Comprehensive Assets Guide

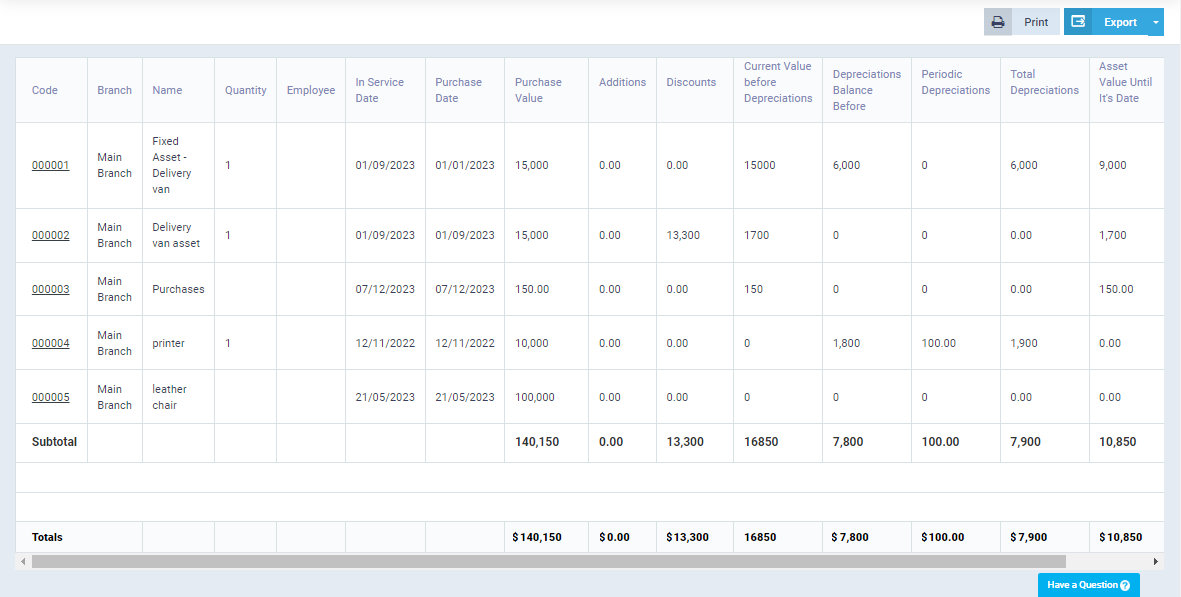

Managing assets and related operations is crucial to ensuring accurate accounting reports and financial statements. It also helps in managing expenses spent on purchasing and depreciating assets in various ways, considering changes that might require re-evaluation or sale of the asset, as well as tracking different asset statuses.

Adding a New Asset

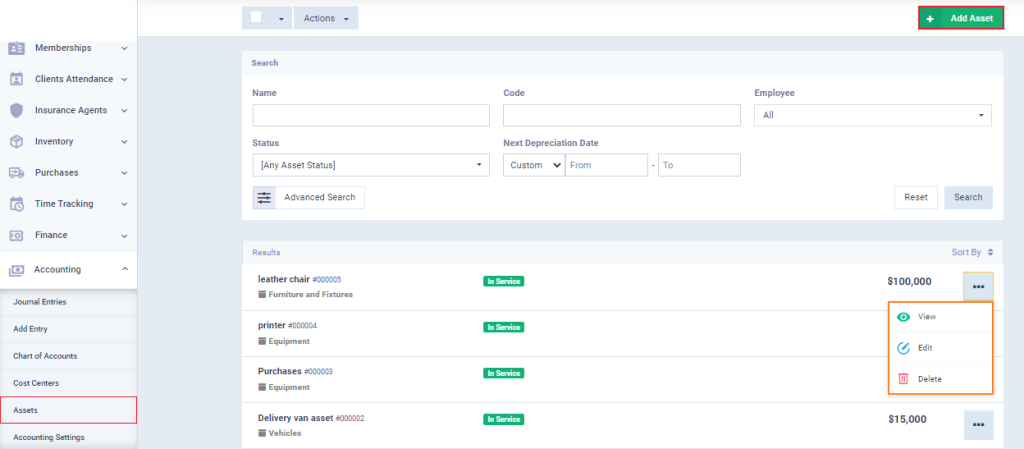

Through the assets menu, you can view the registered fixed assets and know the status of each asset, such as being in service or depreciated, and modify or delete these assets as needed.

To add a new asset, click on “Assets” under “Accounting” in the main menu, then click the “Add Asset” button.

