Assign an Insurance Agent to a Client

After adding a new insurance company and insurance category in the previous tutorial, we will now link them with the clients so that the system can automatically apply insurance when creating invoices for this client. To do this, we need to have clients in the account.

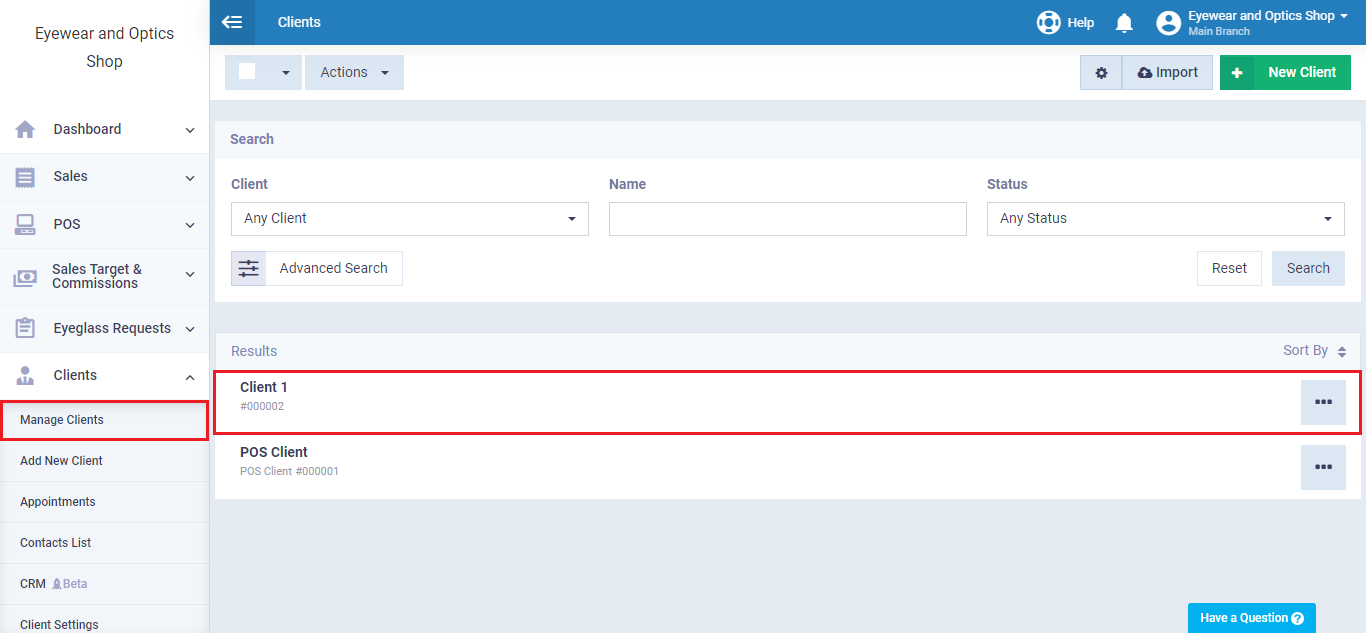

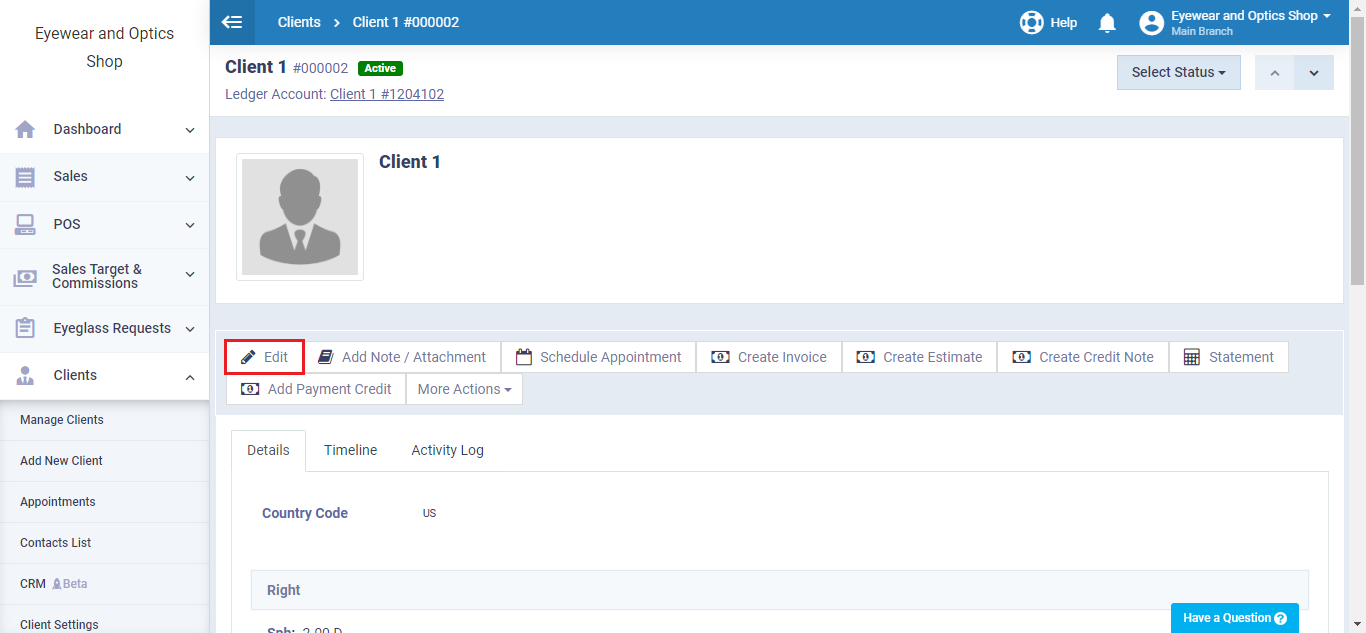

Since we already have clients in our eyewear shop account, we will select one of our clients,

