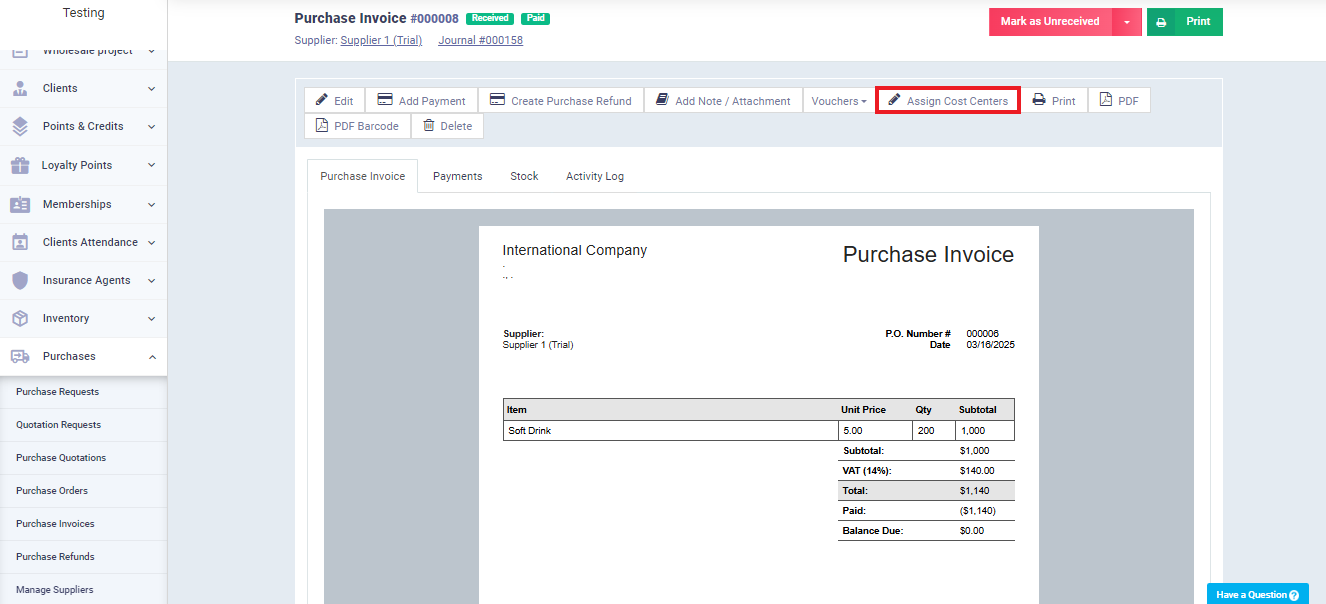

Assigning a Cost Center to a Purchase Invoice

Cost centers are valuable in analyzing cost sources, especially indirect costs, and they help distribute profits according to the costs generated. Cost centers are flexible to the extent that each accountant can use the supportive method for their accounting system and workflow.

Among the methods used is assigning specific cost centers to purchase invoices. For example, you can create a cost center for each supplier, so you ultimately know which suppliers contribute the most to your profits through their products and services. This aids in making more precise purchasing decisions.

