Assign an Insurance Agent to a Patient

After adding a new insurance company and insurance category in the previous tutorial, we are now going to link them with the patients so that the system can automatically apply insurance when creating invoices for this patient. To do this, we need to have patients in the account.

Since we already have patients in our clinic account, we will select one of our patients,

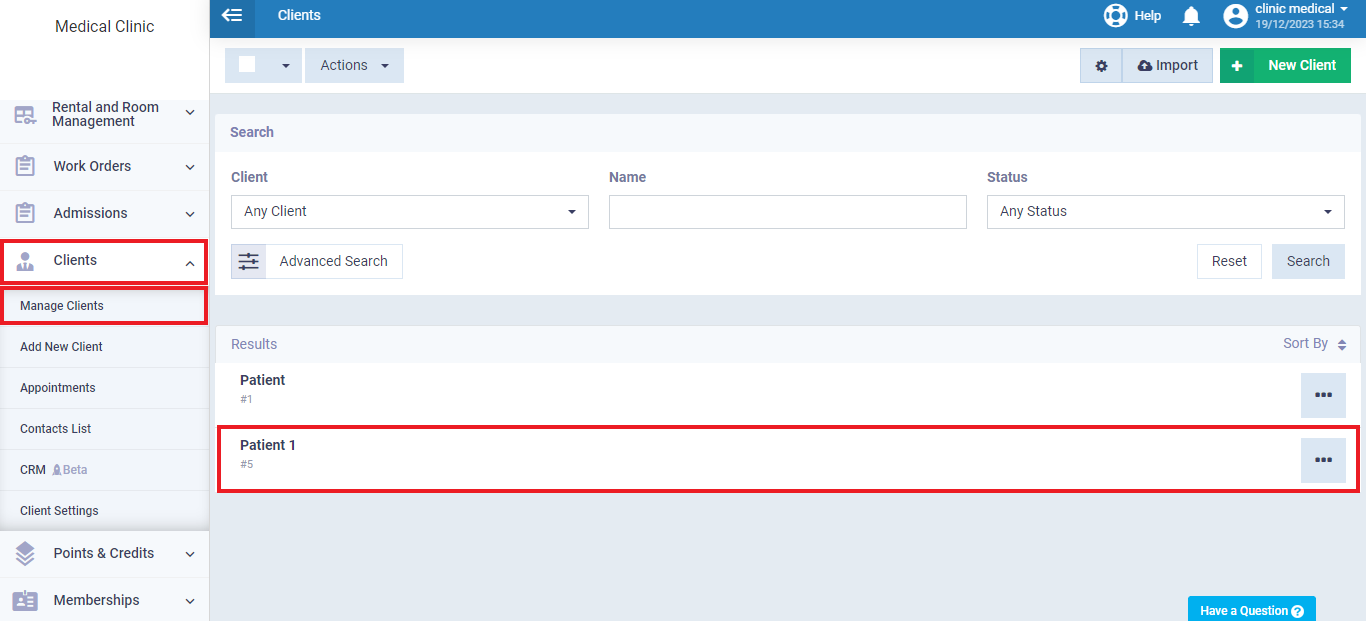

First, we click on ‘Clients’ in the main menu, then ‘Manage Clients,’ and select ‘Patient 1’ as shown in the image.

