How to Record and Pay Accrued Expenses

In this guide, we’ll explain in detail the steps for setting up accounting entries to record and pay accrued expenses, using a practical example of accrued employee salaries to ensure clarity and easy application.

If you have accrued expenses that you want to record in the accounts, follow these steps:

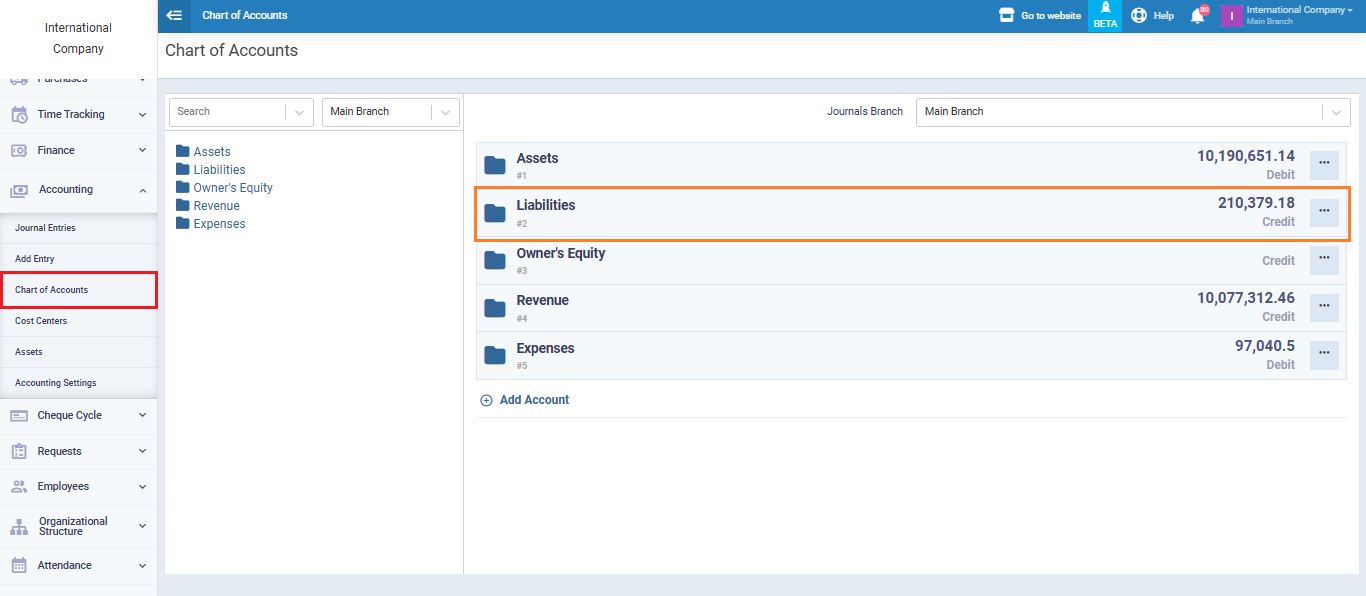

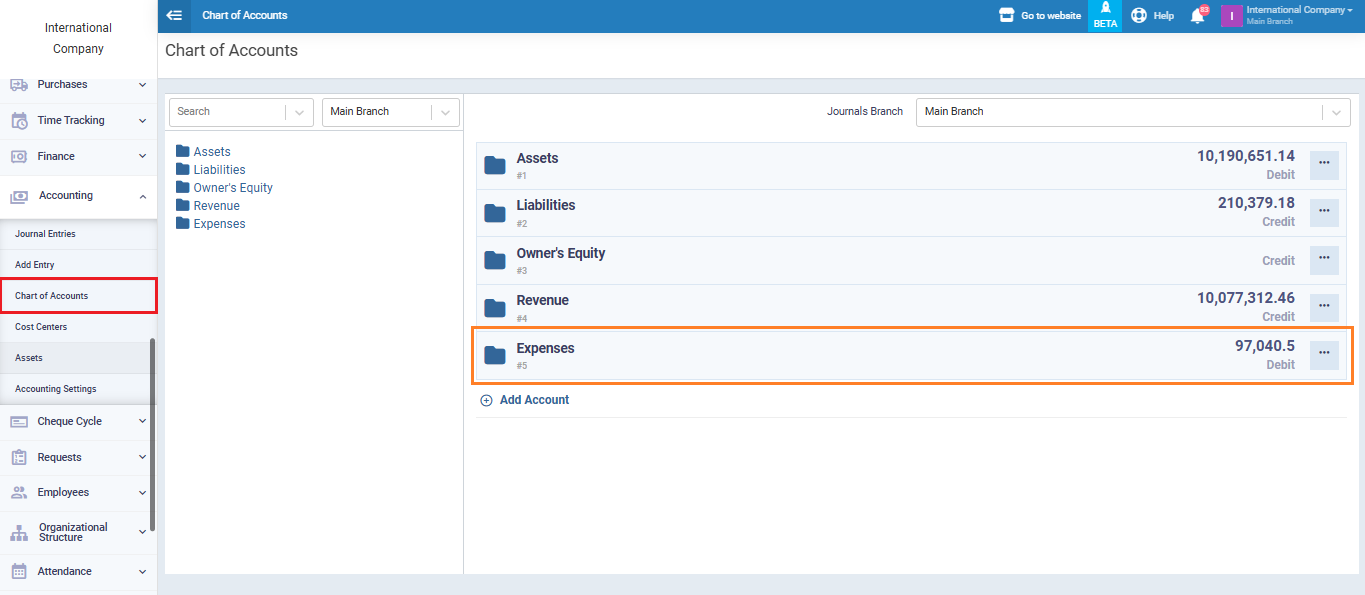

From the main menu, go to “Accounting”, from the dropdown click “Chart of Accounts”, then select “Liabilities.”

