Issuing Expenses and Income as Drafts and Their Properties

You may need to postpone confirming the income/expense you created, or you may want it to be approved after a certain time or when performing certain procedures, or you may not want to register it permanently and have it appear in the entries, financial statements, and reports until ensuring the completion of the associated process. This is where you can use draft-type vouchers for this purpose.

How to Add an Expense or Income as a Draft

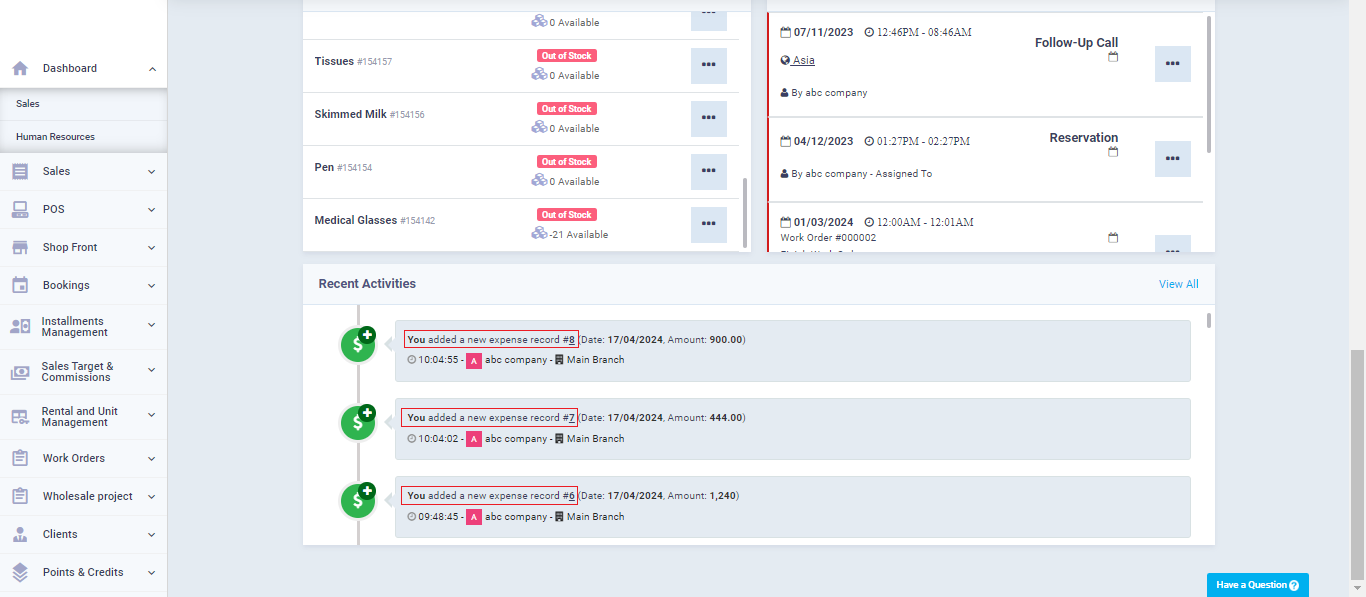

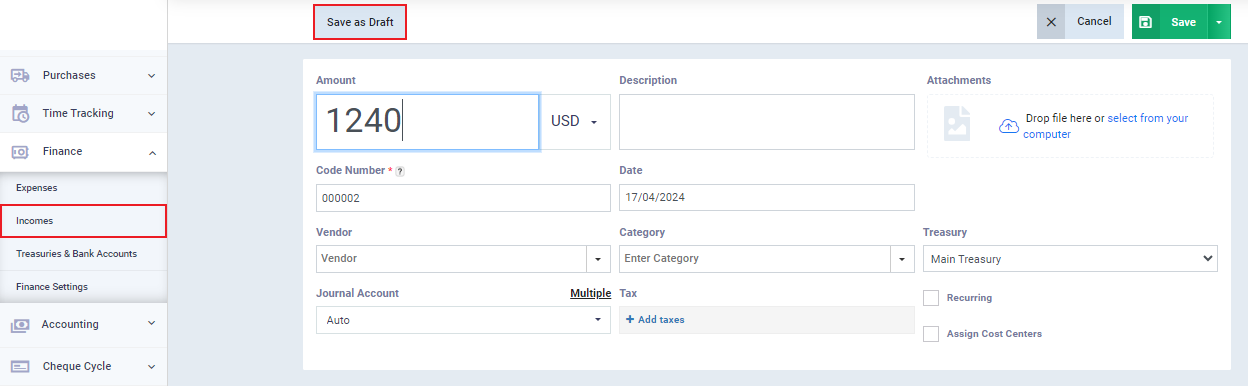

In the same way, you issue regular expense/income vouchers, go to “Expenses” or “Income” under “Finance“.