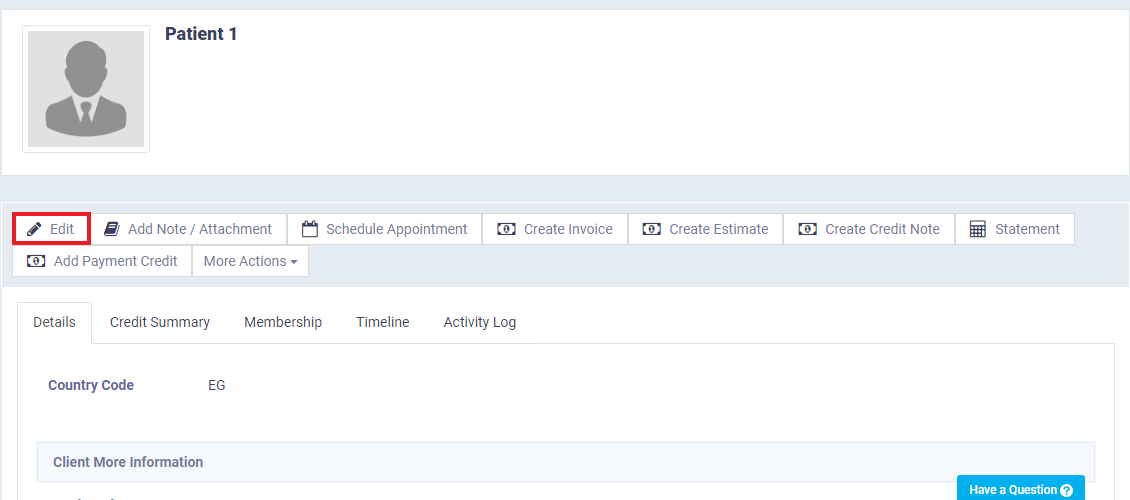

From the patient profile click on “edit“,

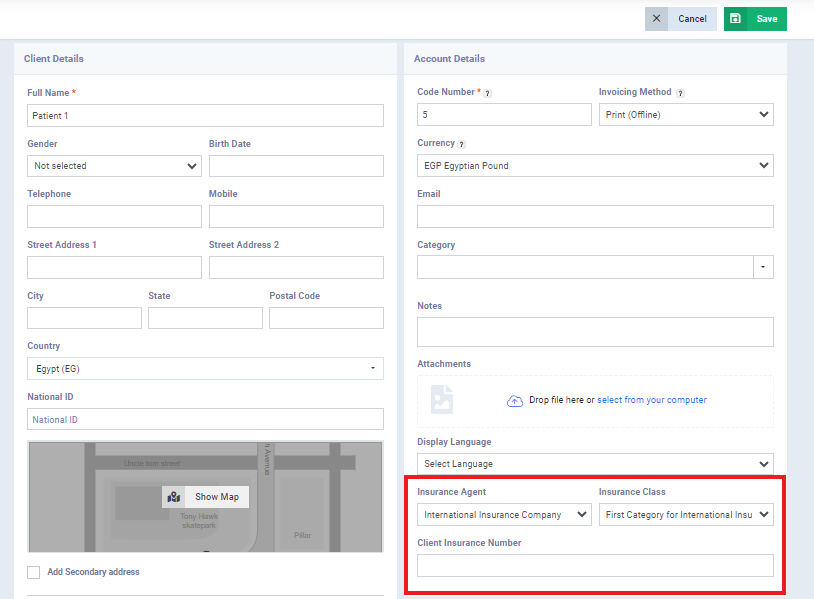

Below the “Account Details” field in the patient’s data control panel, you will find two options:

- Insurance Company: Select from the available options the desired insurance agent.

- Insurance Category: Choose from the available options for the patient’s insurance category.

Beneath these two fields, you can input the client’s insurance number in the “Client Insurance Number” field.

Cases for Configuring Insurance Category Settings and How Each Case Is Processed

Keep the following guidelines in mind to understand how the system calculates the co-payment for both the patient and the insurance company.

Case 1: No maximum payment or discount

In this case, where co-payment percentages are defined for both the client and the insurance company, without setting a maximum payment or discount, the system automatically divides the total cost of the service/product in proportion to the client’s and insurance company’s percentages.

