Setting up the Tax Settings in the System

Taxes vary depending on the country, products, and other factors. Through the system, you can add all the types of taxes you want to calculate, as explained in the following guide.

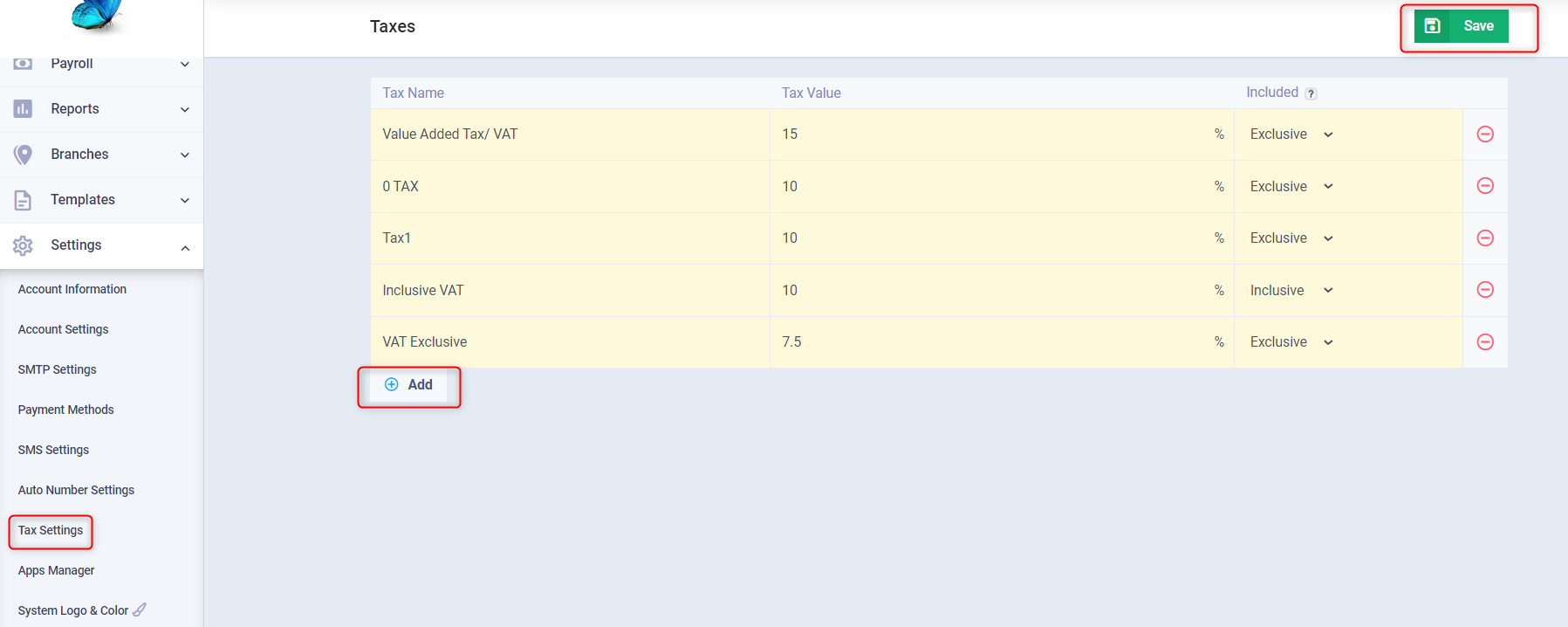

How to add a New Tax to the Account

You can easily add the types of taxes you want to calculate on the system by going to “Tax Settings” under “Settings” in the main menu

Then click on the “Add” button and enter the following new tax details:

- Tax Name

- Tax Value as a Percentage

- Tax Type: Inclusive or Exclusive

- Inclusive Tax:

The inclusive tax is part of the price set for any transaction selected with the inclusive tax

Example:4

If you are selling a product priced at $100, and the tax type is set to “Inclusive” in the system, then in this case, when creating the invoice, the total invoice value for the product after tax is $100,

where the product cost is $89.96, and the tax value is $13.04.

The total after tax is $100.