Enter the required information

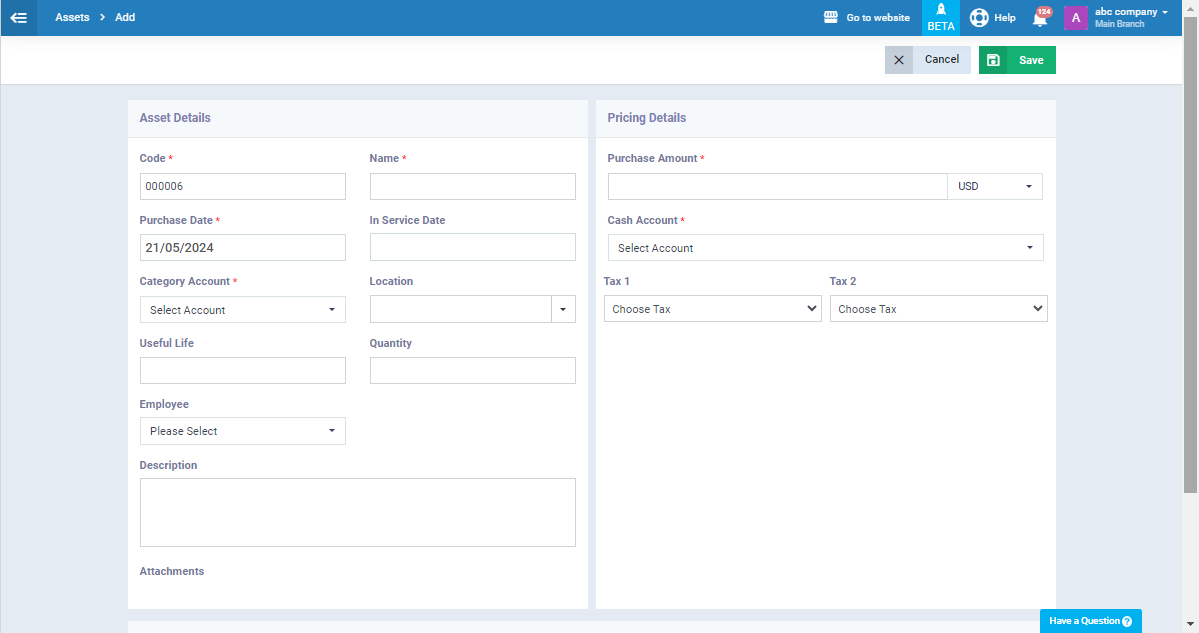

Add Asset Details:

Code: The serial number for each asset, which is automatically added by the system. You can also modify it and change its sequence.

Name: The name of the asset as it appears in the chart of accounts and financial reports.

Purchase Date: The date the asset was purchased.

Start of Service Date: Specify the date the asset started being used.

Main Account: Choose one of the following accounts from the chart of accounts to record the asset:

- Furniture

- Equipment and Machinery

- Vehicles

- Buildings

- Land

Location: Enter the address or location of the asset, used for non-movable assets like land and buildings.

Useful Life of the Asset: This refers to the period during which the asset is productive and functional. Specify the unit for this duration in months or years based on the depreciation period in the depreciation method data.

Quantity: Specify the quantity of the asset purchased.

Employee: Choose an employee directly responsible for the asset and its depreciation.

Description: Provide a general description of the asset’s nature and characteristics.

Attachments: Upload one or more files related to the asset, such as the purchase invoice.

Add Pricing Details:

Purchase Value: The value of the asset at the time of purchase and the currency of the amount.

Cash Account: Specify the account representing the creditor from whom the asset was purchased.

First and Second Tax: Add the applicable taxes on the asset to calculate their values automatically.

Depreciation of Assets and Their Types

Generally, an asset’s productive capacity decreases over its useful life until it is completely worn out. This necessitates distributing the cost of using the asset over its life as periodic expenses, making it easier to set aside the required amount for asset replacement after the end of its depreciation. This is the function of depreciation.

Depreciation of assets is accounted for in three methods, which you can apply on the system.

Depreciation Methods

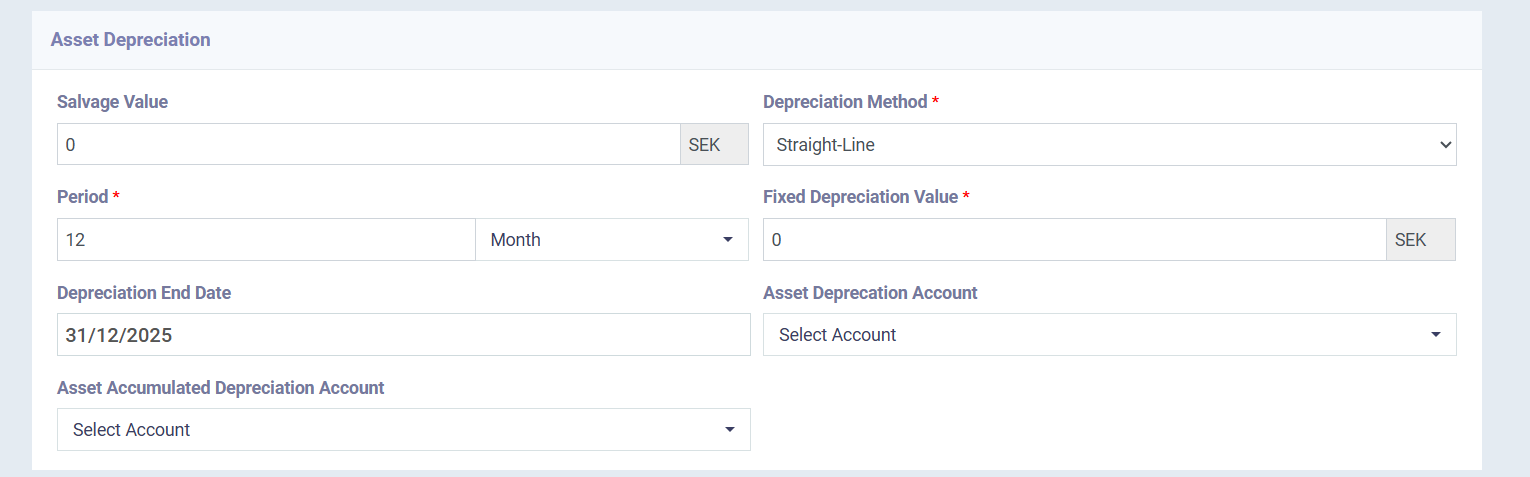

Straight-Line Depreciation

In straight-line depreciation, the value of the asset is distributed as a fixed amount evenly over the productive period.

