Patients with Discount and Maximum (Case 6)

Here we encounter an issue when the patient benefits from the maximum co-payment, as they will receive a discount due to not exceeding this limit, in addition to the discount allocated to them in the insurance category. According to common insurance practices, this situation is handled differently, and it will become clear in the following example.

- Patient: Anas (insured by International Insurance Company – First category of International Insurance Company).

- Service: Heart Surgery (costing 50,000 and classified as a high-priced product).

- Co-payment percentage: For the patient (40%), and the insurance company (60%).

- Discount: 10%

-

Maximum co-payment: Maximum co-payment of 10,000 (for the patient).

Note and Explanation:

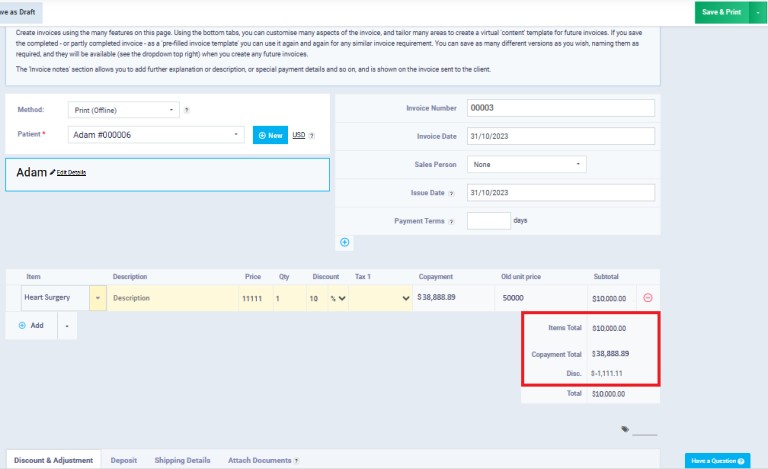

We noticed that the cost borne by the patient is 10,000, which is the maximum co-payment. However, the cost borne by the insurance company is 38,888. Where does this number come from? Let’s first discuss the case from a hypothetical perspective. The system was supposed to load the insurance company with 30,000 and the patient with 20,000 based on the co-payment percentage for each. To avoid exceeding the maximum payment for the patient, the system loaded an additional 10,000 on the insurance company (the value exceeding the maximum payment).

Therefore, the cost borne by the patient is 10,000, and the cost borne by the insurance company is 40,000. This contradicts the result obtained, which divided the cost with the insurance company being 38,888.

Here is an explanation of what happened:

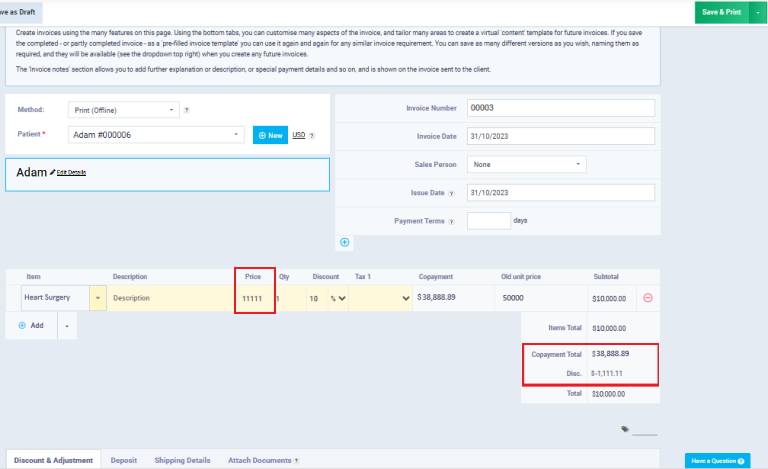

The system loaded the patient with a virtual cost, on which it applied a discount of 10% to make it exactly 10,000 (the maximum payment for the patient). It then subtracted this virtual cost from the total cost of the service (50,000) to calculate the cost borne by the insurance company.

As shown on the invoice, (11,111) is the virtual cost, and the system derived this value using the following equation, where we denote the unknown with (C):

- C – 0.1C (10% discount) = Maximum payment for the client (10,000)

- C – 0.1C = 10,000

- 0.9C = 10,000

- 0.9C ÷ 0.9 = 10,000 ÷ 0.9

-

C = 11,111

So, (C) is the virtual cost that the system loaded for the patient, and then it subtracted it from the total cost of the service to calculate the cost borne by the insurance company:

- Insurance Company’s Payment = Total Cost of the Service – Virtual patient Cost

- Insurance Company’s Payment = 50,000 – 11,111 = 38,888

The system processes this equation as explained to avoid applying the discount after applying the maximum payment.

With this tutorial and the previous ones, we have reached the end of the Medical Insurance Guide for Medical Clinics. We have learned how to add a new insurance company to the account, add an insurance category or class to it, link the patient to an insurance company and a specific insurance category, and the mechanism for processing insurance category rules.