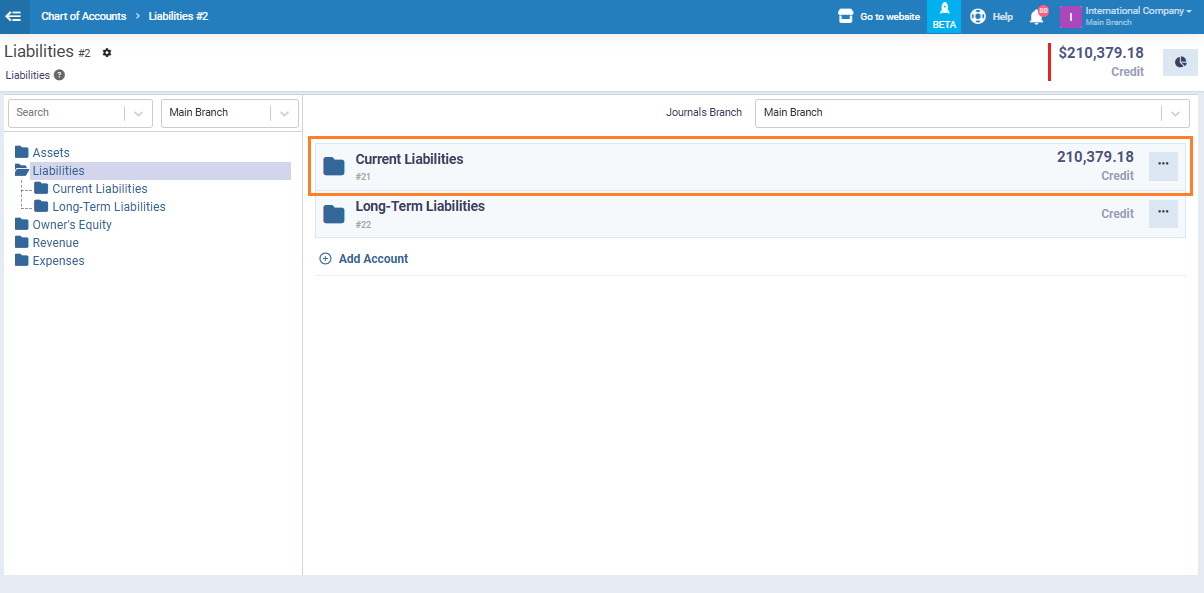

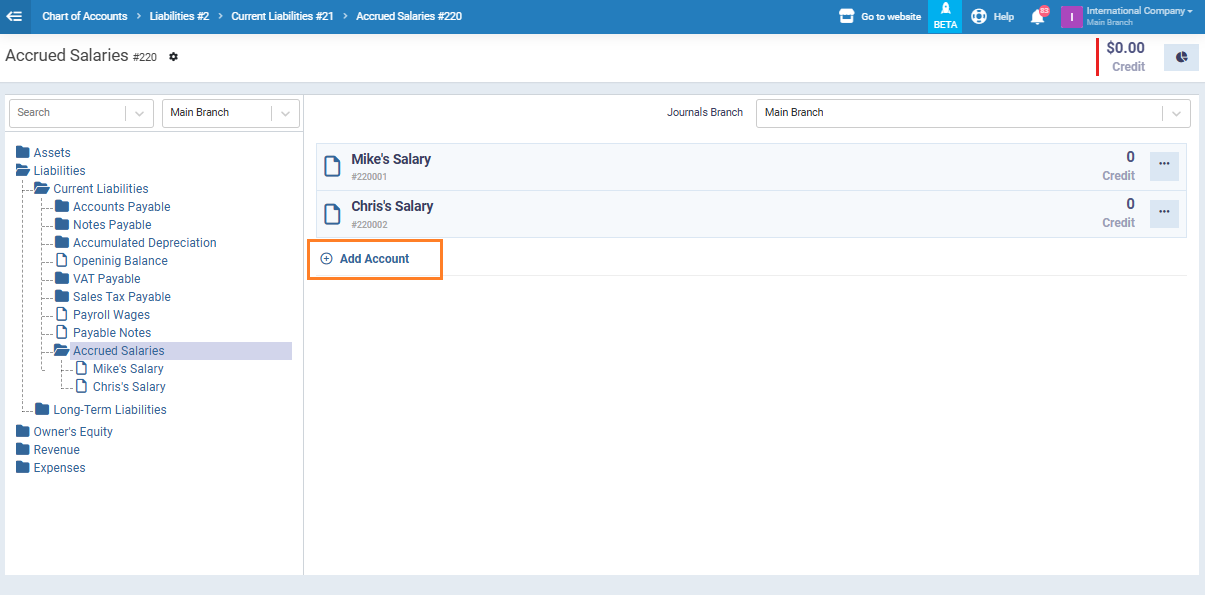

Click on “Current Liabilities.”