Depreciation data using the straight-line method:

Salvage Value: Enter the expected amount to be received if the asset is sold after its useful life ends.

Next Depreciation Date: Enter the first date when the initial depreciation is supposed to be calculated.

Period: Specify the duration for calculating periodic depreciation by entering the number and choosing from “Day,” “Week,” and “Month.” For example, you can specify the period as 1 month or 1 year.

Fixed Depreciation Amount: Enter the amount to be calculated as depreciation after each period.

End of Depreciation Date: Enter the date when the asset’s depreciation ends.

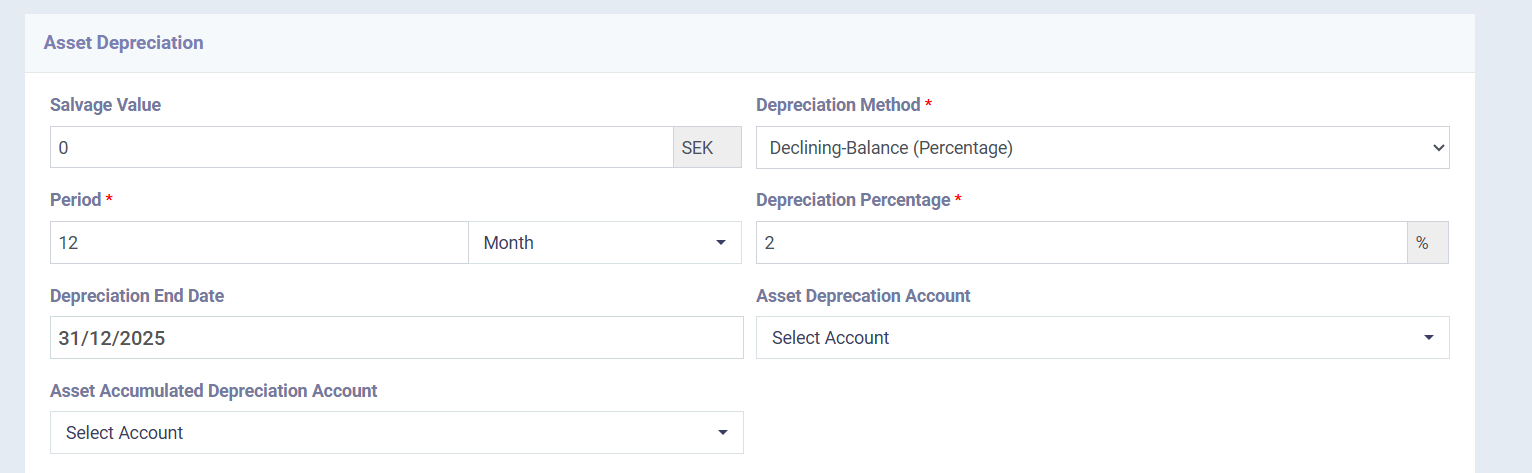

Declining Balance Depreciation (Percentage)

In declining balance depreciation, the depreciation amount is higher at the beginning of the asset’s useful life and gradually decreases over time as the productive efficiency decreases. The decreasing amount is adjusted by calculating a percentage rate.

Depreciation data using the declining balance method:

Salvage Value: Enter the expected amount to be received if the asset is sold after its useful life ends.

Next Depreciation Date: Enter the first date when the initial depreciation is supposed to be calculated.

Period: Specify the duration for calculating periodic depreciation by entering the number and choosing from “Day,” “Week,” and “Month.” For example, you can specify the period as 1 month or 1 year.

Depreciation Percentage: Enter a fixed percentage rate to be applied to calculate depreciation for each period.

End of Depreciation Date: Enter the date when the asset’s depreciation ends.

Units of Production

In this method, the depreciation value is calculated based on the asset’s usage rate. As the asset’s productivity and usage increase, the depreciation amount for the corresponding period also increases.

