Assigning Taxes and Cost Centers to the Items of Journal Entries

Enabling the Settings Related to Adding Taxes and Cost Centers to a Journal Entry

Manual journal entries are a fundamental part of every commercial institution’s operations, and often these entries include taxes that need to be collected or paid, or that need to be assigned to specific cost centers to assist in monitoring your business reports.

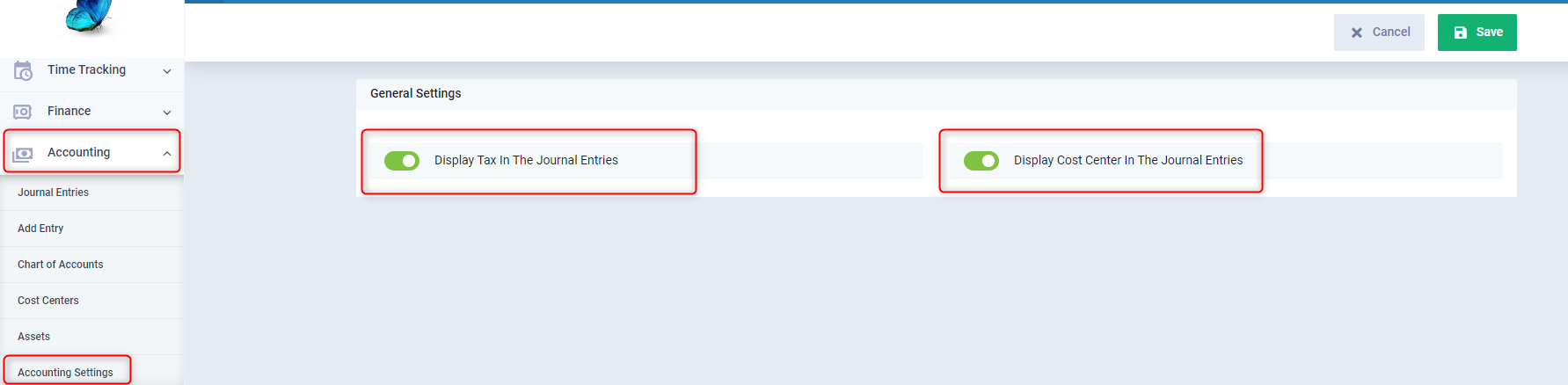

To assign taxes and cost centers to items in a manual journal entry during addition, you must first activate this setting through the following steps:

- From the main menu, click on “Accounting”.

- Click on “Accounting Settings”.

- Click on the “General” tab.

- Activate the option “Display Tax In The Journal Entries” to be able to assign tax.

- Activate the option “Display Cost Center In The Journal Entries” to be able to assign cost centers.

- Click the save button.

Adding a Journal Entry and assigning a Cost Center to it

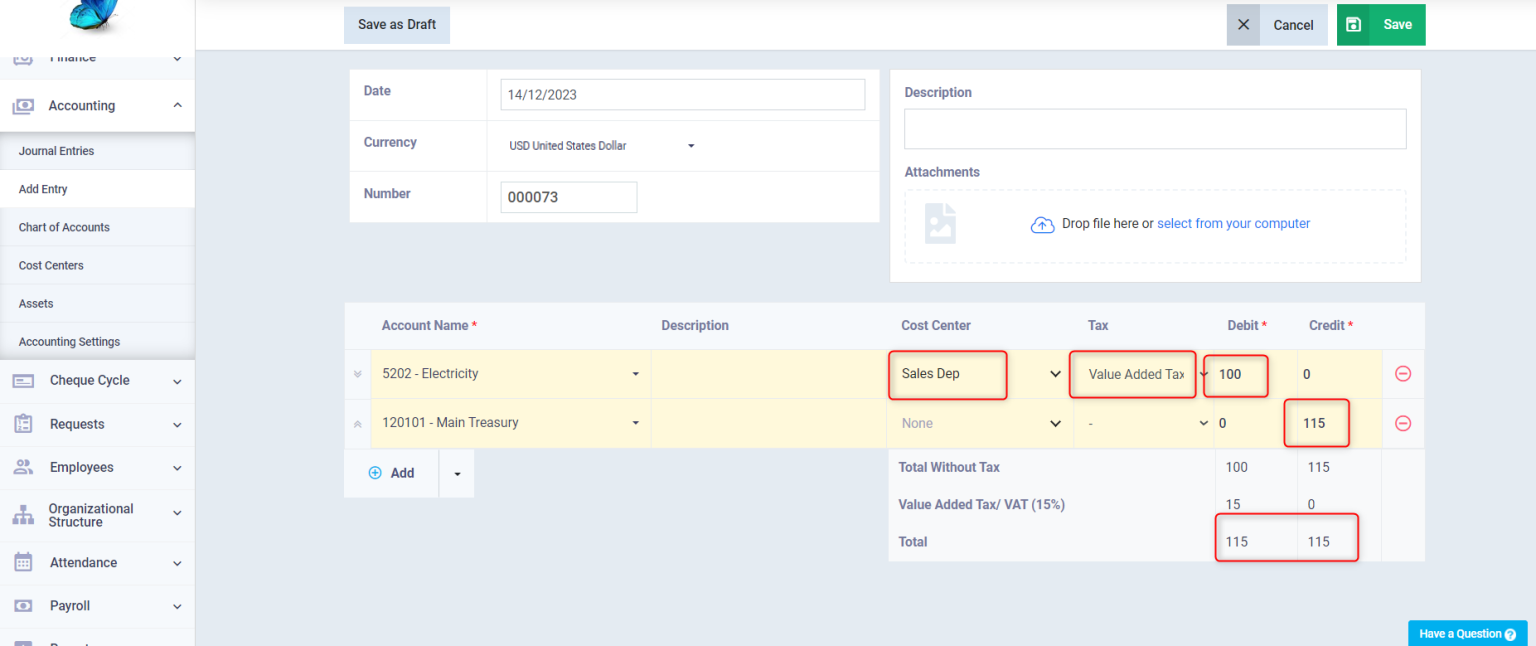

You can add a manual journal entry and assign taxes and cost centers to it by following these steps:

- From the main menu, click on “Accounting”.

- Click on the “Add Entry” button.

- On the Add Manual Entry page, you will see item details, and the columns for these items are as follows:

- Account Name: Assign the name of the specific subsidiary account for the debit account.

- Description: Provide the description for the subsidiary account in the manual entry.

- Cost Center: Choose the desired cost center to assign to the value of the selected subsidiary account.

- Note: If you select a cost center, the selected cost center will bear 100% of the expense value.

- If you want to assign more than one cost center, click on “Multiple”, and a screen will appear allowing you to assign multiple cost centers to the journal entry.

- Tax: Choose the type of tax you want to assign to the value of the subsidiary account’s amount.

- Debit: Define the amount for the debit side.

- Credit: Define the amount for the credit side.

- Note: When adding taxes to one side of the entry, both sides of the entry must be equal.

- Example: If the debit side is valued at 100 Saudi Riyals and the credit side is 100 Saudi Riyals, and a tax is assigned to the debit side, then the value in the credit side of the entry should be 115.

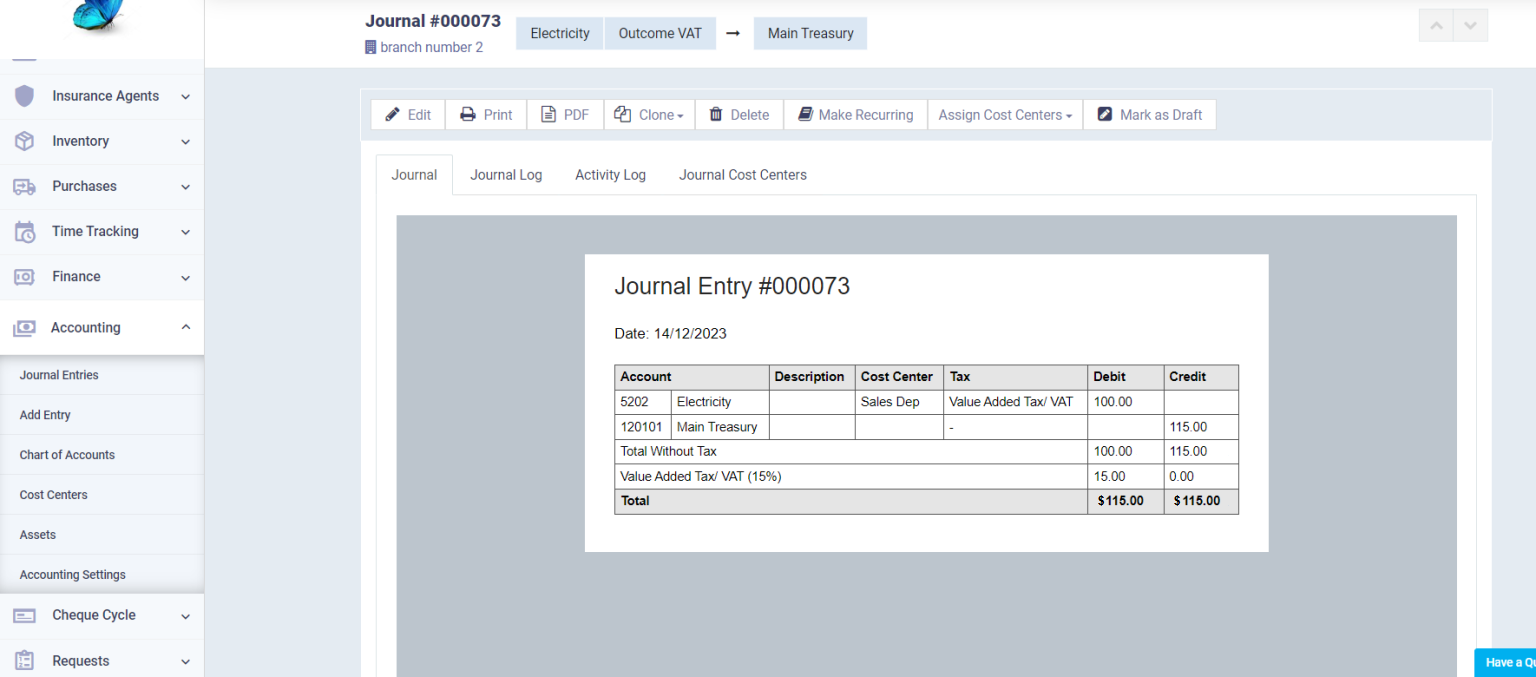

- View the entry after saving.