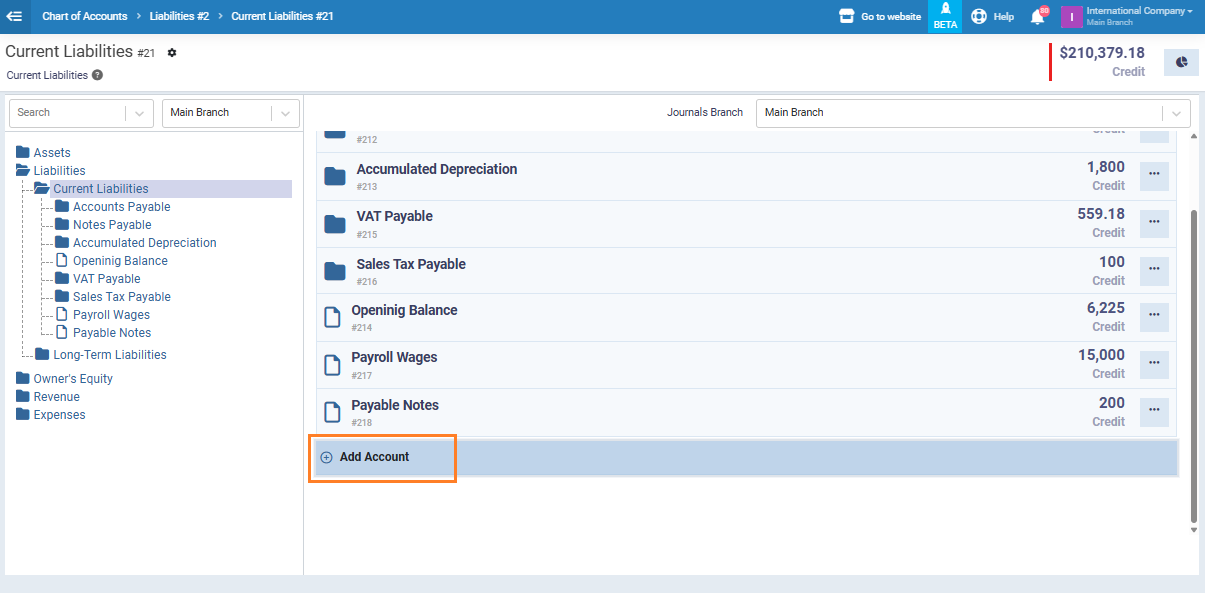

Click “Add Account.”

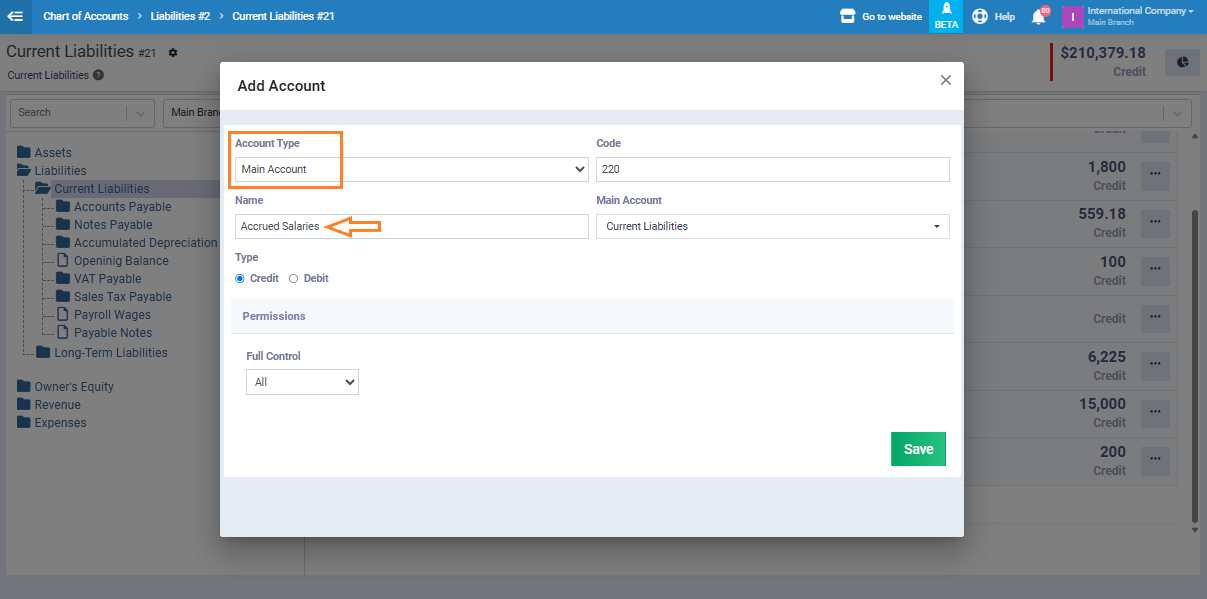

Create a new main account, for example, “Accrued Salaries.”

Inside this account, add sub-accounts for each employee, such as “Mike’s Salary” and “Chris’s Salary,” by clicking “Add Account,” as shown in the example.