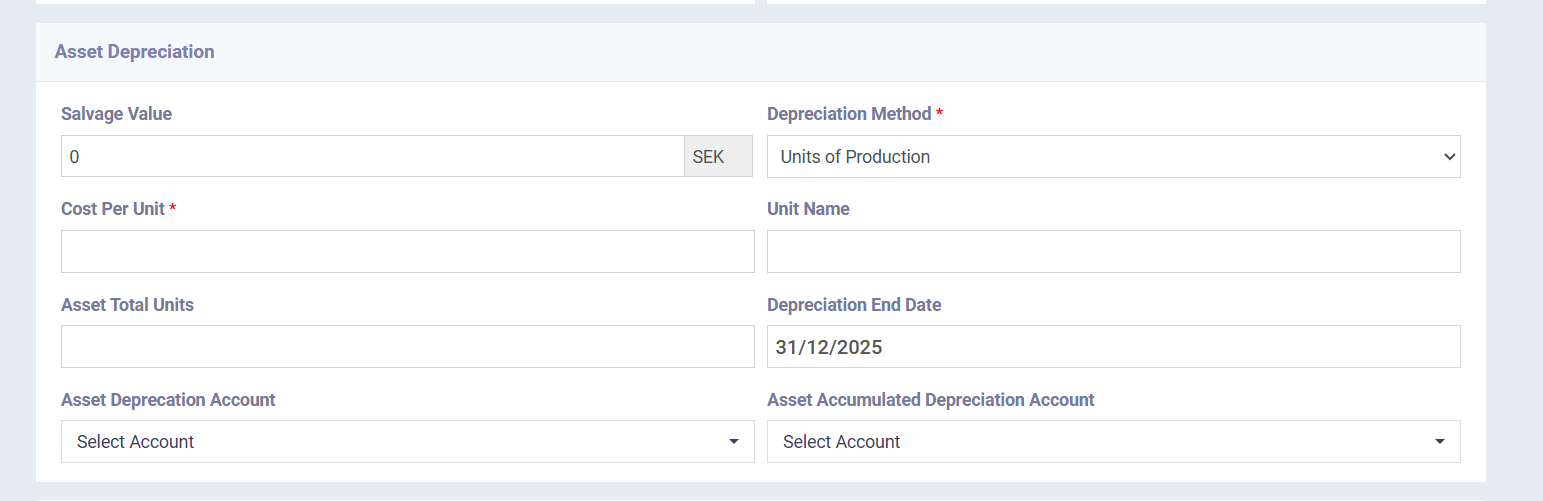

Depreciation data using the units of production method:

Salvage Value: Enter the expected amount to be received if the asset is sold after its useful life ends.

Next Depreciation Date: Enter the first date when the initial depreciation is supposed to be calculated.

Unit Price: Specify the cost deducted when the asset consumes one unit.

Unit Name: This refers to the larger unit of measurement, for example kg.

Asset Total Units: The maximum number of units after which the asset is depreciated.

End of Depreciation Date: Enter the date when the asset’s depreciation ends.

