Salaries and Wages Accounting Entries

The accounting aspects of salaries and wages involve recording, processing, and disbursing employee salaries and wages while ensuring compliance with labor and tax laws. This article includes the key components of salary and wage accounting.

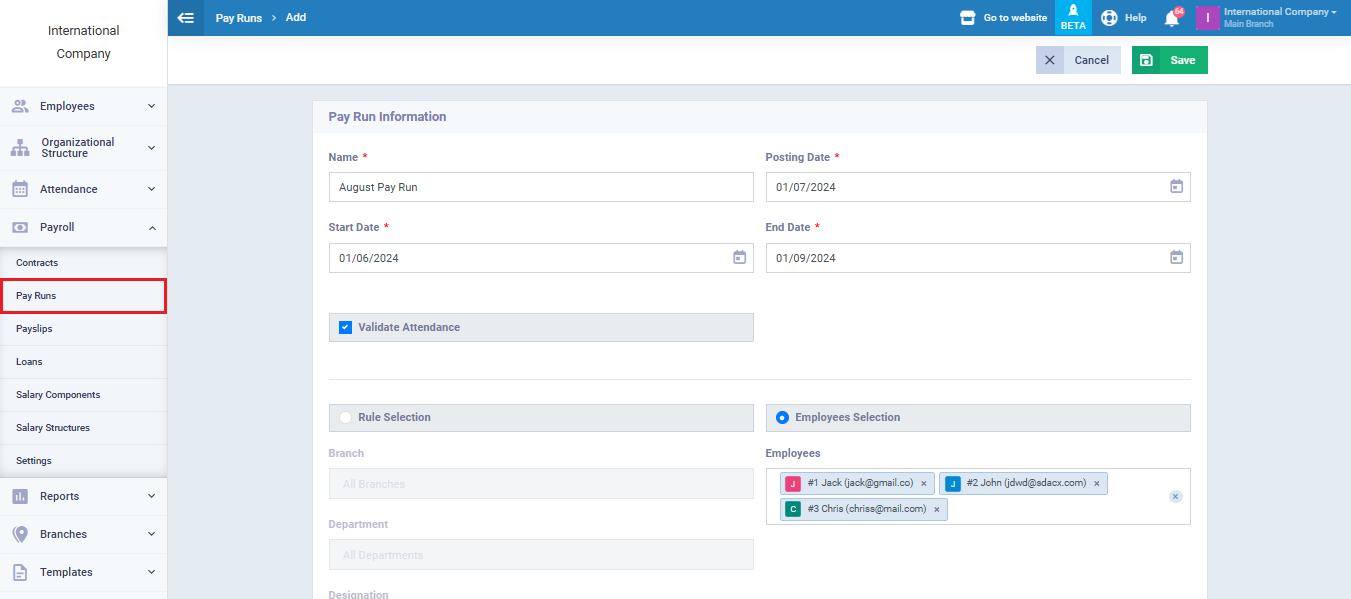

From the main menu click on “Payroll” then “Pay Runs“, and click “New Pay Run“.

Fill in the pay run details then click “Save” to proceed.

