction that resulted in the account movement and the transaction code.

- Due Date: This shows the due date of the financial amount, which may differ from the date of creation of the financial transaction.

- Amount: The amount due is recorded after matching the due date with the current date, and the total amounts due are recorded to know the End of period balance

- End of Period Balance: The end of period balance is the financial amount that must be paid up to this moment.

The end-of-period balance may be a direct result of subtracting the “Amount” due balance from the client’s credit balance, but this is not a rule as they may differ. In this case, the end-of-period balance is relied upon to include all financial transactions that do not affect the amount due balance or the paid balance afterwards.

- Here appears a discrepancy between the “Open Balance”, which expresses all the dues owed by this client, and the balance “Overdue” which is due.

- And subtracting the amount due balance from the credit amount does not represent the end-of-period balance. The reason for the difference is the presence of some financial transactions recorded in the statement of account, while they do not appear in the overdue balance or the open balance, such as the manual journal entry added on October 16.

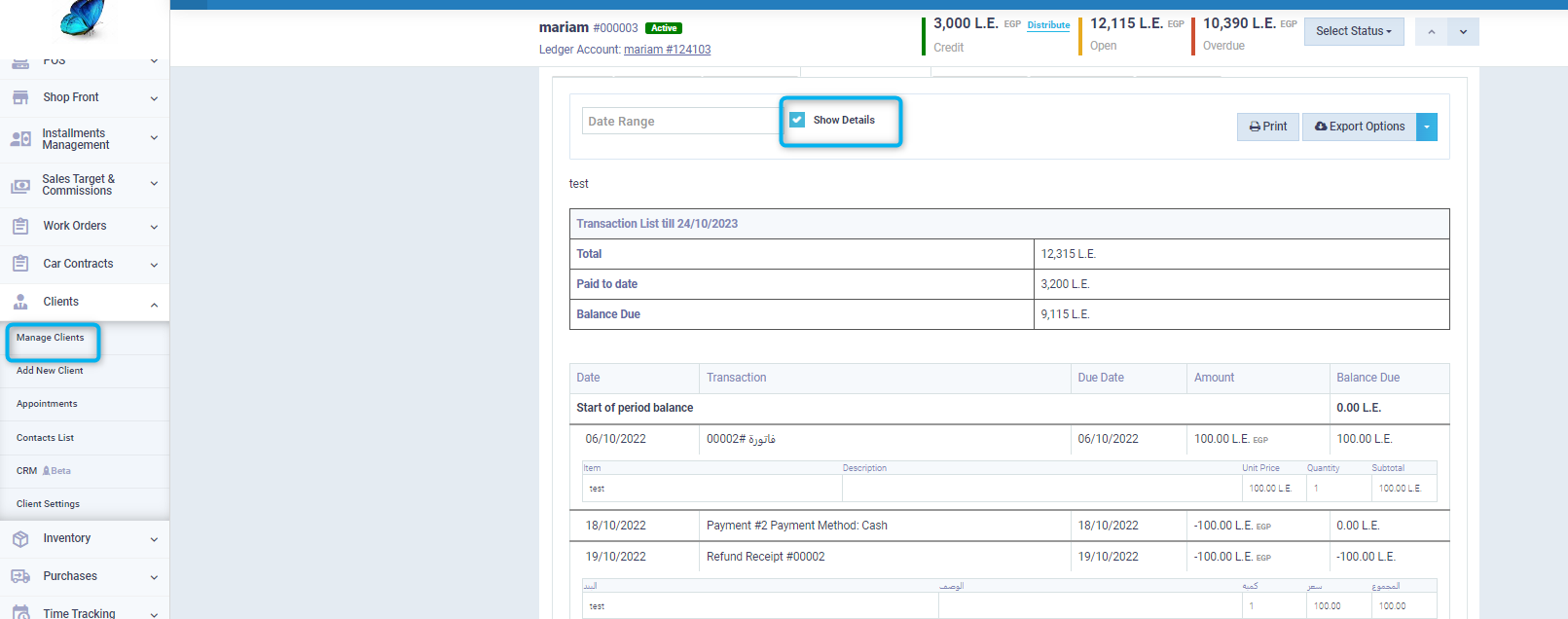

Viewing the Transaction List in Detail

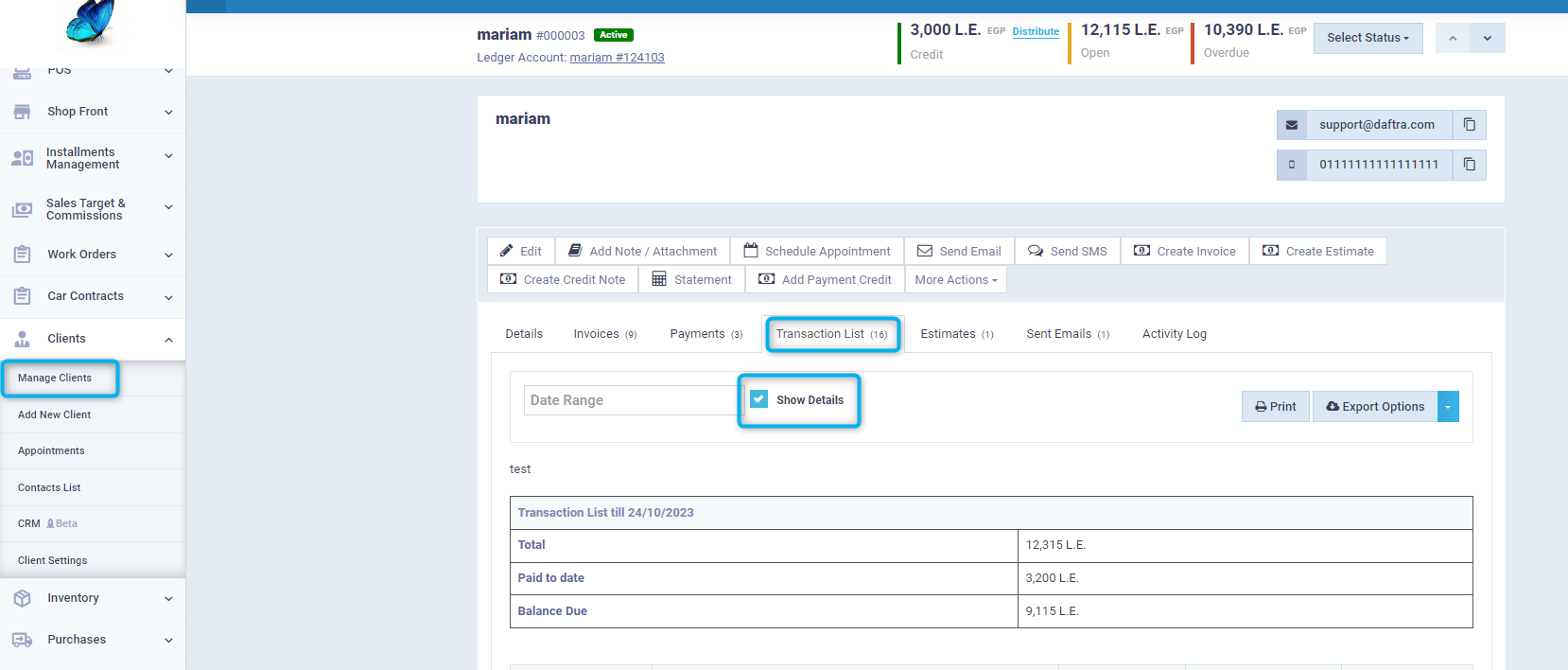

After clicking on the “Transaction List” tab in the client’s profile, activate the “Show Details” ✅ feature.

This will display details of the line items and elements included in the financial transaction, in addition to the basic account statement fields.