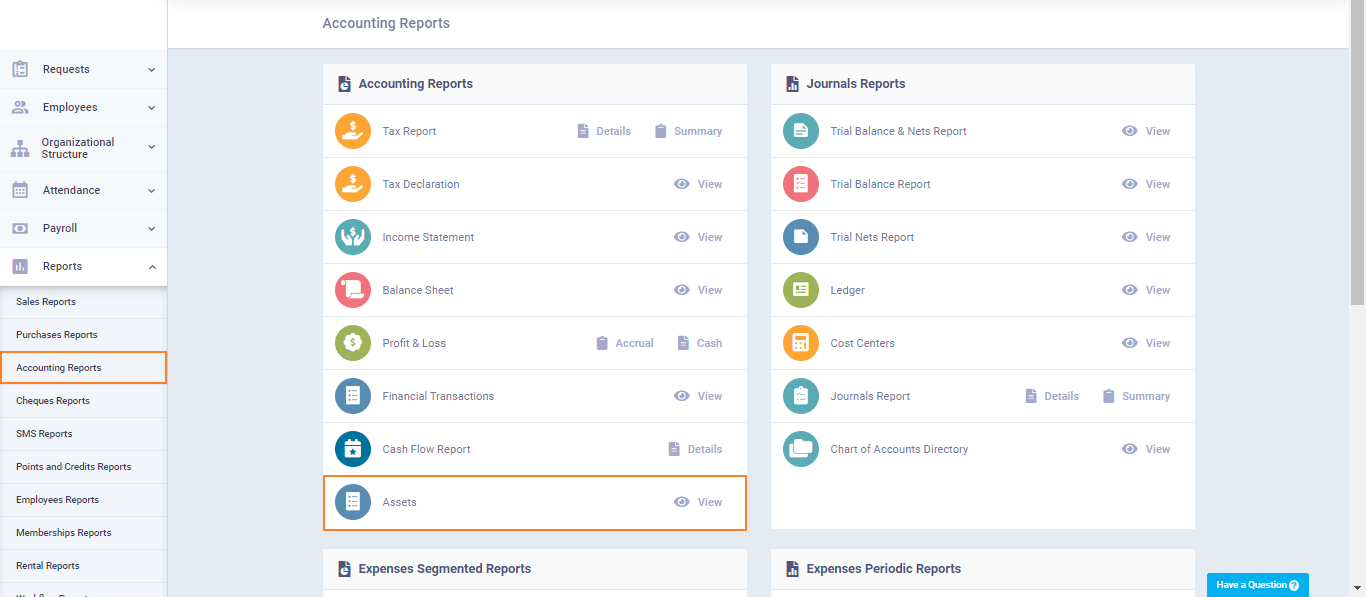

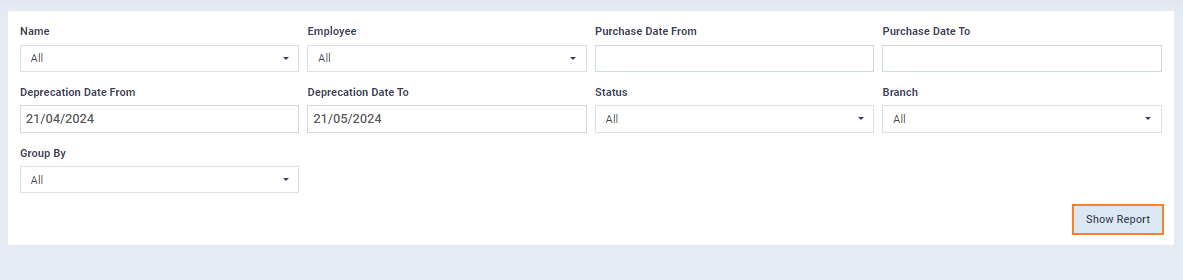

Depreciation, Sale, and Revaluation of Assets

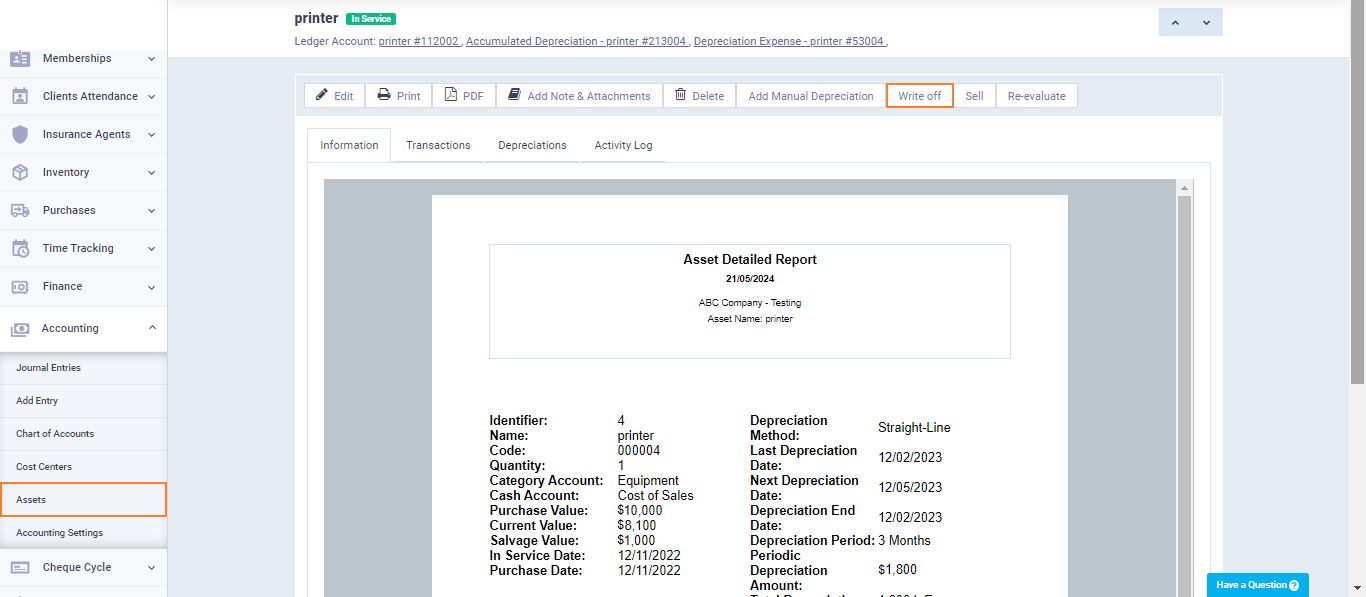

Asset Depreciation: Fully depreciating the asset and converting its current value to zero.

Click on “Assets” under “Accounting” in the main menu, then select the asset you want to fully depreciate (write-off), and click on the “Write-off” button.

Before write-off, note that the current value of the asset is 2000 and its status is “In Service“.

