Distributing a Deferred/ Prepaid Expense Automatically on a Recurring Basis through the System

We often need to record an expense paid in advance, and then distribute the value of this prepaid expense periodically to its corresponding expense account.

Example: The rent for premises is paid in advance for a year amounting to $12,000,

The journal entry would be as follows:

- 12000 from the Prepaid Rent Expense Account

- 12000 to the Treasury Account

After recording the value of the prepaid expense, we need to deduct the amount for each month, which is $1,000 monthly, until the cost is fully charged to the monthly expenses.

The monthly deduction entry would be as follows:

- 1000 from the Rent Expense Account

- 1000 to Prepaid Rent Expense Account

and then repeat this process monthly until the value of the prepaid expense is exhausted.

Therefore, in the following steps, we will define how to perform this process in a recurring “automatic” manner through the program.

Firstly: Creating a New Treasury and Linking it to the Deferred/ Prepaid Expense Account

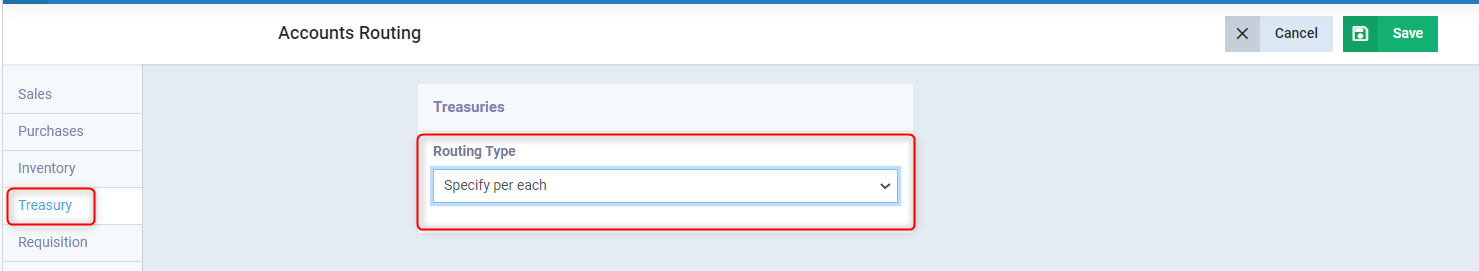

Specifying the Routing of the Treasuries and Bank Accounts

Adding a New Treasury and Linking it to the Sub-account

- From the main menu, click on “Finance”.

- Click on “Treasures & Bank Accounts”.

- Click on the “Add Treasury” button.

- In the Add Treasury screen, fill in the treasury details as follows:

- Status: Choose “Active” to activate the treasury or “Inactive” to deactivate it.

- Treasury Name: Write the name of the treasury as you want it to appear in the program’s lists and windows.

- Description: Add a general description of the nature or specialty of the treasury.

- Account: Delete the phrase “Default Account” and then select the sub-account specific to “Prepaid Expense Account”.

- Permissions:

- Deposit: Select from the dropdown menu the deposit permission in the treasury for a specific employee, job role, specific branch, or all.

- Withdrawal: Select from the dropdown menu the withdrawal permission from the treasury for a specific employee, job role, specific branch, or all.

Secondly: Adding an Expense of the Value of the Deferred/ Prepaid Expense

- Click on “Finance” from the main menu.

- Click on “Expenses”.

- Click on the “New Expense” button.

- Enter the expense data as follows:

- Amount:

- Enter the value or amount of the expense.

- Select the currency of the expense voucher to be recorded.

- Description: Enter any notes or additional guidance that describe the expense.

- Code Number: It is a serial number that distinguishes the expense voucher, and you can change the number and control the format of the series through “Auto Numbering Settings“ in the account.

- Date: Select from the calendar the date of adding the expense voucher to the system.

- Attachments: You can attach a picture of the expense by clicking the “Upload” button and selecting the picture from your device, or through drag and drop.

- Received By: Select the recipient of the income voucher.

- Category: Select one of the categories from the dropdown menu or add a new category for expense vouchers.

- Treasury: Select the treasury or bank account that will issue the expense, from the treasuries or bank accounts added to the account. For more details on how to add a new treasury/bank account, you can review the guide “Adding a Treasury/Bank Account“.

- Journal Account: Select the Deferred Expense account in the “Journal Account” field, for example: Prepaid Rent Expense Account

- Click on “Add Taxes” to assign tax to the expense voucher if applicable.

- Select “Assign Cost Centers” to link all or part of the expense value with one of the cost centers in the account.

- Amount:

- Click the “Save” button to issue the expense voucher.

Thirdly: Adding a Recurring Expense for Monthly Deduction.

- Click on “Finance” from the main menu.

- Click on “Expenses”.

- Click on “New Expense”.

- Ensure you choose the “Rent Expense” account, for example, in the “Journal Account” field

- In the treasury field, ensure you select the treasury that was created and linked to the Prepaid Expense account as previously explained.

- Click on the checkbox “Recurring”.

- Select the duration of “Frequency” whether Weekly, Monthly, or Yearly. In the case of the example mentioned above, select “Monthly” recurrence to deduct the amount each month on the specified date.

- Select from the calendar the “End Date” at which the repetition of the expense voucher stops and the total amount of the prepaid expense has indeed been accrued.

- Click on the “Save” button.