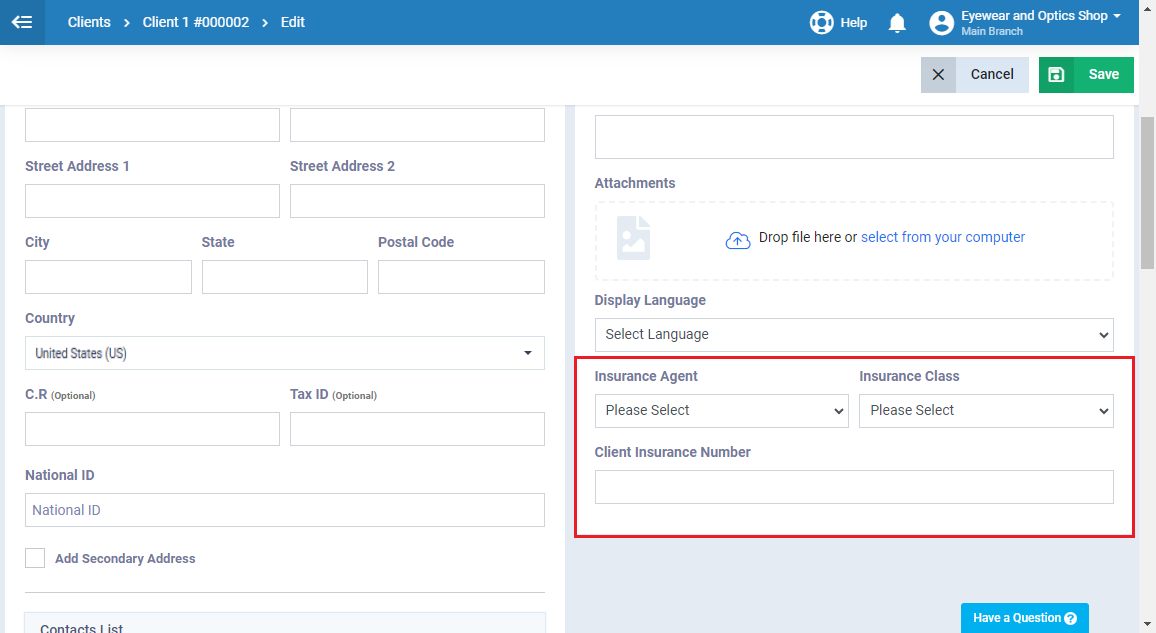

Below the “Account Details” field in the client’s data control panel, you will find two options:

- Insurance Company: Select from the available options the desired insurance agent.

- Insurance Category: Choose from the available options for the client’s insurance category.

Beneath these two fields, you can input the client’s insurance number in the “Client Insurance Number” field.

