Clients Aged Debtors Report

The Client Debt Aging Report divides client debts based on the period of delay in the payment of amounts due on their due dates. It is typically divided as follows:

- Debts overdue for 30 days.

- Debts overdue between 30 and 60 days.

- Debts overdue between 60 and 90 days.

- Debts overdue for more than 90 days.

Through the system, you can automatically generate the Client Debt Aging Report without spending time or effort. We will review how to generate it in this guide.

What is the Client Debtor Aging Report?

The client debt aging report is a report that provides detailed information about the amounts due from clients, categorized by specific periods. This report helps track overdue debts based on payment priority and assists in evaluating how well the company is progressing in collecting these dues. It also enables the company to improve cash flows and increase liquidity.

Importance of the Client Debtor Aging Report

The Customer Debtor Aging Report helps manage your financial relationships with clients and frees you from chasing large numbers of invoices and clients. It consolidates, analyzes, and categorizes the information you need to collect your money without delay. The significance of the Customers Debtor Aging Report lies in the following points:

Cash Flow Management

The most challenging moment for any business is facing a lack of liquidity and being unable to meet financial obligations on time. Your ability to liquidate current assets quickly and easily is one of the most important factors affecting your cash flow. One of the easiest ways to ensure the smooth liquidation of assets is for customers to pay their invoices promptly, which is the benefit of the Customer Debt Aging Report.

Filtering Customers by Payment Compliance

You should regularly generate the Client Debt Aging Report to continuously monitor overdue invoices. This helps you categorize your clients based on their payment behavior. You can then prioritize nurturing relationships with customers who pay on time, offering them deals and encouraging their continued business while taking appropriate actions with customers who are habitually late, possibly even stopping dealings with some altogether.

Evaluating Sales Team Performance

Closing a sale does not mean payment has been completed. What truly matters is that you collect your money, and it may be best to delegate this task to your sales employees. The Customer Debt Aging Report helps you identify which sales employees follow up with customers until payment is made, based on how invoices are classified by the sales employee, depending on whether the customer is late or compliant with payment.

More Accurate Financial Statement Projections

Financial statements reflect the numbers achieved at the end of the reporting period. If customers are late with payments, the financial period will close without clearing those accounts, which may lead to surprises as you expect a larger amount to be collected based on the invoice due dates. Therefore, the Customer Debt Aging Report gives you a forward-looking perspective, allowing you to anticipate continued delays in collecting some of your debts.

Improving Your Payment Strategies and Methods

By tracking patterns of late payments from customers, you may identify issues that are more related to your business than to the customers themselves. Perhaps the payment options available to your customers are limited, or maybe you lack a system for regular follow-ups or forget to send reminders. Thus, you should take your payment policies and mechanisms into account when analyzing why some customers delay payment.

How can the System Help You Generate the Customer Debt Aging Report?

The software provides a variety of easy-to-generate reports to help you understand your company’s financial situation. There are two reports related to customer debt aging:

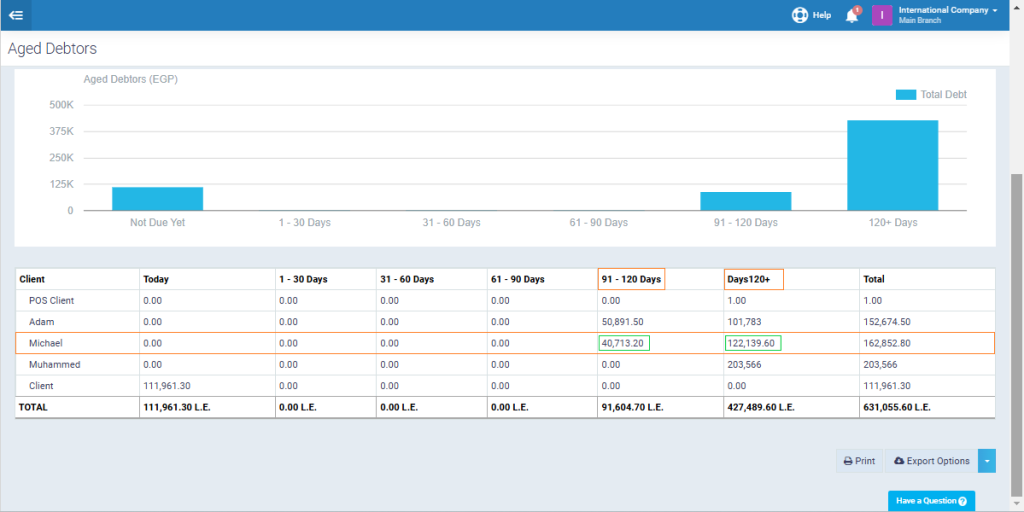

Aged Debtor (Invoices):

This report directly concerns customer invoices. It calculates the time that has passed since the due date of each invoice, and these amounts are recorded in the adjacent fields next to the customer’s name in the report based on the time that has passed since the due date for each client.