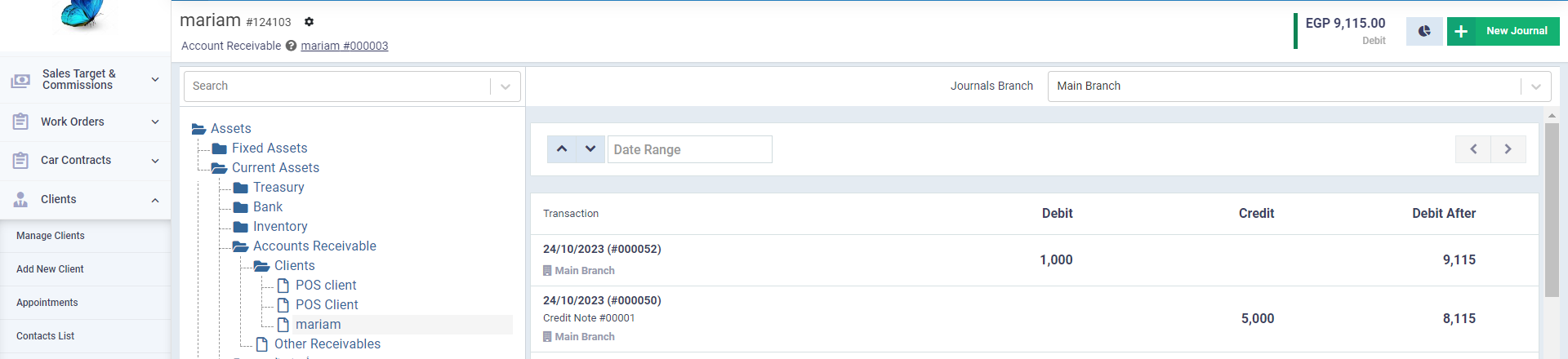

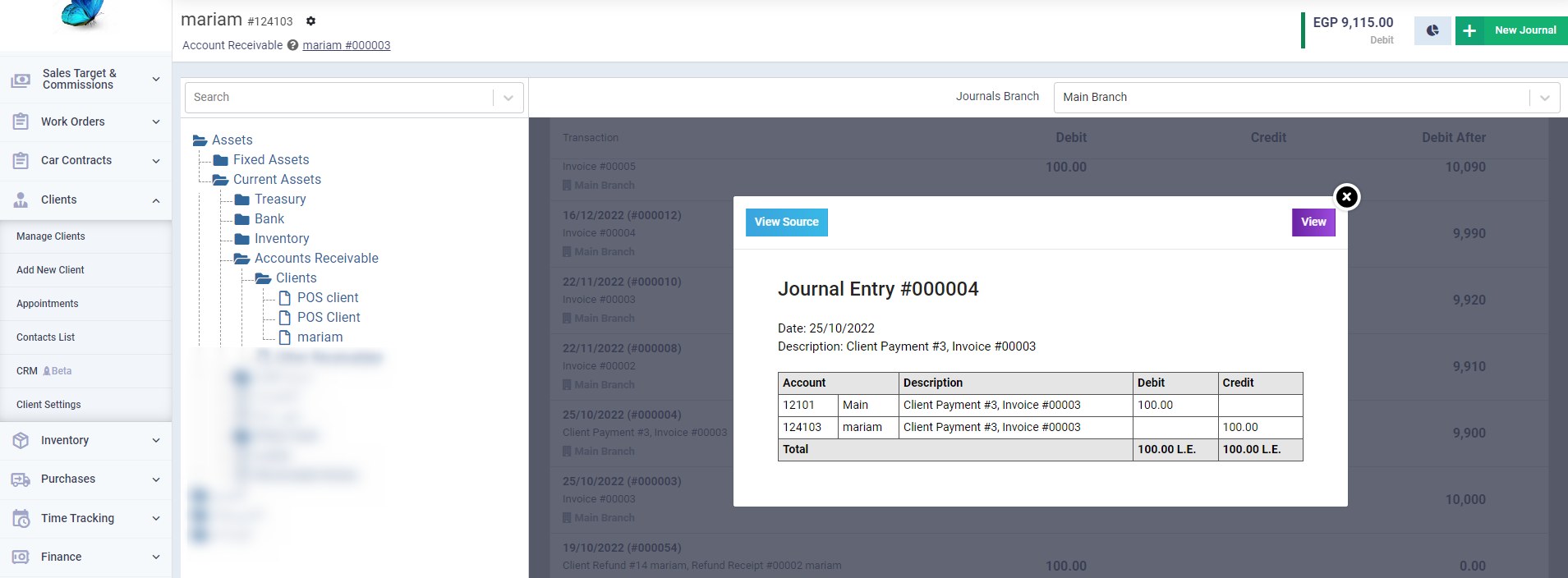

Displaying Journal Entries of the Client's statement Transactions

You can also view the client’s account in the ledger to analyze both the credit and debit sides of the accounting transaction, as well as to view the journals of each transaction that has been recorded. This can be done by clicking on the ledger account number located below the client’s name in their profile.