Then click on “New Expense” or “New Income” and enter the required data.

Then click on the “Save as Draft” button instead of saving it permanently.

Properties of Draft-Type Expenses or Income

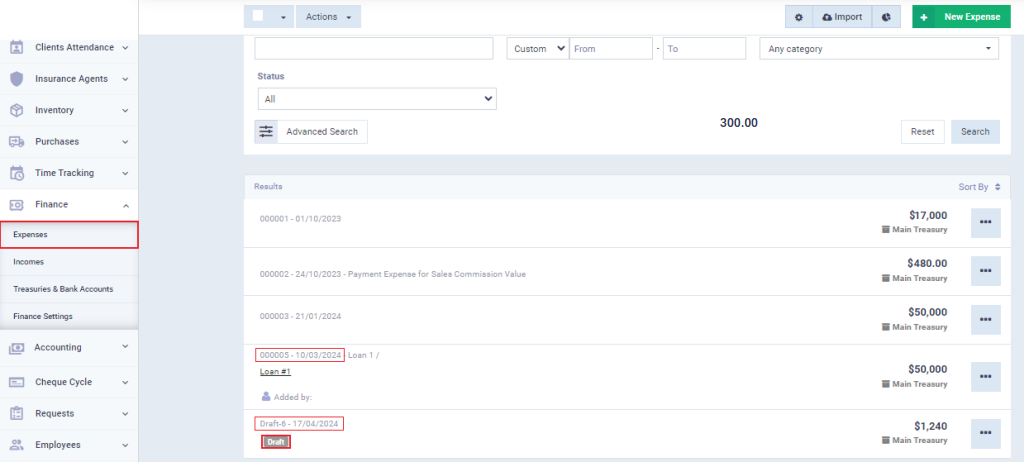

When reviewing the list of income/expenses or one of your drafts, you notice their distinction from regular invoices by the following properties:

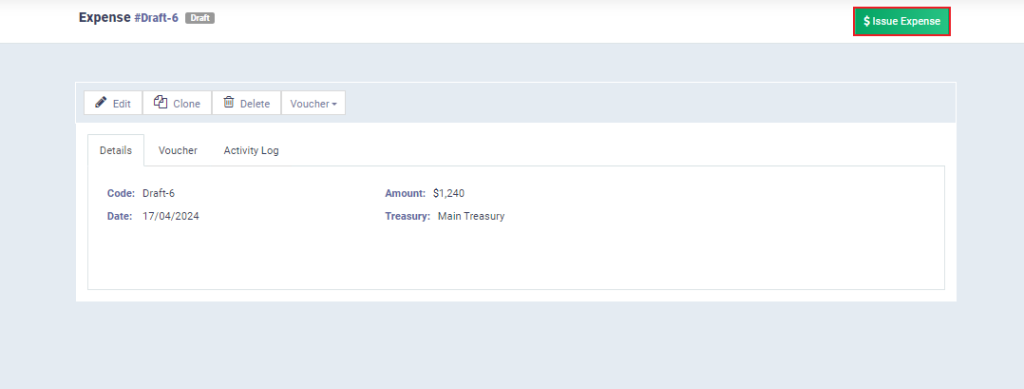

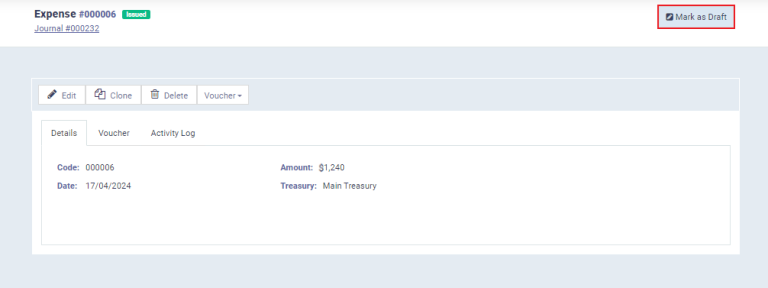

- Their serial number differs from the serial number of regular vouchers and shows the word “draft“. They are considered primary documents rather than complete invoices.

- It does not affect the entries or the accounts of clients or suppliers, and its status is marked as “Not Submitted.”

- Converting the draft into an issued document is facilitated by opening it and clicking the “Issue Income/Expense Voucher” button.