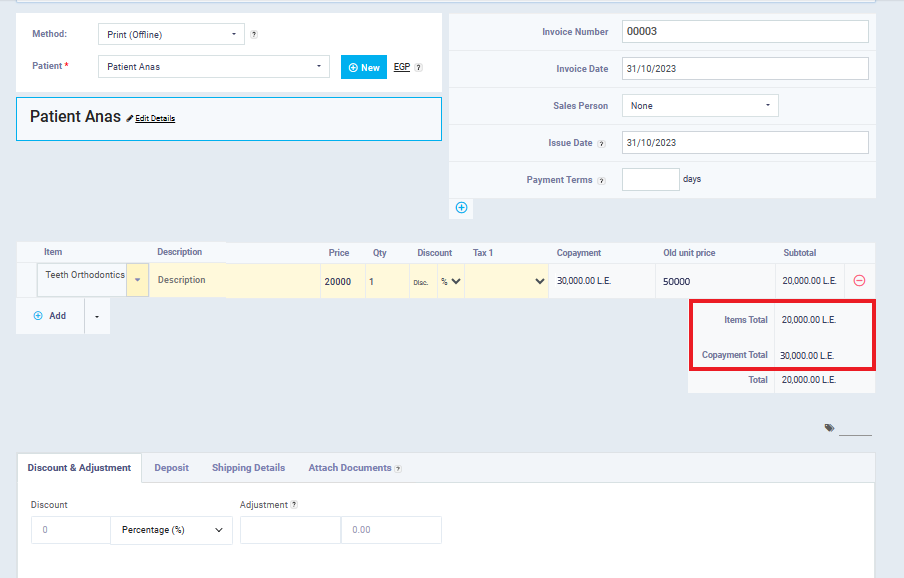

For example:

- Client: Anas (insured by the International Insurance Company – The First Category for International Insurance Company).

- Service: Dental Implant (with a cost of 50,000, categorized as a high-price product).

- Co-payment Percentage: Client (40%), Insurance Company (60%).

- Discount: None

- Maximum Payment: None

Note and Explanation:

We notice that the system automatically charged the client (20,000) and the insurance company (30,000) in proportion to their co-payment percentages.

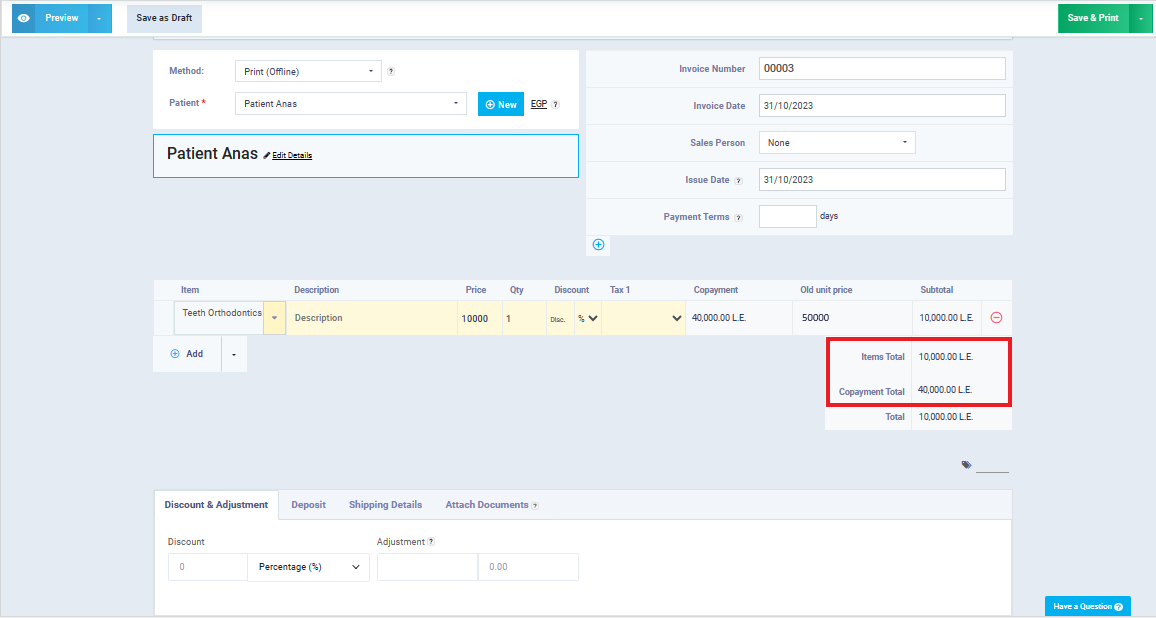

Case 2: There Is a Maximum Patient Co-payment with No Discount

In this case, where a maximum client co-payment is set without specifying a discount, the system charges both the client and the insurance company according to their respective co-payment percentages. If the cost exceeds the maximum client co-payment limit, the system ensures not to exceed this limit by transferring the remaining portion of the total cost of the product or service to the insurance company.