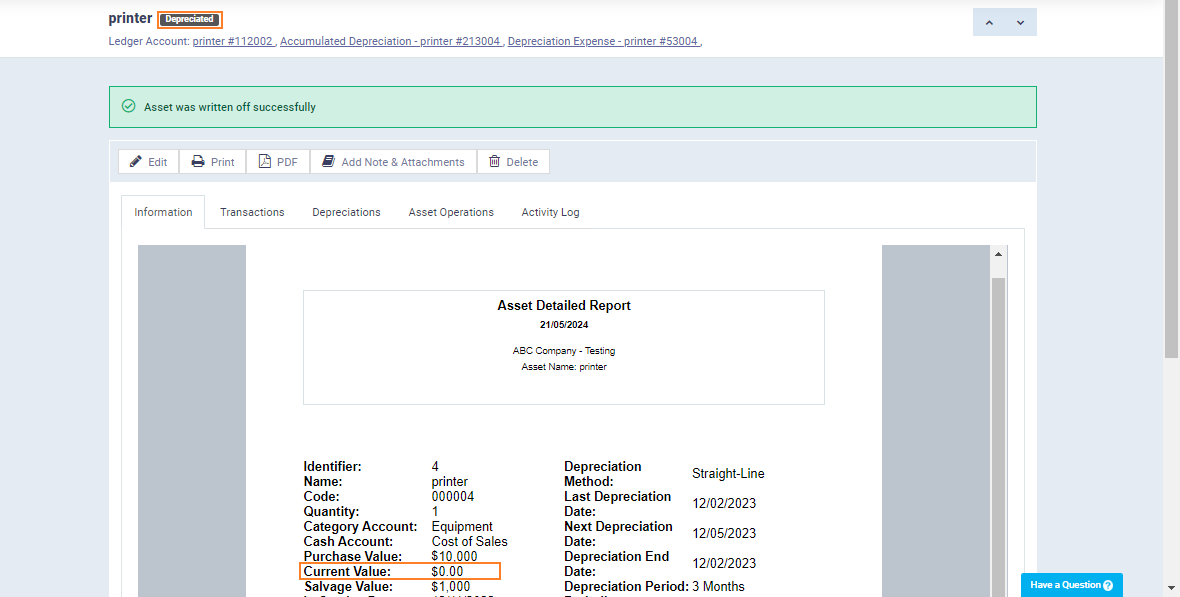

After writing off the asset, its status changes to “Depreciated” and its current value becomes zero.

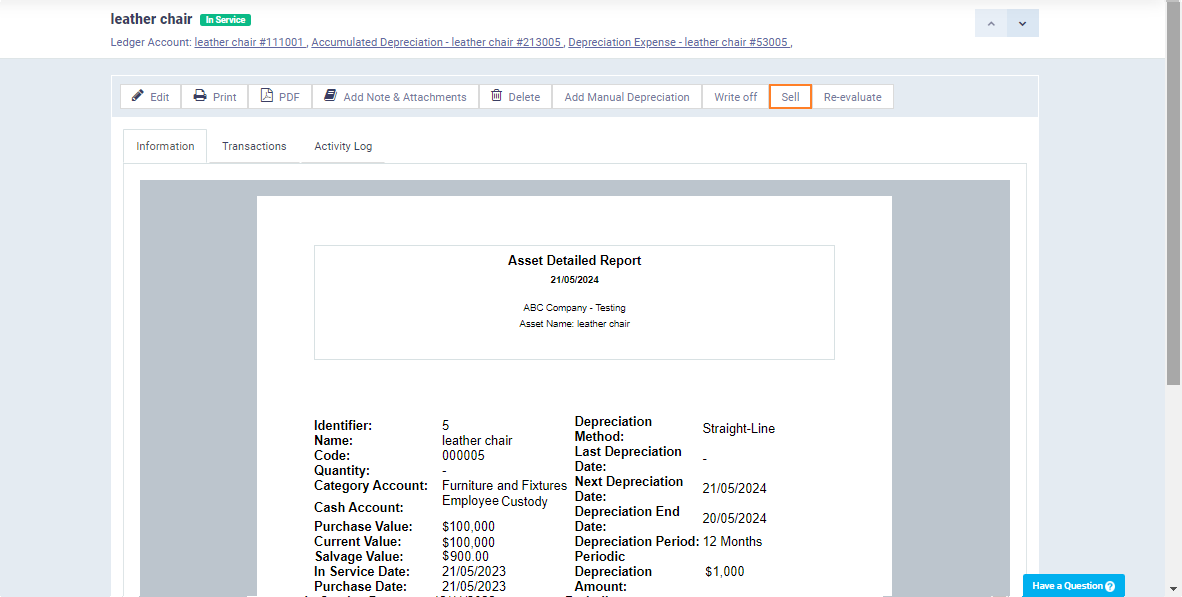

You can sell the asset and document the sales transaction for accounting purposes, whether it results in a loss or profit.

Click on “Assets” from the dropdown menu under “Accounting” in the main menu. Then, select the asset you want to sell and click on the “Sell” button.

