Aged Creditors Reports

The Supplier Aging Report divides your outstanding debts based on the delay in paying the invoices on time. It is often categorized as follows:

- Debts overdue by 30 days.

- Debts overdue between 30 to 60 days.

- Debts overdue between 60 to 9 0 days.

- Debts overdue for more than 90 days.

Through Daftra, you can generate a Supplier Aging Report automatically without wasting time or effort. We will outline how to generate it in this guide.

What is an Aged Creditor Report?

The Supplier Aging Report, or Debtor Aging Report, provides detailed information about the amounts you owe to suppliers, categorized by specific periods. This report helps in tracking your debts according to payment priority, assessing the company’s progress in settling these debts, and enables the company to manage cash flows while protecting it from the risks of late payments.

Importance of the Aged Creditor Report

The Aged Creditor Report helps maintain your financial relationships with suppliers, reduces the risk of late payments, and assists in managing your financial policies, making it easier to negotiate more favorable payment terms. The key benefits of the Supplier Aging Report include:

Cash Flow Management

Debts nearing their due date reduce liquidity and require early planning to ensure timely payment. Being alerted to payment deadlines increases your chances of avoiding cash shortages, allowing you to manage your funds and secure more than needed before the payment due dates.

Prioritizing Debt Repayment

The Supplier Aging Report is categorized by payment periods, making it easier to decide which invoices should be paid first. It’s not reasonable to leave invoices overdue by 90 days or more to pay invoices that are only 30 days late, as the risk associated with late payments often correlates with the length of the delay.

Avoiding Late Payment Penalties

Sometimes contracts or invoices between you and the supplier include penalty clauses for late payments. The Debtor Aging Report helps you avoid these consequences by encouraging you to pay your suppliers on time.

Managing and Planning Your Expenses More Accurately

Being aware of your invoice dues allows you to adjust your overall expenses to match the expected cash flow based on the liabilities you need to settle.

Renegotiating Agreed Payment Terms with Your Suppliers

Regularly reviewing Debtor Aging Reports allows you to directly contact the supplier if you anticipate difficulty in paying the invoices on time. This enables you to renegotiate payment terms and legally change them without waiting for the due date and defaulting on the payment.

Maintaining Supplier Relationships and Securing Better Deals

Paying invoices on time without delay helps build strong relationships with suppliers. Over time, you gain the supplier’s trust, which may grant you privileges not available to others, such as extended payment terms, the ability to purchase larger quantities on credit, and other benefits.

Ensuring the Accuracy of Financial Data Required for Payment

Every financial transaction has two parties, and the supplier is your counterpart. Often, the supplier will send reminders about payment amounts and due dates, and it can be confusing due to the overlap of your financial dealings with this supplier and others. Therefore, it is advisable to track your financial transactions yourself and verify the accuracy of the amounts owed and the payment due dates.