Illustrative Example:

- Client: Anas (insured by International Insurance Company – First Category for International Insurance).

- Service: Dental Implant (costing 50,000, categorized as high-priced products).

- Co-payment Percentage: Client (40%), Insurance Company (60%).

- Discount: None

-

Maximum Client Co-payment: Maximum co-payment of 10,000 (for the client).

Note and Explanation:

We can see that the system charged the client “Anas” an amount that does not exceed his specified maximum co-payment limit (10,000) when it was expected to charge him according to his co-payment percentage (20,000). Meanwhile, the insurance company covered the remaining cost of the service (40,000).

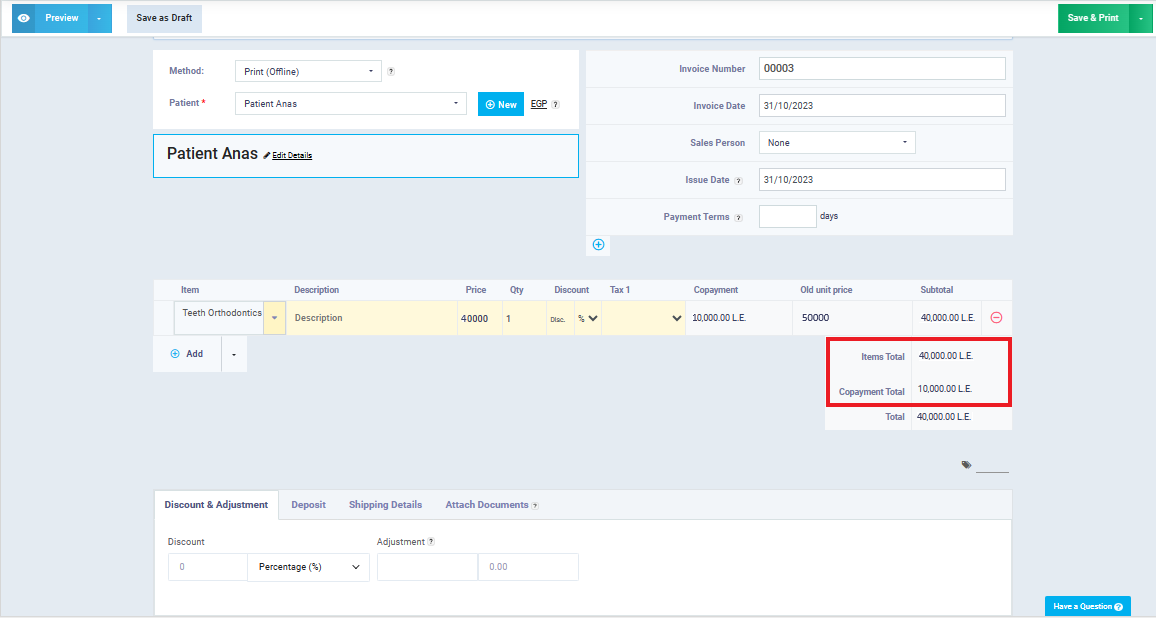

Case 3: There is a maximum insurance company contribution limit, and there is no discount

In this case, the system charges both the client and the insurance company according to their respective co-payment percentages. If the cost exceeds the maximum insurance company contribution limit, the system ensures not to exceed this limit by charging the remaining cost to the client.

Example for illustration:

- Client: Anas (insured by International Insurance Company – First Category for International Insurance Company).

- Service: Dental implant (costs 50,000, within the high-price product category).

- Co-payment percentage: Client (40%), Insurance Company (60%).

- Discount: None

-

Maximum payment limit: Maximum insurance company contribution limit of 10,000.