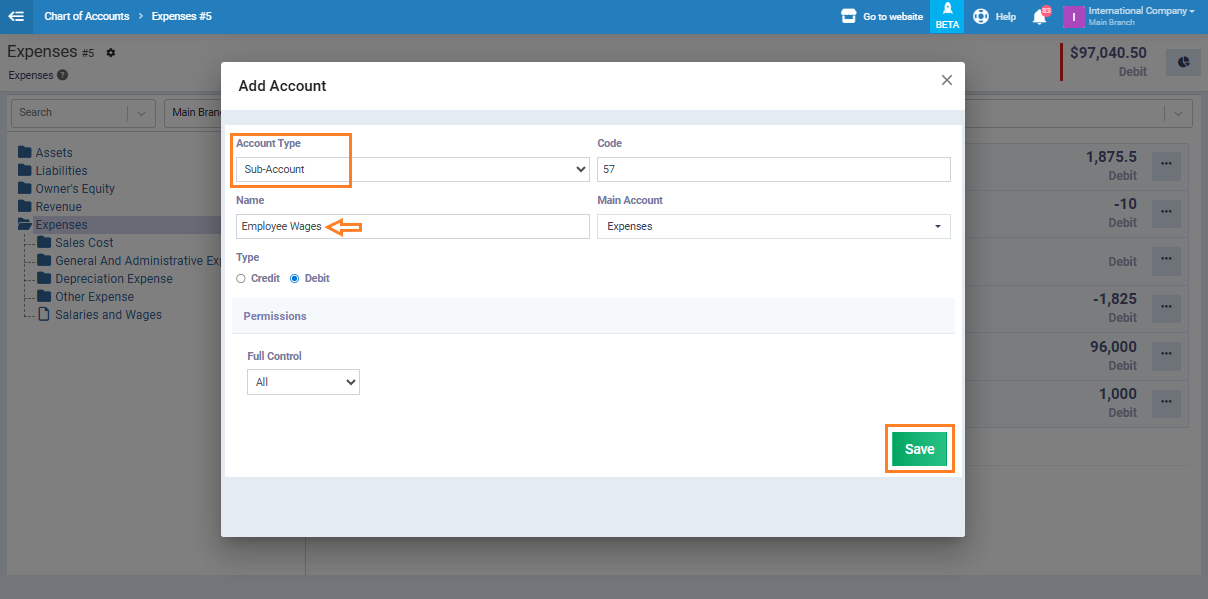

Next step: create a sub-account under Expenses for employee wages:

From the Chart of Accounts again, go to “Expenses.”

Create a sub-account named “Employee Wages.” Click “Save.”