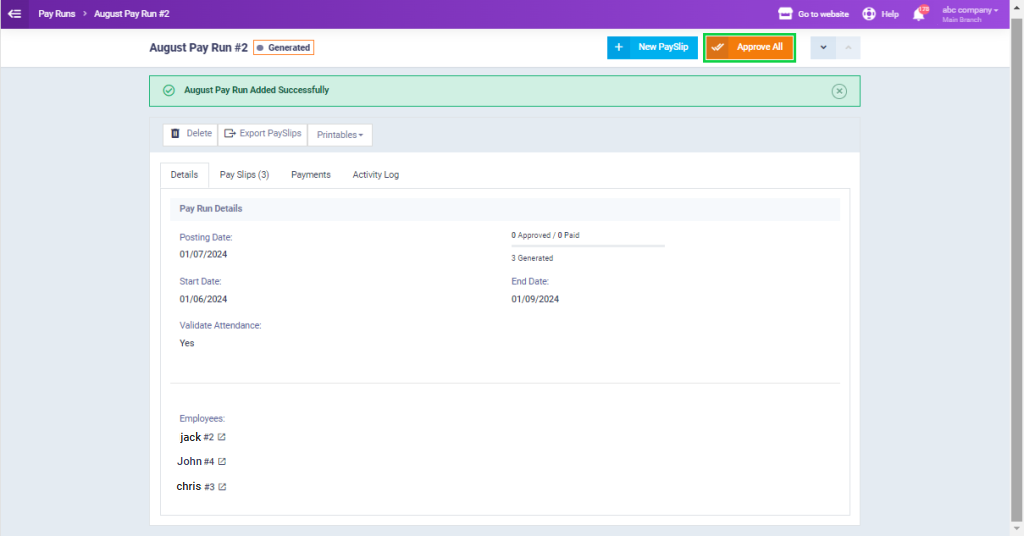

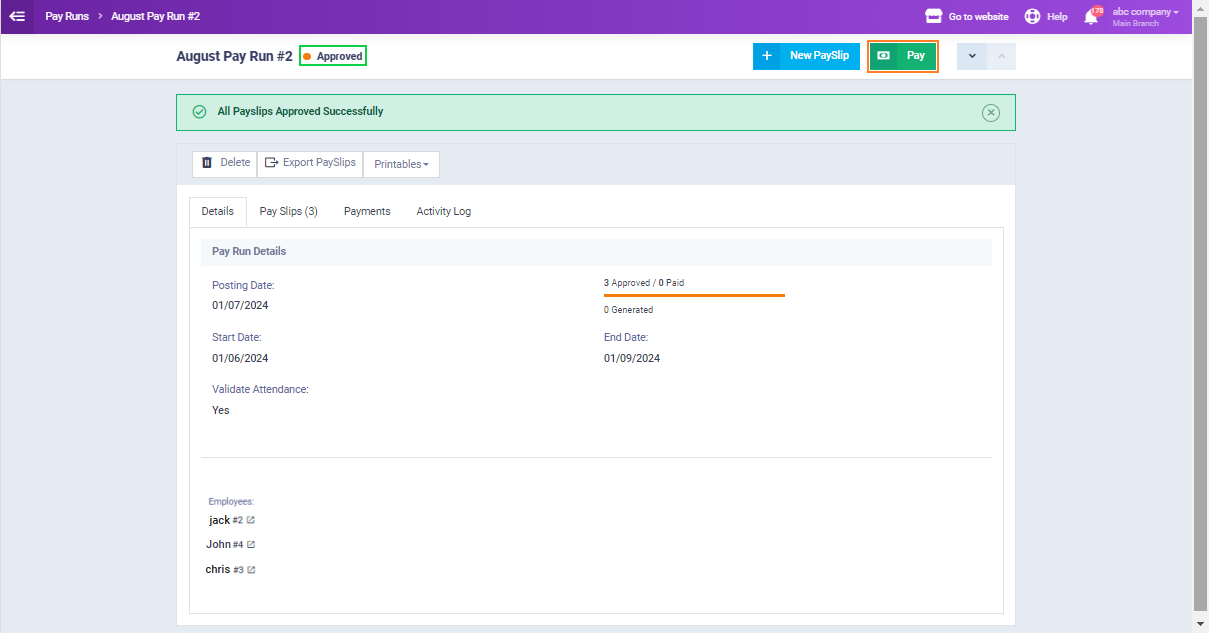

After generating the pay run, an “Approve All” button will appear. Click on this button to proceed.