Note and Explanation:

In this scenario, you will notice that the system has charged the insurance company an amount that does not exceed the specified maximum contribution limit (10,000) when it was expected to be charged according to its co-payment percentage (30,000). Meanwhile, the client has been charged the remaining cost of the service (40,000).

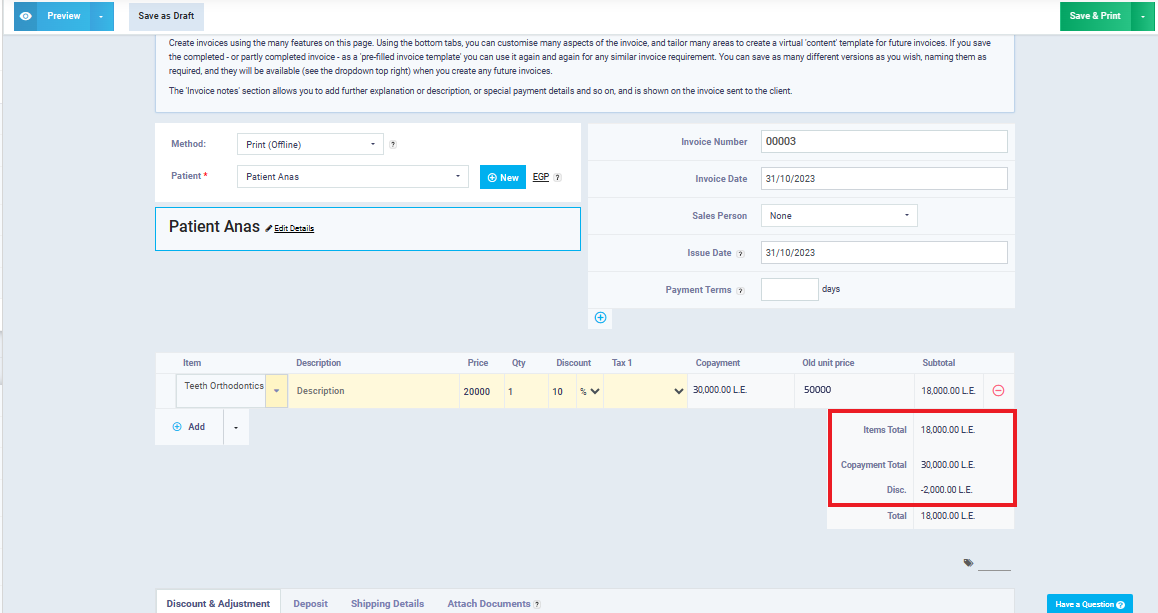

Case 4: There is a discount, and there is no maximum limit

In this scenario, where a discount is set for the client (typically, the discount is applied to the client and not the insurance company) without a maximum limit, the system loads the cost for both the client and the insurance company according to their respective co-payment percentages and then applies the discount to the client’s co-payment percentage.

Illustrative Example:

- Client: Anas (insured by International Insurance Company – First Category for International Insurance).

- Service: Dental Implants (costing 50,000, which falls under the high-price product category).

- Co-payment Percentage: For the client (40%), and the insurance company (60%).

- Discount: 10%

-

Maximum Payment Limit: None.

Note and Explanation:

The system charged the insurance company (30,000) by its specified co-payment percentage and charged the client (18,000) after applying a discount (10%) to the client’s co-payment amount.