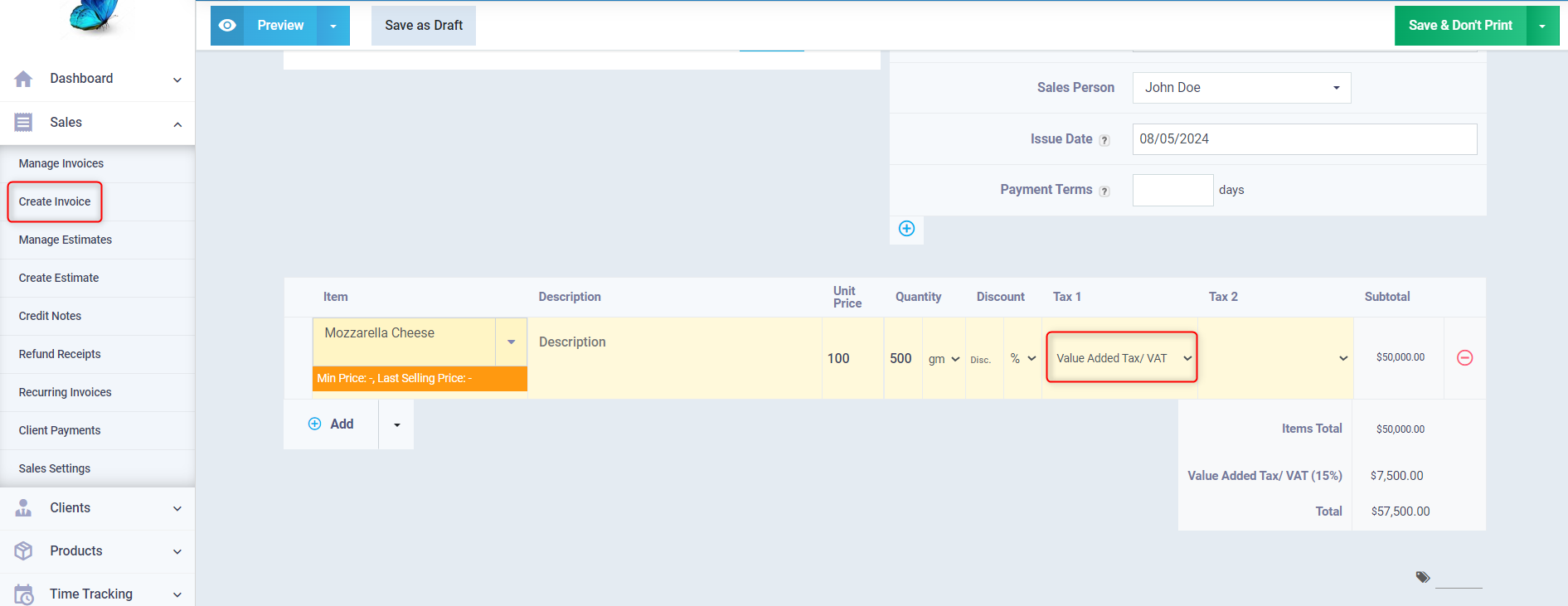

- Exclusive Tax: The exclusive tax is separate from the selling price and is added to the product/transaction value Example: If you are selling a product priced at $100, and the tax type is set to “Exclusive” in the system, then in this case, when creating the invoice, the total invoice value for the product is $115 after tax is added,where the product cost is $100 only “exclusive of tax”,and the tax value is $15making the total after tax $115.

- Inclusive Tax:

then click on the “Save” button.

The new tax appears when you choose the type of tax applied to the product or service in invoices, as shown in the following screen