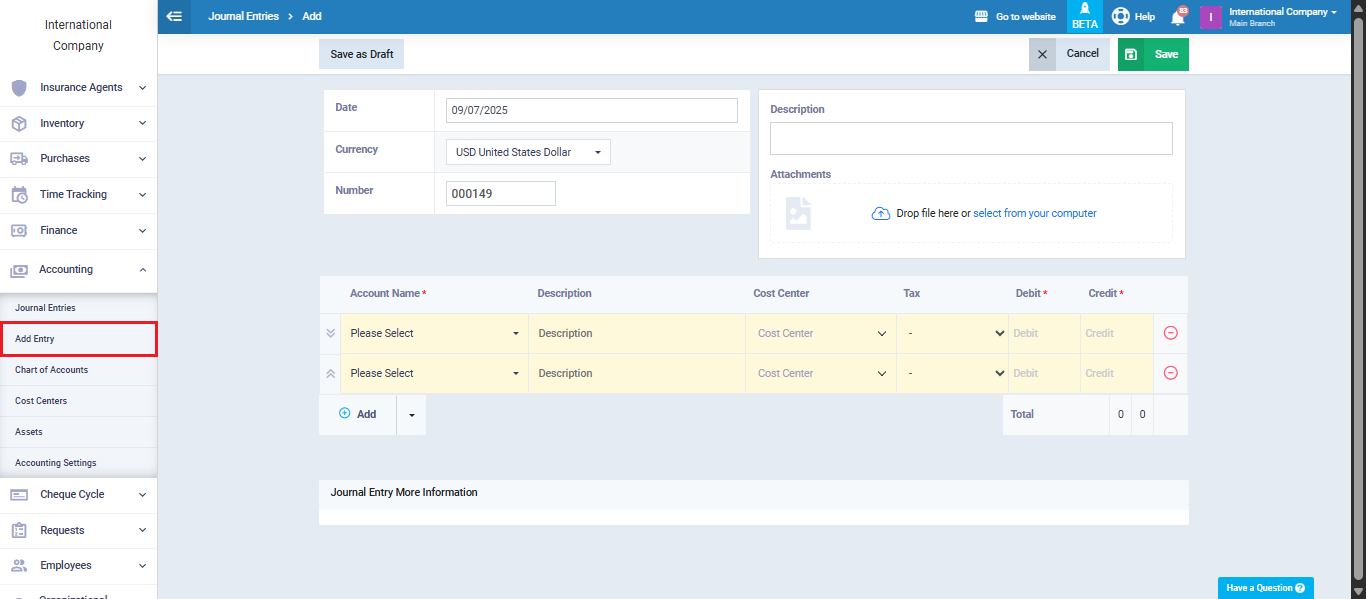

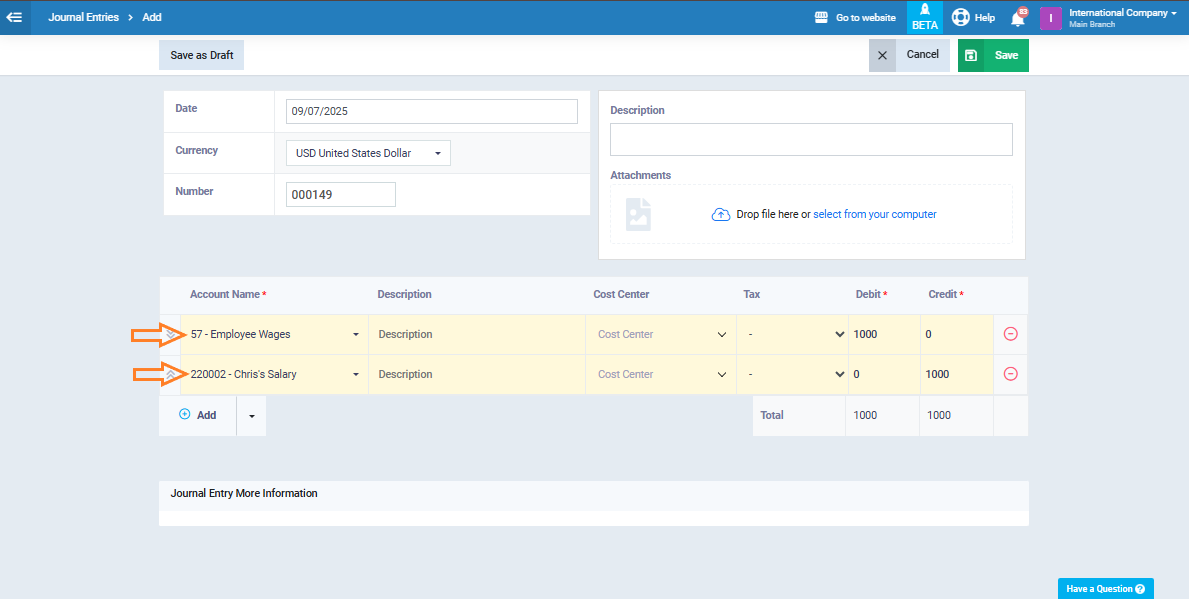

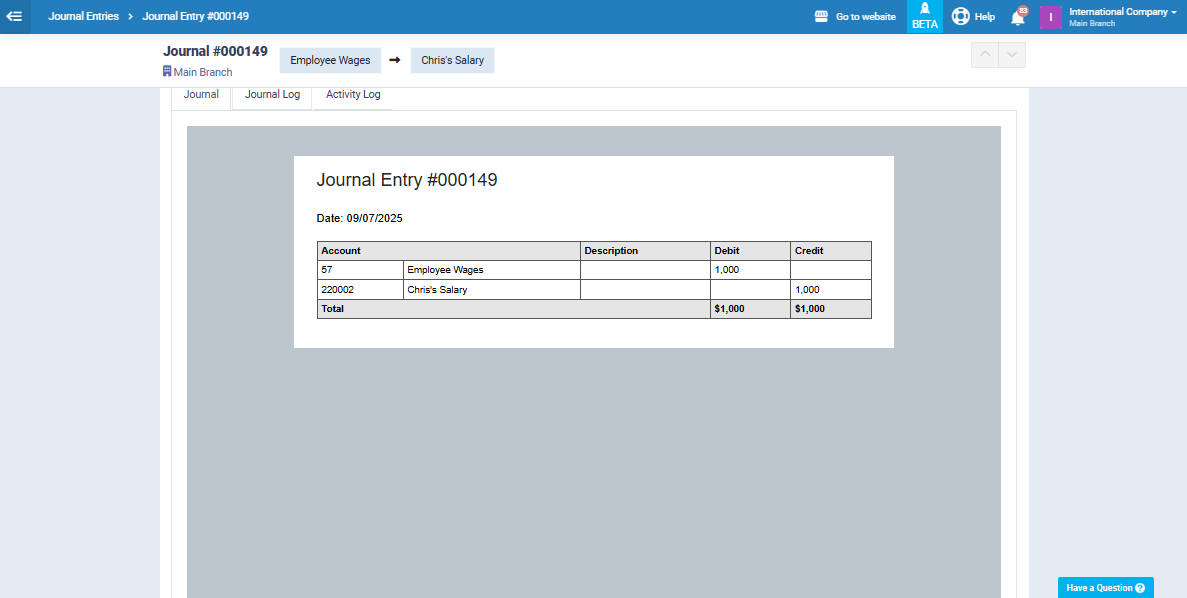

Creating the Accrued Expense Entry

From the main menu, go to “Accounting”, and from the dropdown click “Add Entry.”

Add the “Employee Wages” account (created under Expenses) to the debit side.

Add the accrued salary, in this example “Chris’s Salary” (under “Accrued Salaries”), to the credit side.

Enter the accrued amount and click “Save.”