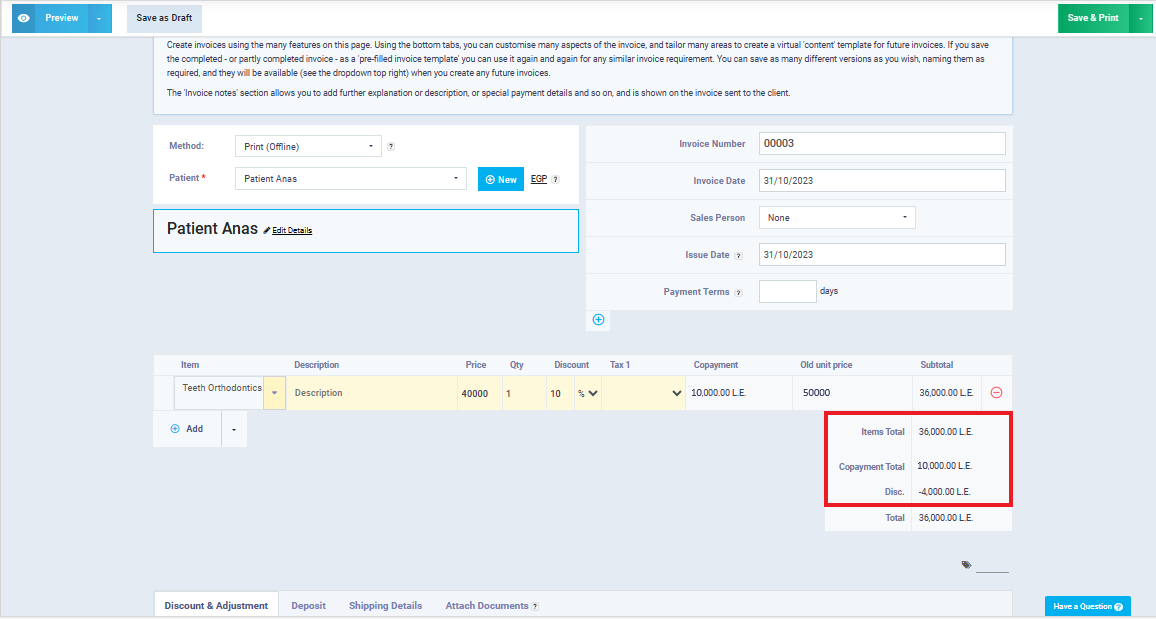

Case 5: There Is a Discount, and There Is an Insurance Company Maximum

In this case, where a discount is set for the client and an insurance company maximum is defined, the system loads the cost for both the client and the insurance company according to their co-payment percentages. If the insurance company’s co-payment exceeds the maximum, the excess over the maximum is charged to the client, and then the system applies the discount to the client’s co-payment percentage.

Illustrative Example:

- Client: Anas (insured by International Insurance Company – First Category for International Insurance Company).

- Service: Dental implant (costing 50,000, falling into the high-priced product category).

- Co-payment percentage: Client (40%), Insurance Company (60%).

- Discount: 10%

-

Insurance Company Maximum: 10,000.

Note and Explanation:

We can observe that the system only charged the insurance company (10,000), adhering to the specified maximum co-payment for the insurance company. However, the system charged the client (36,000), which is the sum of the client’s co-payment amount (20,000) plus the excess over the client’s maximum co-payment (20,000). Then, the system applied a discount percentage (10%) to the (40,000), making the total cost payable by the client (36,000).

Case 6: There Is a Discount and a Maximum for the Patient

The case involves a discrepancy in the system’s handling of co-payments and discounts for a patient receiving a medical service. The system introduces a virtual cost for the patient, applies a discount to reach the maximum allowed payment, and then calculates the insurance company’s payment by subtracting this virtual cost.

The approach aims to prevent applying the discount after reaching the maximum payment but results in a discrepancy in the final calculations.

The issue centers on how the system processes co-payments and discounts for medical services, leading to an unexpected outcome in cost distribution between the patient and the insurance company.

If you still need clarification for this case refer to the tutorial ” There Is a Discount and a Maximum for the Patient (Case 6)”