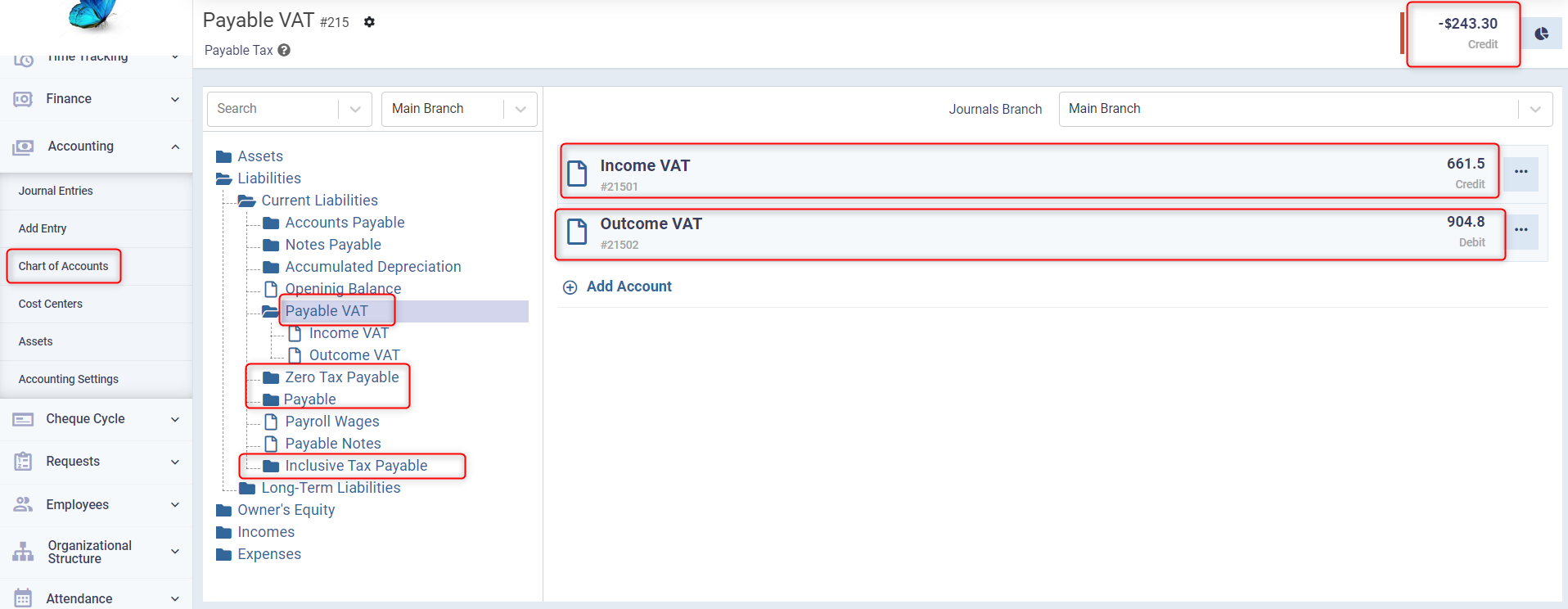

Viewing the Tax Accounts in the Chart of Accounts

When you create a new tax, the system will automatically create three accounts for this tax in the Chart of Accounts.

One main account for the required tax and within it, two sub-accounts for collected tax and payable tax.