Then click “Save“

Cases for Configuring

Insurance Category Settings and How Each Case Is Processed

Keep the following guidelines in mind to understand how the system calculates the co-payment for both the patient and the insurance company.

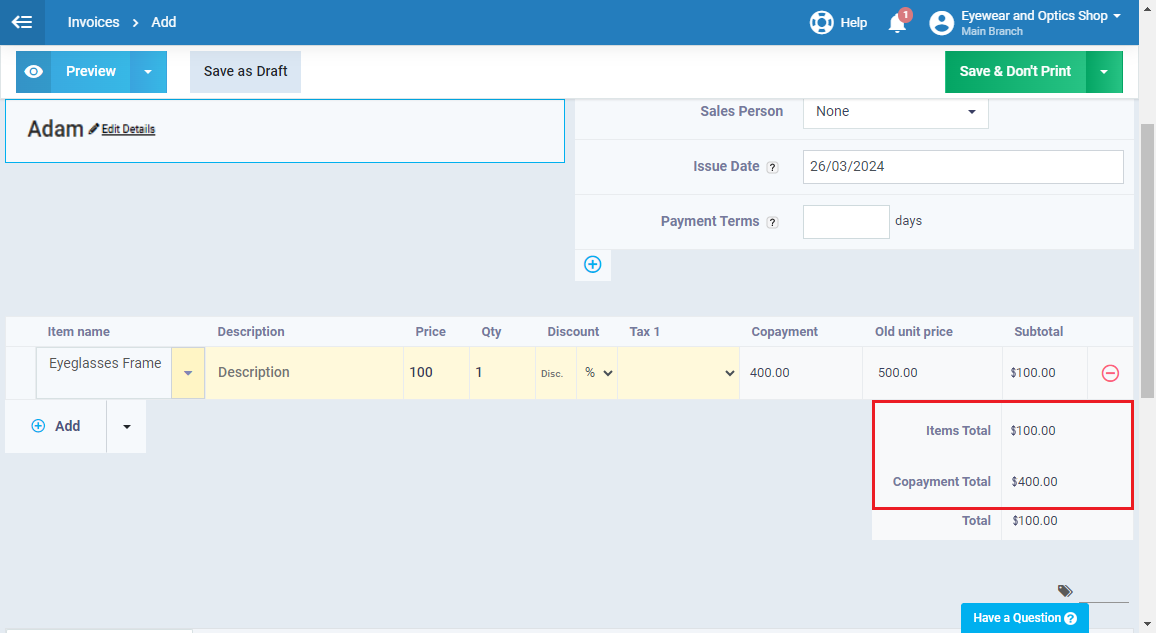

Case 1: No maximum payment or discount

In this case, where co-payment percentages are defined for both the client and the insurance company, without setting a maximum payment or discount, the system automatically divides the total cost of the service/product in proportion to the client’s and insurance company’s percentages.

For example:

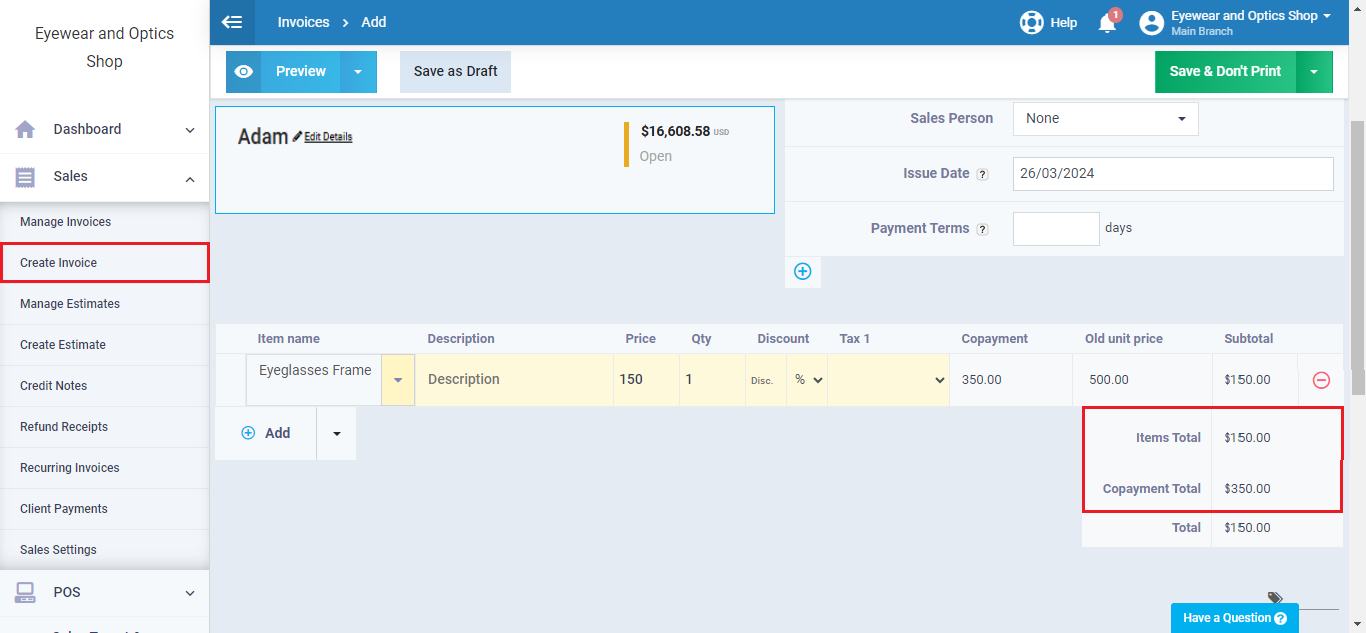

Client: Adam (insured by the International Insurance Company – The First Category for International Insurance Company).

Product: Prescription Eyeglasses (with a cost of $500, categorized as a high-price product).

Co-payment Percentage: Client (30%), Insurance Company (70%).

Discount: None

Maximum Payment: None

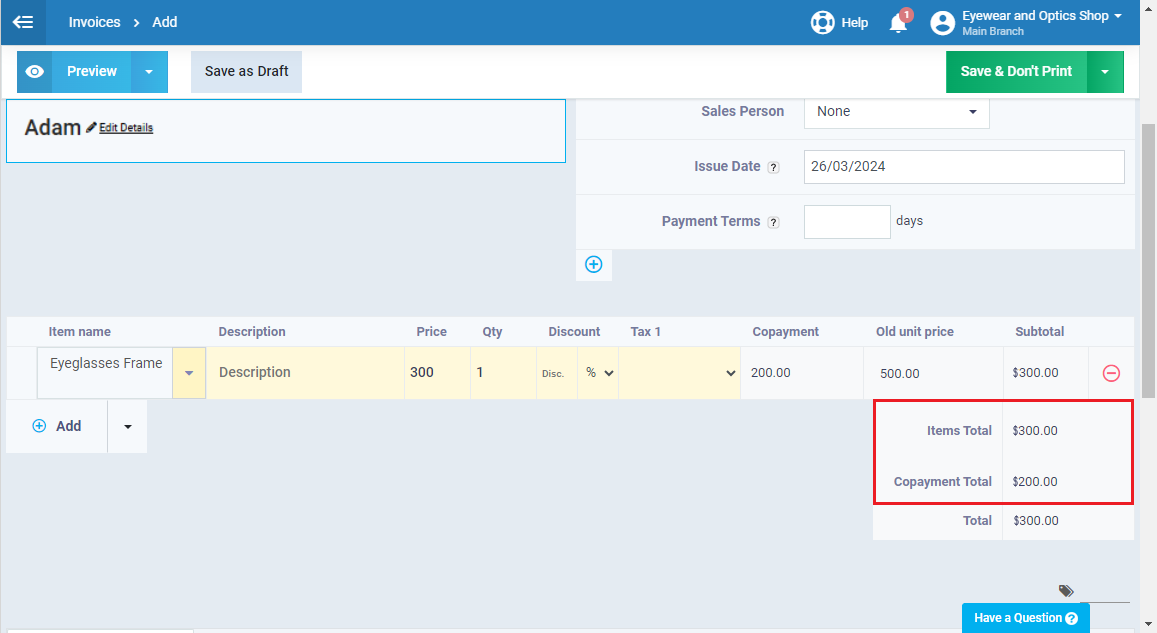

Case 2: There Is a Maximum Client Co-payment with No Discount

In this case, where a maximum client co-payment is set without specifying a discount, the system charges both the client and the insurance company according to their respective co-payment percentages. If the cost exceeds the maximum client co-payment limit, the system ensures not exceed this limit by transferring the remaining portion of the total cost of the product or service to the insurance company.