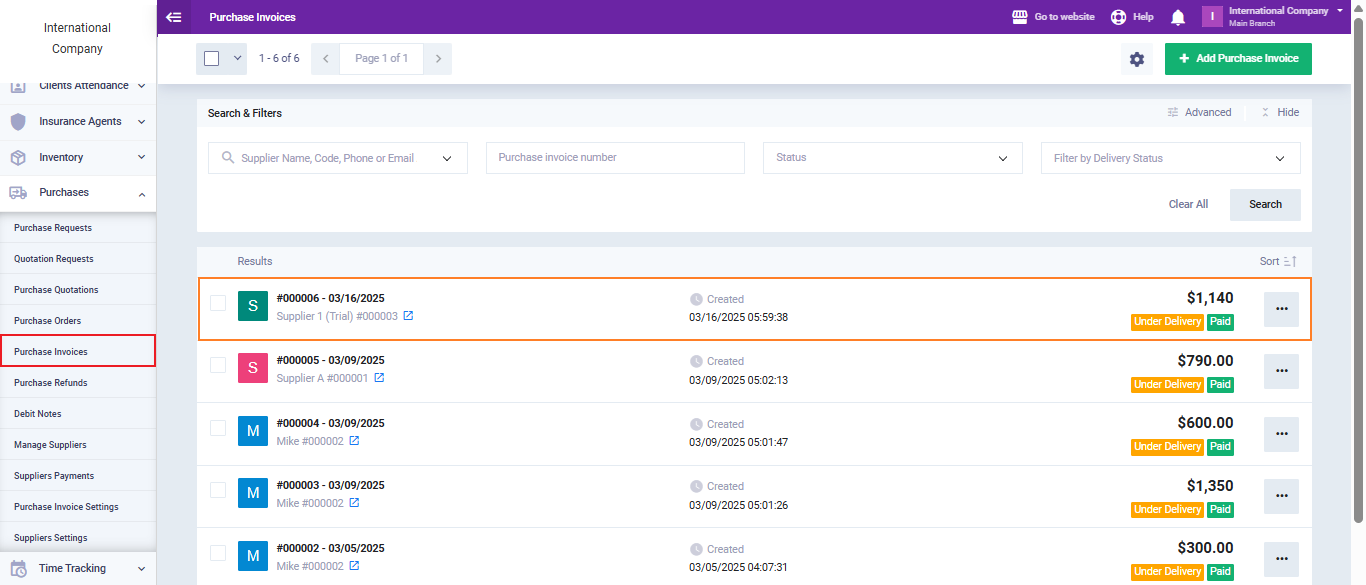

Assigning a Cost Center to a Purchase Invoice

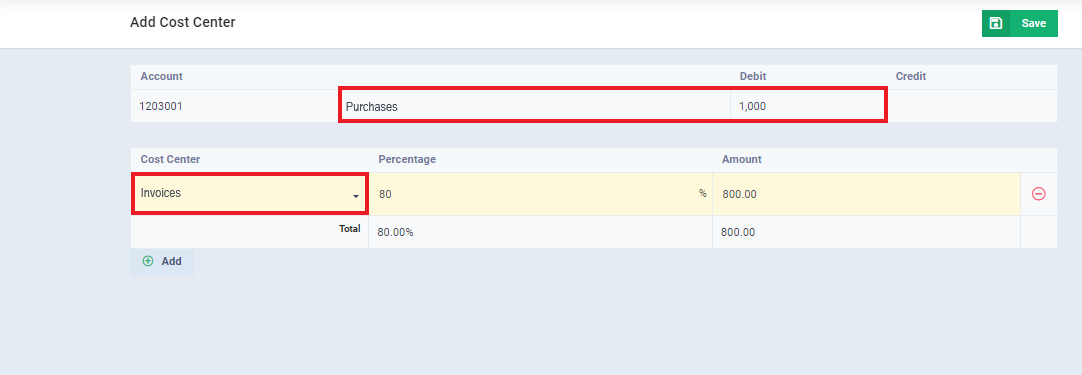

The entry appears from the purchases account to the supplier’s account.

The selected cost center entry also shows, 80% of the total amount allocated.

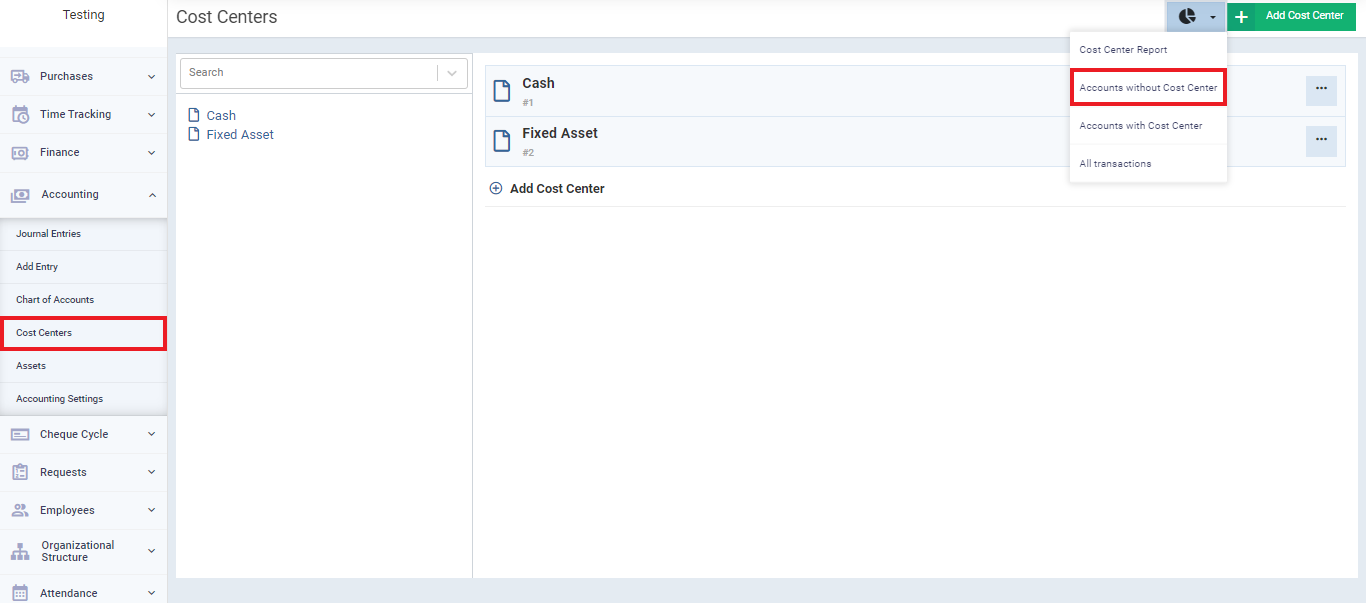

The remaining amount remains unallocated to a cost center unless you assign its accounts to another cost center. You can review and assign a cost center to it by going to ‘Cost Centers‘ under ‘Accounting‘ in the main menu, then clicking on the Accounts and Reports button and selecting ‘Accounts without Cost Centers‘ from the dropdown menu.

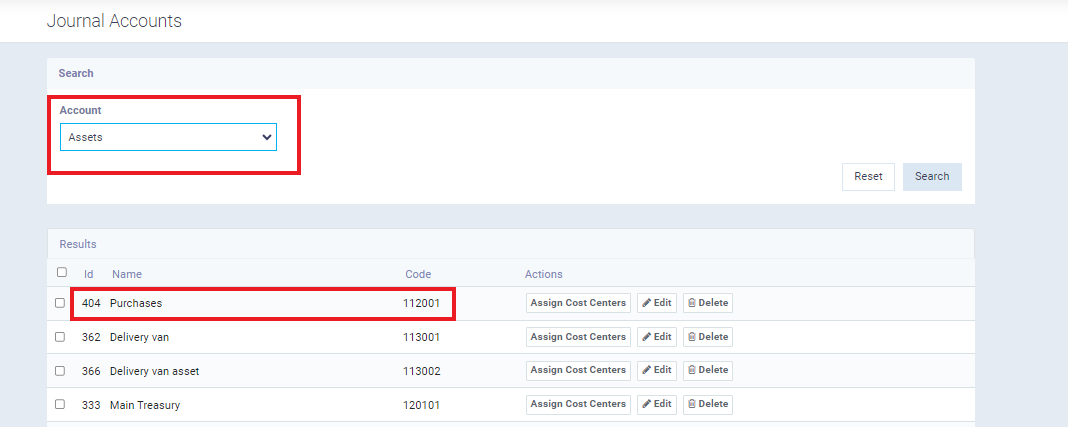

Choose the fixed assets account, and inside it, you will find the purchase account to which the purchase invoices are automatically directed. Assign a cost center to it if you wish, or leave it as is.