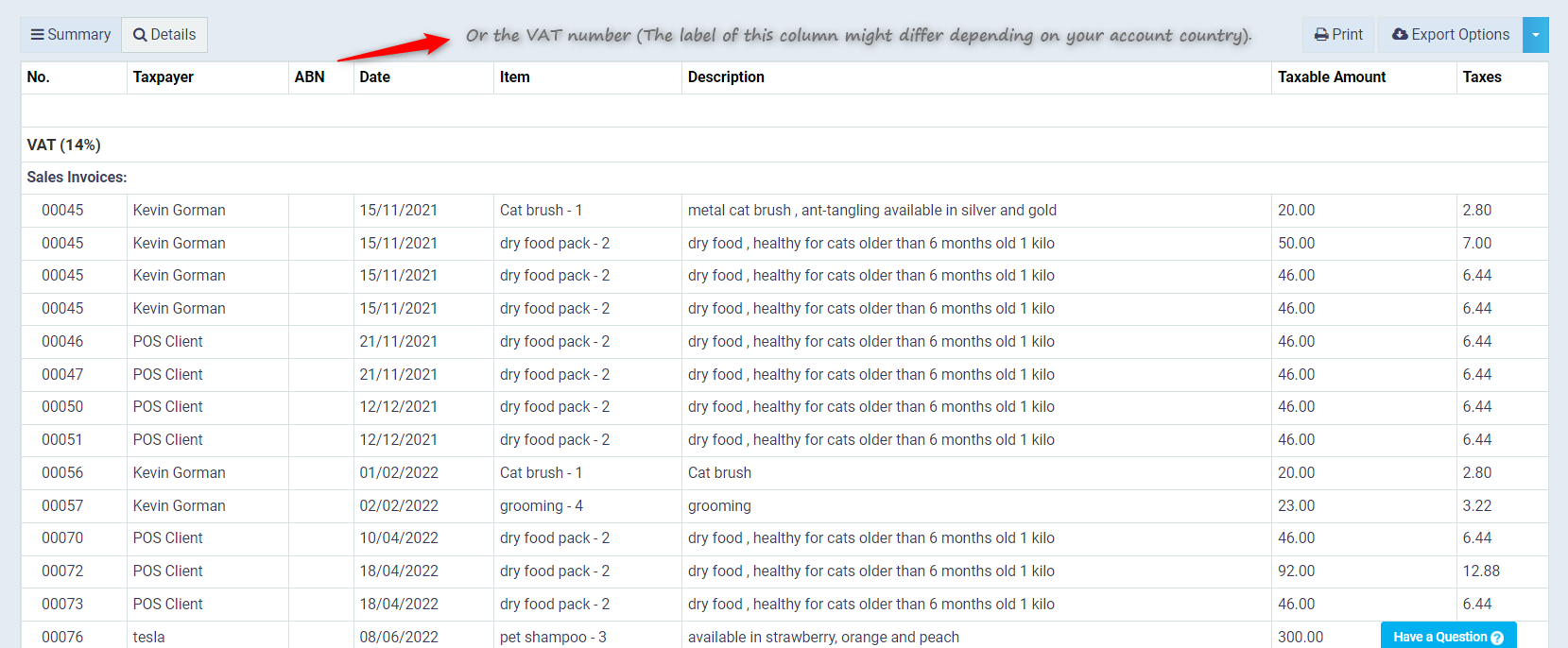

Tax Reports

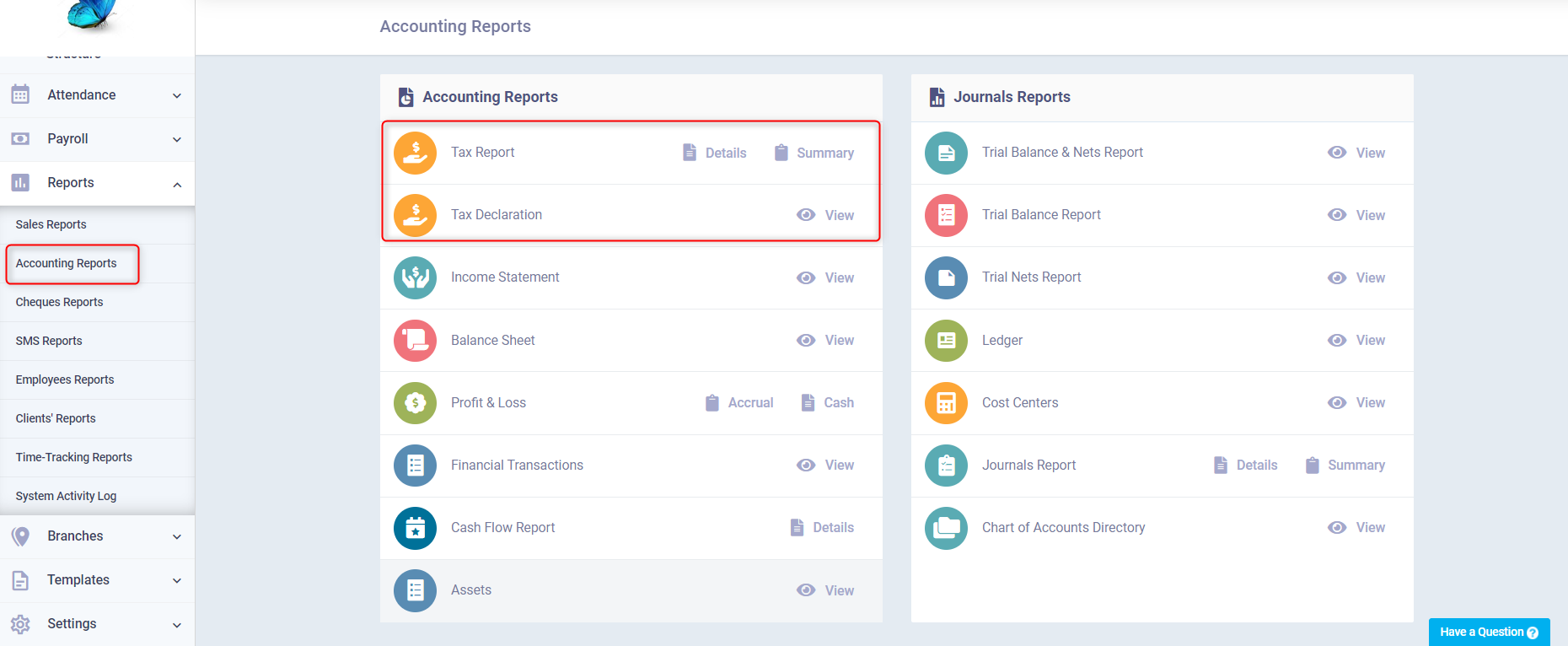

To view the reports related to taxes, click on “Accounting Reports” under “Reports” in the main menu to find both the tax report and the tax declaration. View the one you want, adjust its filters as you want, and download it.

The tax report appears to you, where you choose the type of tax you want to view the report for, as well as the time period. You can then download the report as an Excel or PDF file.