How to Update Product Tax

The system enables you to update all products at once, which helps you quickly adjust tax data without having to update each product individually. This guide walks you through the detailed steps to perform the update easily.

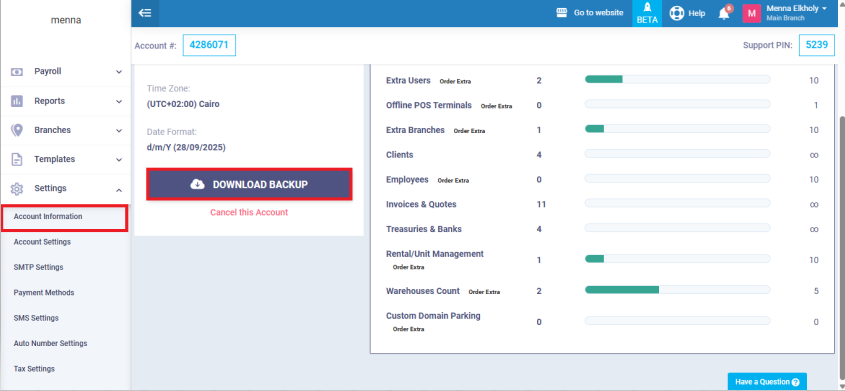

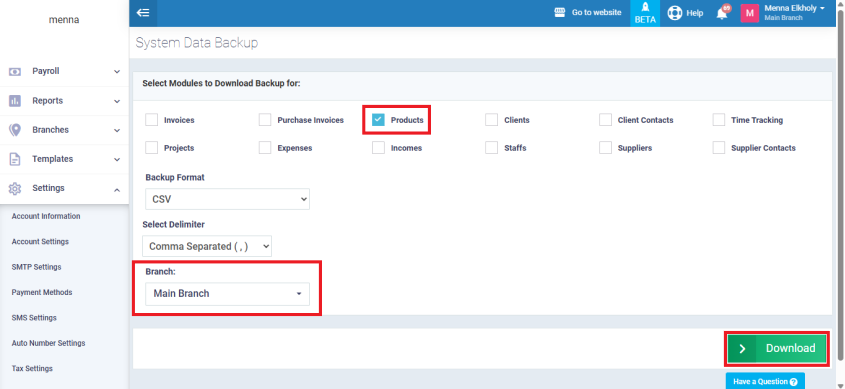

Download a Backup of Products

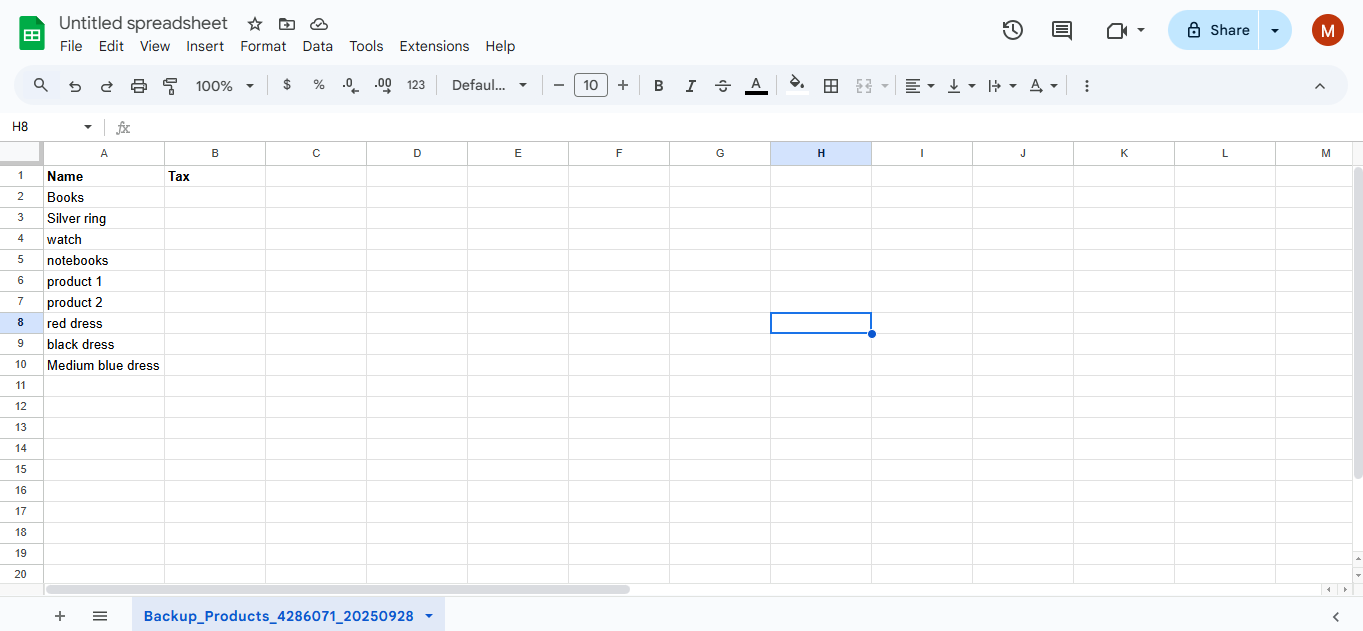

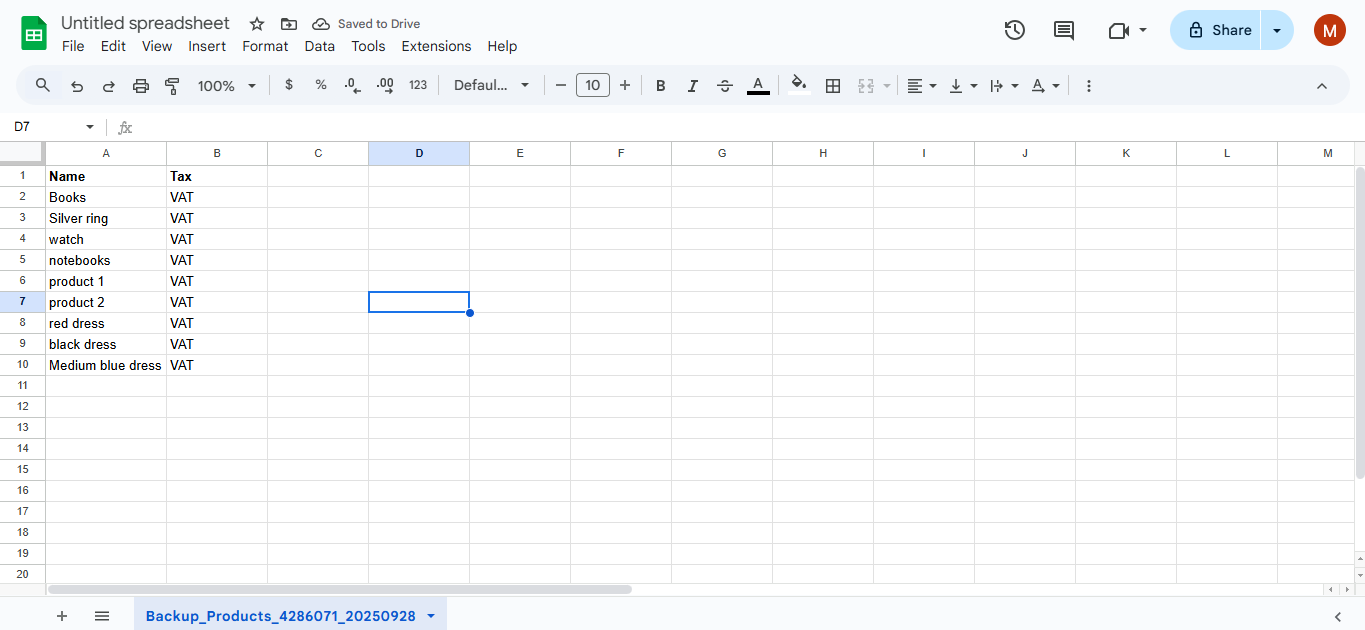

Prepare the File in Google Sheets

Add the Tax Data

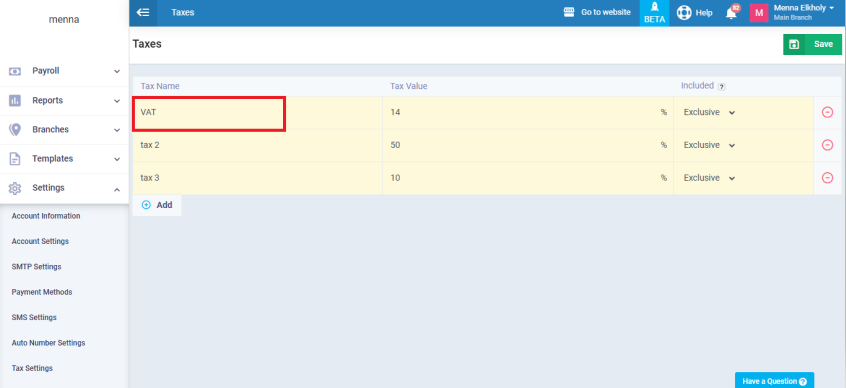

Go back to “Settings” and select “Tax Settings”. Copy the name of the tax you want to apply.

Return to Google Sheets and paste the tax name into the new “Tax” column you created.

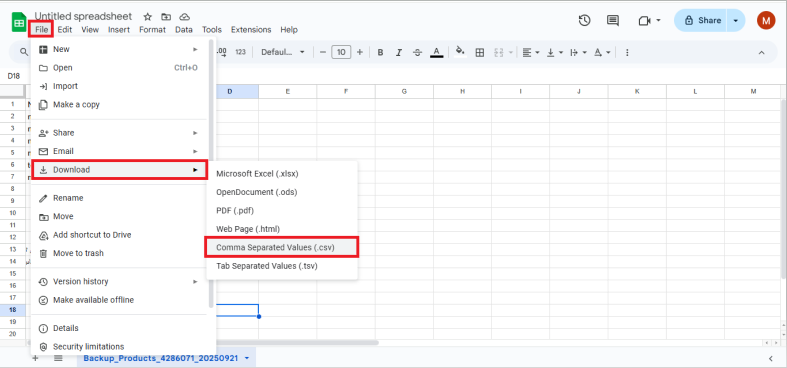

When finished, go to the “File” menu, select “Download”, and save the file as Comma Separated Values (.csv) so it’s ready for import.

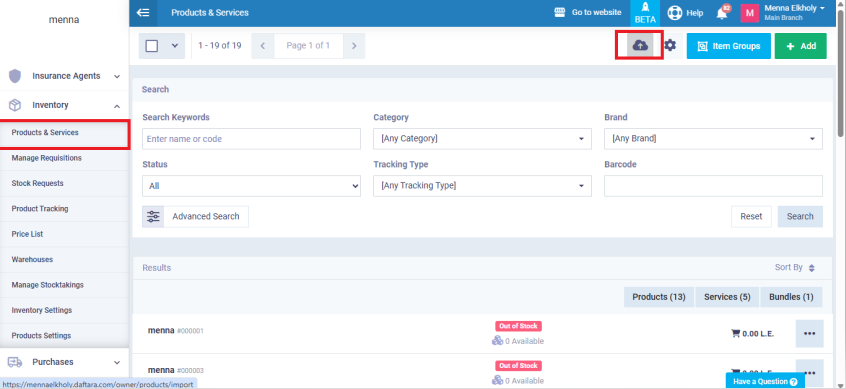

Import the Updated File into the System

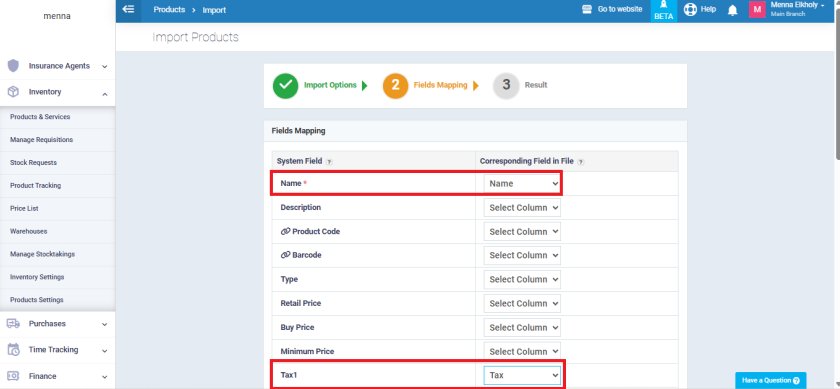

From the main menu, go to “Inventory”, choose “Products & Services”, then click “Import”.

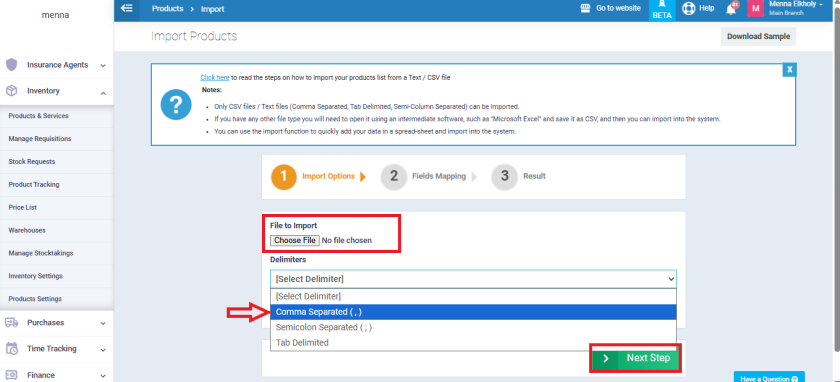

Click “Choose File” and upload the CSV file you saved from Google Sheets. Select the “Comma Separated” option, then click “Next Step”.

On the Fields Mapping screen, map name to the Name field, and map Tax to the Tax 1 field.

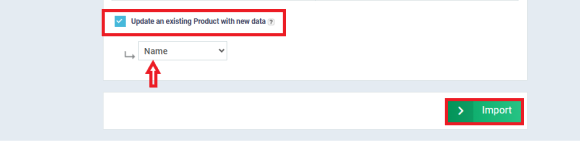

Next, enable the option “Update an existing Product with new data” and set “Name” as the primary key for the update. Finally, click “Import” to complete the process.