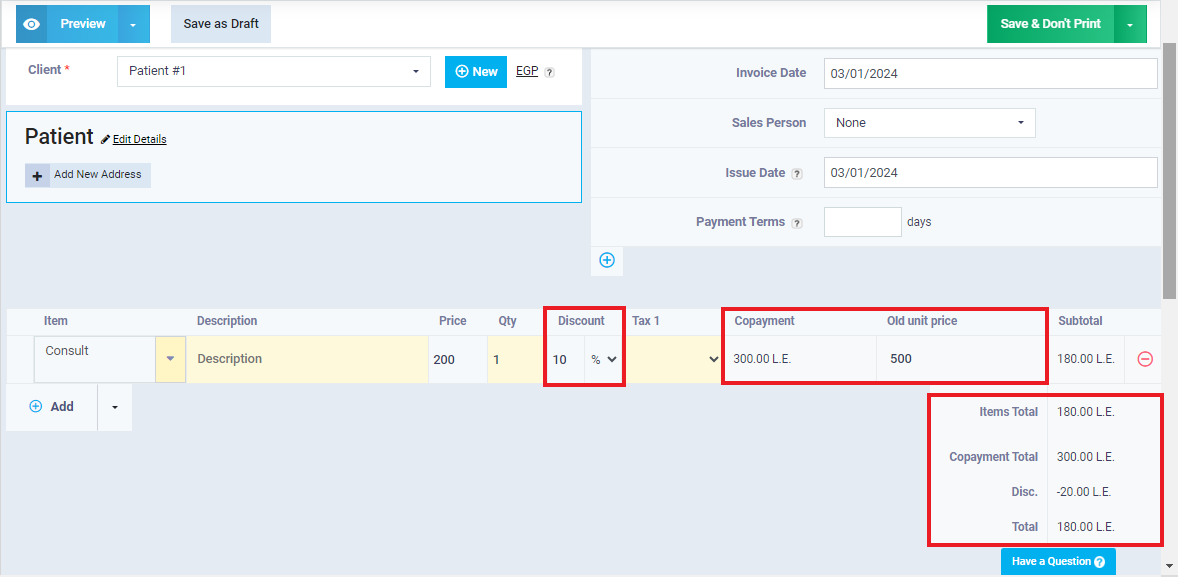

Creating an invoice for a client with insurance

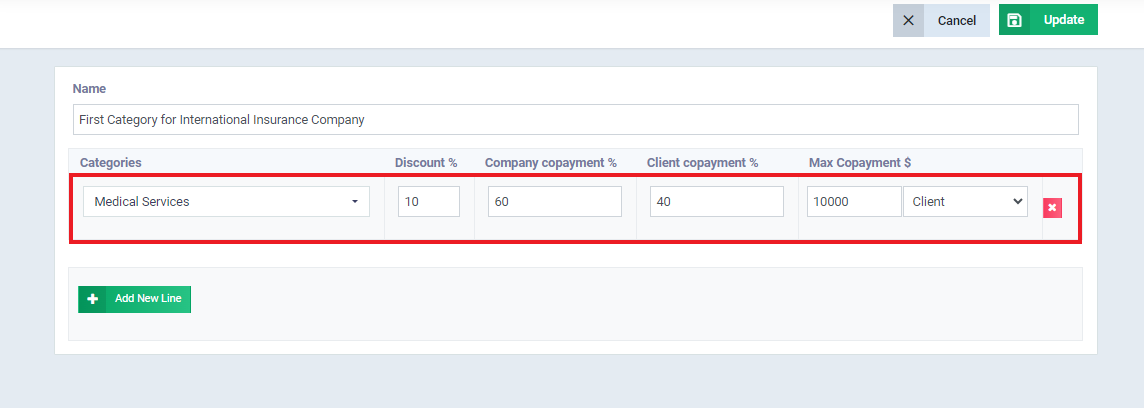

If a patient’s insurance class is set as follows:

- Patient insured by the International Insurance Company – The First Category for International Insurance Company.

- Service: Consult

- Co-payment Percentage: Client (40%), Insurance Company (60%).

- Discount: 10%

- Maximum Payment: 10000

When creating an invoice for any product or service in the category “Medical services” the system will automatically follow the patient’s insurance class.

For Example:

Before starting, ensure that the insurance agent has already been assigned to the patient so that the system can automatically determine the patient’s and the agent’s payment based on the selected class.

This Patient has the insurance class “The First Category for International Insurance Company” assigned and the chosen service “Consult” is included in the category “Medical Services“.