Printing Assets Depreciation

Depreciation is an essential accounting tool for allocating costs and expenses throughout the useful life of assets such as printers. This systematic approach ensures an accurate representation of profitability by accounting for wear and tear on vital equipment. Beyond printers, various assets like software and machinery also undergo depreciation, allowing companies to make informed decisions about replacements and upgrades while maintaining financial accuracy.

Assets Depreciation Methods

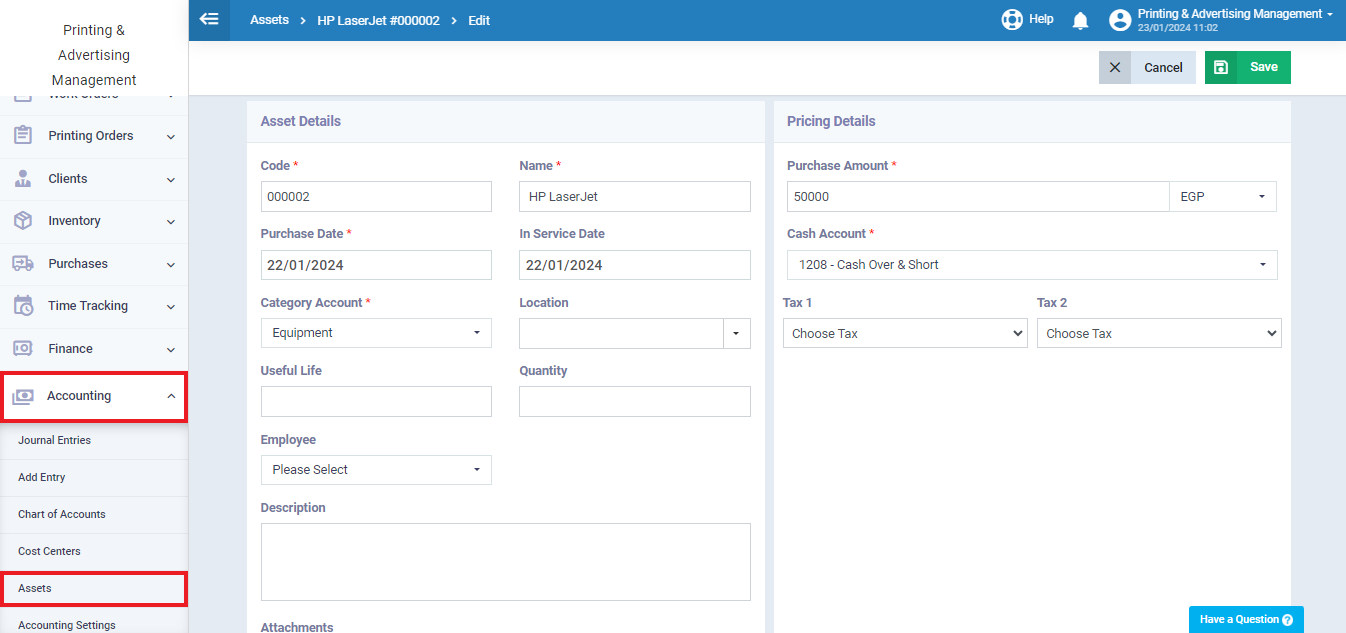

- Click on “Accounting” from the main menu.

- Click on “Assets”.

- Click the button “Add Asset”.

- Add the asset’s details. For more information on the nature of the required fields, refer to the guide “Add a new Asset”.

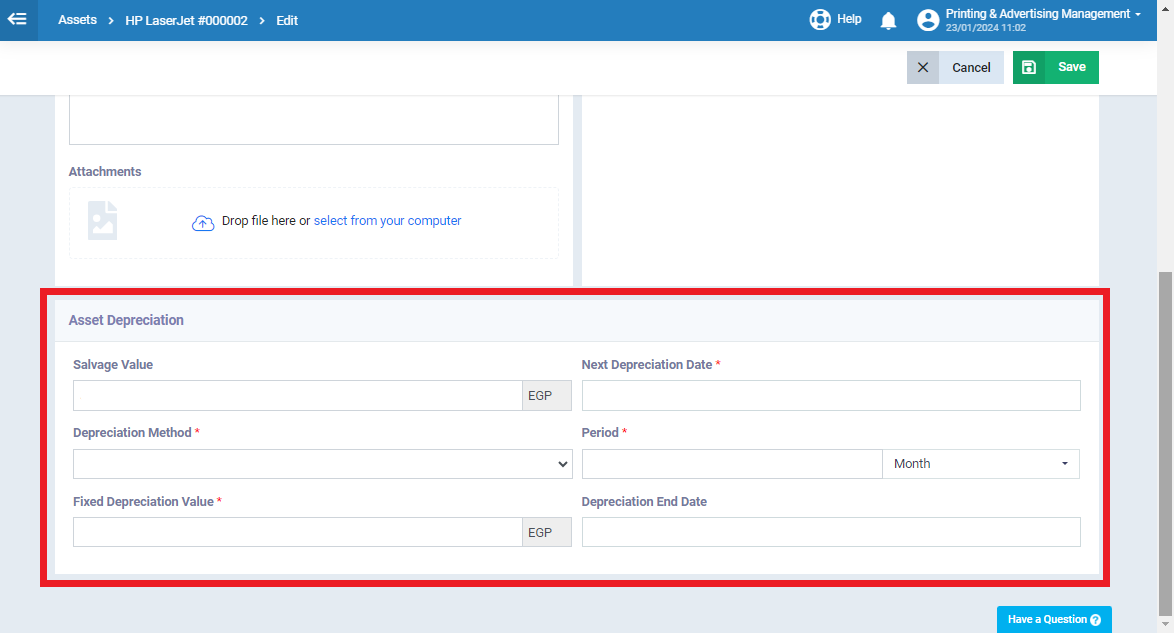

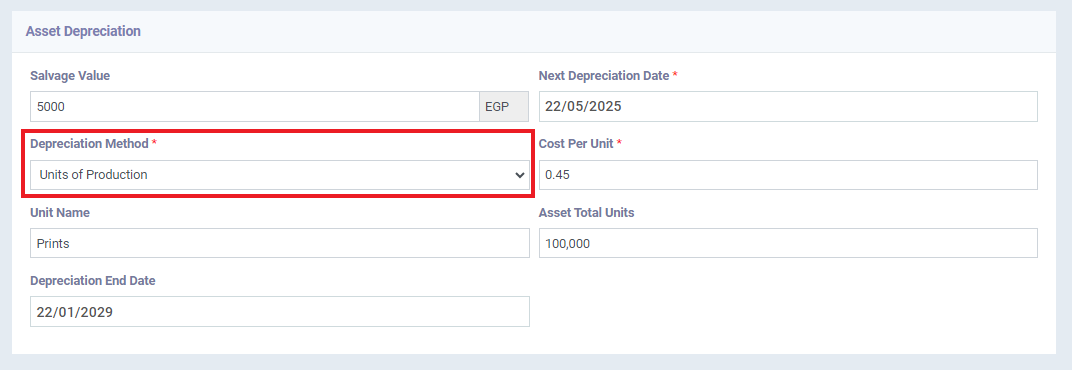

After filling in the asset and pricing details scroll down to find the “Asset Depreciation”

Enter the depreciation data for the asset:

Next Depreciation Date: Set the next depreciation date of the asset.

Depreciation End Date: Set the end date of the asset’s depreciation.

Depreciation Method: Specify the depreciation system for the asset, choosing from:

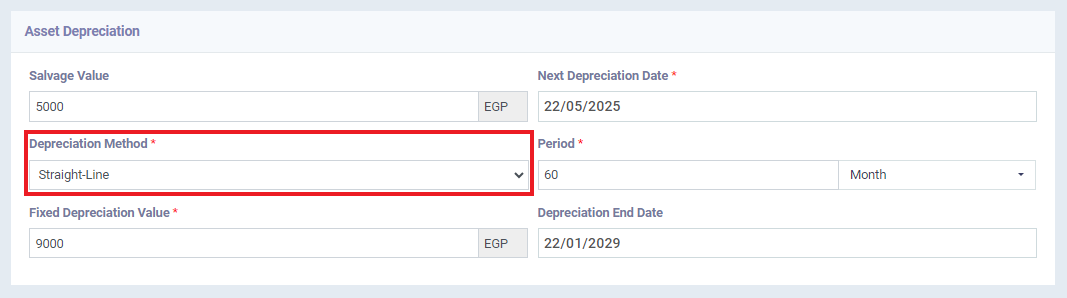

Straight-Line: A fixed value is deducted from the asset when the depreciation period is due.

Period: Determine the interval for depreciation calculation by adding a number and selecting “Day”, “Week”, or “Month”.

Fixed Depreciation Value: Add the fixed depreciation value periodically deducted from the asset’s worth.

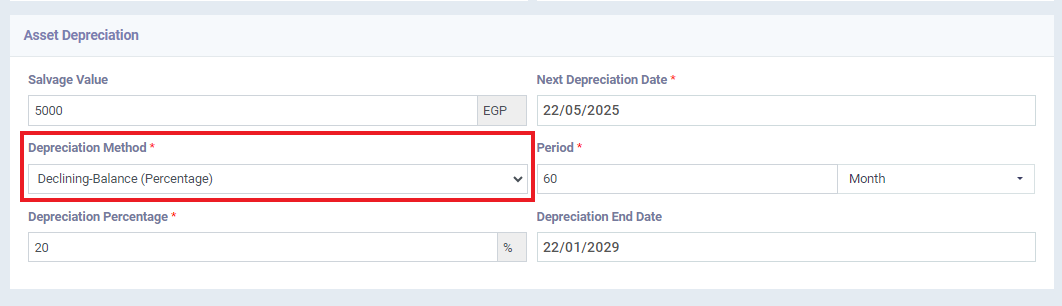

Declining-Balance (Percentage): Depreciation is calculated as a percentage of the current value of the asset and deducted at the depreciation calculation time.

Period: Determine the interval for depreciation calculation by adding a number and selecting “Day”, “Week”, or “Month”.

Depreciation Percentage: Specify the percentage deducted from the asset value periodically.

Units of Production: Determine the maximum number of units based on which the asset is depreciated.

Cost Per Unit: Specify the cost deducted when one unit of the asset is consumed.

Unit Name: Give a designation to the unit based on which the asset’s depreciation is calculated.

Total Asset Units: The maximum number of units after which the asset is fully depreciated.