Illustrative Example:

Client: Adam (insured by International Insurance Company).

Product: Prescription Eyeglasses (costing $500, categorized as high-priced products).

Co-payment Percentage: Client (30%), Insurance Company (70%).

Discount: None

Maximum Client Co-payment: Maximum co-payment of $100 (for the client).

Case 3: There is a maximum insurance company contribution limit, and there is no discount

In this case, the system charges both the client and the insurance company according to their respective co-payment percentages. If the cost exceeds the maximum insurance company contribution limit, the system ensures not to exceed this limit by charging the remaining cost to the client.

Example for illustration:

Client: Adam (insured by International Insurance Company).

Product: Prescription Eyeglasses (costing $500, categorized as high-priced product).

Co-payment percentage: Client (30%), Insurance Company (70%).

Discount: None

Maximum payment limit: Maximum insurance company contribution limit of $200.

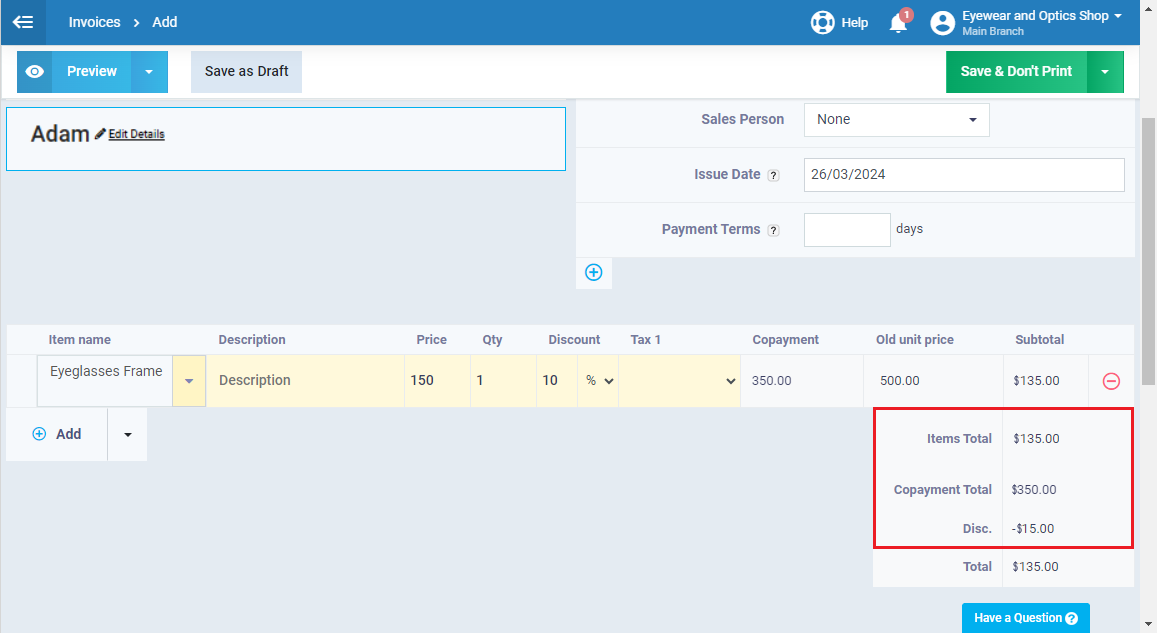

Case 4: There is a discount, and there is no maximum limit

In this scenario, where a discount is set for the client (typically, the discount is applied to the client and not the insurance company) without a maximum limit, the system loads the cost for both the client and the insurance company according to their respective co-payment percentages and then applies the discount to the client’s co-payment percentage.

Illustrative Example:

Client: Adam (insured by International Insurance Company).

Product: Prescription Eyeglasses (costing $500, categorized as a high-priced product).

Co-payment Percentage: Client (30%), Insurance Company (70%).

Discount: 10%

Maximum Payment Limit: None.

In this scenario, we observe the following:

- Client’s Co-payment: Adam’s co-payment would be 30% of $500, which equals $150.

- Insurance Company’s Co-payment: The insurance company’s co-payment would be 70% of $500, which equals $350.

- Discount Applied to Client’s Co-payment: With a 10% discount applied to the client’s co-payment, the final payment is reduced to $135.

- Insurance Company’s Payment: The insurance company covers the remaining cost after the discount, which is $350.