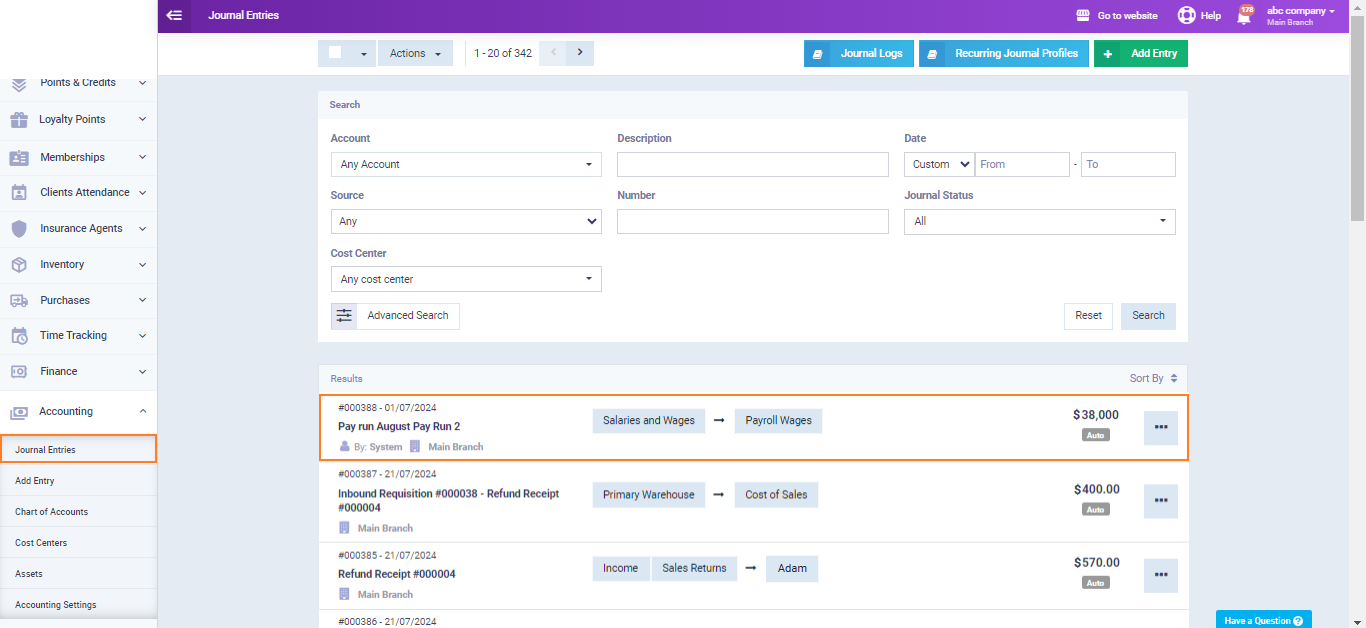

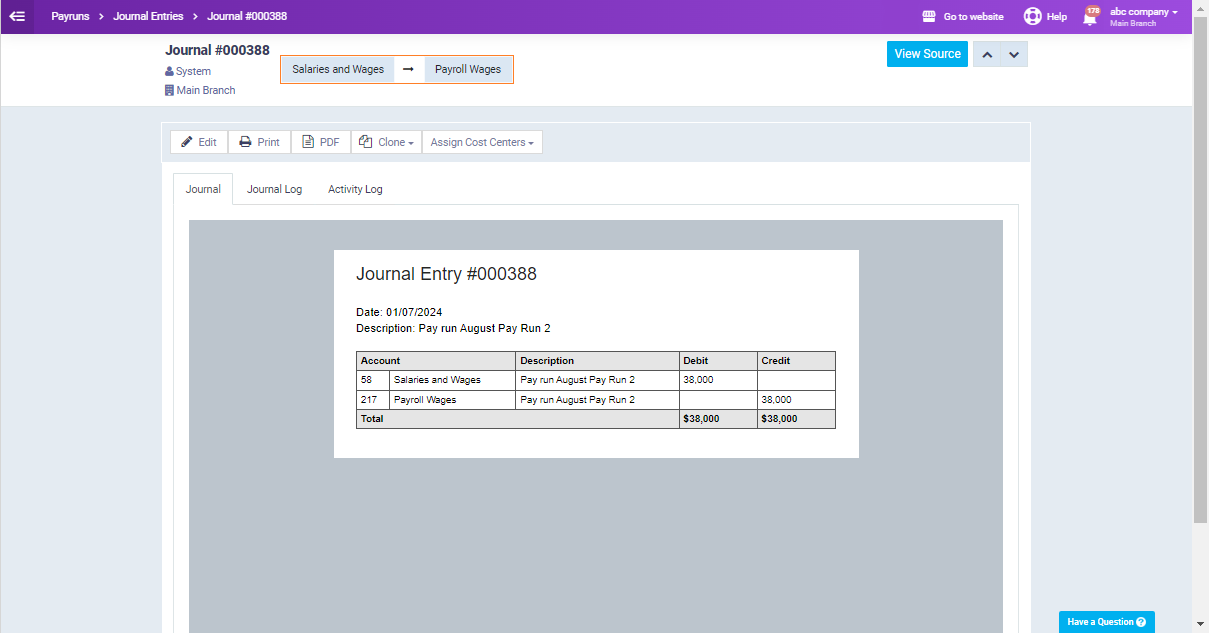

This step creates an initial journal entry that debits the “Salaries and Wages” account and credits the “Payroll Wages” account. This accurately records the salary expenses and payroll obligations.

From the main menu click on “Journal Entries” in the dropdown menu of “Accounting“.

Click on the required entry to view it.

The next step is to settle the outstanding amount by clicking the “Pay” button in the previously created Pay Run.