How Daftra Helps You Create a Supplier Aging Report

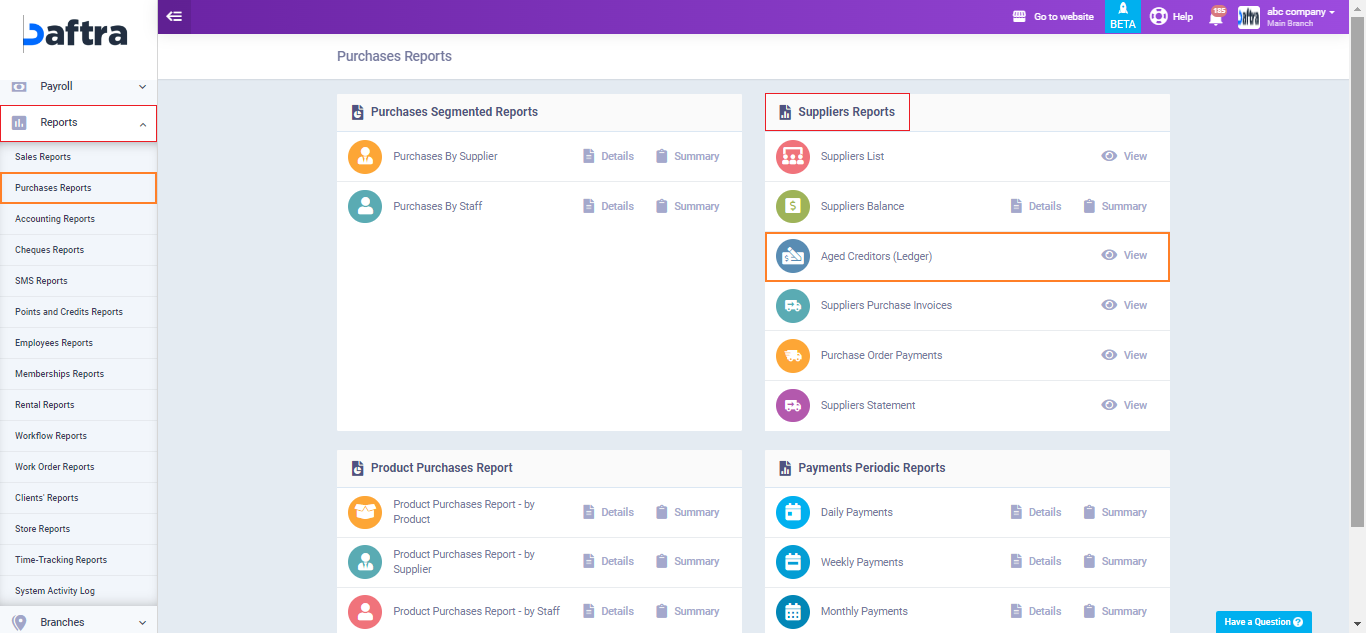

You can easily generate a Supplier Aging Report (Aged Creditor Report) through Daftra. Navigate to “Purchase Reports” under the “Reports” section in the main menu, then click on “Aged Creditors (Ledger)” within “Supplier Reports.”

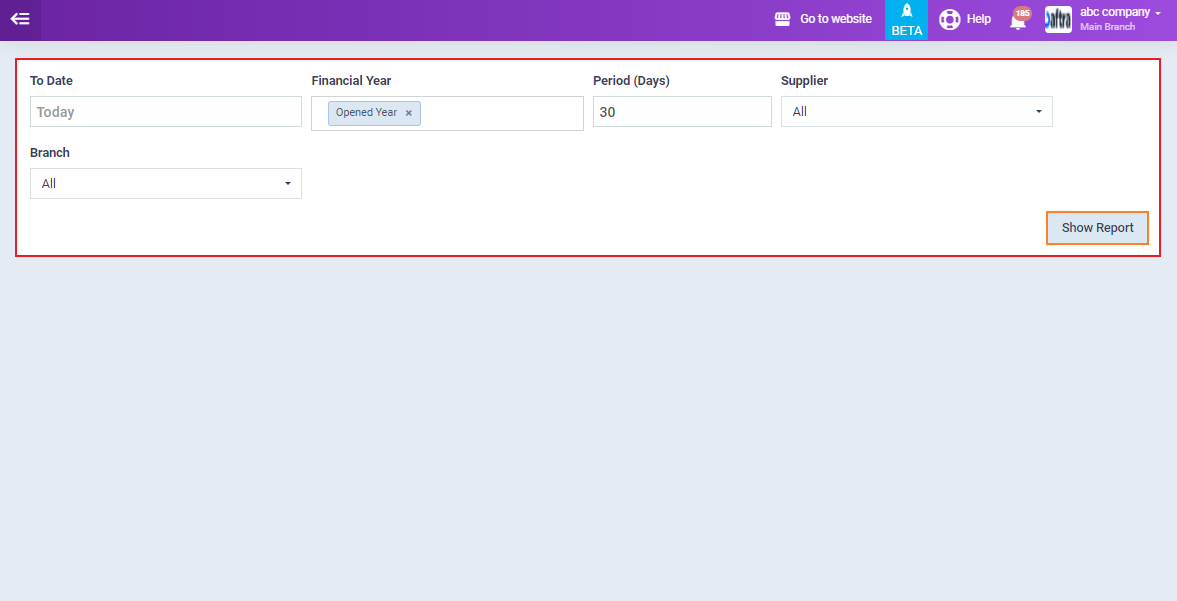

Adjust the report settings to control the period for which the report will be displayed and the financial year associated with the report. Customize the report by branches or suppliers if desired, then click the “View Report” button.

The supplier aging report appears categorized according to your delay in payment, showing the amount due for each supplier individually, as well as the total amount owed.