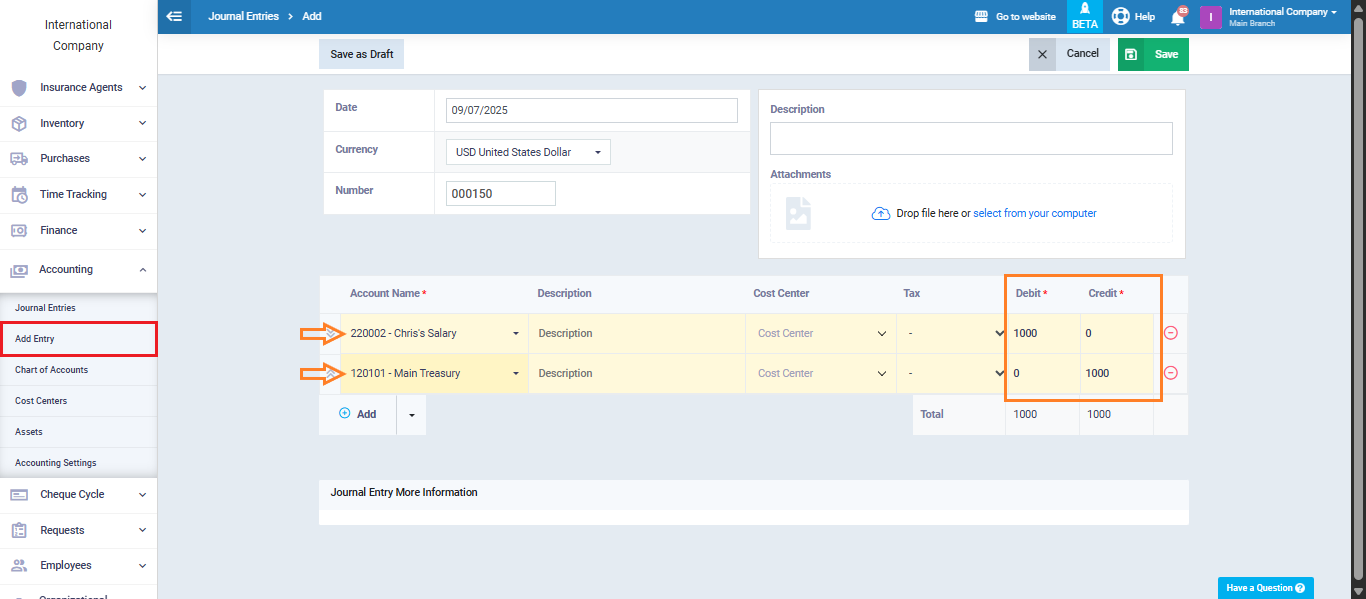

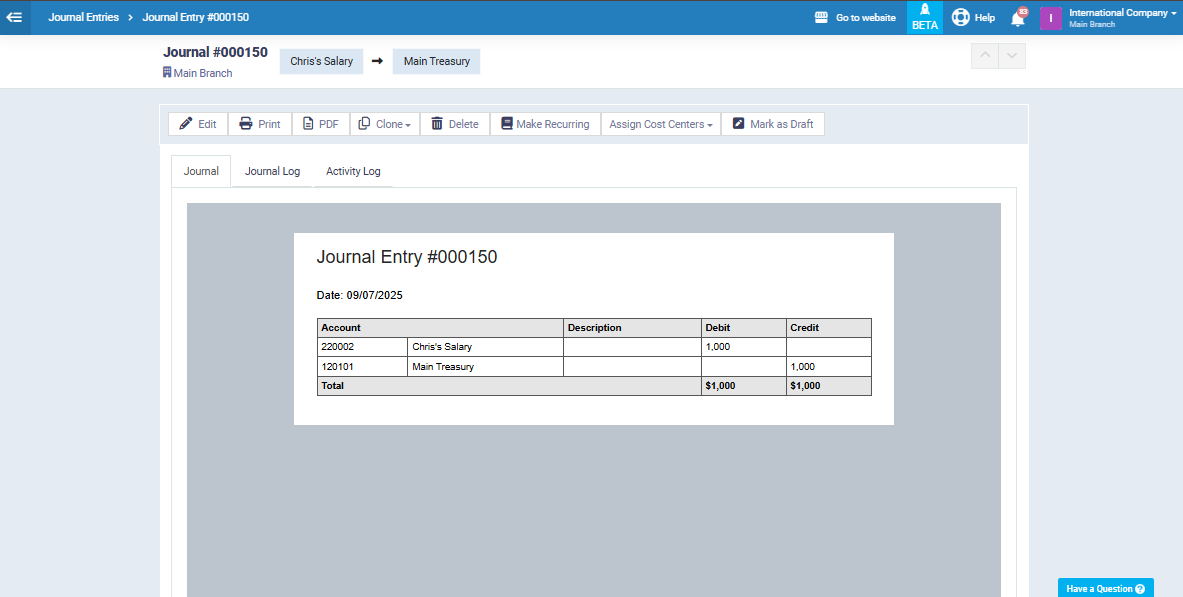

Creating an Entry for Paying the Accrued Salary

From the “Accounting” menu, select “Add Entry” again.

On the debit side, select “Chris’s Salary” (the accrued salary account).

On the credit side, select “Treasury.”

Enter the amount to be paid and click “Save.”

And that’s it, you’ve completed the process of recording and paying accrued expenses step by step.