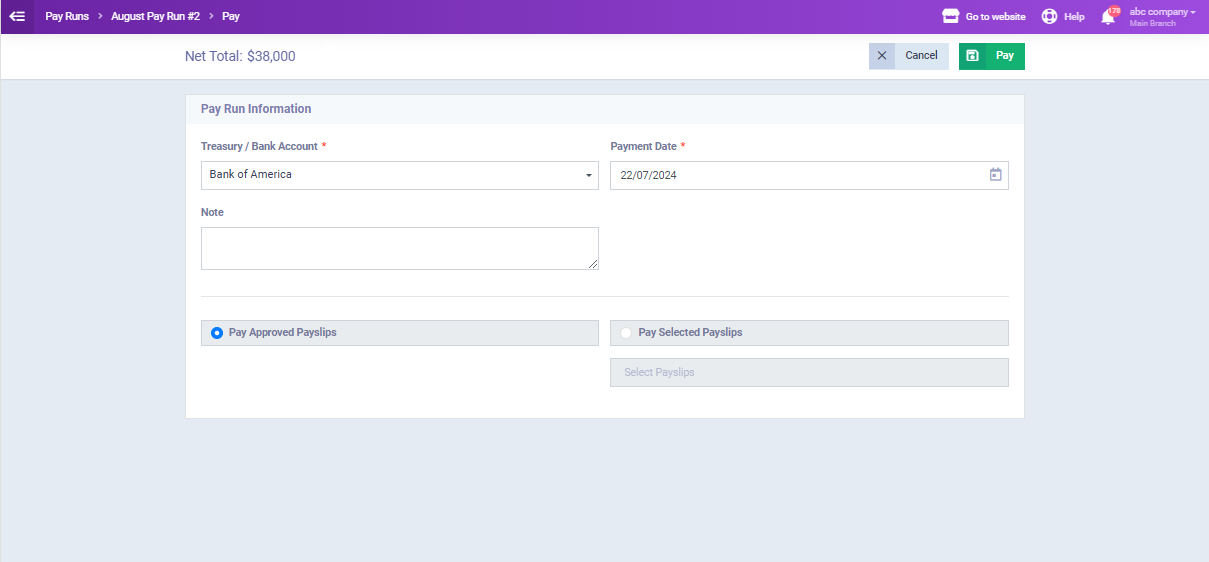

Select the treasury or bank account through which the transaction will be processed.

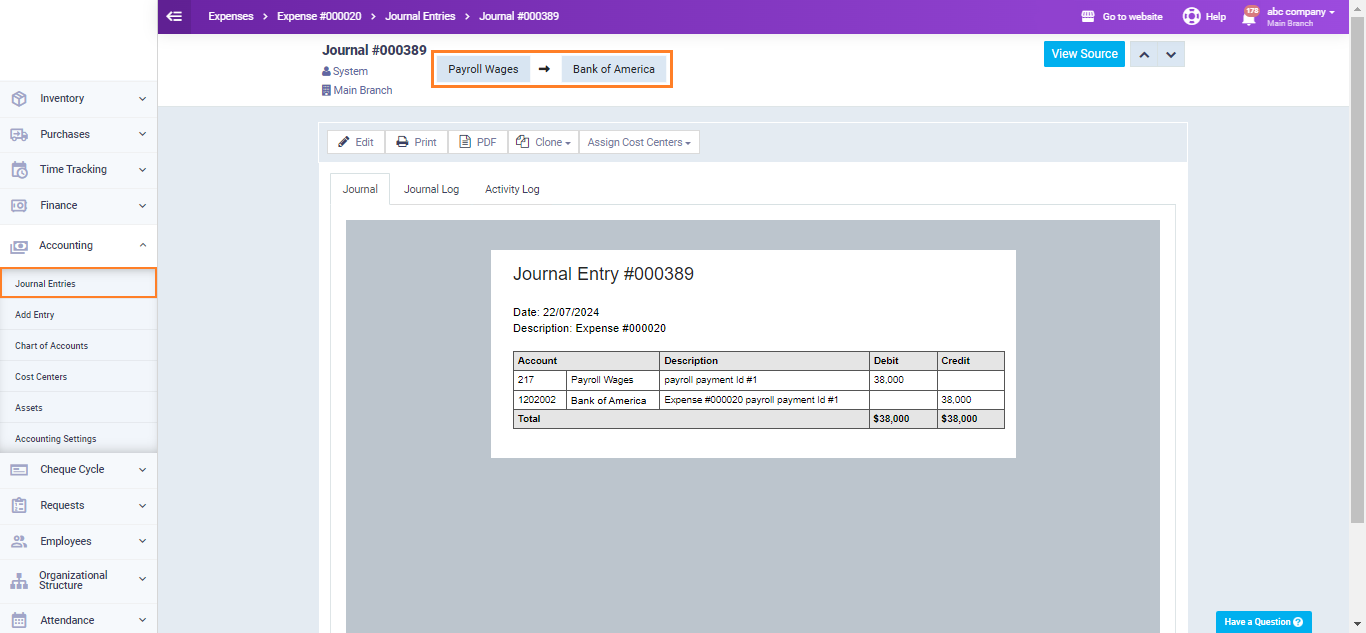

Now, refer to the “Journal Entries” section, where you will find an automatically generated entry that debits the “Payroll Wages” account and credits the “Bank Account.” This entry indicates that the payroll transaction has been completed, disbursing funds from the bank account to the employees included in the pay run.