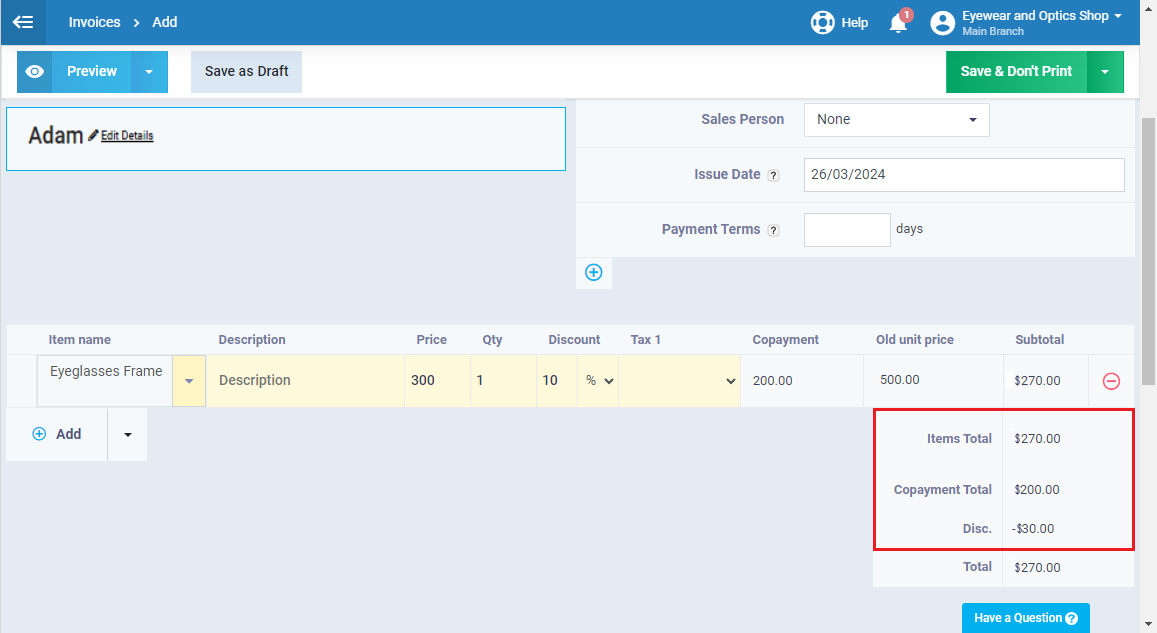

Case 5: There Is a Discount, and There Is an Insurance Company Maximum

In this case, where a discount is set for the client and an insurance company’s maximum is defined, the system loads the cost for both the client and the insurance company according to their co-payment percentages. If the insurance company’s co-payment exceeds the maximum, the excess over the maximum is charged to the client, and then the system applies the discount to the client’s co-payment percentage.

Illustrative Example:

Client: ِAdam (insured by International Insurance Company).

Product: Prescription Eyeglasses (costing $500, falling into the high-priced product category).

Co-payment percentage: Client (30%), Insurance Company (70%).

Discount: 10%

Insurance Company Maximum: $200.

In this scenario, we observe the following:

– Client’s Co-payment: Adam’s co-payment would be 30% of $500, which equals $150.

– Insurance Company’s Co-payment: The insurance company’s co-payment would be 70% of $500, which equals $350.

– Exceeding Insurance Company Maximum: Since the insurance company’s co-payment exceeds the maximum of $200, the excess ($500 – $200 = $300) is charged to the client.

– Client’s Payment After Exceeding Maximum: The client’s final payment includes the excess over the maximum plus the discounted co-payment, which equals $270 ($300 – 10% discount).

– Insurance Company’s Payment: The insurance company covers up to the maximum contribution limit, which is $200.

Therefore, Adam pays $270 after the discount and the excess over the maximum, and the insurance company pays $200.

Case 6: There Is a Discount and a Maximum for the Client

Here we encounter an issue when the client benefits from the maximum co-payment, as they will receive a discount due to not exceeding this limit, in addition to the discount allocated to them in the insurance category. According to common insurance practices, this situation is handled differently, and it will become clear in the following paragraphs.

Client: Adam (insured by International Insurance Company).

Product: Prescription Eyeglasses (costing $500, categorized as a high-priced product).

Co-payment percentage: Client (30%), Insurance Company (70%).

Discount: 10%

Maximum co-payment: Maximum co-payment of $100 (for the client).