For Example:

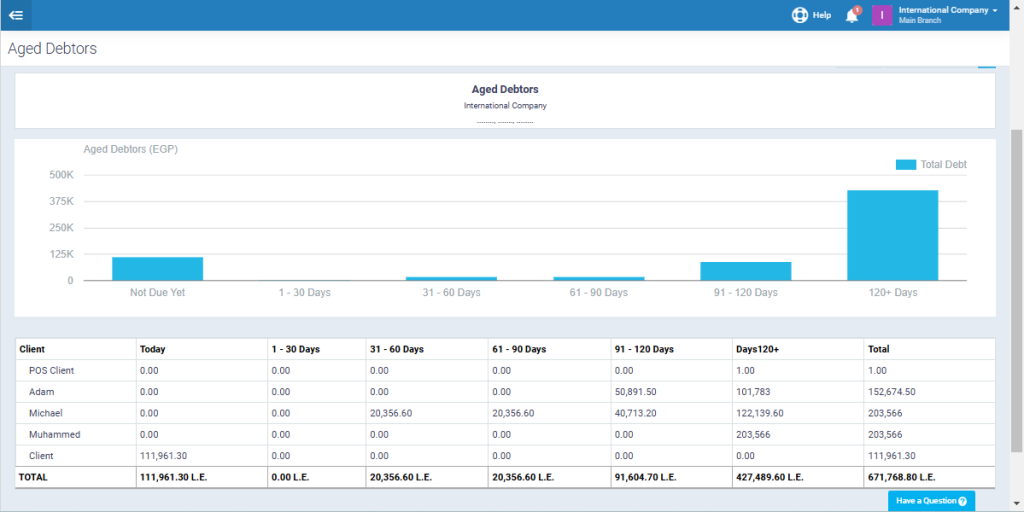

Client “Michael” has:

An invoice overdue for more than 90 days with an amount of 40,713.20 L.E.

Another invoice overdue for more than 120 days with an amount of 122,139.60 L.E.

This will be reflected in the aging report, with each invoice amount recorded in a separate column under the client’s name, both appearing in the same row.