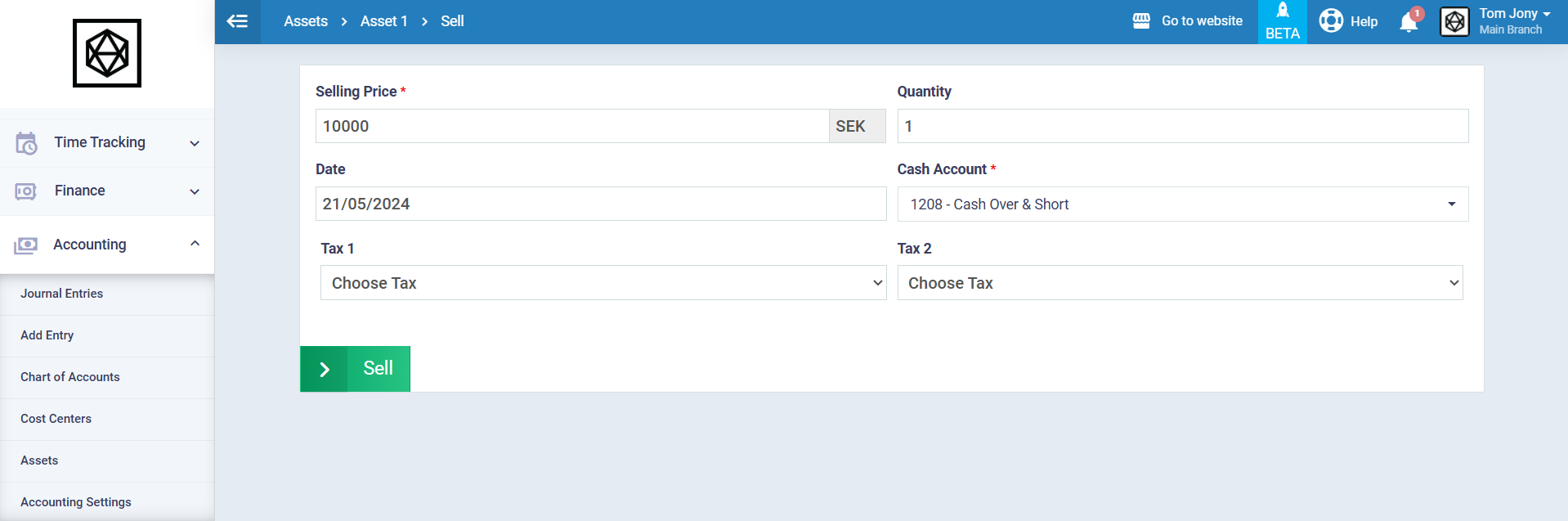

Enter the required information for selling the asset:

Sales Price: Enter the selling price of the asset.

Date: Select the date of the sale transaction.

Tax: Enter any applicable taxes on the asset from the available taxes in your account.

Cash Account: Select the debit party to whom you sold the asset.

Then, click on the “Sell” button.

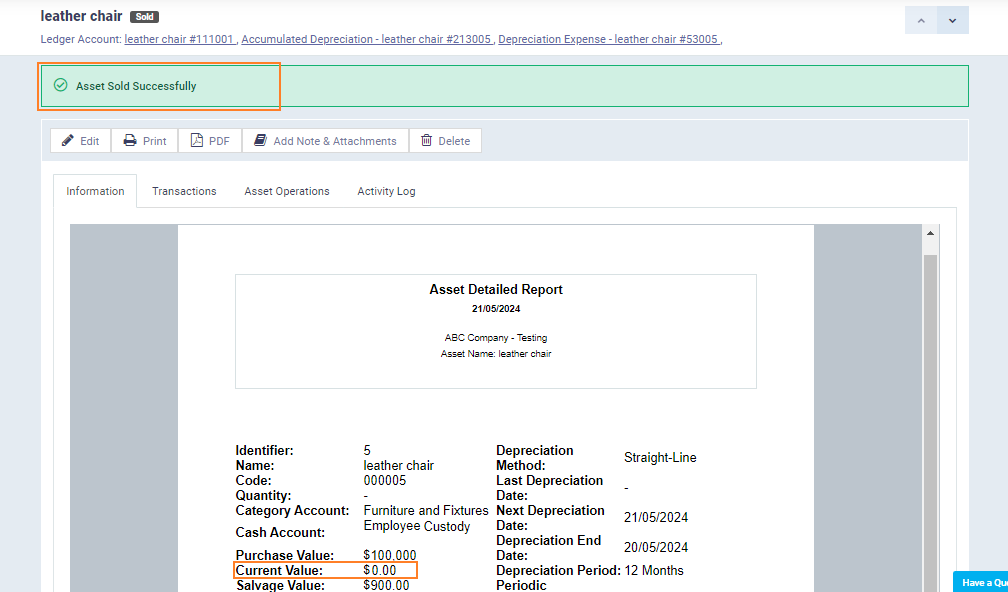

After Selling the asset the message “Asset Sold Successfully” will appear and its status will change to “Sold” and its current value will become zero.

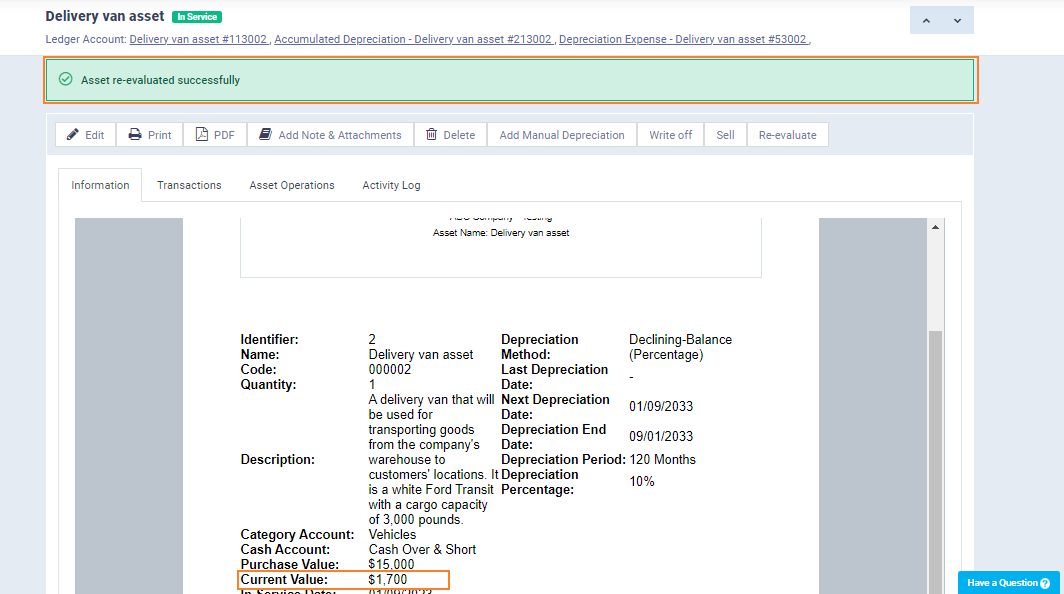

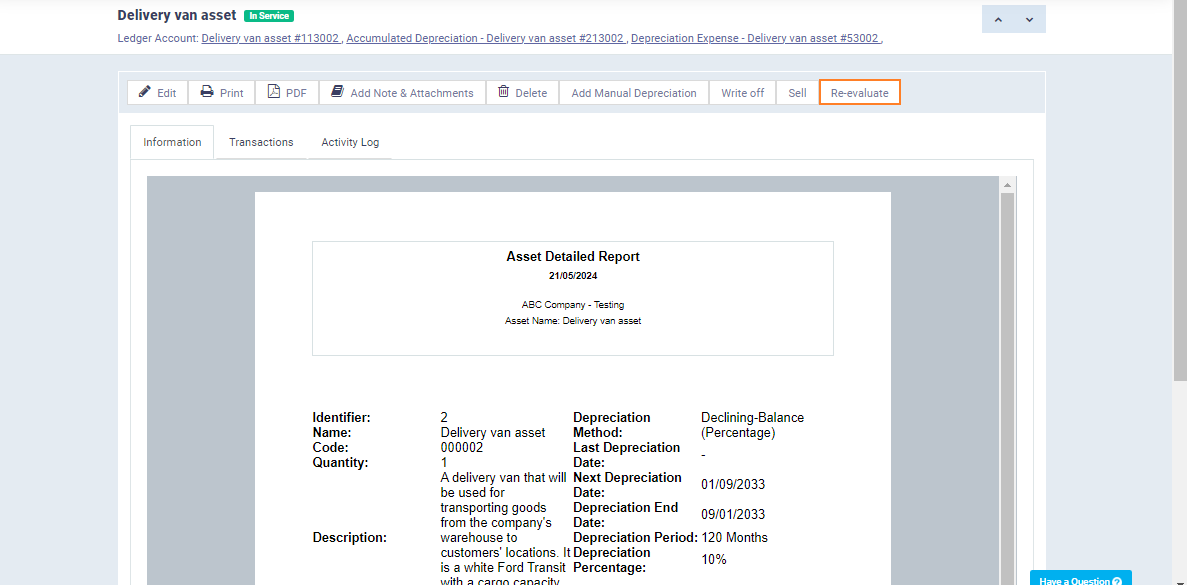

Asset Revaluation: You can revalue the asset and manually enter a new value, based on which subsequent depreciation will be calculated.

Click on “Assets” from the dropdown menu of “Accounting” in the main menu then select the desired asset and click on “Revaluate“.

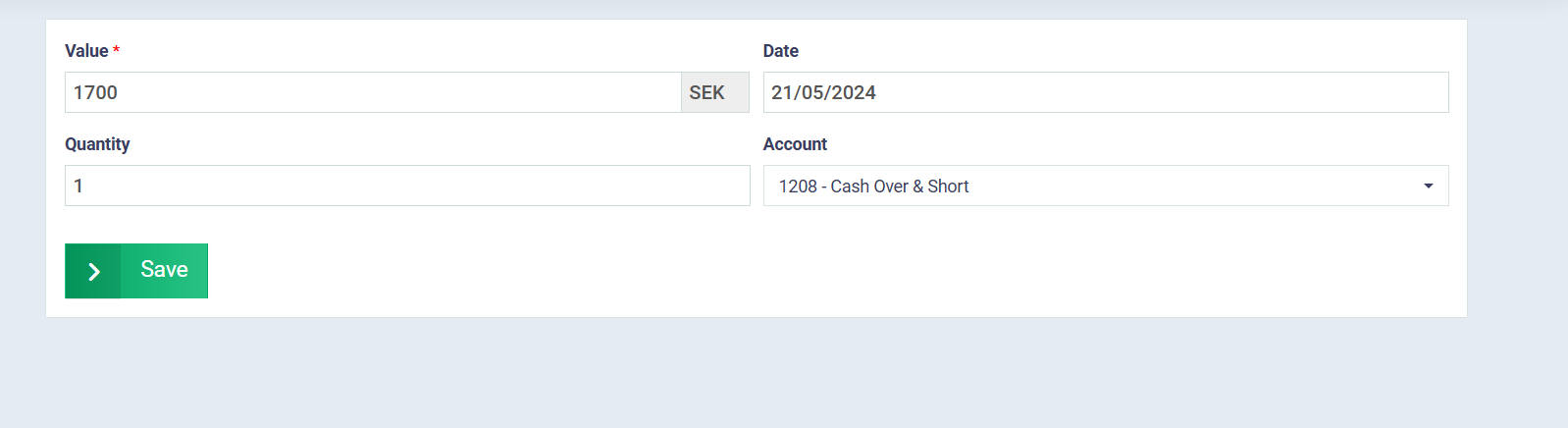

Enter the new asset value and the revaluation date, then click the “Save” button.

After revaluation, you will see the message “Asset re-evaluated successfully.”

The current value of the asset will change to the new value, which in this example is now 1700.