The client’s ledger account within the clients section of the chart of accounts will be displayed. Click on the transaction you wish to review more details about.

A detailed journal entry will appear. Click on the “View Source” button if you want more information.

Actions on the Transaction List

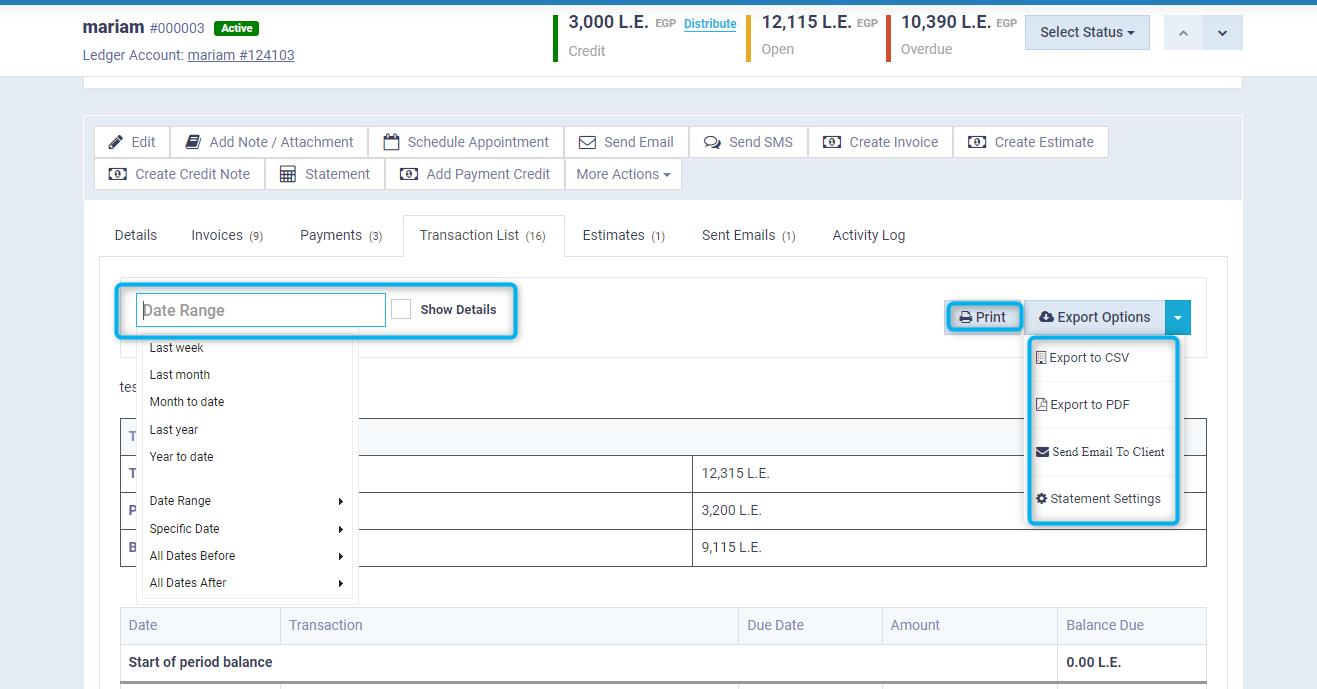

After clicking on the “Transaction List” tab in the client’s profile, some actions become available to you, such as:

- Printing.

- Exporting and downloading the transaction list file.

- Sending the transaction list in an email to the client.

- Controlling the appearance of some additional fields in the account statement through “Statement Settings”.