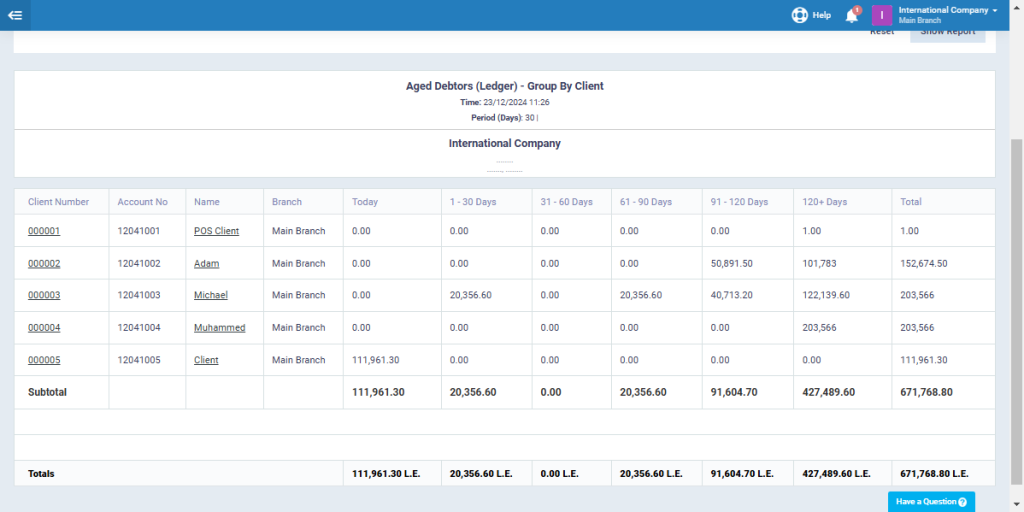

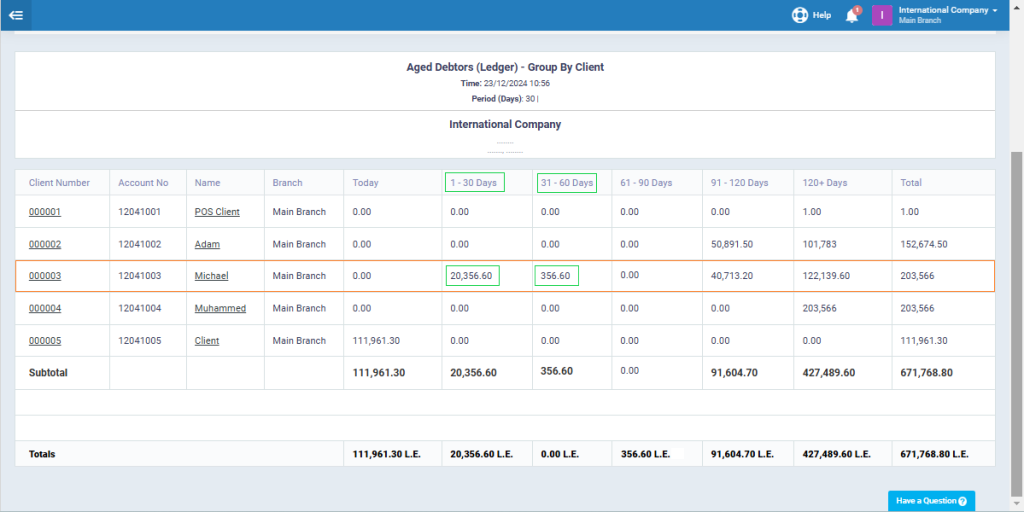

Aged Debtor (Ledger):

This report relates to the debts that the customer owes you, regardless of the source, based on the balances in the customer’s general ledger account for the reporting period. These debts may be the result of invoices or other financial transactions.

For Example:

Client “Michael” has:

She has an invoice due within the period of (1 – 30 days) for an amount of 20,356.60 L.E,

and another invoice due within the period of (31 – 60 days) for an amount of 356.60 L.E.

This will be reflected by recording the amount of each invoice in a separate column in the Aged Debtor Report (Invoices), with both appearing in the same row under the customer’s name.

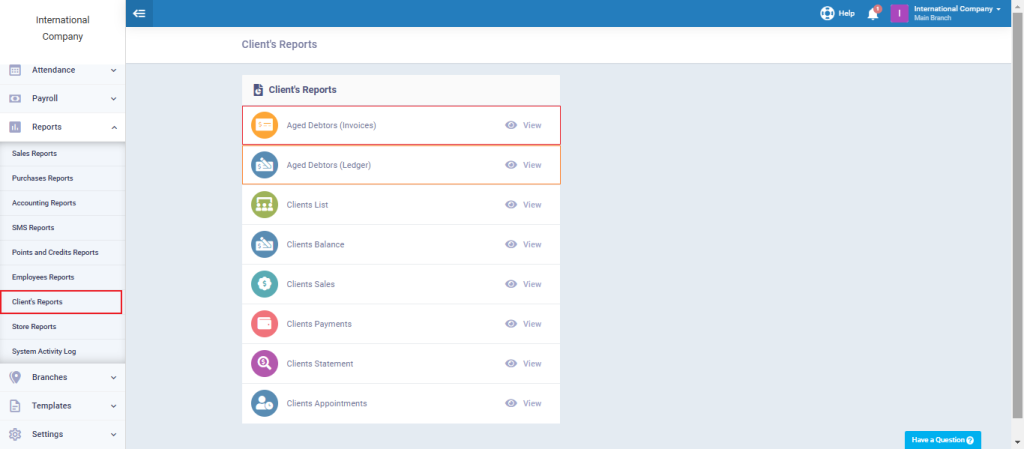

Steps to Generate the Aged Debtor Report

Click on “Clients Reports” from the “Reports” dropdown in the main menu, then click on either “Aged Debtor (Invoices)” or “Aged Debtor (Ledger)” depending on the type of Client Debt Aging Report you wish to generate.

Adjust the report settings as desired, then click the “Show Report” button.

You can also print the report by clicking the “Print” button or download it to your device by clicking “Export Options.”

The Aged Debtor Report (Invoices) will appear as follows:

The Aged Debtor Report (Ledger) will appear as follows: