Activating Adjustment for Purchase Invoices

Purchase adjustments are minor discounts or additional amounts applied to a purchase invoice that are not directly accounted for.

The purpose of these adjustments is to round off the total amount on the invoice. For example, if the invoice total is (10.15), you can add an adjustment of (-0.15) so that the net amount required is exactly (10), making the purchasing process easier.

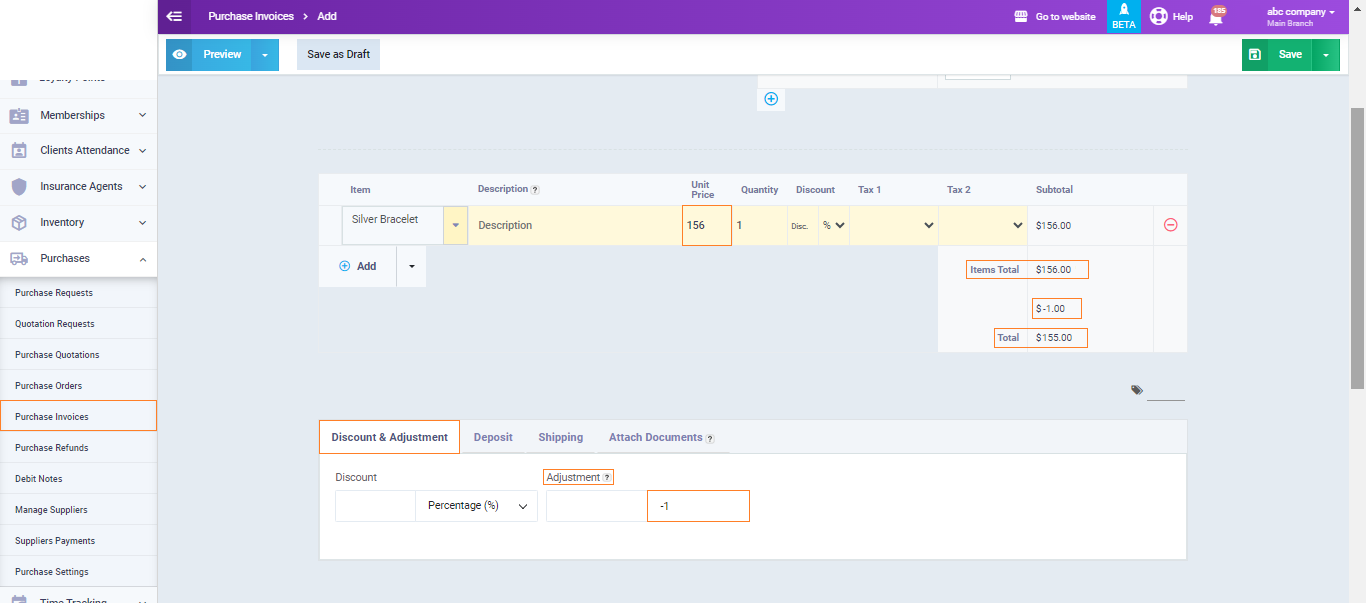

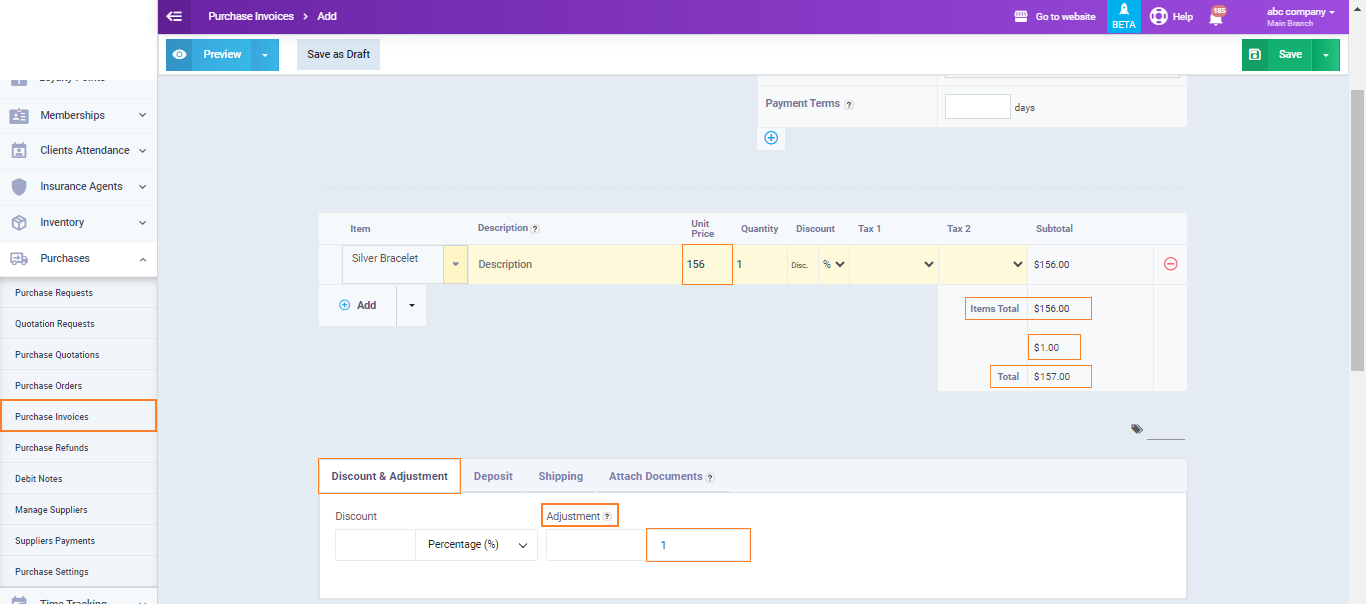

- Note that a positive adjustment value means an increase in the amount paid, while a negative value means a discount in your favor.

- The system allows you to configure the accounting direction for the adjustment account. You can refer to the “Directing Purchase Accounts” guide to set up the adjustment account direction in the purchase invoice.

How to Add an Adjustment to a Purchase Invoice

The actual invoice amount often includes fractions, and many accountants prefer to adjust these fractions and issue the invoice with the nearest appropriate whole number, similar to rounding in mathematics where 5.8 is rounded to 6 and 5.4 is rounded to 5.

In the adjustment box, enter the amount you want to remove or add to the invoice so that the total becomes a whole number. If you are adding an extra amount to the total purchase invoice, the adjustment amount will be positive (+).

And the adjustment amount will be negative (-) if you are deducting the adjustment amount, which will be borne by the supplier.